Funding Liquidity, Market Liquidity and the Cross-Section

... explain very little of the cross-section of average returns across illiquidity and volatility portfolios. But AEM show that leverage risk successfully prices the cross-section of size and book-to-market portfolios. We find that the leverage factor explains by itself 87 percent of the dispersion of r ...

... explain very little of the cross-section of average returns across illiquidity and volatility portfolios. But AEM show that leverage risk successfully prices the cross-section of size and book-to-market portfolios. We find that the leverage factor explains by itself 87 percent of the dispersion of r ...

Measuring Securities Litigation Risk

... comprehensive evidence on the usefulness of the FPS industry variables as a measure and predictor of litigation risk, an important task given the ubiquity of this measure in the extant literature. Second, we provide evidence that allows us to better understand what makes particular firms and industr ...

... comprehensive evidence on the usefulness of the FPS industry variables as a measure and predictor of litigation risk, an important task given the ubiquity of this measure in the extant literature. Second, we provide evidence that allows us to better understand what makes particular firms and industr ...

UNISDR Case Study Report

... and sharing risk and experience in loss prevention, insurance facilitates the resistance, absorption, accommodation, and recovery from the effects of a hazard in a timely manner, including reconstruction of a society’s essential basic infrastructures. II. Public policy issues can facilitate insuranc ...

... and sharing risk and experience in loss prevention, insurance facilitates the resistance, absorption, accommodation, and recovery from the effects of a hazard in a timely manner, including reconstruction of a society’s essential basic infrastructures. II. Public policy issues can facilitate insuranc ...

USE4 - cloudfront.net

... the beta of the asset relative to the market. In other words, within CAPM, the only “priced” factor is the market factor. Using the CAPM framework, the return of any asset can be decomposed into a systematic component that is perfectly correlated with the market, and a residual component that is unc ...

... the beta of the asset relative to the market. In other words, within CAPM, the only “priced” factor is the market factor. Using the CAPM framework, the return of any asset can be decomposed into a systematic component that is perfectly correlated with the market, and a residual component that is unc ...

Equity Risk Premiums (ERP)

... alternate (though unrealistic) world where investors are risk neutral. In this world, the value of an asset would be the present value of expected cash flows, discounted back at a risk free rate. The expected cash flows would capture the cash flows under all possible scenarios (good and bad) and the ...

... alternate (though unrealistic) world where investors are risk neutral. In this world, the value of an asset would be the present value of expected cash flows, discounted back at a risk free rate. The expected cash flows would capture the cash flows under all possible scenarios (good and bad) and the ...

When uncertainty blows in the orchard comovement and equilibrium

... correlations are stochastic and co-move with the equilibrium stochastic discount factor. Volatility is priced and the size of the volatility risk premium is linked to the perceived level of uncertainty. In this context, the volatility risk premium on index options is higher than on single stock opti ...

... correlations are stochastic and co-move with the equilibrium stochastic discount factor. Volatility is priced and the size of the volatility risk premium is linked to the perceived level of uncertainty. In this context, the volatility risk premium on index options is higher than on single stock opti ...

The Internal Ratings-Based Approach

... (iii) Methods for quantifying PD .................................................................................................. 16 (iv) Impact of credit derivatives and guarantees on estimation of PD ........................................ 16 C. LOSS GIVEN DEFAULT (LGD) ........................ ...

... (iii) Methods for quantifying PD .................................................................................................. 16 (iv) Impact of credit derivatives and guarantees on estimation of PD ........................................ 16 C. LOSS GIVEN DEFAULT (LGD) ........................ ...

How to Discount Cashflows with Time

... rate remains constant. Since the total expected return comprises both a riskfree rate and a risk premium, adjusted by a factor loading, time-varying riskfree rates imply that total expected returns also change through time. Note that even an investor who believes that the expected market excess retu ...

... rate remains constant. Since the total expected return comprises both a riskfree rate and a risk premium, adjusted by a factor loading, time-varying riskfree rates imply that total expected returns also change through time. Note that even an investor who believes that the expected market excess retu ...

How to note: Managing fiduciary risk when providing

... financial accountability environment. This note focuses on assessing, mitigating and monitoring risks associated with national PFM systems. 7. This note does not address the management of risks outside the fiduciary and corruption fields in depth, although these may be closely connected – for exampl ...

... financial accountability environment. This note focuses on assessing, mitigating and monitoring risks associated with national PFM systems. 7. This note does not address the management of risks outside the fiduciary and corruption fields in depth, although these may be closely connected – for exampl ...

1492 Syndicate annual accounts 2015

... Syndicate is backed principally by Latin American capital. Consequently, the Syndicate plans to develop business through Latin American contacts from the outset. ...

... Syndicate is backed principally by Latin American capital. Consequently, the Syndicate plans to develop business through Latin American contacts from the outset. ...

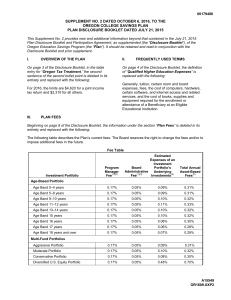

Disclosure Booklet - Oregon College Savings Plan

... collateral securing a loan can decline, be insufficient to meet the obligations of the borrower, or be difficult to liquidate, and that the fund’s rights to collateral may be limited by bankruptcy or insolvency laws; (iii) investments in highly leveraged loans or loans of stressed, distressed, or de ...

... collateral securing a loan can decline, be insufficient to meet the obligations of the borrower, or be difficult to liquidate, and that the fund’s rights to collateral may be limited by bankruptcy or insolvency laws; (iii) investments in highly leveraged loans or loans of stressed, distressed, or de ...

Essentials of Financial Risk Management

... The ability to estimate the likelihood of a financial loss is highly desirable. However, standard theories of probability often fail in the analysis of financial markets. Risks usually do not exist in isolation, and the interactions of several exposures may have to be considered in developing an und ...

... The ability to estimate the likelihood of a financial loss is highly desirable. However, standard theories of probability often fail in the analysis of financial markets. Risks usually do not exist in isolation, and the interactions of several exposures may have to be considered in developing an und ...

strukture for the decree on minimum capital requirements for market

... (j) a securities or commodities lending or borrowing transaction in Article 118, (k) cash assimilated instrument in Article 119, (l) originator in the sixth paragraph of Article 120, (m) sponsor in the seventh paragraph of Article 120, (n) a financial instrument in the first paragraph of Article 121 ...

... (j) a securities or commodities lending or borrowing transaction in Article 118, (k) cash assimilated instrument in Article 119, (l) originator in the sixth paragraph of Article 120, (m) sponsor in the seventh paragraph of Article 120, (n) a financial instrument in the first paragraph of Article 121 ...

Using out-of-sample errors in portfolio optimization

... stocks (in terms of Sharpe ratio).3 For example, in the set of portfolios sorted on size and momentum, the annualized Sharpe ratio of the optimized portfolio OOS is 1.37, versus 0.54 for the 1/N benchmark. On average across the four sets of assets considered the Sharpe ratio improves 80% on the 1/N ...

... stocks (in terms of Sharpe ratio).3 For example, in the set of portfolios sorted on size and momentum, the annualized Sharpe ratio of the optimized portfolio OOS is 1.37, versus 0.54 for the 1/N benchmark. On average across the four sets of assets considered the Sharpe ratio improves 80% on the 1/N ...

lincreasedl Correlation in Bear Markets

... assumption of joint normality would still result in the same mean-variance-efficient portfolio. However, as we have seen, deviations from normality exist with increased probability mass hi the tails of the return distribution, which results irt an increase in 'the coitelations of large negative move ...

... assumption of joint normality would still result in the same mean-variance-efficient portfolio. However, as we have seen, deviations from normality exist with increased probability mass hi the tails of the return distribution, which results irt an increase in 'the coitelations of large negative move ...

Sustainability, Cost-Effectiveness, Fairness and Value

... The structure of large defined benefit pension plans promotes efficient, low-cost investment management. These plans pool the investments of many individuals into a large pension fund that can be professionally managed at low cost. The fund can be invested for the long term, and it can focus on the ...

... The structure of large defined benefit pension plans promotes efficient, low-cost investment management. These plans pool the investments of many individuals into a large pension fund that can be professionally managed at low cost. The fund can be invested for the long term, and it can focus on the ...

Strategic Informed Trades, Diversification, and Expected Returns*

... expected returns are lower when the large trader, and therefore all traders, learn nothing beyond their prior beliefs based on public information. This contrasts with the case of perfectly competitive informed investors, where the introduction of private information reduces expected returns. We also ...

... expected returns are lower when the large trader, and therefore all traders, learn nothing beyond their prior beliefs based on public information. This contrasts with the case of perfectly competitive informed investors, where the introduction of private information reduces expected returns. We also ...

Multi-Period Trading via Convex Optimization

... and reliable when the problems to be solved are convex. Real-world single-period convex problems with thousands of assets can be solved using generic algorithms in well under a second, which is critical for evaluating a proposed algorithm with historical or simulated data, for many values of the par ...

... and reliable when the problems to be solved are convex. Real-world single-period convex problems with thousands of assets can be solved using generic algorithms in well under a second, which is critical for evaluating a proposed algorithm with historical or simulated data, for many values of the par ...

Regulatory Capital Requirements under FTK and

... In the Netherlands, it is obligatory to participate in a pension scheme in case it is provided by the employer. Since employees are obliged to invest part of their salary in a pension scheme, it is important that there is good supervision. The legislation for pension funds is embedded in the Financi ...

... In the Netherlands, it is obligatory to participate in a pension scheme in case it is provided by the employer. Since employees are obliged to invest part of their salary in a pension scheme, it is important that there is good supervision. The legislation for pension funds is embedded in the Financi ...

The Risk-Free Rate`s Impact on Stock Returns with Representative

... management creates an agency problem since the fund has an incentive to maximize its profits rather than the risk-adjusted returns. This may result in excessive risk taking, the funds can increase their expected compensation through increasing the variance of their returns. Rajan also points out tha ...

... management creates an agency problem since the fund has an incentive to maximize its profits rather than the risk-adjusted returns. This may result in excessive risk taking, the funds can increase their expected compensation through increasing the variance of their returns. Rajan also points out tha ...

Managerial Risk-Taking and CEO Excess Compensation

... al. 2006; Murphy, 1999; Perry and Zenner, 2000). This growth has substantially increasedthe sensitivity of CEO wealth to stock price (delta) and the sensitivity of CEO wealth to stock volatility (vega).The positive effect of delta and vega is that a higher delta encourages CEOs to work for sharehold ...

... al. 2006; Murphy, 1999; Perry and Zenner, 2000). This growth has substantially increasedthe sensitivity of CEO wealth to stock price (delta) and the sensitivity of CEO wealth to stock volatility (vega).The positive effect of delta and vega is that a higher delta encourages CEOs to work for sharehold ...

Shareholder Assessment of Bond Fund Risk Ratings

... who owned equity and bond funds as well as those owning money market funds. Most of the respondents were seasoned fund investors who had long-term financial goals and long-term investment strategies. The survey questionnaire was designed, inter alia, to determine: how risk enters into investment dec ...

... who owned equity and bond funds as well as those owning money market funds. Most of the respondents were seasoned fund investors who had long-term financial goals and long-term investment strategies. The survey questionnaire was designed, inter alia, to determine: how risk enters into investment dec ...

Cash-flow Risk, Discount Risk, and the Value Premium

... (1999), Li (2001), and Wachter (2000). These papers though only deal with the time series properties of the market portfolio and have no implications for the risk and return properties of individual securities. ...

... (1999), Li (2001), and Wachter (2000). These papers though only deal with the time series properties of the market portfolio and have no implications for the risk and return properties of individual securities. ...

Mitigating Systemic Risk - A Role for Securities Regulators

... across the financial system and the real economy. Understanding both the development and transmission of risk will undoubtedly facilitate the regulators‟ roles in developing approaches to identify and effectively address emerging systemic risk. In Chapter 3, the paper proposes some approaches and in ...

... across the financial system and the real economy. Understanding both the development and transmission of risk will undoubtedly facilitate the regulators‟ roles in developing approaches to identify and effectively address emerging systemic risk. In Chapter 3, the paper proposes some approaches and in ...

Key Credit Factors For The Regulated Utilities

... 14. Utility products and services are not overly subject to substitution. Where substitution is possible, as in the case of natural gas, consumer behavior is usually stable and there is not a lot of switching to other fuels. Where switching does occur, cost allocation and rate design practices in th ...

... 14. Utility products and services are not overly subject to substitution. Where substitution is possible, as in the case of natural gas, consumer behavior is usually stable and there is not a lot of switching to other fuels. Where switching does occur, cost allocation and rate design practices in th ...

Risk

Risk is potential of losing something of value. Values (such as physical health, social status, emotional well being or financial wealth) can be gained or lost when taking risk resulting from a given action, activity and/or inaction, foreseen or unforeseen. Risk can also be defined as the intentional interaction with uncertainty. Uncertainty is a potential, unpredictable, unmeasurable and uncontrollable outcome, risk is a consequence of action taken in spite of uncertaintyRisk perception is the subjective judgment people make about the severity and/or probability of a risk, and may vary person to person. Any human endeavor carries some risk, but some are much riskier than others.