1 - CGC

... SMEs pay 0.5 ~ 3.0% of annual guarantee fee (upfront) Average fee rate : 1.24%(as of 2015) ...

... SMEs pay 0.5 ~ 3.0% of annual guarantee fee (upfront) Average fee rate : 1.24%(as of 2015) ...

Understanding Debt - UConn Financial Aid

... exists, typically after 30 days Credit Limit based on credit rating, FICO score Debit Card: Connected with a bank account. Comes directly out of the account balance. Account balance is $100. You make a purchase for $10, now your account then has $90 remaining ...

... exists, typically after 30 days Credit Limit based on credit rating, FICO score Debit Card: Connected with a bank account. Comes directly out of the account balance. Account balance is $100. You make a purchase for $10, now your account then has $90 remaining ...

Understanding Debt - UConn Financial Aid

... exists, typically after 30 days Credit Limit based on credit rating, FICO score Debit Card: Connected with a bank account. Comes directly out of the account balance. Account balance is $100. You make a purchase for $10, now your account then has $90 remaining ...

... exists, typically after 30 days Credit Limit based on credit rating, FICO score Debit Card: Connected with a bank account. Comes directly out of the account balance. Account balance is $100. You make a purchase for $10, now your account then has $90 remaining ...

The characteristics of the capital market

... • Lack of infrastructures for debt arrangements • Loss of confidence in the markets (price volatility) ...

... • Lack of infrastructures for debt arrangements • Loss of confidence in the markets (price volatility) ...

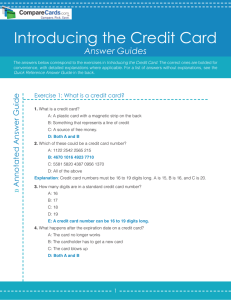

Introduction to Credit Card Answer Guide | CompareCards.com

... 1. B: Annual percentage rate 2. D: Continue to the next section for the Quick Reference Answer Guide. 3. D: When you withdraw money from an ATM 4. C: $96 5. D: $50 ...

... 1. B: Annual percentage rate 2. D: Continue to the next section for the Quick Reference Answer Guide. 3. D: When you withdraw money from an ATM 4. C: $96 5. D: $50 ...

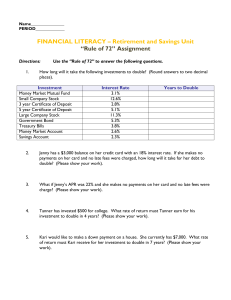

CHAPTER5HOMEWORKWITHANSWERS

... A savings account with daily compounding will have higher earnings than an account with quarterly compounding. ...

... A savings account with daily compounding will have higher earnings than an account with quarterly compounding. ...

Merchant account

A merchant account is a type of bank account that allows businesses to accept payments by payment cards, typically debit or credit cards. A merchant account is established under an agreement between an acceptor and a merchant acquiring bank for the settlement of payment card transactions. In some cases a payment processor, independent sales organization (ISO), or member service provider (MSP) is also a party to the merchant agreement. Whether a merchant enters into a merchant agreement directly with an acquiring bank or through an aggregator, the agreement contractually binds the merchant to obey the operating regulations established by the card associations.