Disclosure of Model and Assumptions Used to Determine RMBS

... The Model – The NAIC engagement requires PIMCO Advisory to conduct a loan level analysis of US RMBS using their proprietary non-agency mortgage model. The PIMCO Advisory analytical process actually refers to and consists of four sub-steps: a macroeconomic model, a mortgage loan credit model, a capit ...

... The Model – The NAIC engagement requires PIMCO Advisory to conduct a loan level analysis of US RMBS using their proprietary non-agency mortgage model. The PIMCO Advisory analytical process actually refers to and consists of four sub-steps: a macroeconomic model, a mortgage loan credit model, a capit ...

Mortgage/Banking

... Money added to your checking or savings account. To add money, you must fill out a deposit slip that tells the bank how much money you are adding to your account. Depending on whether you deposit cash, a payroll check or a check drawn on an out-ofstate bank, you may not have immediate use of the fun ...

... Money added to your checking or savings account. To add money, you must fill out a deposit slip that tells the bank how much money you are adding to your account. Depending on whether you deposit cash, a payroll check or a check drawn on an out-ofstate bank, you may not have immediate use of the fun ...

TAYLOR RULE IN EAST ASIAN COUNTRIES

... targeting as its monetary policy in 1998. In the year 2000 Thailand did the same. Although Indonesia announced inflation targeting in 2005, there is not enough data to study the impact of the policy decision. Japan and Taiwan also ...

... targeting as its monetary policy in 1998. In the year 2000 Thailand did the same. Although Indonesia announced inflation targeting in 2005, there is not enough data to study the impact of the policy decision. Japan and Taiwan also ...

Fixed Income Opportunity

... is expected to occur in a two-stage process in which the impact to the broader economy lags the financial system by 6 to 9 months. Therefore, the impact to the broader economy should continue through 2008 ...

... is expected to occur in a two-stage process in which the impact to the broader economy lags the financial system by 6 to 9 months. Therefore, the impact to the broader economy should continue through 2008 ...

“The Impact of Financial Institutions and Financial ‘Liquidity Lock’ ”

... 6 P.M. Eastern Time / 5 P.M. Central Time or Upon Delivery ...

... 6 P.M. Eastern Time / 5 P.M. Central Time or Upon Delivery ...

Chapter 21

... rapidly declining prices of an asset class, can lead to a financial panic, reductions in the quantity of available credit, and the de-leveraging of the financial system. The most highly leveraged investors suffer most. A lender of last resort is an individual, private institution, or, more commo ...

... rapidly declining prices of an asset class, can lead to a financial panic, reductions in the quantity of available credit, and the de-leveraging of the financial system. The most highly leveraged investors suffer most. A lender of last resort is an individual, private institution, or, more commo ...

The Final Exam is Tuesday May 4th at 1:00 in the normal Todd

... 21. One disadvantage of a currency board (like the one in Hong Kong) a. The country loses the ability to control domestic interest rates b. There is greater exchange rate uncertainty c. It causes current account deficits d. It reduces foreign investment ...

... 21. One disadvantage of a currency board (like the one in Hong Kong) a. The country loses the ability to control domestic interest rates b. There is greater exchange rate uncertainty c. It causes current account deficits d. It reduces foreign investment ...

Exponential and Logarithmic Functions

... remaining, Q, after a time period of t is given by the formula ...

... remaining, Q, after a time period of t is given by the formula ...

Chapter 1

... • To examine how financial markets such as bond, stock and foreign exchange markets work • To examine how financial institutions such as banks, investment and insurance companies work • To examine the role of money in the economy ...

... • To examine how financial markets such as bond, stock and foreign exchange markets work • To examine how financial institutions such as banks, investment and insurance companies work • To examine the role of money in the economy ...

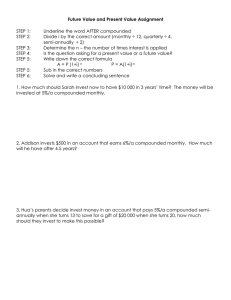

Future Value and Present Value Assignment

... 3. Hua’s parents decide invest money in an account that pays 5%/a compounded semiannually when she turns 13 to save for a gift of $20 000 when she turns 20, how much should they invest to make this possible? ...

... 3. Hua’s parents decide invest money in an account that pays 5%/a compounded semiannually when she turns 13 to save for a gift of $20 000 when she turns 20, how much should they invest to make this possible? ...

Slide 1

... towards $0.95 U.S. by end of 2007 and towards $1.00 U.S. by end of 2008 Canadian dollar will weaken against the euro Large U.S. budget and trade deficits will eventually take its toll on the U.S dollar The U.S. will become increasingly protectionist with Democratic Congress and likely Democrat ...

... towards $0.95 U.S. by end of 2007 and towards $1.00 U.S. by end of 2008 Canadian dollar will weaken against the euro Large U.S. budget and trade deficits will eventually take its toll on the U.S dollar The U.S. will become increasingly protectionist with Democratic Congress and likely Democrat ...

Present and Future Values

... These cashflows represent the amount of money that are expected to be received or paid over time on the back of an investment/debt decision If the cashflows are scheduled on different maturities, their value can’t be directly compared To be compared they need to be expressed on same ...

... These cashflows represent the amount of money that are expected to be received or paid over time on the back of an investment/debt decision If the cashflows are scheduled on different maturities, their value can’t be directly compared To be compared they need to be expressed on same ...

Housing Finance in Emerging Markets: Policy and

... Can lenders generate sufficient scale to cover fixed costs? Is there an ability to manage volume variability Cut costs in slow downs, raise margins in up turns ...

... Can lenders generate sufficient scale to cover fixed costs? Is there an ability to manage volume variability Cut costs in slow downs, raise margins in up turns ...

Derivatives and Risk Management

... inherent in the financial markets due to price fluctuations. Example: A firm holds a portfolio of bonds, interest rates rise, and the value of the bonds falls. ...

... inherent in the financial markets due to price fluctuations. Example: A firm holds a portfolio of bonds, interest rates rise, and the value of the bonds falls. ...

Profit worksheet starter File

... value of _____________________ made within a time period (such as a financial year). It is calculated by the formula: REVENUE ...

... value of _____________________ made within a time period (such as a financial year). It is calculated by the formula: REVENUE ...

PDF Download

... The EU27 annual inflation rate reached 1.4% in February 2010, down from 1.7% in January. A year earlier the rate had been 1.8%. An EUwide HICP comparison shows that in February 2010 the lowest annual rates were observed in Latvia (– 4.3%), Ireland (– 2.4%) and Lithuania (– 0.6%), and the highest rat ...

... The EU27 annual inflation rate reached 1.4% in February 2010, down from 1.7% in January. A year earlier the rate had been 1.8%. An EUwide HICP comparison shows that in February 2010 the lowest annual rates were observed in Latvia (– 4.3%), Ireland (– 2.4%) and Lithuania (– 0.6%), and the highest rat ...

CREDIT PROFILE OF SPAREBANK 1 SR-BANK

... This region is one of Norway's most populous, containing 25% of the country’s population ...

... This region is one of Norway's most populous, containing 25% of the country’s population ...