vsi12-tfs cao 18648401 en

... shed some light on understanding the frictions in financial market and designing proper regulatory rules, especially discussing the role of banking tax in stabilizing the banking sector. The model is an extension of Cao & Illing (2011). There, since illiquidity is the only risk, conditional (with ex ...

... shed some light on understanding the frictions in financial market and designing proper regulatory rules, especially discussing the role of banking tax in stabilizing the banking sector. The model is an extension of Cao & Illing (2011). There, since illiquidity is the only risk, conditional (with ex ...

Chapter 2 Assignment Grid

... Students seemingly understand assets and liabilities more easily than equity. An asset can be touched, a liability can be confirmed by looking at an invoice, but equity is conceptual. Equity is the owner's claims to the business assets; what’s left over after liabilities are subtracted from assets. ...

... Students seemingly understand assets and liabilities more easily than equity. An asset can be touched, a liability can be confirmed by looking at an invoice, but equity is conceptual. Equity is the owner's claims to the business assets; what’s left over after liabilities are subtracted from assets. ...

US monetary policy normalisation tool box stocked

... This research has been prepared by Danske Bank Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be considered as, an offer to sell or a solicitation of an offer to purchase or sell any re ...

... This research has been prepared by Danske Bank Markets (a division of Danske Bank A/S). It is provided for informational purposes only. It does not constitute or form part of, and shall under no circumstances be considered as, an offer to sell or a solicitation of an offer to purchase or sell any re ...

from efficient market hypothesis to behavioural finance

... be rather unsubstantiated. Investors cannot outperform markets and, as a result, they cannot achieve high returns, in view of the fact that information is not exclusive, but available to everybody. Thus, individuals cannot be characterized as investment experts or market specialists as the specific ...

... be rather unsubstantiated. Investors cannot outperform markets and, as a result, they cannot achieve high returns, in view of the fact that information is not exclusive, but available to everybody. Thus, individuals cannot be characterized as investment experts or market specialists as the specific ...

Discount for Lack of Marketability in Preferred Financings

... 5. Was this round priced as an ”up round” or a “down round” (that is, at a premium or discount to the last per share price or implied enterprise value paid)? ...

... 5. Was this round priced as an ”up round” or a “down round” (that is, at a premium or discount to the last per share price or implied enterprise value paid)? ...

INFORMATION REQUEST FORM

... CHB, CHA, Brown Hotel Group, Inc., Los Angeles. “Since 9/11 hotel real estate has been in a slump. Though the market is turning around, some owners wanted to cut their losses and move on.” First to market were the less desirable, older properties, which initially led to concern about a lack of quali ...

... CHB, CHA, Brown Hotel Group, Inc., Los Angeles. “Since 9/11 hotel real estate has been in a slump. Though the market is turning around, some owners wanted to cut their losses and move on.” First to market were the less desirable, older properties, which initially led to concern about a lack of quali ...

The Asset Allocation Debate: Provocative Questions

... Vanguard and other researchers (Ibbotson and Kaplan, 2000). Investment advisors have generally interpreted this research to mean that selecting an appropriate asset allocation is more important than selecting the funds used to implement the allocation. This interpretation has provoked criticism from ...

... Vanguard and other researchers (Ibbotson and Kaplan, 2000). Investment advisors have generally interpreted this research to mean that selecting an appropriate asset allocation is more important than selecting the funds used to implement the allocation. This interpretation has provoked criticism from ...

Impact Investing: How does it make a difference?

... percent returns to investors the fund manager decided to raise a second fund, which invested in a company that sets up water purification plants in rural villages. The plants are owned by the local community and operated by the installation company, which sells the purified water to the village at a ...

... percent returns to investors the fund manager decided to raise a second fund, which invested in a company that sets up water purification plants in rural villages. The plants are owned by the local community and operated by the installation company, which sells the purified water to the village at a ...

Telstra Financial and Economic Profit Analysis

... downturn and a softening in performance from the fixed and mobile business lines. This has been compensated for by increased wholesale profits in 2001. Telstra’s overseas performance has been poor. With access to capital limited by the telecoms downturn, Telstra and its investment partners may see a ...

... downturn and a softening in performance from the fixed and mobile business lines. This has been compensated for by increased wholesale profits in 2001. Telstra’s overseas performance has been poor. With access to capital limited by the telecoms downturn, Telstra and its investment partners may see a ...

trading hours euronext amsterdam, brussels, lisbon and

... Trading arrangements for the period 24 December 2013 to 3 January 2014 for the Amsterdam, Brussels, Lisbon and Paris Derivatives Markets are detailed below. The trading hours of the Amsterdam, Brussels, Lisbon and Paris Derivatives Markets during the period of 24 December 2013 to 3 January 2014, inc ...

... Trading arrangements for the period 24 December 2013 to 3 January 2014 for the Amsterdam, Brussels, Lisbon and Paris Derivatives Markets are detailed below. The trading hours of the Amsterdam, Brussels, Lisbon and Paris Derivatives Markets during the period of 24 December 2013 to 3 January 2014, inc ...

Active ESG investing - BlueBay Asset Management

... manager. An increased awareness of ESG factors and an active approach can potentially have a material impact on an issuer’s long-term financial performance. In our view there are numerous benefits from incorporating ESG into an active management approach, especially for debt investors. ...

... manager. An increased awareness of ESG factors and an active approach can potentially have a material impact on an issuer’s long-term financial performance. In our view there are numerous benefits from incorporating ESG into an active management approach, especially for debt investors. ...

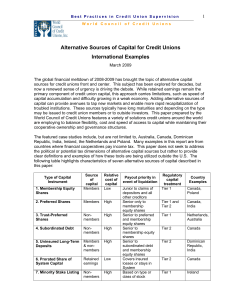

Alternative Sources of Capital for Credit Unions

... movement was able to grow reserves rapidly and improve its overall financial strength. Ten years after the introduction of preferred and membership shares, the average capital ratio had improved to over 4% and these alternative sources represented more than a third of total capital. Patronage shares ...

... movement was able to grow reserves rapidly and improve its overall financial strength. Ten years after the introduction of preferred and membership shares, the average capital ratio had improved to over 4% and these alternative sources represented more than a third of total capital. Patronage shares ...

Table of regulatory documents

... Details This instrument varies ASIC Class Rule Waiver [CW 13/680] allowing ASIC to relieve a Participant from the obligation to comply with Rule 4.1.1(1) of the Competition Rules, in the case where a Participant enters into a Transaction in an Equity Market Product that is part of a Contingent Equit ...

... Details This instrument varies ASIC Class Rule Waiver [CW 13/680] allowing ASIC to relieve a Participant from the obligation to comply with Rule 4.1.1(1) of the Competition Rules, in the case where a Participant enters into a Transaction in an Equity Market Product that is part of a Contingent Equit ...

Unintended Consequences: How higher investor taxes

... United States (and enhance U.S. competitiveness relative to other countries). While in the traditional “C-corporation,” interest payments on debt are tax deductible for corporations but taxable at the investor level, payments to shareholders are not deductible at the corporate level but are still ta ...

... United States (and enhance U.S. competitiveness relative to other countries). While in the traditional “C-corporation,” interest payments on debt are tax deductible for corporations but taxable at the investor level, payments to shareholders are not deductible at the corporate level but are still ta ...

Tributary Capital Management, LLC

... period-end market value of the account. The account is sent an invoice after each period-end. Clients are billed/charged quarterly. We charge a prorated fee for accounts initiated or terminated during a month or quarter. In some instances, advisory fees may be negotiated based on specific account ch ...

... period-end market value of the account. The account is sent an invoice after each period-end. Clients are billed/charged quarterly. We charge a prorated fee for accounts initiated or terminated during a month or quarter. In some instances, advisory fees may be negotiated based on specific account ch ...

4Q15 Economic And Real Estate Report

... ended at a yearly low of 5.0%. Driven by steady household formations, a resilient housing market was evidenced by improving builder sentiment, increased sales activity and healthy price appreciation. Additionally, construction activity registered its highest level in eight years during 2015. In Dece ...

... ended at a yearly low of 5.0%. Driven by steady household formations, a resilient housing market was evidenced by improving builder sentiment, increased sales activity and healthy price appreciation. Additionally, construction activity registered its highest level in eight years during 2015. In Dece ...

NBER WORKING PAPER SERIES THE EQUITY PREMIUM IN RETROSPECT Rajnish Mehra

... stock, per month, from local newspapers. The prices used were the average of the bid and ask prices, rather than transaction prices, and their computation of returns ignores dividends. For the period 1863–1871, Schwert uses data from Macaulay (1938), who constructed a value-weighted index using a po ...

... stock, per month, from local newspapers. The prices used were the average of the bid and ask prices, rather than transaction prices, and their computation of returns ignores dividends. For the period 1863–1871, Schwert uses data from Macaulay (1938), who constructed a value-weighted index using a po ...

This PDF is a selection from an out-of-print volume from... Bureau of Economic Research

... payments lowers corporate taxes.4 (3) The net increase in corporate tax payments reduces dividends and retained earnings, thus lowering tax payments by shareholders. (4) The nominal increase in the value of the corporation's capital stock induces a capital gains tax liability for shareholders. (5) B ...

... payments lowers corporate taxes.4 (3) The net increase in corporate tax payments reduces dividends and retained earnings, thus lowering tax payments by shareholders. (4) The nominal increase in the value of the corporation's capital stock induces a capital gains tax liability for shareholders. (5) B ...

a guide to mutual fund investing

... front-end load because the purchase was more than $1 million. » Exchange Fee – Paid when shareholders exchange (transfer) to another fund within the same fund group. » Management/Investment Advisory Fees – Paid out of the fund’s assets to the fund’s Investment Advisor for investment portfolio mana ...

... front-end load because the purchase was more than $1 million. » Exchange Fee – Paid when shareholders exchange (transfer) to another fund within the same fund group. » Management/Investment Advisory Fees – Paid out of the fund’s assets to the fund’s Investment Advisor for investment portfolio mana ...

Dreyfus Investment Portfolios, MidCap Stock Portfolio

... perceive to be fuller valuations, we expect to replace them with high-quality companies that display then-currently attractive valuations in our model. In addition, we continue to maintain a broadly diversified portfolio. January 17, 2017 ...

... perceive to be fuller valuations, we expect to replace them with high-quality companies that display then-currently attractive valuations in our model. In addition, we continue to maintain a broadly diversified portfolio. January 17, 2017 ...

ACCESS TO FINANCE OF CROATIAN SMEs

... levels of equity, unclear business plan or financial projections, lack of financial strength, poor financial management and reporting system, insufficient reinvestment of profits or diversion of their funds into non-core activities. The longer the enterprise is in operation and has some assets that ...

... levels of equity, unclear business plan or financial projections, lack of financial strength, poor financial management and reporting system, insufficient reinvestment of profits or diversion of their funds into non-core activities. The longer the enterprise is in operation and has some assets that ...

CF Canlife Asia Pacific Fund

... steel. The result of this has been numerous closures in loss-making steel mills and coal mines. This gave rise to better profitability in both coal and steel companies. On the other hand, it is pushing through additional infrastructure spending to support growth. As a result, public investment picked ...

... steel. The result of this has been numerous closures in loss-making steel mills and coal mines. This gave rise to better profitability in both coal and steel companies. On the other hand, it is pushing through additional infrastructure spending to support growth. As a result, public investment picked ...

Private equity secondary market

In finance, the private equity secondary market (also often called private equity secondaries or secondaries) refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds. Given the absence of established trading markets for these interests, the transfer of interests in private equity funds as well as hedge funds can be more complex and labor-intensive.Sellers of private equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. By its nature, the private equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors, including ""pension funds, endowments and wealthy families selling off their private equity funds before the pools have sold off all their assets."" For the vast majority of private equity investments, there is no listed public market; however, there is a robust and maturing secondary market available for sellers of private equity assets.Buyers seek to acquire private equity interests in the secondary market for multiple reasons. For example, the duration of the investment may be much shorter than an investment in the private equity fund initially. Likewise, the buyer may be able to acquire these interests at an attractive price. Finally, the buyer can evaluate the fund's holdings before deciding to purchase an interest in the fund. Conversely, sellers may seek to sell interest for various reasons, including the need to raise capital, the desire to avoid future capital calls, the need to reduce an over-allocation to the asset class or for regulatory reasons.Driven by strong demand for private equity exposure over the past decade, a significant amount of capital has been committed to secondary market funds from investors looking to increase and diversify their private equity exposure.