Covered Bonds in the European Union Reflections on the

... conjunction with the oral presentation provided by Realkredit Danmark. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its acc ...

... conjunction with the oral presentation provided by Realkredit Danmark. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its acc ...

A behavioural finance model of exchange rate expectations within a

... rise from a portfolio point of view? • This can be explained by the large increase in the supply of US bills to the UK. • Higher US imports generate a slowdown in the US economy, lower tax revenues and hence a US government deficit, and thus an increase in the supply of US government bills. • This l ...

... rise from a portfolio point of view? • This can be explained by the large increase in the supply of US bills to the UK. • Higher US imports generate a slowdown in the US economy, lower tax revenues and hence a US government deficit, and thus an increase in the supply of US government bills. • This l ...

Bahamas and Barbados: empirical evidence of interest rate pass-through

... Any government can use at the very least fiscal policy or monetary policy, or both, to impact the country’s macroeconomic aggregates such as the inflation rate, unemployment and economic growth. While government taxes and government expenditures are the main tools of fiscal policy, interest rates an ...

... Any government can use at the very least fiscal policy or monetary policy, or both, to impact the country’s macroeconomic aggregates such as the inflation rate, unemployment and economic growth. While government taxes and government expenditures are the main tools of fiscal policy, interest rates an ...

IOSR Journal of Economics and Finance (IOSR-JEF)

... The interest rate policy in Nigeria is perhaps one of the most controversial of all financial policies. The reason for this may not be farfetched because interest rate policy has direct link to many other macroeconomic variables most especially investment decision. Interest rates play a crucial role ...

... The interest rate policy in Nigeria is perhaps one of the most controversial of all financial policies. The reason for this may not be farfetched because interest rate policy has direct link to many other macroeconomic variables most especially investment decision. Interest rates play a crucial role ...

New Zealand’s economic reforms after 1984 L. Christopher Plantier

... real rate and a particular country’s real rate. Even in this analysis, however, there is still quite a bit of judgement required in order to get sensible results. In other words, capital markets again appear to be segmented, since these risk factors do not always apply equally to all countries, ie t ...

... real rate and a particular country’s real rate. Even in this analysis, however, there is still quite a bit of judgement required in order to get sensible results. In other words, capital markets again appear to be segmented, since these risk factors do not always apply equally to all countries, ie t ...

2006 Prentice Hall Business Publishing Macroeconomics, 4/e

... The first is that there has been a large decline in the ratio of money demand to nominal income since 1960 Economists sometimes refer to the inverse of the ratio of money demand to nominal income as the velocity of money. The second conclusion is that there is a negative relation between year-to ...

... The first is that there has been a large decline in the ratio of money demand to nominal income since 1960 Economists sometimes refer to the inverse of the ratio of money demand to nominal income as the velocity of money. The second conclusion is that there is a negative relation between year-to ...

Read the Economic Commentary "How far can the repo rate be cut?"

... suggestion which has been further developed by e.g. Goodfriend (2000) and Buiter and Panigirtzoglou (2003). Another example is described by Kimball.9 Essentially, these methods are based on putting cash on the same footing as electronic money by introducing a type of exchange rate between both payme ...

... suggestion which has been further developed by e.g. Goodfriend (2000) and Buiter and Panigirtzoglou (2003). Another example is described by Kimball.9 Essentially, these methods are based on putting cash on the same footing as electronic money by introducing a type of exchange rate between both payme ...

CEMA LOAN FAQ - Adams Law Group LLC

... This shortcut works because the purpose of a CEMA is to give borrowers a credit for mortgage taxes paid but not "used" as represented by the PUB of a mortgage at the time of payoff. Imagine that you have a borrower who wants to take a loan for 250,000. Imagine further that the borrower's prior mortg ...

... This shortcut works because the purpose of a CEMA is to give borrowers a credit for mortgage taxes paid but not "used" as represented by the PUB of a mortgage at the time of payoff. Imagine that you have a borrower who wants to take a loan for 250,000. Imagine further that the borrower's prior mortg ...

Press release: Monetary developments in the euro area: January 2016

... 3.1. Deposits with an agreed maturity of over two years 3.2. Deposits redeemable at notice of over three months 3.3. Debt securities issued with a maturity of over two years 3.4. Capital and reserves ...

... 3.1. Deposits with an agreed maturity of over two years 3.2. Deposits redeemable at notice of over three months 3.3. Debt securities issued with a maturity of over two years 3.4. Capital and reserves ...

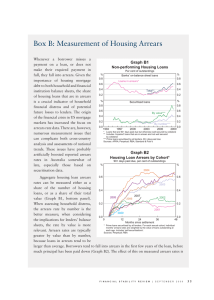

Box B: Measurement of Housing Arrears Graph B1

... amplified because average new loan sizes tend to increase over time, relative to the average size of loans already outstanding, as nominal housing prices and incomes rise. The criteria for defining a given loan as being in arrears can differ across countries and lenders. In Australia, housing loans ...

... amplified because average new loan sizes tend to increase over time, relative to the average size of loans already outstanding, as nominal housing prices and incomes rise. The criteria for defining a given loan as being in arrears can differ across countries and lenders. In Australia, housing loans ...

Changing Interest Rates: The Impact on Your Portfolio

... reinvesting all coupon interest received at the same YTM. Another way to think about YTM is as the interest rate that will make the present value of the bond’s cash flows equal to its purchase price. Yield Curve: a line that plots bond yields from the shortest maturity issues to the longest maturity ...

... reinvesting all coupon interest received at the same YTM. Another way to think about YTM is as the interest rate that will make the present value of the bond’s cash flows equal to its purchase price. Yield Curve: a line that plots bond yields from the shortest maturity issues to the longest maturity ...

Response to HMT consultation on tax deductibility of

... – 7x EBITDA, although in respect of businesses with more stable income streams or in the early development stages the initial multiples may be much higher. As a result, even at today's historically low interest rates and with a fixed ratio set at the highest threshold ...

... – 7x EBITDA, although in respect of businesses with more stable income streams or in the early development stages the initial multiples may be much higher. As a result, even at today's historically low interest rates and with a fixed ratio set at the highest threshold ...

Pindyck/Rubinfeld Microeconomics

... $52.50 – $42.50 = $10 per unit and total profit is $8,000 per month. To make and sell these motors, a firm needs capital—namely, the factory that it built for $10 million. The firm’s $10 million capital stock allows it to earn a flow of profit of $80,000 per month. Was the $10 million investment in ...

... $52.50 – $42.50 = $10 per unit and total profit is $8,000 per month. To make and sell these motors, a firm needs capital—namely, the factory that it built for $10 million. The firm’s $10 million capital stock allows it to earn a flow of profit of $80,000 per month. Was the $10 million investment in ...

History of pawnbroking

This history is partially outdated for developments in the 20th centuryThe history of pawnbroking began in the earliest ages of the world. Lending money on portable security is one of the oldest professions.