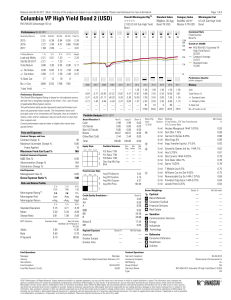

Columbia VP High Yield Bond 2 (USD)

... The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate; thus an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or ...

... The performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate; thus an investor's shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or ...

Answers to Questions

... (1) A statutory merger is created whenever two or more companies come together to form a business combination and only one remains in existence as an identifiable entity. This arrangement is often instituted by the acquisition of substantially all of an enterprise’s assets. (2) a statutory merger ca ...

... (1) A statutory merger is created whenever two or more companies come together to form a business combination and only one remains in existence as an identifiable entity. This arrangement is often instituted by the acquisition of substantially all of an enterprise’s assets. (2) a statutory merger ca ...

Reporting Form SRF 530.0 Investments

... The investment vehicle types are: cash management trust, life company guaranteed, life company investment linked, listed retail trust, pooled superannuation trust, unlisted retail trust, wholesale trust and ‘other indirect investment’. The investment vehicle domicile types are: Australia domicile, i ...

... The investment vehicle types are: cash management trust, life company guaranteed, life company investment linked, listed retail trust, pooled superannuation trust, unlisted retail trust, wholesale trust and ‘other indirect investment’. The investment vehicle domicile types are: Australia domicile, i ...

Seasons Series Trust - Allocation Moderate Growth

... The following Risk/Return Bar Chart and Table illustrate the risks of investing in the Portfolio by showing changes in the Portfolio’s performance from calendar year to calendar year and comparing the Portfolio’s average annual returns to those of the Russell 3000® Index, the MSCI EAFE Index (net), ...

... The following Risk/Return Bar Chart and Table illustrate the risks of investing in the Portfolio by showing changes in the Portfolio’s performance from calendar year to calendar year and comparing the Portfolio’s average annual returns to those of the Russell 3000® Index, the MSCI EAFE Index (net), ...

THE CAPITAL ASSET PRICING MODEL`S RISK

... The mean annualized 5-year inflation rate of 2.43% in panel B was lower than the annual rate. The mean annualized 5-year real returns of 0.53% for TB, 2.00% for IGB, 2.15% for LGB, and 5.48% for stocks were also below their annual means. This pattern of mean returns, and the relationships between me ...

... The mean annualized 5-year inflation rate of 2.43% in panel B was lower than the annual rate. The mean annualized 5-year real returns of 0.53% for TB, 2.00% for IGB, 2.15% for LGB, and 5.48% for stocks were also below their annual means. This pattern of mean returns, and the relationships between me ...

Version: March 14, 1999 - Duke University`s Fuqua School of Business

... tell which method is the best – because the variable of interest is fundamentally unobservable. The average of past returns is the method with the longest tradition. However, there are other time-series methods that use measures like dividend yields to forecast returns. These models are difficult to ...

... tell which method is the best – because the variable of interest is fundamentally unobservable. The average of past returns is the method with the longest tradition. However, there are other time-series methods that use measures like dividend yields to forecast returns. These models are difficult to ...

Venture Capital Investment and Small Business Affiliation Rules

... This means companies must forgo venture capital financing or risk losing eligibility to compete for small business set aside contracts and subcontracting opportunities with prime contractors who seek to meet small business subcontracting goals. As a result, some of the most innovative small business ...

... This means companies must forgo venture capital financing or risk losing eligibility to compete for small business set aside contracts and subcontracting opportunities with prime contractors who seek to meet small business subcontracting goals. As a result, some of the most innovative small business ...

Homeownership and Commercial Real Estate

... risk-return tradeoffs ranging from low risk and single-digit returns to high risk and high returns nearing 20 percent. Homeownership is both a consumption good and an investment asset. It serves the housing needs of the occupants but is also an investment asset, with the potential for capital gains ...

... risk-return tradeoffs ranging from low risk and single-digit returns to high risk and high returns nearing 20 percent. Homeownership is both a consumption good and an investment asset. It serves the housing needs of the occupants but is also an investment asset, with the potential for capital gains ...

Fama EF and French KR (1996) Multifactor explanations of asset

... possible to obtain asset pricing relations from the intertemporal optimal investment decision of the firm. Under the assumption of linear homogeneous production and adjustment cost functions, it was possible to establish, state by state, the equality between the return on investment and the market r ...

... possible to obtain asset pricing relations from the intertemporal optimal investment decision of the firm. Under the assumption of linear homogeneous production and adjustment cost functions, it was possible to establish, state by state, the equality between the return on investment and the market r ...

EGESIF_15-0021-00 GN on CPR42 Managememt costs and fees

... projects or investment plans by final recipients, such as the costs of obtaining planning consent, technical feasibility studies, project management expenses, etc which are part of the cost of the investment. As simple and non-exhaustive examples, in the past the Commission has considered the follow ...

... projects or investment plans by final recipients, such as the costs of obtaining planning consent, technical feasibility studies, project management expenses, etc which are part of the cost of the investment. As simple and non-exhaustive examples, in the past the Commission has considered the follow ...

The buck stops here: Vanguard money market funds Factor

... investors should be aware of the distinction between rewarded and unrewarded factors. Indeed, factor-based investing is premised on the ability to identify factors that will earn a positive premium in the future. A large range of factors have been analysed and debated in the academic literature, and ...

... investors should be aware of the distinction between rewarded and unrewarded factors. Indeed, factor-based investing is premised on the ability to identify factors that will earn a positive premium in the future. A large range of factors have been analysed and debated in the academic literature, and ...

Organizational Decision-Making and Information: Angel Investments

... theory suggests that committees can more effectively aggregate information among informed parties than the parties acting individually (de Condorcet, 1785), so all else equal, we might expect a group decision-making process to outperform an individual decision-making process. We examine a particula ...

... theory suggests that committees can more effectively aggregate information among informed parties than the parties acting individually (de Condorcet, 1785), so all else equal, we might expect a group decision-making process to outperform an individual decision-making process. We examine a particula ...

NBER WORKING PAPER SERIES ARE ASSET PRICE GUARANTEES USEFUL

... example, Calvo (1998), Izquierdo (2000), Calvo and Mendoza (2000a, 2000b), Caballero and Krishnamurty (2001), Mendoza (2004), Paasche (2001) and Schneider and Tornell (1999)). The model introduces asset price guarantees in the form of ex-ante guarantees offered to foreign investors on the liquidatio ...

... example, Calvo (1998), Izquierdo (2000), Calvo and Mendoza (2000a, 2000b), Caballero and Krishnamurty (2001), Mendoza (2004), Paasche (2001) and Schneider and Tornell (1999)). The model introduces asset price guarantees in the form of ex-ante guarantees offered to foreign investors on the liquidatio ...

The Importance of Emerging Capital Markets

... fell further in 1998 when compounded by the Russian crisis in August. The change in the composition of these flows is also significant. Net portfolio flows hit $110 billion in 1994 but fell to under $9 billion by 1998. Bank lending was curtailed with net reductions in loans in 1997, 1998, and 1999. ...

... fell further in 1998 when compounded by the Russian crisis in August. The change in the composition of these flows is also significant. Net portfolio flows hit $110 billion in 1994 but fell to under $9 billion by 1998. Bank lending was curtailed with net reductions in loans in 1997, 1998, and 1999. ...

Sparinvest White paper - Risk Containment in Emerging Markets

... also plenty of investment cases to be made in the more liquid part of the emerging markets universe. Political, legal, regulatory and settlement risks are all related to the strength of institutions and the rule of law in a country. The popular image that these all tend to be weak in emerging market ...

... also plenty of investment cases to be made in the more liquid part of the emerging markets universe. Political, legal, regulatory and settlement risks are all related to the strength of institutions and the rule of law in a country. The popular image that these all tend to be weak in emerging market ...

Leverage, maturities of debt and stock performance

... United States. For each country we use 100 companies. For the United States and the United Kingdom we take the companies of the S&P100 and the FTSE100, respectively. The S&P100 is an index which incorporates 100 US-American large cap stocks. The FTSE100 is the most prominent stock market index in th ...

... United States. For each country we use 100 companies. For the United States and the United Kingdom we take the companies of the S&P100 and the FTSE100, respectively. The S&P100 is an index which incorporates 100 US-American large cap stocks. The FTSE100 is the most prominent stock market index in th ...

Document

... politics will come under increased global pressure: former and current enemies (including Al Qaeda) will try to benefit from US domestic and international weakness; the US will have trouble maintaining its global military leadership role as they won’t be able to appropriately fund not only their mil ...

... politics will come under increased global pressure: former and current enemies (including Al Qaeda) will try to benefit from US domestic and international weakness; the US will have trouble maintaining its global military leadership role as they won’t be able to appropriately fund not only their mil ...

2013 Audit - Hartsel Fire Protection District

... Capital Assets and Long-Term Liabilities Capital asset additions during 2013 were $20,366 for construction in progress, $8,000 for equipment and $29,500 for vehicles and accessories. See notes to financial statements, note 3 capital assets, for more information. During 2013, the District’s long-term ...

... Capital Assets and Long-Term Liabilities Capital asset additions during 2013 were $20,366 for construction in progress, $8,000 for equipment and $29,500 for vehicles and accessories. See notes to financial statements, note 3 capital assets, for more information. During 2013, the District’s long-term ...

Fact sheet Comparing listed and unlisted assets

... period of time, superannuation funds invest in a variety of assets – both listed and unlisted. Every trustee board takes a different approach depending on the fund’s member profile and long-term objectives. AustralianSuper has included unlisted assets among its investments for many years, as these a ...

... period of time, superannuation funds invest in a variety of assets – both listed and unlisted. Every trustee board takes a different approach depending on the fund’s member profile and long-term objectives. AustralianSuper has included unlisted assets among its investments for many years, as these a ...

designated market makers - The New York Stock Exchange

... MKT security by assuming risk and displaying quotes in the exchange limit order book. In 2015, DMMs accounted for about 12% of liquidity adding volume in NYSE-listed securities, on average. • DMMs reduce volatility – DMMs provide price stability by satisfying market demand for a security at competi ...

... MKT security by assuming risk and displaying quotes in the exchange limit order book. In 2015, DMMs accounted for about 12% of liquidity adding volume in NYSE-listed securities, on average. • DMMs reduce volatility – DMMs provide price stability by satisfying market demand for a security at competi ...

Private equity secondary market

In finance, the private equity secondary market (also often called private equity secondaries or secondaries) refers to the buying and selling of pre-existing investor commitments to private equity and other alternative investment funds. Given the absence of established trading markets for these interests, the transfer of interests in private equity funds as well as hedge funds can be more complex and labor-intensive.Sellers of private equity investments sell not only the investments in the fund but also their remaining unfunded commitments to the funds. By its nature, the private equity asset class is illiquid, intended to be a long-term investment for buy-and-hold investors, including ""pension funds, endowments and wealthy families selling off their private equity funds before the pools have sold off all their assets."" For the vast majority of private equity investments, there is no listed public market; however, there is a robust and maturing secondary market available for sellers of private equity assets.Buyers seek to acquire private equity interests in the secondary market for multiple reasons. For example, the duration of the investment may be much shorter than an investment in the private equity fund initially. Likewise, the buyer may be able to acquire these interests at an attractive price. Finally, the buyer can evaluate the fund's holdings before deciding to purchase an interest in the fund. Conversely, sellers may seek to sell interest for various reasons, including the need to raise capital, the desire to avoid future capital calls, the need to reduce an over-allocation to the asset class or for regulatory reasons.Driven by strong demand for private equity exposure over the past decade, a significant amount of capital has been committed to secondary market funds from investors looking to increase and diversify their private equity exposure.