High-frequency trading

... agree to pay the lender the original amount of the loan plus some specified amount of interest. Derivative markets (options, swaps, etc.): A market where financial instruments are derived and traded based on an underlying asset such as commodities or stocks ...

... agree to pay the lender the original amount of the loan plus some specified amount of interest. Derivative markets (options, swaps, etc.): A market where financial instruments are derived and traded based on an underlying asset such as commodities or stocks ...

Arian Silver to focus solely on lithium as Noche Buena option lapses

... You understand that the Site may contain opinions from time to time with regard to securities mentioned in other products, including company related products, and that those opinions may be different from those obtained by using another product related to the Company. You understand and agree that ...

... You understand that the Site may contain opinions from time to time with regard to securities mentioned in other products, including company related products, and that those opinions may be different from those obtained by using another product related to the Company. You understand and agree that ...

TRANSLATED VERSION As of May 30, 2014 Readers should be

... (2) demonstrating that units, as a whole, will be offered to the institutional and high net worth investor [in Thailand]; (3) assigning a brokerage firm acting as an local representative responsible for selling, repurchasing and redeeming units in Thailand; (4) having a local representative, being [ ...

... (2) demonstrating that units, as a whole, will be offered to the institutional and high net worth investor [in Thailand]; (3) assigning a brokerage firm acting as an local representative responsible for selling, repurchasing and redeeming units in Thailand; (4) having a local representative, being [ ...

Montshire Advisors` Federal Home Loan Bank Program White Paper

... exempt from federal, state, and local income taxes; therefore, it can lend to its members (make advances) at favorable rates and terms. The FHLB consists of eleven federally chartered and member owned wholesale banks. Each regional FHLB makes advances to its member institutions on the security of co ...

... exempt from federal, state, and local income taxes; therefore, it can lend to its members (make advances) at favorable rates and terms. The FHLB consists of eleven federally chartered and member owned wholesale banks. Each regional FHLB makes advances to its member institutions on the security of co ...

Pui Ying College

... There are 20 magazines on a shelf. 40% of them have a red cover. How many magazines have a red cover? ...

... There are 20 magazines on a shelf. 40% of them have a red cover. How many magazines have a red cover? ...

I. INTRODUCTION TO SECURITIES TRADING AND MARKETS

... proposed to prevent or mitigate market failures such as the Great Crash of 1929. • Such sweeping legislation was made possible, in part due to overwhelming Democratic majorities having been elected to both houses of Congress and the election of President Roosevelt in 1932. • 25 days after his inaugu ...

... proposed to prevent or mitigate market failures such as the Great Crash of 1929. • Such sweeping legislation was made possible, in part due to overwhelming Democratic majorities having been elected to both houses of Congress and the election of President Roosevelt in 1932. • 25 days after his inaugu ...

Disclosure of Interest/ Changes in Interest of Substantial

... SFA, as the case may be. While Form C will be attached to the announcement template, it will not be disseminated to the public and is made available only to the Monetary Authority of Singapore (the "Authority"). ...

... SFA, as the case may be. While Form C will be attached to the announcement template, it will not be disseminated to the public and is made available only to the Monetary Authority of Singapore (the "Authority"). ...

Practice Problems for FE 486B – Thursday, February 2, 2012 1

... b) A genius invents a new technology that makes factories more productive. Future expected earnings of the company will increase, likely increasing the dividend paid to the stockholders. This increases the value of the company’s stock. Bond prices are not affected because the coupon payments are no ...

... b) A genius invents a new technology that makes factories more productive. Future expected earnings of the company will increase, likely increasing the dividend paid to the stockholders. This increases the value of the company’s stock. Bond prices are not affected because the coupon payments are no ...

Time to Take Stock Brochure - Franklin Templeton Investments

... All investments involve risk, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Investing in dividend-paying stocks involves risks. Companies ...

... All investments involve risk, including possible loss of principal. Stock prices fluctuate, sometimes rapidly and dramatically, due to factors affecting individual companies, particular industries or sectors, or general market conditions. Investing in dividend-paying stocks involves risks. Companies ...

The Wrong 20

... surprisingly high (low) realized returns • Cheap (expensive) stocks tend to have low (high) volatility, because little (much) is expected of them • Investors may expect higher returns from expensive stocks but they may be repeatedly surprised by disappointing ...

... surprisingly high (low) realized returns • Cheap (expensive) stocks tend to have low (high) volatility, because little (much) is expected of them • Investors may expect higher returns from expensive stocks but they may be repeatedly surprised by disappointing ...

Lecture 8

... currency which is different from the home currency of the investor. • The bond will NOT be offered in the capital market of the country whose currency it is denominated in. • Example: A Chinese company issuing a U.S. dollar denominated bond in Japan. This bond will NOT be issued in the United States ...

... currency which is different from the home currency of the investor. • The bond will NOT be offered in the capital market of the country whose currency it is denominated in. • Example: A Chinese company issuing a U.S. dollar denominated bond in Japan. This bond will NOT be issued in the United States ...

movement research note

... two is a recent phenomenon. There have been periods in the past where both stocks and bonds rise and fall together. This type of environment wreaks havoc on people who construct static stock/bond portfolios. They think they’ve achieved diversification. In reality, they have a portfolio that’s acting ...

... two is a recent phenomenon. There have been periods in the past where both stocks and bonds rise and fall together. This type of environment wreaks havoc on people who construct static stock/bond portfolios. They think they’ve achieved diversification. In reality, they have a portfolio that’s acting ...

Good demand for Link REIT boosted market sentiment

... the last twelve months. Mild U.S. inflation figures and greater than expected decline of housing starts also alleviated investors’ concern for aggressive rate hike by the US Fed. The HSI finished up 142.72 points, or 1.0% w-o-w, to close 14,883.32. Average daily turnover was HK$17.72 billion as comp ...

... the last twelve months. Mild U.S. inflation figures and greater than expected decline of housing starts also alleviated investors’ concern for aggressive rate hike by the US Fed. The HSI finished up 142.72 points, or 1.0% w-o-w, to close 14,883.32. Average daily turnover was HK$17.72 billion as comp ...

Exam questions

... Most business in the U.S. is conducted by corporations; corporations’ popularity results primarily from their favorable tax treatment. A good example of an agency relationship is the one between stockholders and managers. * Corporations and partnerships have an advantage over proprietorships because ...

... Most business in the U.S. is conducted by corporations; corporations’ popularity results primarily from their favorable tax treatment. A good example of an agency relationship is the one between stockholders and managers. * Corporations and partnerships have an advantage over proprietorships because ...

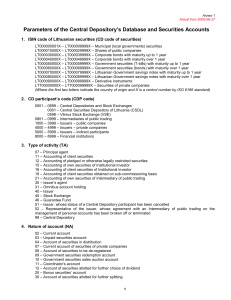

1. ISIN code of Lithuanian securities (CD code of securities)

... 105 – Redemption of the Lithuanian Government savings notes 106 – Redemption of corporate bonds through the Central Depository 109 – Government securities redemption from the participants 111 – Government securities redemption through the Central Depository 112 – Premature Government securities rede ...

... 105 – Redemption of the Lithuanian Government savings notes 106 – Redemption of corporate bonds through the Central Depository 109 – Government securities redemption from the participants 111 – Government securities redemption through the Central Depository 112 – Premature Government securities rede ...

Wheeler Real Estate Investment Trust, Inc. (Form: 8-K

... 1934, both as amended (the “Exchange Act”), with respect to the Company's expectation for future periods. Although the Company believes that the expectations reflected in such forward‐looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be ach ...

... 1934, both as amended (the “Exchange Act”), with respect to the Company's expectation for future periods. Although the Company believes that the expectations reflected in such forward‐looking statements are based upon reasonable assumptions, it can give no assurance that its expectations will be ach ...

Exchange-Traded Funds (ETF)

... or an investment fund that tracks an underlying index and trades as a single equity. • Created around every conceivable types of index… – Market Indices (S&P 500, NASDAQ 100, etc.) – Market Sectors (Health Care, Oil & Gas, etc.) – Stock types (value, growth, etc.) – Specialty, International, Real Es ...

... or an investment fund that tracks an underlying index and trades as a single equity. • Created around every conceivable types of index… – Market Indices (S&P 500, NASDAQ 100, etc.) – Market Sectors (Health Care, Oil & Gas, etc.) – Stock types (value, growth, etc.) – Specialty, International, Real Es ...

on the nature of the stock market: simulations and

... I conclude this thesis with some thoughts on how DSEM may be extended to produce new insights and on further statistical properties which could be tested: As discussed above, one of the most pressing issues is whether scaling and clustered volatility can emerge spontaneously without requiring tuning ...

... I conclude this thesis with some thoughts on how DSEM may be extended to produce new insights and on further statistical properties which could be tested: As discussed above, one of the most pressing issues is whether scaling and clustered volatility can emerge spontaneously without requiring tuning ...

Intermediate Financial Management Homework Assignment 4 If you

... shares sold = (3900 - 3000) / 27 = 33.33 shares Question 2: Use the information for the question(s) below. Omicron Technologies has $50 million in excess cash and no debt. The firm expects to generate additional free cash flows of $40 million per year in subsequent years and will pay out these futur ...

... shares sold = (3900 - 3000) / 27 = 33.33 shares Question 2: Use the information for the question(s) below. Omicron Technologies has $50 million in excess cash and no debt. The firm expects to generate additional free cash flows of $40 million per year in subsequent years and will pay out these futur ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.