Preliminary Debt Investor Presentation

... This document contains certain forward-looking statements within the meaning of Section 21E of the US Securities Exchange Act of 1934 and Section 27A of the US Securities Act of 1933 with respect to certain of the Bank of Ireland Group’s (the “Group”) plans and its current goals and expectations rel ...

... This document contains certain forward-looking statements within the meaning of Section 21E of the US Securities Exchange Act of 1934 and Section 27A of the US Securities Act of 1933 with respect to certain of the Bank of Ireland Group’s (the “Group”) plans and its current goals and expectations rel ...

Document

... Operates like cash or personal check. Withdrawn next business day. Does not affect credit score. Never use on-line. ...

... Operates like cash or personal check. Withdrawn next business day. Does not affect credit score. Never use on-line. ...

1 Barriers to Market Discipline: A Comparative Study of Mortgage

... See, e.g., FINANCIAL SERVICES AUTHORITY, A NEW REGULATOR FOR THE NEW MILLENNIUM 7 (2000) (FSA will pursue improvements in financial literacy and improvements in information and advice available to consumers to address consumers’ lack of understanding of financial products offered); Edward M. Gramlic ...

... See, e.g., FINANCIAL SERVICES AUTHORITY, A NEW REGULATOR FOR THE NEW MILLENNIUM 7 (2000) (FSA will pursue improvements in financial literacy and improvements in information and advice available to consumers to address consumers’ lack of understanding of financial products offered); Edward M. Gramlic ...

2005 Survey - Freddie Mac Home

... A majority of homeowners express interest in learning more about their mortgages. In fact, about six in 10 wish they understood the terms and details of their mortgage better. And while most agree that there is someone at their bank they can talk to if they have questions about their mortgage (75% o ...

... A majority of homeowners express interest in learning more about their mortgages. In fact, about six in 10 wish they understood the terms and details of their mortgage better. And while most agree that there is someone at their bank they can talk to if they have questions about their mortgage (75% o ...

Chapter 9

... Typically obtained by older people whose home loans have been paid off, but can use income of the real estate investment they own. Typical term is no more than 20 years and could be for borrower’s lifetime as an annuity. Homeowners’ equity declines by amount borrowed. Copyright© 2006 John Wiley & So ...

... Typically obtained by older people whose home loans have been paid off, but can use income of the real estate investment they own. Typical term is no more than 20 years and could be for borrower’s lifetime as an annuity. Homeowners’ equity declines by amount borrowed. Copyright© 2006 John Wiley & So ...

Will crowdfunding contribute to financial development in developing

... Crowdfunding has captured the imagination of finance professionals, academics and the public. Its rise in popularity can be linked to two factors. First, crowdfunding promises a “democratization” of fund raising by small and young entrepreneurs, broadening their choices beyond family and friends, an ...

... Crowdfunding has captured the imagination of finance professionals, academics and the public. Its rise in popularity can be linked to two factors. First, crowdfunding promises a “democratization” of fund raising by small and young entrepreneurs, broadening their choices beyond family and friends, an ...

The Effect of Change in Base Lending Rate on

... increased base lending rate is therefore easy to tell the direction of lending for the case of commercial banks. However, the case may not be the same for microfinance since most of them are not controlled by CBK and many small and medium sized borrowers may opt to turn to MFIs due to better credit ...

... increased base lending rate is therefore easy to tell the direction of lending for the case of commercial banks. However, the case may not be the same for microfinance since most of them are not controlled by CBK and many small and medium sized borrowers may opt to turn to MFIs due to better credit ...

Microfinance Consensus Guidelines: Definitions of Selected

... core microfinance operations, such as revenue from business development services, training, or the sale of merchandise. Donations and revenues from grants may also be considered non-operating revenue, but it is recommended that they be included in their own account. It is strongly recommended that M ...

... core microfinance operations, such as revenue from business development services, training, or the sale of merchandise. Donations and revenues from grants may also be considered non-operating revenue, but it is recommended that they be included in their own account. It is strongly recommended that M ...

Georgia Real Estate, 8e - PowerPoint for Ch 09

... Foreclosure on a Security Deed The property would be advertised for four consecutive weeks and then put up at public auction on the county courthouse steps on the first Tuesday of each month. Any party wishing to bid must come with cash (typically a letter of credit from a financial institution). © ...

... Foreclosure on a Security Deed The property would be advertised for four consecutive weeks and then put up at public auction on the county courthouse steps on the first Tuesday of each month. Any party wishing to bid must come with cash (typically a letter of credit from a financial institution). © ...

Bank Capital and Aggregate Credit

... The risk-adjusted spread for bank loans is strictly positive (except at the dividend payout boundary) and decreasing in the level of aggregate bank equity. To get an intuition for this result, note that loss absorbing equity is most valuable when it is scarce and least valuable when it is abundant. ...

... The risk-adjusted spread for bank loans is strictly positive (except at the dividend payout boundary) and decreasing in the level of aggregate bank equity. To get an intuition for this result, note that loss absorbing equity is most valuable when it is scarce and least valuable when it is abundant. ...

The State of Small Business Lending: Credit Access during the

... Small businesses were hit harder than larger businesses during the 2008 financial crisis, and have been slower to recover from a recession of unusual depth and duration. Small firms were hit harder than large firms during the crisis, with the smallest firms hit ...

... Small businesses were hit harder than larger businesses during the 2008 financial crisis, and have been slower to recover from a recession of unusual depth and duration. Small firms were hit harder than large firms during the crisis, with the smallest firms hit ...

Patrick Bayer, Duke University and NBER

... neighborhood sociodemographic characteristics based on Census data.11 We then provided this rich sample to one of the major credit rating agencies. The credit rating agency used the name and address to match borrowers to archival credit reporting data, providing in each year a Vantage credit score p ...

... neighborhood sociodemographic characteristics based on Census data.11 We then provided this rich sample to one of the major credit rating agencies. The credit rating agency used the name and address to match borrowers to archival credit reporting data, providing in each year a Vantage credit score p ...

Financial Soundness Indicators: - svgfsa.com

... Asset Quality Rates of Return Liquidity Signs of Growth ...

... Asset Quality Rates of Return Liquidity Signs of Growth ...

Turning a Blind Eye: Wall Street Finance of Predatory Lending

... 3. See infra note 121. The subprime market charges higher interest rates and fees and is designed for borrowers with weaker credit. 4. For instance, a 2005 study of securitized subprime loans found that 57.2 percent of those loans had one or more predatory features, i.e., a balloon clause or a prepa ...

... 3. See infra note 121. The subprime market charges higher interest rates and fees and is designed for borrowers with weaker credit. 4. For instance, a 2005 study of securitized subprime loans found that 57.2 percent of those loans had one or more predatory features, i.e., a balloon clause or a prepa ...

Working Paper 0809

... percent or greater. Only 3 had a share of 20 percent or more. The highest share of cultivator families with no income from their own farm was 32 percent in Mohindergarh, in northwest India. Many more cultivator families had a very small income from their farm, Rs. 200 or less in 1950, only slightly ...

... percent or greater. Only 3 had a share of 20 percent or more. The highest share of cultivator families with no income from their own farm was 32 percent in Mohindergarh, in northwest India. Many more cultivator families had a very small income from their farm, Rs. 200 or less in 1950, only slightly ...

Tips for Avoiding a Predatory Mortgage Loan

... Not every situation can be resolved through your loan servicer's foreclosure prevention programs. If you're not able to keep your home, or if you don't want to keep it, consider: Selling Your House: Your servicer might postpone foreclosure proceedings if you have a pending sales contract or if you p ...

... Not every situation can be resolved through your loan servicer's foreclosure prevention programs. If you're not able to keep your home, or if you don't want to keep it, consider: Selling Your House: Your servicer might postpone foreclosure proceedings if you have a pending sales contract or if you p ...

SECURITIES AND EXCHANGE COMMISSION Washington, D.C.

... In May 1993, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards No. 114 (SFAS 114), "Accounting by Creditors for Impairment of a Loan". SFAS 114 requires the creation of a valuation allowance for impaired loans based on the present value of expected fu ...

... In May 1993, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards No. 114 (SFAS 114), "Accounting by Creditors for Impairment of a Loan". SFAS 114 requires the creation of a valuation allowance for impaired loans based on the present value of expected fu ...

Low Income Housing in Latin America

... and middle class households. But for many households, the housing solutions supported by traditional mortgage finance are not appropriate. The absence of proper title to a home or proof of stable income may make some households ineligible for mortgage loans. Alternatively, they may not be able to af ...

... and middle class households. But for many households, the housing solutions supported by traditional mortgage finance are not appropriate. The absence of proper title to a home or proof of stable income may make some households ineligible for mortgage loans. Alternatively, they may not be able to af ...

Title of presentation

... Average expected net yield (seasoned) of largest 5-y platforms in each region: local currency (dotted) and swapped into USD (solid) ...

... Average expected net yield (seasoned) of largest 5-y platforms in each region: local currency (dotted) and swapped into USD (solid) ...

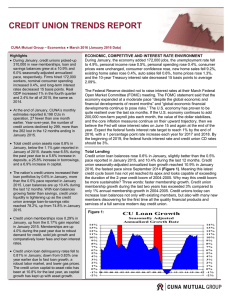

March

... only 1% annual membership growth in 2004-2005. Credit unions today can increase loan balances not only with existing members, but also with many new members discovering for the first time all the quality financial products and services of a full service modern day credit union. Figure 1: ...

... only 1% annual membership growth in 2004-2005. Credit unions today can increase loan balances not only with existing members, but also with many new members discovering for the first time all the quality financial products and services of a full service modern day credit union. Figure 1: ...

5. F M F I

... In addition to funds provided by the CBRT, short-term funds provided from various markets also play a significant role in meeting the Turkish lira liquidity requirement of the banking system. In the money market, non-CBRT funding with up to one-week maturity is mostly provided via swap markets. This ...

... In addition to funds provided by the CBRT, short-term funds provided from various markets also play a significant role in meeting the Turkish lira liquidity requirement of the banking system. In the money market, non-CBRT funding with up to one-week maturity is mostly provided via swap markets. This ...

The Myth of Home Ownership and Why Home Ownership is Not

... public support," the United States has long encouraged, supported, and subsidized home ownership.' 8 Even before the recent mortgage crisis forced the government to increase its involvement in the housing market, the United States had an active role in the housing market and helped facilitate the tr ...

... public support," the United States has long encouraged, supported, and subsidized home ownership.' 8 Even before the recent mortgage crisis forced the government to increase its involvement in the housing market, the United States had an active role in the housing market and helped facilitate the tr ...

Chapter One * Introduction - Mutual Fund Directors Forum

... market events of 2008 and 2009 where credit and liquidity challenges affected most cash collateral pools. Additionally, the default of Lehman Brothers tested the unwinding procedures of the lending and collateralization processes at agent and principal lenders alike. Short sale bans and negative pre ...

... market events of 2008 and 2009 where credit and liquidity challenges affected most cash collateral pools. Additionally, the default of Lehman Brothers tested the unwinding procedures of the lending and collateralization processes at agent and principal lenders alike. Short sale bans and negative pre ...

Assessing the risk-return trade-off in loans

... rates and probabilities of default. In the case of the variances, (15) is the sum of two components. The first one is proportional to the reciprocal of (17), which can be interpreted as a granularity parameter. For any finite number of loans, (17) will always be finite. However, if I let Nk grow to infi ...

... rates and probabilities of default. In the case of the variances, (15) is the sum of two components. The first one is proportional to the reciprocal of (17), which can be interpreted as a granularity parameter. For any finite number of loans, (17) will always be finite. However, if I let Nk grow to infi ...

Loan shark

A loan shark is a person or body who offers loans at extremely high interest rates. The term usually refers to illegal activity, but may also refer to predatory lending with extremely high interest rates such as payday or title loans. Loan sharks sometimes enforce repayment by blackmail or threats of violence. Historically, many moneylenders skirted between legal and extra-legal activity. In the recent western world, loan sharks have been a feature of the criminal underworld.