Parallel Computing Method of Valuing for Multi-Asset

... relationship between demands and services, but also rely on the balance of demand and serve of underlying asset. ...

... relationship between demands and services, but also rely on the balance of demand and serve of underlying asset. ...

DESCRIPTION OF FINANCIAL INSTRUMENT TYPES AND

... market interest rates. When the market interest rates grow, the prices of bonds decline, so their holders may incur a loss, if they want to sell the bonds before their maturity date. The fluctuations of market interest rates will mostly affect the long-term bond prices. ...

... market interest rates. When the market interest rates grow, the prices of bonds decline, so their holders may incur a loss, if they want to sell the bonds before their maturity date. The fluctuations of market interest rates will mostly affect the long-term bond prices. ...

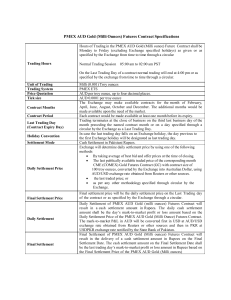

PMEX AUD Gold Futures Contract

... result in a cash settlement amount in Rupees. The daily cash settlement amount shall be the day’s mark-to-market profit or loss amount based on the Daily Settlement Price of the PMEX AUD Gold (Milli Ounce) Futures Contract. The mark-to-market P&L in AUD will be converted first in USD at AUD/USD exch ...

... result in a cash settlement amount in Rupees. The daily cash settlement amount shall be the day’s mark-to-market profit or loss amount based on the Daily Settlement Price of the PMEX AUD Gold (Milli Ounce) Futures Contract. The mark-to-market P&L in AUD will be converted first in USD at AUD/USD exch ...

TTSE Rule 405 - Price Stabilisation Amended April 19th 2010

... cases of a one sided market with no opposing bids or offers for some securities. As at June 30th 2009, there were three (3) securities with bids or offers at the 10% limit and twenty one (21) securities with a one sided market. ...

... cases of a one sided market with no opposing bids or offers for some securities. As at June 30th 2009, there were three (3) securities with bids or offers at the 10% limit and twenty one (21) securities with a one sided market. ...

Note 3 Finansiell risikostyring_EN

... loans. The fair value of all the company's borrowings taken out before 31 December 2009 will be affected by changes in interest rates, including changes in credit spreads. In the course of 2011 the change in credit spreads, viewed in isolation, resulted in a NOK 20 million reduction in the fair valu ...

... loans. The fair value of all the company's borrowings taken out before 31 December 2009 will be affected by changes in interest rates, including changes in credit spreads. In the course of 2011 the change in credit spreads, viewed in isolation, resulted in a NOK 20 million reduction in the fair valu ...

DOE-Personal Finance Boot Camp-#3

... Historically, common stocks have out-performed other investments over long time periods BUT…it has not been a smooth ride! ...

... Historically, common stocks have out-performed other investments over long time periods BUT…it has not been a smooth ride! ...

presents at the Humboldt Distinguished Lecture Series in Applied Mathematics

... system. The first two lectures will address contingent capital for banks in the form of debt that converts to equity when a bank nears financial distress. Contingent capital offers a promising potential solution to the problem of banks that are too big to fail, but the design of these securities and ...

... system. The first two lectures will address contingent capital for banks in the form of debt that converts to equity when a bank nears financial distress. Contingent capital offers a promising potential solution to the problem of banks that are too big to fail, but the design of these securities and ...

Paul Glasserman

... system. The first two lectures will address contingent capital for banks in the form of debt that converts to equity when a bank nears financial distress. Contingent capital offers a promising potential solution to the problem of banks that are too big to fail, but the design of these securities and ...

... system. The first two lectures will address contingent capital for banks in the form of debt that converts to equity when a bank nears financial distress. Contingent capital offers a promising potential solution to the problem of banks that are too big to fail, but the design of these securities and ...

Monte-Carlo simulation with Black-Scholes

... selling an amount of the underlie that corresponds to the delta of the portfolio. By adjusting the amount bought or sold on new positions, the portfolio delta can be made to sum to zero, and the portfolio is then delta ...

... selling an amount of the underlie that corresponds to the delta of the portfolio. By adjusting the amount bought or sold on new positions, the portfolio delta can be made to sum to zero, and the portfolio is then delta ...

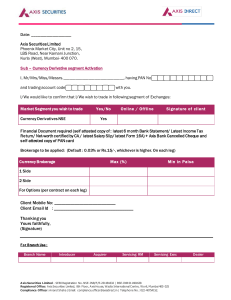

Client Email Id : Thanking you Yours faithfu

... Return/ Net-worth certified by CA / latest Salary Slip/ latest Form 16A) + Axis Bank Cancelled Cheque and self-attested copy of PAN card Brokerage to be applied: (Default : 0.03% or Rs.15/-, whichever is higher. On each leg) Currency Brokerage ...

... Return/ Net-worth certified by CA / latest Salary Slip/ latest Form 16A) + Axis Bank Cancelled Cheque and self-attested copy of PAN card Brokerage to be applied: (Default : 0.03% or Rs.15/-, whichever is higher. On each leg) Currency Brokerage ...

The Stock Exchange Corner

... Bonds – which are documents acknowledging a debt by the issuer of the bonds to the holders of the bonds - are valued by reference to the rate of interest paid to the holders of the bonds. The Government can raise money at the lowest rate of interest; publicly owned bodies may have to pay a little mo ...

... Bonds – which are documents acknowledging a debt by the issuer of the bonds to the holders of the bonds - are valued by reference to the rate of interest paid to the holders of the bonds. The Government can raise money at the lowest rate of interest; publicly owned bodies may have to pay a little mo ...

Lecture 2 - Leeds Maths

... The consequence of this arbitrage opportunity is an increased supply of euros in London which pushes the exchange rate up there. In Paris, the echange rate will drop, until the rates in London and Paris are equal. In well-developed liquid markets, any arbitrage opportunity will disappear quickly. Th ...

... The consequence of this arbitrage opportunity is an increased supply of euros in London which pushes the exchange rate up there. In Paris, the echange rate will drop, until the rates in London and Paris are equal. In well-developed liquid markets, any arbitrage opportunity will disappear quickly. Th ...

Conventional Wisdom and the Impact of Market Volatility

... passive speculation; it will not go away on its own. When passive speculators are eliminated from the markets, then most consumable commodities derivatives markets will no longer be excessively speculative, and their intended functions will be restored.” Michael W. Masters, Testimony before the Comm ...

... passive speculation; it will not go away on its own. When passive speculators are eliminated from the markets, then most consumable commodities derivatives markets will no longer be excessively speculative, and their intended functions will be restored.” Michael W. Masters, Testimony before the Comm ...

Canadian Institute of Actuaries L`Institut canadien des actuaires

... Determining Appropriate Mix of Instruments Relative Factors to Consider ...

... Determining Appropriate Mix of Instruments Relative Factors to Consider ...

Futures Contracts

... derives its economic value from an underlying asset, such as a stock or a bond. Hedge To take action to reduce risk by, for example, purchasing a derivative contract that will increase in value when another asset in an investor’s portfolio decreases in value. • Derivatives can serve as a type of ins ...

... derives its economic value from an underlying asset, such as a stock or a bond. Hedge To take action to reduce risk by, for example, purchasing a derivative contract that will increase in value when another asset in an investor’s portfolio decreases in value. • Derivatives can serve as a type of ins ...

Money, Banking, and the Financial System

... futures contracts include those for Treasury bills, notes, and bonds; stock indexes; and currencies. • An investor who believes that he or she has superior insight into the likely path of future interest rates can use the futures market to speculate. • For example, if you wanted to speculate that fu ...

... futures contracts include those for Treasury bills, notes, and bonds; stock indexes; and currencies. • An investor who believes that he or she has superior insight into the likely path of future interest rates can use the futures market to speculate. • For example, if you wanted to speculate that fu ...

Multiple Choice - Marriott School

... D) If interest rates increase by 45 basis points over the next month, what will be the effect on bank equity? (3 points) Change in Assets=-13*750*.0045=-43.88 Change in Liabilities=-5.1*500*.0045=-11.48 Change in bank equity=-43.88-(-11.48)=-32.4 (million) 9. A futures contract for Cisco stock is tr ...

... D) If interest rates increase by 45 basis points over the next month, what will be the effect on bank equity? (3 points) Change in Assets=-13*750*.0045=-43.88 Change in Liabilities=-5.1*500*.0045=-11.48 Change in bank equity=-43.88-(-11.48)=-32.4 (million) 9. A futures contract for Cisco stock is tr ...

Derivatives and their feedback effects on the spot markets

... importance and information content, Monthly Report, ...

... importance and information content, Monthly Report, ...

Intermediate Financial Management, 5th Ed.

... Example: A firm holds a portfolio of bonds, interest rates rise, and the value of the bonds falls. ...

... Example: A firm holds a portfolio of bonds, interest rates rise, and the value of the bonds falls. ...

CHAPTER 32. INTERNATIONAL CORPORATE FINANCE. I. The

... However, the cross rate is not the same as the actual quotation of DG1.70 / C$ Is there any arbitrage opportunity ? ..Netherlands.. DG 1,062.5 ...

... However, the cross rate is not the same as the actual quotation of DG1.70 / C$ Is there any arbitrage opportunity ? ..Netherlands.. DG 1,062.5 ...

the weather market - University of Toronto

... • For wind farms, risk found both in too little wind and too much wind • For the construction industry, risk may be transferred for wind, frost and rain in a hybrid contract ...

... • For wind farms, risk found both in too little wind and too much wind • For the construction industry, risk may be transferred for wind, frost and rain in a hybrid contract ...

The Nasdaq-100 Index Option - The New York Stock Exchange

... The Nasdaq-100 is a modified capitalization weighted index composed of 100 of the largest non-financial securities listed on the Nasdaq Stock Market. The index was created in 1985 with a base value set to 250 on February 1 of that year. After reaching a level of nearly 800 on December 31, 1993, the ...

... The Nasdaq-100 is a modified capitalization weighted index composed of 100 of the largest non-financial securities listed on the Nasdaq Stock Market. The index was created in 1985 with a base value set to 250 on February 1 of that year. After reaching a level of nearly 800 on December 31, 1993, the ...

pdf

... (a) Determine the put price by working backward through the tree. (b) Determine the put price by using the formula which gives it as an average over all final-time payoffs. Of course your answer should be the same as for (a). (c) Describe the associated trading strategy using forwards. In other wor ...

... (a) Determine the put price by working backward through the tree. (b) Determine the put price by using the formula which gives it as an average over all final-time payoffs. Of course your answer should be the same as for (a). (c) Describe the associated trading strategy using forwards. In other wor ...

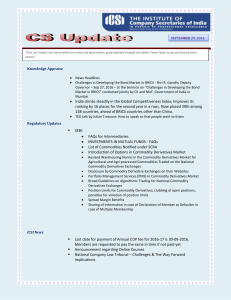

Kindly send your feedback/suggestions regarding CS updates

... Symposium on Companies Act, 2013 – Recent Amendments and NCLT & NCLAT at Goa on October 6, 2016 Master Classes on Goods and Services Tax Webinar Announcement Training Programme for Peer Reviewers at Kolkata on 01.10.2016 Training Programme for Peer Reviewers at Guwahati on 03.10.2016 Second Series o ...

... Symposium on Companies Act, 2013 – Recent Amendments and NCLT & NCLAT at Goa on October 6, 2016 Master Classes on Goods and Services Tax Webinar Announcement Training Programme for Peer Reviewers at Kolkata on 01.10.2016 Training Programme for Peer Reviewers at Guwahati on 03.10.2016 Second Series o ...