chapter 10: arbitrage pricing theory and multifactor models of risk

... This question appears to point to a flaw in the FF model. The model predicts that firm size affects average returns, so that, if two firms merge into a larger firm, then the FF model predicts lower average returns for the merged firm. However, there seems to be no reason for the merged firm to under ...

... This question appears to point to a flaw in the FF model. The model predicts that firm size affects average returns, so that, if two firms merge into a larger firm, then the FF model predicts lower average returns for the merged firm. However, there seems to be no reason for the merged firm to under ...

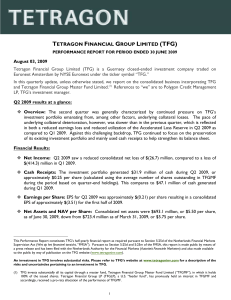

press release

... year-end.(12) Furthermore, compared to the first quarter, the gains recorded during Q2 2009 were more broad-based, reaching across the credit spectrum to Caa1/CCC+ or below rated credits, second-liens and covenant-lite loans. We believe that investors were likely attracted to these lowerquality cred ...

... year-end.(12) Furthermore, compared to the first quarter, the gains recorded during Q2 2009 were more broad-based, reaching across the credit spectrum to Caa1/CCC+ or below rated credits, second-liens and covenant-lite loans. We believe that investors were likely attracted to these lowerquality cred ...

cost of capital

... & Investment Decisions • The Weighted Marginal Cost of Capital (WMCC) – The WACC typically increases as the volume of new capital raised within a given period increases. – This is true because companies need to raise the return to investors in order to entice them to invest to compensate them for th ...

... & Investment Decisions • The Weighted Marginal Cost of Capital (WMCC) – The WACC typically increases as the volume of new capital raised within a given period increases. – This is true because companies need to raise the return to investors in order to entice them to invest to compensate them for th ...

Investment Policy - Rochester Area Community Foundation

... The Community Foundation's endowment and quasi-endowment funds are managed with a long-term horizon using the total rate of return approach. The assets are invested in the equity, fixed income and alternative investment pools of the Community Foundation using an asset allocation of 70% equities as d ...

... The Community Foundation's endowment and quasi-endowment funds are managed with a long-term horizon using the total rate of return approach. The assets are invested in the equity, fixed income and alternative investment pools of the Community Foundation using an asset allocation of 70% equities as d ...

Official PDF , 31 pages

... remained stable. Then a loss in confidence (related to the reparations problem) ensued, and in a few weeks the exchange rate increased sevenfold. The exchange rate depreciation raised import prices, wages, and the budget deficit, which opened all mechanisms for uncontrolled price rises and hyperinfl ...

... remained stable. Then a loss in confidence (related to the reparations problem) ensued, and in a few weeks the exchange rate increased sevenfold. The exchange rate depreciation raised import prices, wages, and the budget deficit, which opened all mechanisms for uncontrolled price rises and hyperinfl ...

managing cash flow in times of crisis

... keeping cash at the local level has disadvantages. It can place added burden on local accounting staff that might lack cash management expertise. Further, having pockets of cash in so many different physical locations is problematic in that it may not be withdrawn easily or wired quickly enough to m ...

... keeping cash at the local level has disadvantages. It can place added burden on local accounting staff that might lack cash management expertise. Further, having pockets of cash in so many different physical locations is problematic in that it may not be withdrawn easily or wired quickly enough to m ...

Chapter 8 - Mississippi State University, College of Business

... new crisis in the Middle East that threatens world oil supplies. Experts estimate that the return on an average stock will drop from 12% to 8% because of investor concerns over the economic impact of a potential oil shortage as well as the threat of a limited war. Estimate the change in the return o ...

... new crisis in the Middle East that threatens world oil supplies. Experts estimate that the return on an average stock will drop from 12% to 8% because of investor concerns over the economic impact of a potential oil shortage as well as the threat of a limited war. Estimate the change in the return o ...

Financialization and the nonfinancial corporation

... the top quartile of the asset distribution. Among small firms, total financial assets rise from 28.5 percent of sales in 1971 to 51.4 percent in 2011, while fixed capital declines from 18.2 percent of sales to 9.7 percent. Similarly, total financial assets held by large firms increase from 29.8 perc ...

... the top quartile of the asset distribution. Among small firms, total financial assets rise from 28.5 percent of sales in 1971 to 51.4 percent in 2011, while fixed capital declines from 18.2 percent of sales to 9.7 percent. Similarly, total financial assets held by large firms increase from 29.8 perc ...

The Law on Investment Entities

... the investment trust company itself will carry out financial investments in other entities of a type prescribed in the memorandum of association. In truth, the investor here is primarily an investor in an ordinary company except that the ordinary company is not carrying on a trade - instead, it is m ...

... the investment trust company itself will carry out financial investments in other entities of a type prescribed in the memorandum of association. In truth, the investor here is primarily an investor in an ordinary company except that the ordinary company is not carrying on a trade - instead, it is m ...

Interest Rates and Monetary Policy Uncertainty

... ney growth conveys information about the true mean growth rate of the money stock. An unexpectedly large increase in the money stock induces households to revise upwards their expectation of money growth and, because of the associated increase in the nominal rate of interest, to decrease their holdi ...

... ney growth conveys information about the true mean growth rate of the money stock. An unexpectedly large increase in the money stock induces households to revise upwards their expectation of money growth and, because of the associated increase in the nominal rate of interest, to decrease their holdi ...

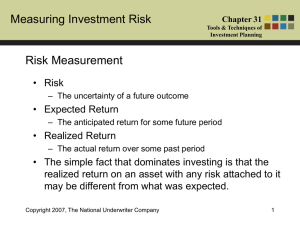

Chapter 31 Tools & Techniques of Investment Planning

... – Except that all returns above a benchmark or target return (sometimes called the minimal acceptable rate of return) rather than the expected return are ignored. Copyright 2007, The National Underwriter Company ...

... – Except that all returns above a benchmark or target return (sometimes called the minimal acceptable rate of return) rather than the expected return are ignored. Copyright 2007, The National Underwriter Company ...

What Stock Market Returns to Expect for the

... of investing in some asset decreases, that asset should have a higher price and a lower expected return gross of investment costs. The availability of mutual funds and the decrease in the cost of purchasing them should lower the equity premium in the future relative to long-term historical values. A ...

... of investing in some asset decreases, that asset should have a higher price and a lower expected return gross of investment costs. The availability of mutual funds and the decrease in the cost of purchasing them should lower the equity premium in the future relative to long-term historical values. A ...

Guaranteed returns with the benefit of Tax-Deferral

... that can offer competitive, guaranteed returns for your risk-averse clients.1 And, unlike a CD, this product offers the tax and planning benefits of an annuity. The Commonwealth MYGA is designed as a long-term savings vehicle, providing your clients with the following advantages: • Competitive rate ...

... that can offer competitive, guaranteed returns for your risk-averse clients.1 And, unlike a CD, this product offers the tax and planning benefits of an annuity. The Commonwealth MYGA is designed as a long-term savings vehicle, providing your clients with the following advantages: • Competitive rate ...

KKR Private Equity Investors Reports Second Quarter Results

... The Investment Partnership is currently in the process of establishing a senior secured credit facility with certain lenders for the purpose of providing an additional source of liquidity. The credit facility is expected to have a 5-year term and an initial availability of $1.0 billion, with an opti ...

... The Investment Partnership is currently in the process of establishing a senior secured credit facility with certain lenders for the purpose of providing an additional source of liquidity. The credit facility is expected to have a 5-year term and an initial availability of $1.0 billion, with an opti ...

NBER WORKING PAPER SERIES TAX POLICY AND INTERNATIONAL CAPiTAL FLOWS Martin Feldstein

... investment. Like the components of portfolio investment, foreign direct investment does not respond to differences in national saving rates but is determined by operating business goals. It does however play an important part in transferring national saving across borders. Each incremental dollar of ...

... investment. Like the components of portfolio investment, foreign direct investment does not respond to differences in national saving rates but is determined by operating business goals. It does however play an important part in transferring national saving across borders. Each incremental dollar of ...

Developing an Investment Policy Statement Under ERISA

... from, and are based upon, sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed. All opinions included in this report constitute the Firm’s judgment as of the date of this report and are subject to change without no ...

... from, and are based upon, sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed. All opinions included in this report constitute the Firm’s judgment as of the date of this report and are subject to change without no ...

estimating terminal value

... estimate that emerges is called a liquidation value. There are two ways in which the liquidation value can be estimated. One is to base it on the book value of the assets, adjusted for any inflation during the period. Thus, if the book value of assets ten years from now is expected to be $2 billion, ...

... estimate that emerges is called a liquidation value. There are two ways in which the liquidation value can be estimated. One is to base it on the book value of the assets, adjusted for any inflation during the period. Thus, if the book value of assets ten years from now is expected to be $2 billion, ...

THE EFFECT OF LENDING INTEREST RATE ON ECONOMIC

... According to economic theory the base rate is set by the banks to determine the interest rate and in Kenya it’s the CBK rate. Darrat and Dickens (1999), argue that interest rate environment is important in the performance and the returns of any given investment. The CBK through the monetary policy a ...

... According to economic theory the base rate is set by the banks to determine the interest rate and in Kenya it’s the CBK rate. Darrat and Dickens (1999), argue that interest rate environment is important in the performance and the returns of any given investment. The CBK through the monetary policy a ...

The Influences of WTO to International Direct Investment

... (1) The protection of intellectual property right will rapidly promote R&D investment and the investment of new production equipment and technology. Thus the effective actualization of “Agreement on Trade-Related Aspects of Intellectual Property Rights” can accelerate the investment of research and ...

... (1) The protection of intellectual property right will rapidly promote R&D investment and the investment of new production equipment and technology. Thus the effective actualization of “Agreement on Trade-Related Aspects of Intellectual Property Rights” can accelerate the investment of research and ...

Capital requirements for MiFID investment firms

... of all EU investment firms. The report concludes that the scope of a firm's MiFID permissions is not necessarily a good proxy for risk. Under current rules a firm whose sole MiFID activity is to place financial instruments without a firm commitment is hit by the highest initial capital requirement ( ...

... of all EU investment firms. The report concludes that the scope of a firm's MiFID permissions is not necessarily a good proxy for risk. Under current rules a firm whose sole MiFID activity is to place financial instruments without a firm commitment is hit by the highest initial capital requirement ( ...