Commodity forward curves: models and data

... Preliminary Findings • This model can provide much more realistic dynamics of commodity price volatility • It can also explain some otherwise anomalous things, such as simultaneous rises in inventories and prices (which some argue are an indicator of speculative distortion) • Greater uncertainty ma ...

... Preliminary Findings • This model can provide much more realistic dynamics of commodity price volatility • It can also explain some otherwise anomalous things, such as simultaneous rises in inventories and prices (which some argue are an indicator of speculative distortion) • Greater uncertainty ma ...

macd convergence – divergence oscillator indicator

... the relation between price and volume. When the TSV crosses up above the zero line it signals a positive accumulation or buying pressure showing the possibility of a bullish state. On the other hand, if TSV crosses below the zero line it indicates a distribution or selling pressure where we can ente ...

... the relation between price and volume. When the TSV crosses up above the zero line it signals a positive accumulation or buying pressure showing the possibility of a bullish state. On the other hand, if TSV crosses below the zero line it indicates a distribution or selling pressure where we can ente ...

Using Data Envelopment Analysis to Select Efficient Large Market

... were found to be most desirable (referred to here as efficient), and an additional four were found to be somewhat desirable. Of these fourteen “efficient” stocks, several displayed robustness to unfavorable changes, while others did not. INTRODUCTION The decision to purchase stock can be difficult s ...

... were found to be most desirable (referred to here as efficient), and an additional four were found to be somewhat desirable. Of these fourteen “efficient” stocks, several displayed robustness to unfavorable changes, while others did not. INTRODUCTION The decision to purchase stock can be difficult s ...

Meetup Outreach Speaker Topics

... It doesn’t matter if you’re a new or seasoned investor, or if you’re retired or a have a full-time day job. Everyone’s busy. And if you want to maximize your returns using the CAN SLIM® System, but minimize the amount of time you spend doing it, your best bet is to use the Daily Graphs Online® Compl ...

... It doesn’t matter if you’re a new or seasoned investor, or if you’re retired or a have a full-time day job. Everyone’s busy. And if you want to maximize your returns using the CAN SLIM® System, but minimize the amount of time you spend doing it, your best bet is to use the Daily Graphs Online® Compl ...

McGraw Hill / Irwin 6

... Relative strength chart A measure of the performance of one investment relative to another A ratio bigger than 1.0 indicates that on relative basis , the company is outperformed Example page 255 between ford and GM ...

... Relative strength chart A measure of the performance of one investment relative to another A ratio bigger than 1.0 indicates that on relative basis , the company is outperformed Example page 255 between ford and GM ...

Informational overshooting, booms, and crashes

... This paper presents an explanation to stock markets’ booms and crashes, which is based on informational dynamics. Episodes of booms and crashes have occured in many stock markets since the famous South Sea Bubble.1 The US stock market has experienced two such episodes during this century: the boom a ...

... This paper presents an explanation to stock markets’ booms and crashes, which is based on informational dynamics. Episodes of booms and crashes have occured in many stock markets since the famous South Sea Bubble.1 The US stock market has experienced two such episodes during this century: the boom a ...

Characterization of foreign exchange market using the threshold

... Mathematical models of open markets can be categorized into two types. In one type, the market price time series are directly modeled by formulation such as a random walk model, ARCH and GARCH models[1][2], and the potential model[3][4][5]. The other type is the agent-based model which creates an ar ...

... Mathematical models of open markets can be categorized into two types. In one type, the market price time series are directly modeled by formulation such as a random walk model, ARCH and GARCH models[1][2], and the potential model[3][4][5]. The other type is the agent-based model which creates an ar ...

Stock Market Efficiency and Insider Trading Kris McKinley, Elon

... to the executive level an individual must have confidence in themselves and their ability to perform well in the future. This can be seen in Michael Eisner’s (CEO of Disney) comment about his ability to face challenges. “No obstacle ever seemed too difficult to surmount.” Maybe this confidence, whic ...

... to the executive level an individual must have confidence in themselves and their ability to perform well in the future. This can be seen in Michael Eisner’s (CEO of Disney) comment about his ability to face challenges. “No obstacle ever seemed too difficult to surmount.” Maybe this confidence, whic ...

VectorVest ProTrader

... Our primary focus is on the market trend. Through two decades of experience, we’ve found this to be the most powerful influence on traders’ success. We begin by identifying the short-term trend of the market using the Primary Wave (the week-over-week direction of the market, represented by the Vect ...

... Our primary focus is on the market trend. Through two decades of experience, we’ve found this to be the most powerful influence on traders’ success. We begin by identifying the short-term trend of the market using the Primary Wave (the week-over-week direction of the market, represented by the Vect ...

A common factor analysis for the US and the German stock markets

... Over the last three decades, the financial world has undergone a profound change. While national financial markets were largely isolated until the beginning of the 1970s, the stock market crash in October 1987 and recently the events of September 11, 2001 have shown how inter-connected securities ma ...

... Over the last three decades, the financial world has undergone a profound change. While national financial markets were largely isolated until the beginning of the 1970s, the stock market crash in October 1987 and recently the events of September 11, 2001 have shown how inter-connected securities ma ...

multi-market trading and market liquidity: the post-mifid picture

... No evidence that order flow fragmentation between trading platforms harms liquidity ● Spreads have decreased between Oct. 2007 and Sep. 2009 in proportion with the level of market competition o More significant after June 2009 o More significant for FTSE 100 stocks/ Less or no significant for SBF ...

... No evidence that order flow fragmentation between trading platforms harms liquidity ● Spreads have decreased between Oct. 2007 and Sep. 2009 in proportion with the level of market competition o More significant after June 2009 o More significant for FTSE 100 stocks/ Less or no significant for SBF ...

from efficient market hypothesis to behavioural finance

... be rather unsubstantiated. Investors cannot outperform markets and, as a result, they cannot achieve high returns, in view of the fact that information is not exclusive, but available to everybody. Thus, individuals cannot be characterized as investment experts or market specialists as the specific ...

... be rather unsubstantiated. Investors cannot outperform markets and, as a result, they cannot achieve high returns, in view of the fact that information is not exclusive, but available to everybody. Thus, individuals cannot be characterized as investment experts or market specialists as the specific ...

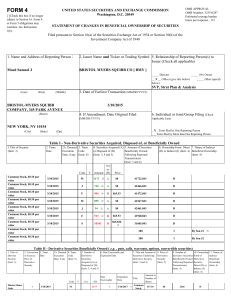

BRISTOL MYERS SQUIBB CO (Form: 4, Received

... /s/ Robert J. Wollin, attorney-in-fact for Samuel J. Moed ...

... /s/ Robert J. Wollin, attorney-in-fact for Samuel J. Moed ...

Market Efficiency, Market Anomalies, Causes

... market efficiency, forms of market efficiency, fundamental and technical analysis. 3rd section defines market anomalies with three major types of anomalies. For the sake of convenience we divide the anomalies into three types i.e. Fundamental anomalies, technical anomalies and calendar anomilies.Sec ...

... market efficiency, forms of market efficiency, fundamental and technical analysis. 3rd section defines market anomalies with three major types of anomalies. For the sake of convenience we divide the anomalies into three types i.e. Fundamental anomalies, technical anomalies and calendar anomilies.Sec ...

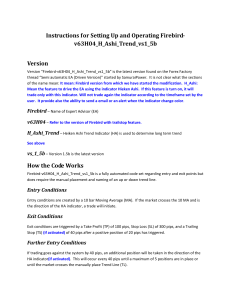

Instructions for Setting Up and Operating Firebird

... “Waiting for Main trend” is referring to a manual trend line that needs to be added before the EA will function. Create this line as a normal trend line. Select the line by right clicking it. Select Trendline properties…, and Common. In the Description field enter “Main_UpTrend_Alert_” if the trend ...

... “Waiting for Main trend” is referring to a manual trend line that needs to be added before the EA will function. Create this line as a normal trend line. Select the line by right clicking it. Select Trendline properties…, and Common. In the Description field enter “Main_UpTrend_Alert_” if the trend ...

CHAPTER 8 Stock Price Behavior and Market Efficiency

... the difference between the number of shares that closed on an uptick and those that closed on a down tick. From our discussion of the NYSE short sale rule in Chapter 5, you know that an uptick occurs when the last price change was positive; a downtick is just the reverse. The tick gives an indicatio ...

... the difference between the number of shares that closed on an uptick and those that closed on a down tick. From our discussion of the NYSE short sale rule in Chapter 5, you know that an uptick occurs when the last price change was positive; a downtick is just the reverse. The tick gives an indicatio ...

Company Analysis - Beedie School of Business

... automated, lights-out data center. An environment that will need to be highly secure, highly automated and remotely accessed and managed ...

... automated, lights-out data center. An environment that will need to be highly secure, highly automated and remotely accessed and managed ...

Document - Oman College of Management & Technology

... involves quantitative measurement of actual return realized and the risk born by the portfolio over the period of investment. These have to be compared with objective norms to asses the relative performance of the portfolio. Alternative measures of performance evaluation have been developed for use ...

... involves quantitative measurement of actual return realized and the risk born by the portfolio over the period of investment. These have to be compared with objective norms to asses the relative performance of the portfolio. Alternative measures of performance evaluation have been developed for use ...

offensive selling – selling into strength

... Leading Stocks in the Group Break Down - A large percentage of a stock’s movement is directly tied to the performance of the industry group of which it is a part. As a result, stocks often run in “packs” - When one or more leading stocks in a group clearly top after an extended run: o The selling of ...

... Leading Stocks in the Group Break Down - A large percentage of a stock’s movement is directly tied to the performance of the industry group of which it is a part. As a result, stocks often run in “packs” - When one or more leading stocks in a group clearly top after an extended run: o The selling of ...

Market Impact Studies

... included in the price and the actual readings above or below forecast influence the price. For non-scalping traders, this study still provides useful information because it tells them if the market has overreacted to a large shock or underreacted to a small one, for instance. The only way to discove ...

... included in the price and the actual readings above or below forecast influence the price. For non-scalping traders, this study still provides useful information because it tells them if the market has overreacted to a large shock or underreacted to a small one, for instance. The only way to discove ...

Stocks

... Factors that Influence the Market The company itself When co. is doing well, profits are up, debt is down, stock is attractive Interest Rates When interest rates are low, savings acc’ts aren’t profitable, return on investment not keeping pace with inflation, so people look to stock to incre ...

... Factors that Influence the Market The company itself When co. is doing well, profits are up, debt is down, stock is attractive Interest Rates When interest rates are low, savings acc’ts aren’t profitable, return on investment not keeping pace with inflation, so people look to stock to incre ...

Growth/Value/Momentum Returns as a Function of the Cross

... We could just take the cross-sectional dispersion of securities in a particular market on a period by period basis Beta differences will cause cross-sectional dispersion in volatile (market index across time) conditions So let us define our dispersion measure as the cross-sectional standard deviatio ...

... We could just take the cross-sectional dispersion of securities in a particular market on a period by period basis Beta differences will cause cross-sectional dispersion in volatile (market index across time) conditions So let us define our dispersion measure as the cross-sectional standard deviatio ...

CH05

... Dealer “makes a market” in the security More than one dealer for each security in overthe-counter markets ...

... Dealer “makes a market” in the security More than one dealer for each security in overthe-counter markets ...

Amazing Market Why does the stock market exist? The answer

... broadened and deepened the market by assembling in one marketplace buy and sell offers from investors everywhere. The stock prices that emerge from these offers provide important signals to direct the nation's savings to those companies most likely to use the money productively. As investors avoid ...

... broadened and deepened the market by assembling in one marketplace buy and sell offers from investors everywhere. The stock prices that emerge from these offers provide important signals to direct the nation's savings to those companies most likely to use the money productively. As investors avoid ...