Long-term investments - McGraw Hill Higher Education

... Equity Securities • Reflect an owner relationship • Examples: Investments in shares of stock • Issued by companies ...

... Equity Securities • Reflect an owner relationship • Examples: Investments in shares of stock • Issued by companies ...

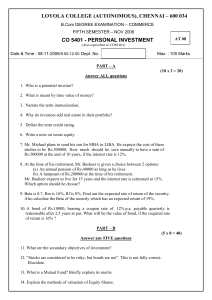

CO 5401 - Loyola College

... 1. Who is a potential investor? 2. What is meant by time value of money? 3. Narrate the term immunization. 4. Why do investors add real estate in their portfolio? 5. Define the term credit rating. 6. Write a note on sweat equity. 7. Mr. Michael plans to send his son for MBA in LIBA. He expects the c ...

... 1. Who is a potential investor? 2. What is meant by time value of money? 3. Narrate the term immunization. 4. Why do investors add real estate in their portfolio? 5. Define the term credit rating. 6. Write a note on sweat equity. 7. Mr. Michael plans to send his son for MBA in LIBA. He expects the c ...

Securities Purchase Ad

... 2. “Purchase Ad-hoc Facility” is applicable for purchasing HKEx listed securities which settled in HKD only, excluding derivative warrants and callable bull/ bear contracts. 3. “Purchase Ad-hoc Facility” is applicable to manned phone securities trading hotline or branches securities trading desk onl ...

... 2. “Purchase Ad-hoc Facility” is applicable for purchasing HKEx listed securities which settled in HKD only, excluding derivative warrants and callable bull/ bear contracts. 3. “Purchase Ad-hoc Facility” is applicable to manned phone securities trading hotline or branches securities trading desk onl ...

Account of Fiduciary, Long Form (pc584)

... NOTE: In guardianships and conservatorships, except as provided by MCR 5.409(C)(4), you must present to the court copies of corresponding financial institution statements or you must file with the court a verification of funds on deposit, either of which must reflect the value of all liquid assets h ...

... NOTE: In guardianships and conservatorships, except as provided by MCR 5.409(C)(4), you must present to the court copies of corresponding financial institution statements or you must file with the court a verification of funds on deposit, either of which must reflect the value of all liquid assets h ...

FIN550 final exam

... Assume that the dividend payout ratio will be 55 percent when the rate on long-term government bonds falls to 9 percent. Since investors are becoming more risk averse, the equity risk premium will rise to 8 percent and investors will require a 7 percent return. The return on equity will be 13 percen ...

... Assume that the dividend payout ratio will be 55 percent when the rate on long-term government bonds falls to 9 percent. Since investors are becoming more risk averse, the equity risk premium will rise to 8 percent and investors will require a 7 percent return. The return on equity will be 13 percen ...

Why Share-Owner Value? - Florida International University

... And it cannot contribute anything to society, which is the second reason we work to create value for our share owners: If we do our jobs, we can contribute to society in very meaningful ways. Our Company has invested millions of dollars in Eastern Europe since the fall of the Berlin Wall, and people ...

... And it cannot contribute anything to society, which is the second reason we work to create value for our share owners: If we do our jobs, we can contribute to society in very meaningful ways. Our Company has invested millions of dollars in Eastern Europe since the fall of the Berlin Wall, and people ...

Business Plug

... property owned by a company and of claims against the property on a specific date ...

... property owned by a company and of claims against the property on a specific date ...

Aggregate Stock Market

... and the volatility of returns are much higher than what can be obtained under the traditional model (b0 =0). The bottom panel in Table IV shows that the results can be significantly improved by increasing k. For b0 =2, a k of 10 is enough to give a premium of 5.02 percent and a volatility of 23.84 ...

... and the volatility of returns are much higher than what can be obtained under the traditional model (b0 =0). The bottom panel in Table IV shows that the results can be significantly improved by increasing k. For b0 =2, a k of 10 is enough to give a premium of 5.02 percent and a volatility of 23.84 ...

Additional charges for dealing in international markets

... When you deal in certain international markets additional charges are payable, these are either levied by the government or the local exchange and these charges can appear as exchange fees, tax, levies or stamp duty. These charges will be added to your contract note. The detail of these additional c ...

... When you deal in certain international markets additional charges are payable, these are either levied by the government or the local exchange and these charges can appear as exchange fees, tax, levies or stamp duty. These charges will be added to your contract note. The detail of these additional c ...

Define - kthsyr12acc

... Presumable he will run it next year and he would have to start the business up again. And what does he do with the money left over from the first festival. ...

... Presumable he will run it next year and he would have to start the business up again. And what does he do with the money left over from the first festival. ...

Elements of the Income Statement

... each of the company’s stockholders’ equity accounts, including the change in the retained earnings balance caused by net income and dividends during the reporting period. STATEMENT OF CASH FLOWS – reports inflows and outflows of cash during the accounting period in the categories of operating, inves ...

... each of the company’s stockholders’ equity accounts, including the change in the retained earnings balance caused by net income and dividends during the reporting period. STATEMENT OF CASH FLOWS – reports inflows and outflows of cash during the accounting period in the categories of operating, inves ...

Chapter 15: Intercorporate Investments

... • Equity method investments need periodic reviews for impairment. - Under IFRS, an impairment is recorded only if there is objective evidence that one (or more) loss event(s) has occurred since the initial recognition and that loss event has an impact on the investment’s future cash flows, which mus ...

... • Equity method investments need periodic reviews for impairment. - Under IFRS, an impairment is recorded only if there is objective evidence that one (or more) loss event(s) has occurred since the initial recognition and that loss event has an impact on the investment’s future cash flows, which mus ...

Core - 1 Financial Accounting

... accounting. Branches of accounting. Bases of accounting; cash basis and accrual basis. ii. The nature of financial accounting principles - Basic concepts and conventions: entity, money measurement, going concern, cost, realization, accruals, periodicity, consistency, prudence (conservatism), materia ...

... accounting. Branches of accounting. Bases of accounting; cash basis and accrual basis. ii. The nature of financial accounting principles - Basic concepts and conventions: entity, money measurement, going concern, cost, realization, accruals, periodicity, consistency, prudence (conservatism), materia ...

Purchase Price Allocations for Solar Energy Systems

... In an asset acquisition, transaction costs are capitalized in the basis of the assets acquired; however, in a business combination, transaction costs are required to be expensed. Furthermore, goodwill is n ...

... In an asset acquisition, transaction costs are capitalized in the basis of the assets acquired; however, in a business combination, transaction costs are required to be expensed. Furthermore, goodwill is n ...

BusAd 551 - Corporate Financial Decisions

... above-average future growth in earnings and above-average valuations as a result of high price/earnings ratio – Value stocks feature cheap assets and strong balance sheets ...

... above-average future growth in earnings and above-average valuations as a result of high price/earnings ratio – Value stocks feature cheap assets and strong balance sheets ...

Main heading goes in here second line of main heading

... • Accounting standards moved closer to GFS over time as they moved toward greater use of fair value (matching GFS market value) • Engagement with statistical people at both national and international level has resulted in a number of changes or potential changes to GFS which reduce the differences • ...

... • Accounting standards moved closer to GFS over time as they moved toward greater use of fair value (matching GFS market value) • Engagement with statistical people at both national and international level has resulted in a number of changes or potential changes to GFS which reduce the differences • ...

Quarterly Insights April 2017 - The Investment Counsel Company of

... declines and falling again after the market bottoms. However, volatility spikes are typically much more extreme in bear markets and at major market bottoms than they are during less severe corrections. So it is a near certainty that stock market volatility will increase at some point (both up and do ...

... declines and falling again after the market bottoms. However, volatility spikes are typically much more extreme in bear markets and at major market bottoms than they are during less severe corrections. So it is a near certainty that stock market volatility will increase at some point (both up and do ...

Laura Piatti - CeRP - Collegio Carlo Alberto

... plans represent for a distributors an outflows of assets, while as investment products are mostly illiquid and transferable with high costs for the consumers • For consumers who would prefer to accept an investment risk and capture the spread themselves (sometime underestimating the longevity risk), ...

... plans represent for a distributors an outflows of assets, while as investment products are mostly illiquid and transferable with high costs for the consumers • For consumers who would prefer to accept an investment risk and capture the spread themselves (sometime underestimating the longevity risk), ...

FV View - El Corte Inglés

... (avoiding loopholes for ‘creative’ accounting). • Also a guide for interpretation of IFRS, especially where specific guidance in standards is unclear or absent. ...

... (avoiding loopholes for ‘creative’ accounting). • Also a guide for interpretation of IFRS, especially where specific guidance in standards is unclear or absent. ...

Are Financial Markets Efficient?

... behaviours that can be detrimental to their wealth. For instance, buying or selling securities when everybody else is doing it (i.e., herding) or selling (buying) when the markets is down (up), without examining the stock’s fundamentals. In fact, these behaviours may occur from time to time which co ...

... behaviours that can be detrimental to their wealth. For instance, buying or selling securities when everybody else is doing it (i.e., herding) or selling (buying) when the markets is down (up), without examining the stock’s fundamentals. In fact, these behaviours may occur from time to time which co ...

BGF European Value Fund

... price basis with income reinvested. Fund performance figures are calculated net of fees. The above Fund data is for information only. ^Morningstar All Rights Reserved. Morningstar Rating as of 30/04/2015. Investment involves risk. Past performance is not necessarily a guide to future performance. Th ...

... price basis with income reinvested. Fund performance figures are calculated net of fees. The above Fund data is for information only. ^Morningstar All Rights Reserved. Morningstar Rating as of 30/04/2015. Investment involves risk. Past performance is not necessarily a guide to future performance. Th ...