Chapter 13 Equity Valuation Multiple Choice Questions 1. The

... 15. A firm that has an ROE of 12% is considering cutting its dividend payout. The stockholders of the firm desire a dividend yield of 4% and a capital gain yield of 9%. Given this information, which of the following statements is (are) correct? I. All else equal, the firm's growth rate will acceler ...

... 15. A firm that has an ROE of 12% is considering cutting its dividend payout. The stockholders of the firm desire a dividend yield of 4% and a capital gain yield of 9%. Given this information, which of the following statements is (are) correct? I. All else equal, the firm's growth rate will acceler ...

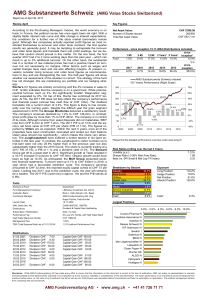

AMG Substanzwerte Schweiz (AMG Value Stocks

... results are generally good. It may be tempting to extrapolate the turnover and order book figures and translate them into profit postings, but we believe that caution should prevail in this matter. On the one hand, the first quarter 2017 had 2 to 3 more working days than the past year – which can re ...

... results are generally good. It may be tempting to extrapolate the turnover and order book figures and translate them into profit postings, but we believe that caution should prevail in this matter. On the one hand, the first quarter 2017 had 2 to 3 more working days than the past year – which can re ...

Cost Approach Inconsistencies

... profit) is less than value, then there is a “true” profit and money will be attracted to that type of property in that location. Often land values for the particular use will spike until the true profit goes away or so much product will be built that there is a downward pressure on profits and it go ...

... profit) is less than value, then there is a “true” profit and money will be attracted to that type of property in that location. Often land values for the particular use will spike until the true profit goes away or so much product will be built that there is a downward pressure on profits and it go ...

Fair Value Measurements and Disclosures (Topic 820)

... An investor may invest in entities (investees) that permit the investor to redeem its investments directly with the investee or receive distributions from the investee at times specified under the terms of the investee’s governing documents. Many of these investments do not have readily determinable ...

... An investor may invest in entities (investees) that permit the investor to redeem its investments directly with the investee or receive distributions from the investee at times specified under the terms of the investee’s governing documents. Many of these investments do not have readily determinable ...

Direct Investing in Private Equity

... classes of institutional investors (principals) appear to sub-optimally choose which private equity groups to invest with (Lerner, et al., 2007; Hochberg and Rauh, 2011). In this context, the interest on the part of institutional investors in undertaking direct investments—and thus bypassing interm ...

... classes of institutional investors (principals) appear to sub-optimally choose which private equity groups to invest with (Lerner, et al., 2007; Hochberg and Rauh, 2011). In this context, the interest on the part of institutional investors in undertaking direct investments—and thus bypassing interm ...

Is the Investment-Uncertainty Link Really Elusive?

... outcomes matters when deciding to invest: the one with the negative outcomes. The option approach helps to understand why firms require high hurdle rates to undertake investment projects: whenever the option has a positive value the firm should invest only if the NPV is higher than the option value. ...

... outcomes matters when deciding to invest: the one with the negative outcomes. The option approach helps to understand why firms require high hurdle rates to undertake investment projects: whenever the option has a positive value the firm should invest only if the NPV is higher than the option value. ...

Chap011 Last modified February 26, 2017 at 8:02 pm

... 19. Scenario analysis is best suited to accomplishing which one of the following when analyzing a project? A. determining how fixed costs affect NPV B. estimating the residual value of fixed assets C. identifying the potential range of reasonable outcomes D. determining the minimal level of sales re ...

... 19. Scenario analysis is best suited to accomplishing which one of the following when analyzing a project? A. determining how fixed costs affect NPV B. estimating the residual value of fixed assets C. identifying the potential range of reasonable outcomes D. determining the minimal level of sales re ...

Conclusions

... unrealistic, characterized by instability, and so forth. Keynes’ followers have been attempting to "improve" the theory (multiplier) of Keynes in order to silence such critics. A central argument, often used by them, is that the multiplier has rests on a solid mathematical foundation (Minsky, 1975). ...

... unrealistic, characterized by instability, and so forth. Keynes’ followers have been attempting to "improve" the theory (multiplier) of Keynes in order to silence such critics. A central argument, often used by them, is that the multiplier has rests on a solid mathematical foundation (Minsky, 1975). ...

Rent growth continues, albeit at a slower pace, amid hefty new

... market—with the annual growth rate well above both its 10-year average (2.9%) and core inflation (2.1%)—they also indicate a loss of momentum from Q3 2015. In Q3 2015, the 62-market average rent increased by 5.1%, year-over-year, and 33 markets posted rent growth of 5% or more. High effective rent l ...

... market—with the annual growth rate well above both its 10-year average (2.9%) and core inflation (2.1%)—they also indicate a loss of momentum from Q3 2015. In Q3 2015, the 62-market average rent increased by 5.1%, year-over-year, and 33 markets posted rent growth of 5% or more. High effective rent l ...

Time-varying risk premia and the cost of capital

... Blanchard, 1986). In short, the fabled Q theory of investment implies that stock returns should covary positively with investment, while discount rates (expected returns) should covary negatively with investment. The difficulty with this implication is that it is scarcely apparent in aggregate data. ...

... Blanchard, 1986). In short, the fabled Q theory of investment implies that stock returns should covary positively with investment, while discount rates (expected returns) should covary negatively with investment. The difficulty with this implication is that it is scarcely apparent in aggregate data. ...

102finalmc

... ____ 44. Suppose that the Congress and President increase the maximum annual contributions limits to retirement accounts and at the same time reduce the budget deficit. What happens to the interest rate? a. It decreases. b. It increases. c. It stays the same. d. It might do any of the above. ____ 45 ...

... ____ 44. Suppose that the Congress and President increase the maximum annual contributions limits to retirement accounts and at the same time reduce the budget deficit. What happens to the interest rate? a. It decreases. b. It increases. c. It stays the same. d. It might do any of the above. ____ 45 ...

Zephyr Analytics API - Informa Investment Solutions

... XX Rolling, expanding, and simple date range windows are available for all statistics XX Cash adjust any statistic XX Calculate any benchmark-relative statistic vs. an RBSA style benchmark XX Calculate a universe of any statistic – both the range in percentiles of that universe and the position of a ...

... XX Rolling, expanding, and simple date range windows are available for all statistics XX Cash adjust any statistic XX Calculate any benchmark-relative statistic vs. an RBSA style benchmark XX Calculate a universe of any statistic – both the range in percentiles of that universe and the position of a ...

employment protection, investment, and firm growth

... increase productivity by mitigating hold-up problems between firms and employees. In the model of Belot et al. (2007), workers can invest in non-contractible firm-specific knowledge. Because workers bear the entire cost of exerting effort in learning firm-specific knowledge but only receive a fracti ...

... increase productivity by mitigating hold-up problems between firms and employees. In the model of Belot et al. (2007), workers can invest in non-contractible firm-specific knowledge. Because workers bear the entire cost of exerting effort in learning firm-specific knowledge but only receive a fracti ...

Zephyr Analytics API - Informa Investment Solutions

... Rolling, expanding, and simple date range windows are available for all statistics ...

... Rolling, expanding, and simple date range windows are available for all statistics ...

The Swaps Market: A Case Study Detailing Market

... student B are now better off than before they swapped – overall utility has increased! Keeping this example in mind, we move to discussing the swaps commonly used in the financial marketplace. In financial markets, there are primarily two types of swaps: fixed-for-floating rate swaps known as intere ...

... student B are now better off than before they swapped – overall utility has increased! Keeping this example in mind, we move to discussing the swaps commonly used in the financial marketplace. In financial markets, there are primarily two types of swaps: fixed-for-floating rate swaps known as intere ...

Ethical Investment and Portfolio Theory

... was unethical to consider issues other than shareholder value in their deliberations” (Sampford and Berry, [13]). According to Richardson [14], the “separation theorem” suggests the best way for an investor to help is to maximize their own income without limiting their portfolio to ethical investmen ...

... was unethical to consider issues other than shareholder value in their deliberations” (Sampford and Berry, [13]). According to Richardson [14], the “separation theorem” suggests the best way for an investor to help is to maximize their own income without limiting their portfolio to ethical investmen ...

Returning Cash to the Owners: Dividend Policy

... Invest in projects that yield a return greater than the minimum acceptable hurdle rate. • The hurdle rate should be higher for riskier projects and reflect the financing mix used - owners’ funds (equity) or borrowed money (debt) • Returns on projects should be measured based on cash flows generated ...

... Invest in projects that yield a return greater than the minimum acceptable hurdle rate. • The hurdle rate should be higher for riskier projects and reflect the financing mix used - owners’ funds (equity) or borrowed money (debt) • Returns on projects should be measured based on cash flows generated ...

exam3a - Trinity University

... e. None of the above 4. (7 Points) Using Exhibit 1 data, what is the balance sheet asset or liability for Interest Rate Options (ORO) current value reported on October 31 for the ten options purchased on July 21 in Question 1? Assume the ten options qualify as a cash flow interest rate cap hedge of ...

... e. None of the above 4. (7 Points) Using Exhibit 1 data, what is the balance sheet asset or liability for Interest Rate Options (ORO) current value reported on October 31 for the ten options purchased on July 21 in Question 1? Assume the ten options qualify as a cash flow interest rate cap hedge of ...

Foreign Investment in the Solomon Islands: A Legal Analysis By

... company registration income tax registration [and others] before applying for registration by the Investment Board.(46) This procedure could take up to 6 months and cost at least $50 000. After completing the above requirements, the application is then considered. If the Investment Board for any rea ...

... company registration income tax registration [and others] before applying for registration by the Investment Board.(46) This procedure could take up to 6 months and cost at least $50 000. After completing the above requirements, the application is then considered. If the Investment Board for any rea ...

Our investment process - Close Brothers Asset Management

... We believe the best way to achieve strong risk-adjusted returns is through the right level of diversification. Our objective is to provide investors with a broad range of investments that are likely to have a low correlation in terms of performance. We believe that selecting the optimal asset alloca ...

... We believe the best way to achieve strong risk-adjusted returns is through the right level of diversification. Our objective is to provide investors with a broad range of investments that are likely to have a low correlation in terms of performance. We believe that selecting the optimal asset alloca ...