Effects of Dividends on Stock Prices in Nepal

... and Puckett (1964). Some theories supported MM’s theory of dividend irrelevance whereas most of the theories opposed. MM theorized that the dividend policy is irrelevant like in the capital-structure irrelevance proposition with no taxes or bankruptcy costs. This is known as the "dividend-irrelevanc ...

... and Puckett (1964). Some theories supported MM’s theory of dividend irrelevance whereas most of the theories opposed. MM theorized that the dividend policy is irrelevant like in the capital-structure irrelevance proposition with no taxes or bankruptcy costs. This is known as the "dividend-irrelevanc ...

Investment

... Investment is defined as the commitment of current financial resources in order to achieve higher gains in the future. It deals with what is called uncertainty domains. From this definition, the importance of time and future arises as they are two important elements in investment. Hence, the informa ...

... Investment is defined as the commitment of current financial resources in order to achieve higher gains in the future. It deals with what is called uncertainty domains. From this definition, the importance of time and future arises as they are two important elements in investment. Hence, the informa ...

ch15 - U of L Class Index

... • Become a market order to sell a set number of shares if shares trade at the stop price • Can be used to minimize losses or to protect a ...

... • Become a market order to sell a set number of shares if shares trade at the stop price • Can be used to minimize losses or to protect a ...

Investment Analysis (FIN 670)

... 4. You purchased 100 shares of ABC stock for $20 per share. One year later you received $1 cash dividend and sold the shares for $22 each. Your holding-period return was ...

... 4. You purchased 100 shares of ABC stock for $20 per share. One year later you received $1 cash dividend and sold the shares for $22 each. Your holding-period return was ...

Testing the Strong-Form Efficiency of the Namibian Stock Market

... corresponding future spot rates; market agents can use the forward rates as indicators of the future spot rates. This can be interpreted as it usually has been that market expectations regarding exchange rate movements are rational and/or non-existence of time varying risk premium, i.e. no systemati ...

... corresponding future spot rates; market agents can use the forward rates as indicators of the future spot rates. This can be interpreted as it usually has been that market expectations regarding exchange rate movements are rational and/or non-existence of time varying risk premium, i.e. no systemati ...

US Treasury Securities

... A lower market price isn’t a problem if you plan to hold the bond to maturity, since you will still receive your entire principal back at that time. But interest rate risk does mean you could find yourself holding a bond that pays interest at a lower rate than newer bonds being issued, so you realiz ...

... A lower market price isn’t a problem if you plan to hold the bond to maturity, since you will still receive your entire principal back at that time. But interest rate risk does mean you could find yourself holding a bond that pays interest at a lower rate than newer bonds being issued, so you realiz ...

Axovant Sciences Ltd.

... in The Wall Street Journal plus 6.80%, and (ii) 10.55%. The Term Loan has a scheduled maturity date of March 1, 2021 (the “Scheduled Maturity Date”). The Borrowers are obligated to make monthly payments of accrued interest under the Loan Agreement until September 1, 2018, followed by monthly install ...

... in The Wall Street Journal plus 6.80%, and (ii) 10.55%. The Term Loan has a scheduled maturity date of March 1, 2021 (the “Scheduled Maturity Date”). The Borrowers are obligated to make monthly payments of accrued interest under the Loan Agreement until September 1, 2018, followed by monthly install ...

Announcement Concerning Results of Tender Offer (Second) for

... 19th Business Period Third Quarterly Report”) (described on the assumption that 1 unit is 100 shares). However, because shares constituting less than a whole unit (except for the treasury shares constituting less than a whole unit held by the Target Company) were also subject to the Tender Offer, fo ...

... 19th Business Period Third Quarterly Report”) (described on the assumption that 1 unit is 100 shares). However, because shares constituting less than a whole unit (except for the treasury shares constituting less than a whole unit held by the Target Company) were also subject to the Tender Offer, fo ...

Life Technologies Corporation

... of June 16, 2006 on the public offerings of securities and the admission to trading of securities on a regulated market and approved by the Belgian Financial Services and Markets Authority on July 26, 2011. This supplement to the Prospectus was established by the issuer and the issuer is responsible ...

... of June 16, 2006 on the public offerings of securities and the admission to trading of securities on a regulated market and approved by the Belgian Financial Services and Markets Authority on July 26, 2011. This supplement to the Prospectus was established by the issuer and the issuer is responsible ...

AMBICOM HOLDINGS, INC

... and the reported amounts of revenues and expenses during the reporting period. Actual results may differ from those estimates, and the differences may be material to the financial statements. Estimates are used primarily in determining the valuation of stock based compensation, valuation of converti ...

... and the reported amounts of revenues and expenses during the reporting period. Actual results may differ from those estimates, and the differences may be material to the financial statements. Estimates are used primarily in determining the valuation of stock based compensation, valuation of converti ...

“Inflation-Maintenance” Theory of Securities Fraud Liability

... Background Vivendi was an appeal from a jury verdict finding Vivendi Universal, S.A. (“Vivendi”) liable for securities fraud under Section 10(b) and Rule 10b-5. The class plaintiffs were investors in Vivendi’s stock between October 30, 2000 and August 14, 2002. They alleged that during this period, ...

... Background Vivendi was an appeal from a jury verdict finding Vivendi Universal, S.A. (“Vivendi”) liable for securities fraud under Section 10(b) and Rule 10b-5. The class plaintiffs were investors in Vivendi’s stock between October 30, 2000 and August 14, 2002. They alleged that during this period, ...

Stock Price Predictability

... 1965). However, market frictions or human imperfections are assumed to impede such pricecorrecting, or "arbitrage" trading. Predictable patterns can thus emerge when there are important market imperfections, like trading costs, taxes, or information costs, or important human imperfections in process ...

... 1965). However, market frictions or human imperfections are assumed to impede such pricecorrecting, or "arbitrage" trading. Predictable patterns can thus emerge when there are important market imperfections, like trading costs, taxes, or information costs, or important human imperfections in process ...

Nationwide® Investor Destinations Conservative Fund

... variety of asset classes, primarily by investing in underlying funds. Therefore, in addition to the expenses of the Nationwide Investor Destinations Funds, each investor is indirectly paying a proportionate share of the applicable fees and expenses of the underlying funds. Each Fund is subject to di ...

... variety of asset classes, primarily by investing in underlying funds. Therefore, in addition to the expenses of the Nationwide Investor Destinations Funds, each investor is indirectly paying a proportionate share of the applicable fees and expenses of the underlying funds. Each Fund is subject to di ...

H R Khan: Promoting retail investor participation in government bonds

... debt market. Given the low level of participation of retail investors in equity and more so in debt markets, the specific theme of the conference aimed at the retail investors is most appropriate. Retail participation in financial instruments has assumed critical importance as the decline in the ove ...

... debt market. Given the low level of participation of retail investors in equity and more so in debt markets, the specific theme of the conference aimed at the retail investors is most appropriate. Retail participation in financial instruments has assumed critical importance as the decline in the ove ...

Circular 2018/2 Duty to report securities transactions Duty to

... placement to the client without booking to the nostro account requires only one report. The report on interal client allocations must be submitted before the close of trading on the following trading day at the latest. If a single report is submitted in consolidated form for several partial executio ...

... placement to the client without booking to the nostro account requires only one report. The report on interal client allocations must be submitted before the close of trading on the following trading day at the latest. If a single report is submitted in consolidated form for several partial executio ...

Master Circular for Currency Derivatives

... Gross open position across all contracts shall not exceed 15% of the total open interest or EUR 50 million, whichever is higher. Gross open position across all contracts shall not exceed 15% of the total open interest or GBP 50 million, whichever is higher. Gross open position across all contracts s ...

... Gross open position across all contracts shall not exceed 15% of the total open interest or EUR 50 million, whichever is higher. Gross open position across all contracts shall not exceed 15% of the total open interest or GBP 50 million, whichever is higher. Gross open position across all contracts s ...

Investors in Peabody Energy have lost over $16 billion of their stock

... This spring, the proxy advisory firm Glass Lewis & Co gave Peabody an “F” grade on its 2014 pay-for-performance compensation plan. The advisory firm is recommending that shareholders vote no on the company’s advisory vote on executive compensation at its annual meeting on May 4, 2015, due to the “p ...

... This spring, the proxy advisory firm Glass Lewis & Co gave Peabody an “F” grade on its 2014 pay-for-performance compensation plan. The advisory firm is recommending that shareholders vote no on the company’s advisory vote on executive compensation at its annual meeting on May 4, 2015, due to the “p ...

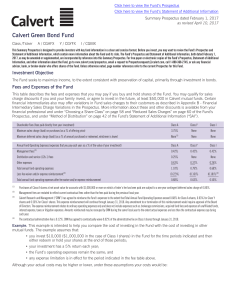

Calvert Green Bond Fund

... Fixed income markets have recently experienced a period of relatively high volatility due to rising U.S. treasury yields which, in part, reflect the market’s expectations for higher U.S. economic growth and inflation. As a result of the Federal Reserve’s recent decision to raise the target fed funds ...

... Fixed income markets have recently experienced a period of relatively high volatility due to rising U.S. treasury yields which, in part, reflect the market’s expectations for higher U.S. economic growth and inflation. As a result of the Federal Reserve’s recent decision to raise the target fed funds ...

Interaction Between Value Line`s Timeliness and

... whole, securities ranked as having higher levels of total risk are also those with higher betas. The average betas of the timeliness groups are all significantly different except T3 and T5. We find that investors choosing the timeliest securities tended to take on relatively high levels of systemati ...

... whole, securities ranked as having higher levels of total risk are also those with higher betas. The average betas of the timeliness groups are all significantly different except T3 and T5. We find that investors choosing the timeliest securities tended to take on relatively high levels of systemati ...

chapter 69o-187 professional liability self

... 69O-187.005 Solvency of the Self-Insurance Trust Fund and Trustees’ Responsibilities. The Trustees of the Fund shall be responsible for all operations of the Fund and shall assure the financial stability of the operations of the Fund by taking all necessary precautions to safeguard the assets of the ...

... 69O-187.005 Solvency of the Self-Insurance Trust Fund and Trustees’ Responsibilities. The Trustees of the Fund shall be responsible for all operations of the Fund and shall assure the financial stability of the operations of the Fund by taking all necessary precautions to safeguard the assets of the ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.