Explain what is meant by the term structure of interest rates. Critically

... according to changes in the interest rates and therefore the higher the risk of potential losses. Moreover, the buyer of a long‐term bond will require compensation for the risks he undergoes when purchasing long‐term bonds instead of short‐term bonds. The key assumption in this theory is that ...

... according to changes in the interest rates and therefore the higher the risk of potential losses. Moreover, the buyer of a long‐term bond will require compensation for the risks he undergoes when purchasing long‐term bonds instead of short‐term bonds. The key assumption in this theory is that ...

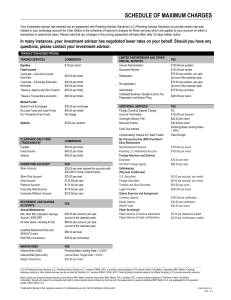

Schedule of Maximum Charges

... $75.00 per position, per year (at end of the calendar year) $75.00 per position, per year (at end of the calendar year) $75.00 per purchase $200.00 per return ...

... $75.00 per position, per year (at end of the calendar year) $75.00 per position, per year (at end of the calendar year) $75.00 per purchase $200.00 per return ...

CEDAR REALTY TRUST, INC.

... Cedar Realty Trust Partnership, L.P. (the “Operating Partnership”) is the entity through which the Company conducts substantially all of its business and owns (either directly or through subsidiaries) substantially all of its assets. At June 30, 2015, the Company owned a 99.5% economic interest in, ...

... Cedar Realty Trust Partnership, L.P. (the “Operating Partnership”) is the entity through which the Company conducts substantially all of its business and owns (either directly or through subsidiaries) substantially all of its assets. At June 30, 2015, the Company owned a 99.5% economic interest in, ...

Download paper (PDF)

... that determines the response of current inflation in the basic New Keynesian model. So, the further in the future is the interest rate that the monetary authority announces it will change, the larger is the current response of inflation. At the zero lower bound, this large effect on inflation will l ...

... that determines the response of current inflation in the basic New Keynesian model. So, the further in the future is the interest rate that the monetary authority announces it will change, the larger is the current response of inflation. At the zero lower bound, this large effect on inflation will l ...

The Effect of Change in Base Lending Rate on

... increased base lending rate is therefore easy to tell the direction of lending for the case of commercial banks. However, the case may not be the same for microfinance since most of them are not controlled by CBK and many small and medium sized borrowers may opt to turn to MFIs due to better credit ...

... increased base lending rate is therefore easy to tell the direction of lending for the case of commercial banks. However, the case may not be the same for microfinance since most of them are not controlled by CBK and many small and medium sized borrowers may opt to turn to MFIs due to better credit ...

determining the risk free rate for regulated companies

... formula for setting output prices of regulated firms should satisfy. To draw an analogy mentioned by Davis (1998, p 15), the resetting of prices in accordance with the current five year interest rate removes interest rate risk at the end of the regulatory period in the same way that a long-term bond ...

... formula for setting output prices of regulated firms should satisfy. To draw an analogy mentioned by Davis (1998, p 15), the resetting of prices in accordance with the current five year interest rate removes interest rate risk at the end of the regulatory period in the same way that a long-term bond ...

A World with Higher Interest Rates

... January 2011, 59% of the United States' marketable debt matures before 2016. Table 1 shows the size of Treasury securities outstanding as of January 2011. A majority of U.S. outstanding debt is in the form of notes, which have a maturity of between one and ten years. ...

... January 2011, 59% of the United States' marketable debt matures before 2016. Table 1 shows the size of Treasury securities outstanding as of January 2011. A majority of U.S. outstanding debt is in the form of notes, which have a maturity of between one and ten years. ...

Form 10-Q - Town Sports International Holdings, Inc.

... consolidated financial statements and notes thereto, included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2012. The year-end condensed consolidated balance sheet data included within this Form 10-Q was derived from audited financial statements, but does not include al ...

... consolidated financial statements and notes thereto, included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2012. The year-end condensed consolidated balance sheet data included within this Form 10-Q was derived from audited financial statements, but does not include al ...

History of pawnbroking

This history is partially outdated for developments in the 20th centuryThe history of pawnbroking began in the earliest ages of the world. Lending money on portable security is one of the oldest professions.