Transactional Energy Market Information Exchange (TeMIX) using

... Energy transactions must account for the transmission and distribution costs, line limits and losses. Transport transactions transport energy in one location to another for a price. TeMIX Transport and Energy products work together to balance supply and demand across the grid while accounting for lo ...

... Energy transactions must account for the transmission and distribution costs, line limits and losses. Transport transactions transport energy in one location to another for a price. TeMIX Transport and Energy products work together to balance supply and demand across the grid while accounting for lo ...

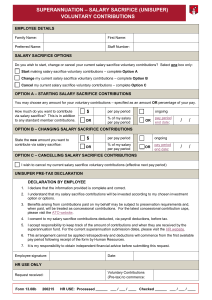

superannuation – salary sacrifice (unisuper) voluntary

... 2. I understand that my salary sacrifice contributions will be invested according to my chosen investment option or options. 3. Benefits arising from contributions paid on my behalf may be subject to preservation requirements and, when paid, will be treated as concessional contributions. For the lat ...

... 2. I understand that my salary sacrifice contributions will be invested according to my chosen investment option or options. 3. Benefits arising from contributions paid on my behalf may be subject to preservation requirements and, when paid, will be treated as concessional contributions. For the lat ...

Document

... VaR as “margin” • Value-at-Risk is the corresponding concept of “margin” in the futures market. • In futures markets, positions are marked-to-market every day, and for each position a margin (a cash deposit) is posted by both the buyer and the seller, to ensure enough capital is available to absorb ...

... VaR as “margin” • Value-at-Risk is the corresponding concept of “margin” in the futures market. • In futures markets, positions are marked-to-market every day, and for each position a margin (a cash deposit) is posted by both the buyer and the seller, to ensure enough capital is available to absorb ...

Note présentée au Collège

... Number of contracts * notional contract size * market value of underlying equity share * maximum delta Whereby the maximum delta is equal to the highest (if positive) or lowest (if negative) value that the delta of the option may attain taking account of all possible market ...

... Number of contracts * notional contract size * market value of underlying equity share * maximum delta Whereby the maximum delta is equal to the highest (if positive) or lowest (if negative) value that the delta of the option may attain taking account of all possible market ...

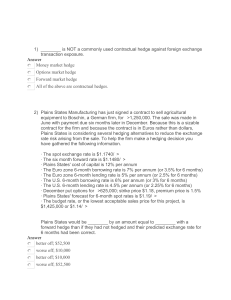

______ is NOT a commonly used contractual hedge against foreign

... with closest maturity are traded at USD0.8350 per 100 JPY. Futures contract expires 18 days after on February 19th. . Suppose the exporter takes a futures position equal to 50% of its cash position (JPY200m) at USD0.8350. Also Company treasurer buys an over the counter put option for the JPY150m por ...

... with closest maturity are traded at USD0.8350 per 100 JPY. Futures contract expires 18 days after on February 19th. . Suppose the exporter takes a futures position equal to 50% of its cash position (JPY200m) at USD0.8350. Also Company treasurer buys an over the counter put option for the JPY150m por ...

Derivatives: The Good, The Bad and … the Necessary?

... In the U.S., proposed legislation will address the credit risks posed by the nature of the bilateral agreement, as well as the risks posed to the financial system from fraud and market manipulation. The “Over-the-Counter Derivatives Markets Act of 2009” drafted by the U.S. administration in Augu ...

... In the U.S., proposed legislation will address the credit risks posed by the nature of the bilateral agreement, as well as the risks posed to the financial system from fraud and market manipulation. The “Over-the-Counter Derivatives Markets Act of 2009” drafted by the U.S. administration in Augu ...

Pricing Bermudan Style Swaptions Using the Calibrated Hull White

... swap that will start at a given time in the future and last for some number of years. The option will be exercised if the swap rate for exactly the same swap as the one that can be entered into by the swaption at the exercise time is higher than the fixed rate guaranteed by the swaption agreement. A ...

... swap that will start at a given time in the future and last for some number of years. The option will be exercised if the swap rate for exactly the same swap as the one that can be entered into by the swaption at the exercise time is higher than the fixed rate guaranteed by the swaption agreement. A ...

PDF

... appropriate type of hedge transaction. Clearly, the analysis does not include a wider variety of risk management strategies such as enterprise diversification or geographic diversification that are potentially available to all growers. Nonetheless, the recommendations that emerge should provide the ...

... appropriate type of hedge transaction. Clearly, the analysis does not include a wider variety of risk management strategies such as enterprise diversification or geographic diversification that are potentially available to all growers. Nonetheless, the recommendations that emerge should provide the ...

С П Е Ц И Ф И К А Ц И Я

... The Contract remaining open at the end of trading on the last Contract trading day shall be settled by transfer of the variation margin on the Contract settlement date. The Contract settlement price shall be an arithmetic mean value of the PLATT’S High and Low closing prices for the underlying asset ...

... The Contract remaining open at the end of trading on the last Contract trading day shall be settled by transfer of the variation margin on the Contract settlement date. The Contract settlement price shall be an arithmetic mean value of the PLATT’S High and Low closing prices for the underlying asset ...

Pricing Swing Options and other Electricity Derivatives

... reformed their power sector. One important consequence is the trade of electricity delivery contracts on exchanges, similar to the trade of shares on a stock exchange, for example. The new freedom achieved has brought the drawback of increased uncertainty about the price development and indeed, many ...

... reformed their power sector. One important consequence is the trade of electricity delivery contracts on exchanges, similar to the trade of shares on a stock exchange, for example. The new freedom achieved has brought the drawback of increased uncertainty about the price development and indeed, many ...

DETERMINING THE FAIR PRICE OF WEATHER HEDGING

... tradable financial instruments or commodities hinders the application of conventional pricing methods for derivative instruments in the case of weather derivatives. Instead, methods are used which have been borrowed from the insurance industry. The actuarial approach is based on assessing the likeli ...

... tradable financial instruments or commodities hinders the application of conventional pricing methods for derivative instruments in the case of weather derivatives. Instead, methods are used which have been borrowed from the insurance industry. The actuarial approach is based on assessing the likeli ...

Hedging volatility risk

... The proposed contract has two main features: first, the value of the contract at maturity depends on the volatility expected in the interval T1 to T2 and therefore it is a tool to hedge future volatility. It is sensitive to changes in volatility but not to changes in interest rates or to large change ...

... The proposed contract has two main features: first, the value of the contract at maturity depends on the volatility expected in the interval T1 to T2 and therefore it is a tool to hedge future volatility. It is sensitive to changes in volatility but not to changes in interest rates or to large change ...

PDF

... increased intervention by the federal government to stabilize milk prices seems unlikely. Thus, a potential demand exists for low-cost risk management tools that can be used by farmers. Futures, options, and forward contracts may be such tools. ...

... increased intervention by the federal government to stabilize milk prices seems unlikely. Thus, a potential demand exists for low-cost risk management tools that can be used by farmers. Futures, options, and forward contracts may be such tools. ...

Investing in Stocks Chapter Sixteen

... Par value is an assigned dollar value that is printed on a stock certificate. Callable preferred stock is stock a corporation may exchange for a specified amount of money. After calling an issue, they can issue new preferred stock with a lower dividend. ...

... Par value is an assigned dollar value that is printed on a stock certificate. Callable preferred stock is stock a corporation may exchange for a specified amount of money. After calling an issue, they can issue new preferred stock with a lower dividend. ...

Optimal Hedge Ratio and Hedge Efficiency

... The evidence on options can be divided into five areas: (i) The effect of listing of options on volatility and liquidity (bid-ask spread) of underlying cash market (Trennepohl and Dukes, 1979; Skinner, 1989; Watt, Yadav and Draper, 1992; Chamberlain, Cheung and Kwan, 1993; Kumar, Sarin and Shastri, ...

... The evidence on options can be divided into five areas: (i) The effect of listing of options on volatility and liquidity (bid-ask spread) of underlying cash market (Trennepohl and Dukes, 1979; Skinner, 1989; Watt, Yadav and Draper, 1992; Chamberlain, Cheung and Kwan, 1993; Kumar, Sarin and Shastri, ...

Storage costs in commodity option pricing

... spikes occur regularly; each price jump is followed by a relatively fast price decay, returning back to the normal price level. Such a pattern is not possible for the gold spot price. Consider now a calendar spread call option, which can be viewed as a regular call written on the price spread betwee ...

... spikes occur regularly; each price jump is followed by a relatively fast price decay, returning back to the normal price level. Such a pattern is not possible for the gold spot price. Consider now a calendar spread call option, which can be viewed as a regular call written on the price spread betwee ...

The One Sigma Method

... In Statistics and for our purposes , 1 sigma is a reference to 1 standard deviation. More on sigma later in these slides and in APPENDIX A ...

... In Statistics and for our purposes , 1 sigma is a reference to 1 standard deviation. More on sigma later in these slides and in APPENDIX A ...

Valuing a European option with the Heston model

... Among the variety of financial derivatives, the option is one of the most important financial instruments. An option is define as the right, but not the obligation, to buy (call option) or sell (put option) a specific asset by paying a strike price on or before a specific date. Nowadays, the use of ...

... Among the variety of financial derivatives, the option is one of the most important financial instruments. An option is define as the right, but not the obligation, to buy (call option) or sell (put option) a specific asset by paying a strike price on or before a specific date. Nowadays, the use of ...

Towards a Theory of Volatility Trading

... the price risk, then a prime determinant of the profit or loss from this strategy is the difference between the realized volatility and the anticipated volatility used in pricing and hedging the option. The final method reviewed for trading realized volatility involves buying or selling an over-the-cou ...

... the price risk, then a prime determinant of the profit or loss from this strategy is the difference between the realized volatility and the anticipated volatility used in pricing and hedging the option. The final method reviewed for trading realized volatility involves buying or selling an over-the-cou ...