Private Information

... The Market for Insurance People who buy insurance face moral hazard, and insurance companies face adverse selection. Moral hazard arises because a person with insurance against a loss has less incentive than an uninsured person to avoid the loss. Adverse selection arises because people who create gr ...

... The Market for Insurance People who buy insurance face moral hazard, and insurance companies face adverse selection. Moral hazard arises because a person with insurance against a loss has less incentive than an uninsured person to avoid the loss. Adverse selection arises because people who create gr ...

Uncertainty and Risk

... The Market for Insurance People who buy insurance face moral hazard, and insurance companies face adverse selection. Moral hazard arises because a person with insurance against a loss has less incentive than an uninsured person to avoid the loss. Adverse selection arises because people who create gr ...

... The Market for Insurance People who buy insurance face moral hazard, and insurance companies face adverse selection. Moral hazard arises because a person with insurance against a loss has less incentive than an uninsured person to avoid the loss. Adverse selection arises because people who create gr ...

Purchase of Rental Property Form

... 4. The most common answer of all is admitting to never thinking about this question. The problem with the answers above is that investing in a rental property costs time and money, which are precious resources. Planning for retirement has enough pitfalls, without knowing whether an investment is hel ...

... 4. The most common answer of all is admitting to never thinking about this question. The problem with the answers above is that investing in a rental property costs time and money, which are precious resources. Planning for retirement has enough pitfalls, without knowing whether an investment is hel ...

November 2005 Course FM/2 Examination 1. An insurance

... let us go over the answers and treat this as a learning experience: A. Black-Scholes option pricing model: This is not in the syllabus of Course FM/2. My guess is that the “original intent” of the question creator was that you would see this and realize it is not in the syllabus, and reject this ans ...

... let us go over the answers and treat this as a learning experience: A. Black-Scholes option pricing model: This is not in the syllabus of Course FM/2. My guess is that the “original intent” of the question creator was that you would see this and realize it is not in the syllabus, and reject this ans ...

SILICON VALLEY BANCSHARES - Investor Relations Solutions

... During 1993, the Company and Bank consented to formal supervisory orders by the Federal Reserve Bank of San Francisco and the Bank consented to a formal supervisory order by the California State Banking Department. These orders require, among other actions, the following: suspension of cash dividend ...

... During 1993, the Company and Bank consented to formal supervisory orders by the Federal Reserve Bank of San Francisco and the Bank consented to a formal supervisory order by the California State Banking Department. These orders require, among other actions, the following: suspension of cash dividend ...

Simple, Compound Interest, Depreciation, Growth

... to each question does not reflect the actual papers to save space. These questions have been collated by me as the basis for a GCSE working party set up by the GLOW maths hub - if you want to get involved please get in touch. The objective is to provide support to fellow teachers and to give you a f ...

... to each question does not reflect the actual papers to save space. These questions have been collated by me as the basis for a GCSE working party set up by the GLOW maths hub - if you want to get involved please get in touch. The objective is to provide support to fellow teachers and to give you a f ...

The Balance of Payments Accounts

... Rise in interest rates – drop in investments and employment – decline in inflation – recession Decline in inflation and recession were deeper than expected due to strong appreciation of USD, caused by inflow of capital due high interest rates: recession born by FX-sensitive industries and interest-r ...

... Rise in interest rates – drop in investments and employment – decline in inflation – recession Decline in inflation and recession were deeper than expected due to strong appreciation of USD, caused by inflow of capital due high interest rates: recession born by FX-sensitive industries and interest-r ...

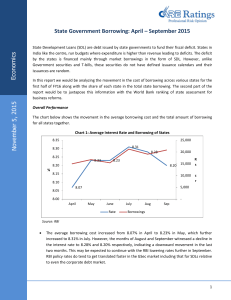

State Government Borrowing

... Himachal Pradesh, Kerala, Bihar, Uttarakhand, Jammu and Kashmir fall under the lowest category. However, except Kerala, the other states have very low share in the amount borrowed. ...

... Himachal Pradesh, Kerala, Bihar, Uttarakhand, Jammu and Kashmir fall under the lowest category. However, except Kerala, the other states have very low share in the amount borrowed. ...

risk - Development Studies

... Exchange rate/currency risk cont’d • Exchange-rate risk may be the single biggest risk for holders of bonds that make interest and principal payments in a foreign currency. – A Namibian company A pays interest and principal on a R1,000mn bond with a 5% coupon in N$. If the exchange rate at the time ...

... Exchange rate/currency risk cont’d • Exchange-rate risk may be the single biggest risk for holders of bonds that make interest and principal payments in a foreign currency. – A Namibian company A pays interest and principal on a R1,000mn bond with a 5% coupon in N$. If the exchange rate at the time ...

Existing proposals for taming procyclicality

... • The international accounting standards currently in force (IAS 39) allow banks to provision only for loans for which there is clear evidence of impairment (i.e. backward-looking provisioning). • specific provisions are created and entered in the accounts only after credit risk comes to light (whic ...

... • The international accounting standards currently in force (IAS 39) allow banks to provision only for loans for which there is clear evidence of impairment (i.e. backward-looking provisioning). • specific provisions are created and entered in the accounts only after credit risk comes to light (whic ...

Non-performing loans and the real economy: Japan’s experience

... aggregated figures for self-assessments are only available from 1997, and there have even been changes since then, with the criteria for self-assessment said to have changed when the “Inspection Manual” was introduced. As a very preliminary stage of research, we have estimated the cross section mode ...

... aggregated figures for self-assessments are only available from 1997, and there have even been changes since then, with the criteria for self-assessment said to have changed when the “Inspection Manual” was introduced. As a very preliminary stage of research, we have estimated the cross section mode ...

Measuring systemic risk: the role of macro

... Lending from financial institutions located offshore is another potential source of credit for New Zealand households and firms. Data from the Balance of Payments accounts suggest, however, that this direct cross-border lending is very small. This contrasts with many other jurisdictions where direct ...

... Lending from financial institutions located offshore is another potential source of credit for New Zealand households and firms. Data from the Balance of Payments accounts suggest, however, that this direct cross-border lending is very small. This contrasts with many other jurisdictions where direct ...

Account for Agriculture, Forestry, Fisheries and Food Business

... d. JFC provided necessary loans for stability and preservation of management to farmers whose businesses temporarily suffer a downturn because of disasters such as earthquakes/typhoons and changes in social and economic environments such as drops in prices of agricultural products. It is estimated t ...

... d. JFC provided necessary loans for stability and preservation of management to farmers whose businesses temporarily suffer a downturn because of disasters such as earthquakes/typhoons and changes in social and economic environments such as drops in prices of agricultural products. It is estimated t ...

A Time-Series Analysis of US Savings and Loan Performance: Major Trends and Policy Issues After the Housing Crisis:

... variable in most banking studies. This type of analysis extends beyond market structures by taking into account the larger regulatory and policy environment of banks. The premise of structural analysis is that the organizational make-up of the US financial system impacts the viability of savings and ...

... variable in most banking studies. This type of analysis extends beyond market structures by taking into account the larger regulatory and policy environment of banks. The premise of structural analysis is that the organizational make-up of the US financial system impacts the viability of savings and ...

Exchange-traded Treasury Bonds (TBs) - text version

... Why TBs with a similar yield might trade at a different price The price difference can be explained by comparing the coupon rates. A higher coupon rate means the investor earns more income. This is because income (coupon payments) is calculated by multiplying the coupon rate (which is a percentage) ...

... Why TBs with a similar yield might trade at a different price The price difference can be explained by comparing the coupon rates. A higher coupon rate means the investor earns more income. This is because income (coupon payments) is calculated by multiplying the coupon rate (which is a percentage) ...

Determinants of non-performing loans in Central and Eastern

... The recent financial crisis has left a legacy of extremely high levels of NPLs in the CEE region. In 2008, countries that had based their economic growth on the booming banking sector (Sirtaine and Skamnelos, 2007) at the beginning of the past decade found themselves faced with a sudden credit growt ...

... The recent financial crisis has left a legacy of extremely high levels of NPLs in the CEE region. In 2008, countries that had based their economic growth on the booming banking sector (Sirtaine and Skamnelos, 2007) at the beginning of the past decade found themselves faced with a sudden credit growt ...

19 - Commercial Real Estate Analysis and Investment

... When the yield curve is steeply rising (e.g., 200-400 bps from ST to LT yields), ARM rates may appear particularly favorable (for borrowers) relative to FRM rates. ...

... When the yield curve is steeply rising (e.g., 200-400 bps from ST to LT yields), ARM rates may appear particularly favorable (for borrowers) relative to FRM rates. ...