DERIVATIVES-II

... Agreement to buy or sell an asset at a certain time for a certain price. Traded on the exchange. Forward contract is not traded on the market and it is usually between two financial institutions, One of the parties has a long position who agrees to buy the underlying asset at a certain price, the pa ...

... Agreement to buy or sell an asset at a certain time for a certain price. Traded on the exchange. Forward contract is not traded on the market and it is usually between two financial institutions, One of the parties has a long position who agrees to buy the underlying asset at a certain price, the pa ...

Chapter 1: Introduction

... The purchase of a T-bill is, therefore, an investment that pays no cash flow between the purchase date and the bill’s maturity. Hence, its current market price is the NPV of the bill’s Face Value: ...

... The purchase of a T-bill is, therefore, an investment that pays no cash flow between the purchase date and the bill’s maturity. Hence, its current market price is the NPV of the bill’s Face Value: ...

Derivatives Market Risk Related to Certain Variable

... model does not estimate the greatest possible loss. The results of these models and analysis thereof are subject to the judgment of our risk management personnel. ...

... model does not estimate the greatest possible loss. The results of these models and analysis thereof are subject to the judgment of our risk management personnel. ...

Investigators probe $500tn interest rate swaps market

... the market totalled $505tn, around 80 per cent of the global swaps market, according to figures from the Bank for International Settlements. Isdafix prices are also used to settle interest rate swaps futures contracts traded on the Chicago Mercantile Exchange, the world’s most liquid futures market. ...

... the market totalled $505tn, around 80 per cent of the global swaps market, according to figures from the Bank for International Settlements. Isdafix prices are also used to settle interest rate swaps futures contracts traded on the Chicago Mercantile Exchange, the world’s most liquid futures market. ...

October 20, 2014 Interest Rate Risk Management Weekly Update Current Rate Environment

... than expected retail sales data in the US, fueling fear of a zero inflation environment. All asset classes were affected by high volatility for the rest of the week, with the 10yr Treasury yield moving as much as 40bps down in one day and the S&P 500 down nearly 3% . Pressure for action from the E ...

... than expected retail sales data in the US, fueling fear of a zero inflation environment. All asset classes were affected by high volatility for the rest of the week, with the 10yr Treasury yield moving as much as 40bps down in one day and the S&P 500 down nearly 3% . Pressure for action from the E ...

DOC - Europa.eu

... which the CDS is written defaults. As the revenue he receives is usually but a fraction of the payment that he would need to make, he is exposed to the risk of incurring a substantial loss in case a default does occur. Contracts are non-fungible. Because of this, market participants that wish to c ...

... which the CDS is written defaults. As the revenue he receives is usually but a fraction of the payment that he would need to make, he is exposed to the risk of incurring a substantial loss in case a default does occur. Contracts are non-fungible. Because of this, market participants that wish to c ...

Investors and Markets

... credit risks of the reference entities without directly holding the debt obligations of the reference entities and without involving any reference entity in the transaction. ...

... credit risks of the reference entities without directly holding the debt obligations of the reference entities and without involving any reference entity in the transaction. ...

Chapter 9

... extremely helpful financial instruments. • They can reduce risk, allowing firms and individual to enter into agreements that they could not have otherwise. • Derivatives can also be used an insurance against future events. • This chapter will provide an introduction to the use and abuse of derivativ ...

... extremely helpful financial instruments. • They can reduce risk, allowing firms and individual to enter into agreements that they could not have otherwise. • Derivatives can also be used an insurance against future events. • This chapter will provide an introduction to the use and abuse of derivativ ...

Total Return Swap

... The vanilla type of international interest rate swap or cross-currency swap is only possible, in Brazil, through a series of index swaps. Usually, these swaps have non-standard underlying indexes, (e.g. Libor), and are registered at CETIP as “others” ...

... The vanilla type of international interest rate swap or cross-currency swap is only possible, in Brazil, through a series of index swaps. Usually, these swaps have non-standard underlying indexes, (e.g. Libor), and are registered at CETIP as “others” ...

download

... Can be viewed as an investment asset paying a dividend yield The futures price and spot price relationship is therefore ...

... Can be viewed as an investment asset paying a dividend yield The futures price and spot price relationship is therefore ...

gbpusd - Forex Factory

... trading involves substantial risk of loss and is not suitable for every investor. The value of currencies may fluctuate and investors may lose all or more than their original investments. Risks also include, but are not limited to, the potential for changing political and/or economic conditions that ...

... trading involves substantial risk of loss and is not suitable for every investor. The value of currencies may fluctuate and investors may lose all or more than their original investments. Risks also include, but are not limited to, the potential for changing political and/or economic conditions that ...

Leveraged ETF credit risks

... ProShares and Rydex are the two biggest issuers of leveraged funds, which seek to provide some multiple of the return on an index or sector. Examples include UltraShort Financials ProShares (NasdaqGS:SKF - News), which seeks to provide twice the opposite of the daily return of the U.S. financials se ...

... ProShares and Rydex are the two biggest issuers of leveraged funds, which seek to provide some multiple of the return on an index or sector. Examples include UltraShort Financials ProShares (NasdaqGS:SKF - News), which seeks to provide twice the opposite of the daily return of the U.S. financials se ...

STATE UNIVERSITY – THE HIGHER SCHOOL OF ECONOMICS

... Most common types of market derivatives are taken into account in the course: Forwards and futures – as instruments providing definite forward projection of final profit if not cash flows. Exchange trading habits and certain issues such as offset dealing or private defaults form the focus of the par ...

... Most common types of market derivatives are taken into account in the course: Forwards and futures – as instruments providing definite forward projection of final profit if not cash flows. Exchange trading habits and certain issues such as offset dealing or private defaults form the focus of the par ...

Understanding Derivative – Beyond Accounting Presented By Safwat Khalid

... Credit Risk • The risk of loss of principal or loss of a financial reward stemming from a borrower's failure to repay a loan or otherwise meet a contractual obligation. Credit risk arises whenever a borrower is expecting to use future cash flows to pay a current debt. Investors are compensated for ...

... Credit Risk • The risk of loss of principal or loss of a financial reward stemming from a borrower's failure to repay a loan or otherwise meet a contractual obligation. Credit risk arises whenever a borrower is expecting to use future cash flows to pay a current debt. Investors are compensated for ...

Get the flexibility to determine a futures price without

... price without committing to a basis. What is it? A fixed futures contract allows you to fix the futures price on a quantity of grain and leave the basis open. ...

... price without committing to a basis. What is it? A fixed futures contract allows you to fix the futures price on a quantity of grain and leave the basis open. ...

Introduction

... A derivative is an instrument whose value depends on the values of other more basic underlying variables ...

... A derivative is an instrument whose value depends on the values of other more basic underlying variables ...

An introduction to pricing methods for credit derivatives

... Credit Default Swaps: • The most important derivative (2002: accounting for about 67% of the credit ...

... Credit Default Swaps: • The most important derivative (2002: accounting for about 67% of the credit ...

Unless otherwise stated in the examination question, assume: • The

... Unless otherwise stated in the examination question, assume: • The market is frictionless. There are no taxes, transaction costs, bid/ask spreads or restrictions on short sales. All securities are perfectly divisible. Trading does not affect prices. Information is available to all investors simultan ...

... Unless otherwise stated in the examination question, assume: • The market is frictionless. There are no taxes, transaction costs, bid/ask spreads or restrictions on short sales. All securities are perfectly divisible. Trading does not affect prices. Information is available to all investors simultan ...

Speculation and Recessions – “A Bit of a Punt”

... are unemployed in the West, but unofficial estimates are twice that high. We are in deep trouble. But what can be done? Foreign exchange transactions based on the real economy are now only 2% of all transactions. 98% are speculative! The annual GDP of the USA is turned over via currency trading ever ...

... are unemployed in the West, but unofficial estimates are twice that high. We are in deep trouble. But what can be done? Foreign exchange transactions based on the real economy are now only 2% of all transactions. 98% are speculative! The annual GDP of the USA is turned over via currency trading ever ...

WNE UW - Derivatives Markets

... But we do not live in a simple world of only stocks and bonds, and in fact investors can adjust the level of risk in a variety of ways. For example, one way to reduce risk is to use insurance, which can be described as the act of paying someone to assume a risk for you. The financial markets have cr ...

... But we do not live in a simple world of only stocks and bonds, and in fact investors can adjust the level of risk in a variety of ways. For example, one way to reduce risk is to use insurance, which can be described as the act of paying someone to assume a risk for you. The financial markets have cr ...

LMAX EXCHANGE Wall Street 30 (Mini) Contract Terms

... Rulebook, unless the context otherwise requires or unless separately defined herein. The same rules of interpretation set out in the LMAX Rulebook apply. ...

... Rulebook, unless the context otherwise requires or unless separately defined herein. The same rules of interpretation set out in the LMAX Rulebook apply. ...

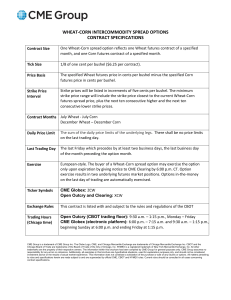

Wheat-Corn Intercommodity Spread Options Contract

... Chicago Board of Trade are trademarks of the Board of Trade of the City of Chicago, Inc. NYMEX is a registered trademark of New York Mercantile Exchange, Inc. All other trademarks are the property of their respective owners. The information within this brochure has been compiled by CME Group for gen ...

... Chicago Board of Trade are trademarks of the Board of Trade of the City of Chicago, Inc. NYMEX is a registered trademark of New York Mercantile Exchange, Inc. All other trademarks are the property of their respective owners. The information within this brochure has been compiled by CME Group for gen ...

Lecture Notes_Chapter 1 - the School of Economics and Finance

... • End of month 12: $100(1+1%)12 = $100(1+12.68%) 12.68% is the effective annual rate (EAR). ...

... • End of month 12: $100(1+1%)12 = $100(1+12.68%) 12.68% is the effective annual rate (EAR). ...