COMMISSION REGULATION (EC)

... other variable-yield securities plus net profit or net loss on financial operations plus other operating income. For the enterprises defined in Section 3 of Annex 7 of Regulation (EC, Euratom) No 58/97, the production value is defined as turnover less insurance premiums payable plus investment incom ...

... other variable-yield securities plus net profit or net loss on financial operations plus other operating income. For the enterprises defined in Section 3 of Annex 7 of Regulation (EC, Euratom) No 58/97, the production value is defined as turnover less insurance premiums payable plus investment incom ...

Wahlen 1e_PPT_Ch 21_IE

... Decreases in Assets. The sale or other disposal of assets (other than cash) typically causes a direct increase in cash when cash is received or collected in exchange for the assets (such as selling an investment security for cash or collecting a receivable in cash). In some cases, however, a decreas ...

... Decreases in Assets. The sale or other disposal of assets (other than cash) typically causes a direct increase in cash when cash is received or collected in exchange for the assets (such as selling an investment security for cash or collecting a receivable in cash). In some cases, however, a decreas ...

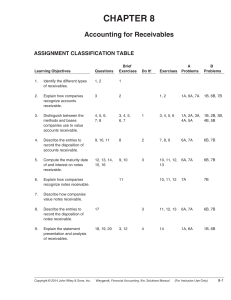

Accounting for Receivables

... Illustration: Assume that Higley Co. on November 1 indicates that it cannot pay at the present time. If Wolder Co. does expect eventual collection, it would make the following entry at the time the note is dishonored (assuming no previous accrual of interest). ...

... Illustration: Assume that Higley Co. on November 1 indicates that it cannot pay at the present time. If Wolder Co. does expect eventual collection, it would make the following entry at the time the note is dishonored (assuming no previous accrual of interest). ...

Index Methodology Template w_Cover

... The primary accounting standard followed by MSCI is the local GAAP. If the company does not report in local GAAP but reports in other GAAPs, such as IAS or US GAAP, then MSCI will follow the latter. For a large number of European countries and some other countries in the Asia-Pacific, MSCI started f ...

... The primary accounting standard followed by MSCI is the local GAAP. If the company does not report in local GAAP but reports in other GAAPs, such as IAS or US GAAP, then MSCI will follow the latter. For a large number of European countries and some other countries in the Asia-Pacific, MSCI started f ...

Annual Report 2015 : Setting new sights with our - Hydro

... The year’s achievements are all the more remarkable considering that Thierry Vandal, appointed President and Chief Executive Officer in April 2005, left the company last May after serving in that capacity for a decade— a period during which the company’s profitability rose to unprecedented heights. ...

... The year’s achievements are all the more remarkable considering that Thierry Vandal, appointed President and Chief Executive Officer in April 2005, left the company last May after serving in that capacity for a decade— a period during which the company’s profitability rose to unprecedented heights. ...

The Accruals Anomaly: A 50/50 chance game? Evidence from the

... This topic has been very controversial, dividing the scientific community, either because some authors affirms that the anomaly exists and will persist in time and others do not; either because there are no consensus in the literature regarding the causes of the anomaly. As it was mentioned before, ...

... This topic has been very controversial, dividing the scientific community, either because some authors affirms that the anomaly exists and will persist in time and others do not; either because there are no consensus in the literature regarding the causes of the anomaly. As it was mentioned before, ...

THU VI?N PHÁP LU?T

... VND 10 billion or more accounted according to the book value; b/ Its business operation in the year preceding the year of offering registration is profitable and, at the same time, it has no accrued loss up to the year of offering registration; c/ Its issuance plan and plan on the use of capital gen ...

... VND 10 billion or more accounted according to the book value; b/ Its business operation in the year preceding the year of offering registration is profitable and, at the same time, it has no accrued loss up to the year of offering registration; c/ Its issuance plan and plan on the use of capital gen ...

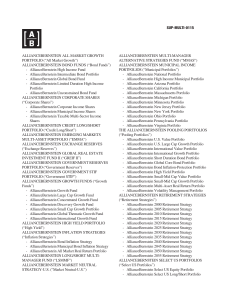

SUP-MULTI-0115 ALLIANCEBERNSTEIN ALL MARKET GROWTH

... are designed for use in two or more securities markets, such as Europe and Asia. Derivatives The Underlying Portfolios may, but are not required to, use derivatives for hedging or other risk management purposes or as part of their investment practices. Derivatives ...

... are designed for use in two or more securities markets, such as Europe and Asia. Derivatives The Underlying Portfolios may, but are not required to, use derivatives for hedging or other risk management purposes or as part of their investment practices. Derivatives ...

Staff Guidance for Auditors of SEC-Registered Brokers and

... This publication was developed primarily for auditors of smaller brokers and dealers that have less complex operations. Because some auditors of smaller, less complex brokers and dealers will be applying PCAOB standards for the first time, this publication includes "Getting Started," a chapter, whic ...

... This publication was developed primarily for auditors of smaller brokers and dealers that have less complex operations. Because some auditors of smaller, less complex brokers and dealers will be applying PCAOB standards for the first time, this publication includes "Getting Started," a chapter, whic ...

99 COMPANY XYZ LIMITED

... Paul Dobbyn is a Director of Sanlam Qualifying Investors Funds Plc and Sanlam Universal Funds Plc. Paul Dobbyn is also a Director of Sanlam Global Fund of Hedge Funds Plc, which the Directors resolved to place into voluntary liquidation on 7 November 2014. Paul Dobbyn was also a Partner in Maples an ...

... Paul Dobbyn is a Director of Sanlam Qualifying Investors Funds Plc and Sanlam Universal Funds Plc. Paul Dobbyn is also a Director of Sanlam Global Fund of Hedge Funds Plc, which the Directors resolved to place into voluntary liquidation on 7 November 2014. Paul Dobbyn was also a Partner in Maples an ...

Donnelley Financial Solutions, Inc. (Form: S

... Neither we, RRD, the selling stockholder, nor the underwriters (or any of our or their respective affiliates) have authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred y ...

... Neither we, RRD, the selling stockholder, nor the underwriters (or any of our or their respective affiliates) have authorized anyone to provide any information other than that contained in this prospectus or in any free writing prospectus prepared by or on behalf of us or to which we have referred y ...

IAS 39 Implementation Guidance Questions and Answers

... principles for recognising, measuring, and disclosing information about financial assets and financial liabilities. When the old IASC Board voted to approve IAS 39 in December 1998, the Board noted that, at about the same time, the United States had adopted new standards on derecognition, derivative ...

... principles for recognising, measuring, and disclosing information about financial assets and financial liabilities. When the old IASC Board voted to approve IAS 39 in December 1998, the Board noted that, at about the same time, the United States had adopted new standards on derecognition, derivative ...

LOGITECH INTERNATIONAL SA (Form: 10-K

... The aggregate market value of the voting shares held by non-affiliates of the registrant, based upon the closing sale price of the shares on September 30, 2012, the last business day of the registrant's second fiscal quarter on the NASDAQ Global Select Market, was approximately $819,557,681. For pur ...

... The aggregate market value of the voting shares held by non-affiliates of the registrant, based upon the closing sale price of the shares on September 30, 2012, the last business day of the registrant's second fiscal quarter on the NASDAQ Global Select Market, was approximately $819,557,681. For pur ...

Annual Information Form

... We manage the Portfolios according to securities laws. Except as described below, each Portfolio has adopted the standard investment restrictions and practices imposed by the applicable legislation, including Regulation 81-102 respecting Investment Funds (“Regulation 81-102”). These restrictions and ...

... We manage the Portfolios according to securities laws. Except as described below, each Portfolio has adopted the standard investment restrictions and practices imposed by the applicable legislation, including Regulation 81-102 respecting Investment Funds (“Regulation 81-102”). These restrictions and ...

Accounts Receivable

... Segregation of duties. The foundation should not have allowed an accounts receivable clerk, whose job was to record receivables, to also handle cash, record cash, make deposits, and especially prepare the bank reconciliation. Independent internal verification. The controller was supposed to perform ...

... Segregation of duties. The foundation should not have allowed an accounts receivable clerk, whose job was to record receivables, to also handle cash, record cash, make deposits, and especially prepare the bank reconciliation. Independent internal verification. The controller was supposed to perform ...

View the presentation.

... Sample U.S. Person Analysis 5 U.S. asset manager organizes a fund outside the U.S. Fund is sold primarily to non-U.S. investors and Fund sales force is located outside the U.S.; some investors (less than a majority) have moved to the U.S. and are "U.S. persons" Fund managed by non-U.S. affili ...

... Sample U.S. Person Analysis 5 U.S. asset manager organizes a fund outside the U.S. Fund is sold primarily to non-U.S. investors and Fund sales force is located outside the U.S.; some investors (less than a majority) have moved to the U.S. and are "U.S. persons" Fund managed by non-U.S. affili ...

Form 10-K EDGEWELL PERSONAL CARE Co

... The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information, except to the extent such damages or losses cannot be limited or excluded ...

... The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information, except to the extent such damages or losses cannot be limited or excluded ...

JP Morgan Structured Products BV JPMorgan Chase Bank, National

... Some of the terms which we have used in this summary will have precise definitions, or could be subject to change as provided in the legal documentation. For example: the date on which the cash settlement amount (if any) is paid and each valuation date for determining the average price for cash set ...

... Some of the terms which we have used in this summary will have precise definitions, or could be subject to change as provided in the legal documentation. For example: the date on which the cash settlement amount (if any) is paid and each valuation date for determining the average price for cash set ...

Words - corporate

... Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are based on current expectations, estimates, forecasts and projections about the industry in which we operate, management’s beliefs and assumptions made by man ...

... Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These statements are based on current expectations, estimates, forecasts and projections about the industry in which we operate, management’s beliefs and assumptions made by man ...

FAP 20e Chapter 4 SM - Arab Academy Research Papers AAST

... The adjustments in the Adjustments columns of a work sheet are identified by letters to link the debits with the credits to ensure that the entries are complete and in balance (debits = credits) and for reference purposes (audit trail). The letters can also be used to identify the reasons for the en ...

... The adjustments in the Adjustments columns of a work sheet are identified by letters to link the debits with the credits to ensure that the entries are complete and in balance (debits = credits) and for reference purposes (audit trail). The letters can also be used to identify the reasons for the en ...