Lecture 6

... rB be the required return to the debt rs be the required return to the firm's equity ro be the discount rate applied to the business risk of the firm ...

... rB be the required return to the debt rs be the required return to the firm's equity ro be the discount rate applied to the business risk of the firm ...

Presentation to Hon`ble Finance Minister

... year without the attendance of non-independent directors ...

... year without the attendance of non-independent directors ...

Statement of Changes in Equity

... Forms of Business Organizations: Partnership • Similar to proprietorship except owned by more than one person • Formalized in a written agreement • Limited life • Each partner has unlimited liability • Income tax paid by individual partners ...

... Forms of Business Organizations: Partnership • Similar to proprietorship except owned by more than one person • Formalized in a written agreement • Limited life • Each partner has unlimited liability • Income tax paid by individual partners ...

3i agrees sale of Inspecta to ACTA*

... Helsinki-headquartered Inspecta Group (“the Company”) to Netherlands-based ACTA*. ACTA* is the Dutch Holding company of Kiwa and Shield Group International. The transaction remains conditional upon approval by the relevant Competition Authorities, but is expected to complete in May 2015. 3i, and fun ...

... Helsinki-headquartered Inspecta Group (“the Company”) to Netherlands-based ACTA*. ACTA* is the Dutch Holding company of Kiwa and Shield Group International. The transaction remains conditional upon approval by the relevant Competition Authorities, but is expected to complete in May 2015. 3i, and fun ...

Seven Solutions - ZAI Corporate Finance Ltd

... The “seven solutions” describe the various sources of equity capital, from within the 3 major marketplaces (Quoted Equity, Private Equity and M&A), to which a client may turn to raise money We break the 3 major markets down into 7 distinct categories of Capital because of the differences in the ...

... The “seven solutions” describe the various sources of equity capital, from within the 3 major marketplaces (Quoted Equity, Private Equity and M&A), to which a client may turn to raise money We break the 3 major markets down into 7 distinct categories of Capital because of the differences in the ...

Jeremy Siegel, Rob Arnott and Other Experts Forecast Equity Returns

... chicken – are underinvested in equities, if these ERP projections are to be believed. 5 These investors have over-weighted illiquid assets, hedge funds, and perhaps bonds because they have implicitly presumed that the horrible equity returns of the last decade will repeat themselves forever. An equi ...

... chicken – are underinvested in equities, if these ERP projections are to be believed. 5 These investors have over-weighted illiquid assets, hedge funds, and perhaps bonds because they have implicitly presumed that the horrible equity returns of the last decade will repeat themselves forever. An equi ...

Pensions Investment Sub 080512 Appendix A to Previous Part 1

... Adding complexity to the investment strategy as noted above leads us to believe that, whilst the introduction of property to the investment strategy is not unreasonable, there are other demands on the governance budget that should take precedence at the current time. An active approach to commodity ...

... Adding complexity to the investment strategy as noted above leads us to believe that, whilst the introduction of property to the investment strategy is not unreasonable, there are other demands on the governance budget that should take precedence at the current time. An active approach to commodity ...

TEMPLETON GLOBAL SMALLER COMPANIES FUND

... 1. Performance data may represent blended share class performance e.g. hybrid created from an A(Ydis) share class that was converted to A(acc). Performance details provided are in base currency, include reinvested dividends and are net of management fees. Sales charges and other commissions, taxes a ...

... 1. Performance data may represent blended share class performance e.g. hybrid created from an A(Ydis) share class that was converted to A(acc). Performance details provided are in base currency, include reinvested dividends and are net of management fees. Sales charges and other commissions, taxes a ...

Tips for Startups – Understanding Debt vs. Equity

... participate in the upside in a profitable company, or in a future exit. Preferred Shares Preferred shares are the favoured form of equity for most sophisticated investors, whether venture capital firms, other institutional investors, or just those savvy in the modern realm of investment. Preferred s ...

... participate in the upside in a profitable company, or in a future exit. Preferred Shares Preferred shares are the favoured form of equity for most sophisticated investors, whether venture capital firms, other institutional investors, or just those savvy in the modern realm of investment. Preferred s ...

Dan diBartolomeo

... – An equal weighted portfolio of the low sustainability stocks (high risk) in Quintile 5 produced the highest monthly mean return of 1.33%. The volatility of such this portfolio was so high at over 9% per month that the annualized compound return was only 10.9%, which is inferior to the 11.50% annua ...

... – An equal weighted portfolio of the low sustainability stocks (high risk) in Quintile 5 produced the highest monthly mean return of 1.33%. The volatility of such this portfolio was so high at over 9% per month that the annualized compound return was only 10.9%, which is inferior to the 11.50% annua ...

Long-term investments - McGraw Hill Higher Education

... investments to produce higher income. 2.Some companies are set up to produce income from investments. 3.Companies make investments for ...

... investments to produce higher income. 2.Some companies are set up to produce income from investments. 3.Companies make investments for ...

Chenavari enter into an agreement to acquire BuyWay Personal

... - personal loans (including consumer and car loans). In addition to its credit institution operations, Buy Way has developed a credit card management business for third parties, forming a joint venture with KBC Bank. ...

... - personal loans (including consumer and car loans). In addition to its credit institution operations, Buy Way has developed a credit card management business for third parties, forming a joint venture with KBC Bank. ...

Equity Valuation-a

... Need additional financing of 17.5. Can obtain without changing the leverage ratio, by splitting between debt and equity. Although done for 1-year in the above example, as sustainable growth = ROE * b, these numbers tend to vary widely over time . The common practice is to use a Dupont equation, and ...

... Need additional financing of 17.5. Can obtain without changing the leverage ratio, by splitting between debt and equity. Although done for 1-year in the above example, as sustainable growth = ROE * b, these numbers tend to vary widely over time . The common practice is to use a Dupont equation, and ...

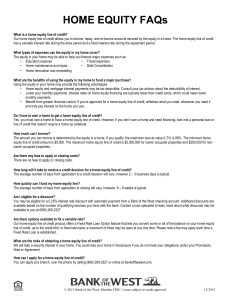

HOME EQUITY FAQs - Bank of the West

... What are the benefits of using the equity in my home to fund a major purchase? Using the equity in your home may provide the following advantages: • Home equity and mortgage interest payments may be tax deductible. Consult your tax advisor about the deductibility of interest. • Lower your monthly pa ...

... What are the benefits of using the equity in my home to fund a major purchase? Using the equity in your home may provide the following advantages: • Home equity and mortgage interest payments may be tax deductible. Consult your tax advisor about the deductibility of interest. • Lower your monthly pa ...

SECOND ANNUAL WOMEN`S ALTERNATIVE INVESTMENT

... 2nd Annual Women’s Alternative Investment Summit/page 2 of 2 ...

... 2nd Annual Women’s Alternative Investment Summit/page 2 of 2 ...

please hate the markets

... Despite all the volatility, markets had gone virtually no where for 2010 until mid September. And that just added to investor angst and frustration after two tough years in 2008 and ...

... Despite all the volatility, markets had gone virtually no where for 2010 until mid September. And that just added to investor angst and frustration after two tough years in 2008 and ...

Capital Structure

... quality as managers face a cost in bankruptcy which is less likely (for a given level of debt) the higher is the quality of the firm. • Leland and Pyle use managerial risk aversion as the cost of the signal. Increased leverage allows managers to retain a larger fraction of the equity which via the r ...

... quality as managers face a cost in bankruptcy which is less likely (for a given level of debt) the higher is the quality of the firm. • Leland and Pyle use managerial risk aversion as the cost of the signal. Increased leverage allows managers to retain a larger fraction of the equity which via the r ...

November 2011 - Capital Markets Board of Turkey

... During their stay in Turkey, the Korean Delegation also visited the Istanbul Stock Exchange and Banking Regulation and Supervision Agency. ...

... During their stay in Turkey, the Korean Delegation also visited the Istanbul Stock Exchange and Banking Regulation and Supervision Agency. ...

THE EXTRAORDINARY DIVIDEND

... This does introduce a problem too, however. The difficulty that boards and management teams have with dividend cuts, can lead to some ambiguous behaviour. Sometimes companies will go to great lengths to avoid a dividend cut and this simply stores up trouble for the future. This is where judgement co ...

... This does introduce a problem too, however. The difficulty that boards and management teams have with dividend cuts, can lead to some ambiguous behaviour. Sometimes companies will go to great lengths to avoid a dividend cut and this simply stores up trouble for the future. This is where judgement co ...

MedTech ”Made in Germany”

... make Germany a buyer‘s market at the moment. But negative past experiences with venture capital investments make many institutional investors reluctant to invest. Nonetheless, alternative investments such as venture capital could prove prosperous again in the future. To begin with, investors are inc ...

... make Germany a buyer‘s market at the moment. But negative past experiences with venture capital investments make many institutional investors reluctant to invest. Nonetheless, alternative investments such as venture capital could prove prosperous again in the future. To begin with, investors are inc ...

New Venture Creation

... • What type of ventures lends themselves to the use of informal investors? – Ventures with capital requirements of between $50,000 and $500,000 – Ventures with sales potential of between $2 million and $20 million within 5 to 10 years – Small, established, privately held ventures with sales and prof ...

... • What type of ventures lends themselves to the use of informal investors? – Ventures with capital requirements of between $50,000 and $500,000 – Ventures with sales potential of between $2 million and $20 million within 5 to 10 years – Small, established, privately held ventures with sales and prof ...

small and medium-sized enterprises` access to finance

... are willing to accept outside equity investors. These firms are in a small minority, but have the potential to grow into large companies. Overall, equity financing is used by 3 % of European SMEs. Innovative SMEs use equity financing more often than non-innovative enterprises8. The absence of an equ ...

... are willing to accept outside equity investors. These firms are in a small minority, but have the potential to grow into large companies. Overall, equity financing is used by 3 % of European SMEs. Innovative SMEs use equity financing more often than non-innovative enterprises8. The absence of an equ ...

global health investment fund

... Times at the end of June. This is among the highest awards given to new development financing models. In announcing the award, the judges remarked: “It would be criminal not to give this award to this pioneering project.” ...

... Times at the end of June. This is among the highest awards given to new development financing models. In announcing the award, the judges remarked: “It would be criminal not to give this award to this pioneering project.” ...

Answers to Chapter 1 Questions

... 14. As long as the returns on different investments are not perfectly positively correlated, by spreading their investments across a number of assets, FIs can diversify away significant amounts of their portfolio risk. Further, for equal investments in different securities, as the number of securiti ...

... 14. As long as the returns on different investments are not perfectly positively correlated, by spreading their investments across a number of assets, FIs can diversify away significant amounts of their portfolio risk. Further, for equal investments in different securities, as the number of securiti ...

Strong lending and profit growth

... and Germany lending rates for existing customers are adjusted based on market rates. Variable lending rates contribute to a stable interest margin when market rates change. ...

... and Germany lending rates for existing customers are adjusted based on market rates. Variable lending rates contribute to a stable interest margin when market rates change. ...

Private equity in the 2000s

Private equity in the 2000s relates to one of the major periods in the history of private equity and venture capital. Within the broader private equity industry, two distinct sub-industries, leveraged buyouts and venture capital experienced growth along parallel although interrelated tracks.The development of the private equity and venture capital asset classes has occurred through a series of boom and bust cycles since the middle of the 20th century. As the 20th century ended, so, too, did the dot-com bubble and the tremendous growth in venture capital that had marked the previous five years. In the wake of the collapse of the dot-com bubble, a new ""Golden Age"" of private equity ensued, as leveraged buyouts reach unparalleled size and the private equity firms achieved new levels of scale and institutionalization, exemplified by the initial public offering of the Blackstone Group in 2007.