Chapter_2_KP

... Variable costs: These are expenses that are uniform per unit of output within a relevant time period; yet total variable costs fluctuate in direct proportion to the output volume units produced. In other words, as volume increases total variable costs increase. The more you produce, the more variabl ...

... Variable costs: These are expenses that are uniform per unit of output within a relevant time period; yet total variable costs fluctuate in direct proportion to the output volume units produced. In other words, as volume increases total variable costs increase. The more you produce, the more variabl ...

Invesco Short Term Bond Fund fact sheet

... Performance quoted is past performance and cannot guarantee comparable future results; current performance may be lower or higher. Visit invesco.com/performance for the most recent month-end performance. Performance figures reflect reinvested distributions and changes in net asset value (NAV). Inves ...

... Performance quoted is past performance and cannot guarantee comparable future results; current performance may be lower or higher. Visit invesco.com/performance for the most recent month-end performance. Performance figures reflect reinvested distributions and changes in net asset value (NAV). Inves ...

PompeuFabra Platform Oct 11 2006

... 9 Account for elasticities of demand on both sides: price structure should aim at getting both sides on board, not at allocating costs "fairly". 9 Account for surplus generated on the other side: high value to other side low price on this side, high price on other side; and conversely. Most obvious ...

... 9 Account for elasticities of demand on both sides: price structure should aim at getting both sides on board, not at allocating costs "fairly". 9 Account for surplus generated on the other side: high value to other side low price on this side, high price on other side; and conversely. Most obvious ...

記錄 編號 6812 狀態 NC094FJU00457001 助教 查核 索書 號 學校

... Through a certain domestic reputed securities company, 53680 individual investors account transaction details were supplied for this research. Based on the research model of Barber and Odean (2001) as the basis, the behavioral framework of procurement decision by dispersed investors is established. ...

... Through a certain domestic reputed securities company, 53680 individual investors account transaction details were supplied for this research. Based on the research model of Barber and Odean (2001) as the basis, the behavioral framework of procurement decision by dispersed investors is established. ...

Chapter 15 PowerPoint Presentation

... Consider a U.S.-based company that owns a controlling interest in a French company. The reporting currency of the U.S. company is the dollar. The French company maintains its books in Euros. Before preparing consolidated statements, the U.S. company must translate the French company’s statements int ...

... Consider a U.S.-based company that owns a controlling interest in a French company. The reporting currency of the U.S. company is the dollar. The French company maintains its books in Euros. Before preparing consolidated statements, the U.S. company must translate the French company’s statements int ...

Payout-Policy-preference-of-Listed-Firms-in-the

... Every firm’s goal is to maximize shareholders’ wealth. When a firm has ample cash and wants to distribute it to shareholders, it can do so by means of dividends or stock repurchase. In the U.S., dividend payout is the fundamental way of corporations to give back to shareholders. But after the introd ...

... Every firm’s goal is to maximize shareholders’ wealth. When a firm has ample cash and wants to distribute it to shareholders, it can do so by means of dividends or stock repurchase. In the U.S., dividend payout is the fundamental way of corporations to give back to shareholders. But after the introd ...

securities and exchange commission - corporate

... On December 7, 2010, at a special meeting of shareholders of Aaron’s, Inc. (the “Company”), the shareholders of the Company approved, among other things, a proposal to amend and restate the Company’s Amended and Restated Articles of Incorporation to (a) effect a reclassification of each outstanding ...

... On December 7, 2010, at a special meeting of shareholders of Aaron’s, Inc. (the “Company”), the shareholders of the Company approved, among other things, a proposal to amend and restate the Company’s Amended and Restated Articles of Incorporation to (a) effect a reclassification of each outstanding ...

What Income-Seeking Investors Should Know

... results, share prices will fluctuate and you may have a gain or loss when you redeem shares. Borrowing for investment purposes creates leverage, which can increase the risk and volatility of a fund. Concentration in a particular industry will involve a greater degree of risk than a more diversified ...

... results, share prices will fluctuate and you may have a gain or loss when you redeem shares. Borrowing for investment purposes creates leverage, which can increase the risk and volatility of a fund. Concentration in a particular industry will involve a greater degree of risk than a more diversified ...

Safe: Cap and Discount

... Company will pay an amount equal to the Purchase Amount, due and payable to the Investor immediately prior to, or concurrent with, the consummation of the Dissolution Event. The Purchase Amount will be paid prior and in preference to any Distribution of any of the assets of the Company to holders of ...

... Company will pay an amount equal to the Purchase Amount, due and payable to the Investor immediately prior to, or concurrent with, the consummation of the Dissolution Event. The Purchase Amount will be paid prior and in preference to any Distribution of any of the assets of the Company to holders of ...

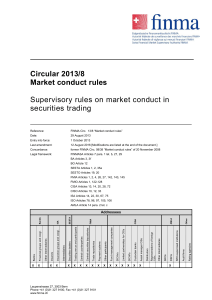

Circular 2013/8 Market conduct rules Supervisory rules on

... Nostro-nostro in-house crosses where equal and opposite trades are matched in the stock exchange system independently of one another and without any previous agreement. ...

... Nostro-nostro in-house crosses where equal and opposite trades are matched in the stock exchange system independently of one another and without any previous agreement. ...

(1) - Studyclix

... The following are the main groups of people who would be interested in finding out information about the performance of a firm. These groups of people will examine the accounts and the ratios for their own reason: ...

... The following are the main groups of people who would be interested in finding out information about the performance of a firm. These groups of people will examine the accounts and the ratios for their own reason: ...

Regulatory Notice 14-23

... and Compliance Engine (TRACE). However, firms may request the set-up of a new hybrid security for trade reporting purposes in accordance with this interpretation prior to that date. A list of covered hybrid securities that will be moved from the OTC Reporting Facility (ORF) to TRACE on June 16, 2014 ...

... and Compliance Engine (TRACE). However, firms may request the set-up of a new hybrid security for trade reporting purposes in accordance with this interpretation prior to that date. A list of covered hybrid securities that will be moved from the OTC Reporting Facility (ORF) to TRACE on June 16, 2014 ...

SPECULATIVE BUBBLES – A BEHAVIORAL APPROACH

... models and search different stores for the best market price, instead for a stock they might decide to buy or sell the stock in a matter of minutes. -Familiarity biases – people tend to think that assets they know more about are less risky than the others that do not know much about: for instance, t ...

... models and search different stores for the best market price, instead for a stock they might decide to buy or sell the stock in a matter of minutes. -Familiarity biases – people tend to think that assets they know more about are less risky than the others that do not know much about: for instance, t ...

Georgia State University Policy 5.10.06 Endowment Funds

... Full Policy Text Endowment funds may be invested in cash and cash equivalents, U.S. Government and Agency securities, certificates of deposit, banker's acceptances, corporate bonds, commercial paper, common stocks, and pooled investment funds. Endowment funds may be invested in the Total Return Fund ...

... Full Policy Text Endowment funds may be invested in cash and cash equivalents, U.S. Government and Agency securities, certificates of deposit, banker's acceptances, corporate bonds, commercial paper, common stocks, and pooled investment funds. Endowment funds may be invested in the Total Return Fund ...

Manulife Financial Corporation announces Preferred Share issue

... offering of Non-cumulative Rate Reset Class 1 Shares Series 23 (“Series 23 Preferred Shares”). Manulife will issue 14 million Series 23 Preferred Shares priced at $25 per share to raise gross proceeds of $350 million. The offering will be underwritten by a syndicate of investment dealers coled by RB ...

... offering of Non-cumulative Rate Reset Class 1 Shares Series 23 (“Series 23 Preferred Shares”). Manulife will issue 14 million Series 23 Preferred Shares priced at $25 per share to raise gross proceeds of $350 million. The offering will be underwritten by a syndicate of investment dealers coled by RB ...

Lincoln Financial Securities Corporation (LFS) Brokerage

... program fee. The total program fee is found on the Statement of Investment Selection when opening your account. Lincoln Financial Securities reserves the right to amend this Fee and Commission Schedule, in its sole discretion, upon written notice to the Account Holder. The Account Holder will be dee ...

... program fee. The total program fee is found on the Statement of Investment Selection when opening your account. Lincoln Financial Securities reserves the right to amend this Fee and Commission Schedule, in its sole discretion, upon written notice to the Account Holder. The Account Holder will be dee ...

Porters Five Forces: Rivalry Phil Kenkel Bill Fitzwater Cooperative

... Rivalry is the competition that occurs as firms try to increase their market share. In a grain, farm supply or cotton cooperative, rivalry occurs because members have other opportunities to delivery their grain, gin their cotton or purchase inputs. Rivalry often focuses on price competition with oth ...

... Rivalry is the competition that occurs as firms try to increase their market share. In a grain, farm supply or cotton cooperative, rivalry occurs because members have other opportunities to delivery their grain, gin their cotton or purchase inputs. Rivalry often focuses on price competition with oth ...

Q2 2016 - SAGE Investment Advisors

... Investment Outlook we cited geopolitical risk in the “eurozone related to the immigration crisis”. Since then, the “Brexit” exit has come to fruition. As investors we must remember that there is always another Brexit ...

... Investment Outlook we cited geopolitical risk in the “eurozone related to the immigration crisis”. Since then, the “Brexit” exit has come to fruition. As investors we must remember that there is always another Brexit ...

Intel In Talks To Buy Altera Economic Growth

... Corporate profits after tax—without accounting for the value of inventory and depreciation of buildings and equipment— fell at a 3% pace from the third quarter. That was the largest quarterly drop in profits since the first quarter of 2011. ...

... Corporate profits after tax—without accounting for the value of inventory and depreciation of buildings and equipment— fell at a 3% pace from the third quarter. That was the largest quarterly drop in profits since the first quarter of 2011. ...

Short (finance)

.png?width=300)

In finance, short selling (also known as shorting or going short) is the practice of selling securities or other financial instruments that are not currently owned, and subsequently repurchasing them (""covering""). In the event of an interim price decline, the short seller will profit, since the cost of (re)purchase will be less than the proceeds which were received upon the initial (short) sale. Conversely, the short position will be closed out at a loss in the event that the price of a shorted instrument should rise prior to repurchase. The potential loss on a short sale is theoretically unlimited in the event of an unlimited rise in the price of the instrument, however in practice the short seller will be required to post margin or collateral to cover losses, and any inability to do so on a timely basis would cause its broker or counterparty to liquidate the position. In the securities markets, the seller generally must borrow the securities in order to effect delivery in the short sale. In some cases, the short seller must pay a fee to borrow the securities and must additionally reimburse the lender for cash returns the lender would have received had the securities not been loaned out.Short selling is most commonly done with instruments traded in public securities, futures or currency markets, due to the liquidity and real-time price dissemination characteristic of such markets and because the instruments defined within each class are fungible.In practical terms, going short can be considered the opposite of the conventional practice of ""going long"", whereby an investor profits from an increase in the price of the asset. Mathematically, the return from a short position is equivalent to that of owning (being ""long"") a negative amount of the instrument. A short sale may be motivated by a variety of objectives. Speculators may sell short in the hope of realizing a profit on an instrument which appears to be overvalued, just as long investors or speculators hope to profit from a rise in the price of an instrument which appears undervalued. Traders or fund managers may hedge a long position or a portfolio through one or more short positions.