Changes_in_measurement_of_pensions

... ▪ “The 2008 SNA recognizes that employment-related pension entitlements are contractual engagements, that are expected or likely to be enforceable. They should be recognized as liabilities towards households, irrespectively of whether the necessary assets exist in segregated schemes or not.” (A3.127 ...

... ▪ “The 2008 SNA recognizes that employment-related pension entitlements are contractual engagements, that are expected or likely to be enforceable. They should be recognized as liabilities towards households, irrespectively of whether the necessary assets exist in segregated schemes or not.” (A3.127 ...

Pensions are cheap- It’s tax concessions for superanuation

... collections would rise faster than GDP (and be reflected in higher tax to GDP ratios). This mainly reflects the progressivity of the personal income tax system. ...

... collections would rise faster than GDP (and be reflected in higher tax to GDP ratios). This mainly reflects the progressivity of the personal income tax system. ...

Document

... Source: CBO Long-Term Budget Outlook (2005); Budget and Economic Outlook (2007); Heritage Foundation calculations ...

... Source: CBO Long-Term Budget Outlook (2005); Budget and Economic Outlook (2007); Heritage Foundation calculations ...

[Presentación en inglés]

... In the current crisis many of these mechanisms proved to cause pro-cyclical changes in benefit levels, would thus decrease the benefit levels when economy and labour market is in recess. To prevent above, in some cases, these automatic mechanisms were suspended. These mechanisms have ot be revised. ...

... In the current crisis many of these mechanisms proved to cause pro-cyclical changes in benefit levels, would thus decrease the benefit levels when economy and labour market is in recess. To prevent above, in some cases, these automatic mechanisms were suspended. These mechanisms have ot be revised. ...

Publication in pptx format

... • Employer helps individuals build pension savings • The new social norm – employer pays tax, NI and pension ...

... • Employer helps individuals build pension savings • The new social norm – employer pays tax, NI and pension ...

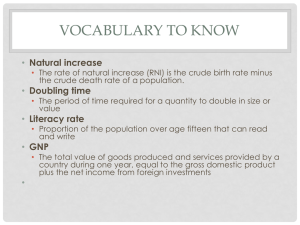

Exam Part I - Kleykamp in Taiwan

... d. income inequality cannot be measured in less developed countries ...

... d. income inequality cannot be measured in less developed countries ...

Can we say that there is sustainable growth in Brazil?

... Expansion of Social Protection Programmes o Social Protection as social insurance: dual welfare system: formal/urban versus informal/rural sector workers o Incipient SP for informal workers (authoritarian regime to 1988 Constitution: rural pension and non-contributory pension (from Funrural to unive ...

... Expansion of Social Protection Programmes o Social Protection as social insurance: dual welfare system: formal/urban versus informal/rural sector workers o Incipient SP for informal workers (authoritarian regime to 1988 Constitution: rural pension and non-contributory pension (from Funrural to unive ...

November 13, 2013, The Citizen`s Share Idea for Europe, Saving EU

... In principle, trade-off of wages for equity/profit-sharing can maintain worker lifetime income by transferring lower wage today for higher income tomorrow, adjusted for risk-> no reduction in consumer spending. Wage concession lowers price of goods, which could increase spending dependent on demand ...

... In principle, trade-off of wages for equity/profit-sharing can maintain worker lifetime income by transferring lower wage today for higher income tomorrow, adjusted for risk-> no reduction in consumer spending. Wage concession lowers price of goods, which could increase spending dependent on demand ...

PDF

... Migrant workers’ basic pension insurance CANNOT be transferred or continued (old policy) Result: Workers’ income decline, inducing them to leave urban areas to return home. 2 – Security scenario: Migrant workers’ basic pension insurance CAN be transferred or continued “in part” between jurisdictions ...

... Migrant workers’ basic pension insurance CANNOT be transferred or continued (old policy) Result: Workers’ income decline, inducing them to leave urban areas to return home. 2 – Security scenario: Migrant workers’ basic pension insurance CAN be transferred or continued “in part” between jurisdictions ...

the Powerpoint file from week #3

... • Latin America: the end of ISI and the debt crisis (followed by structural adjustment) required massive pension reforms (much more extensive than in any developed country) ...

... • Latin America: the end of ISI and the debt crisis (followed by structural adjustment) required massive pension reforms (much more extensive than in any developed country) ...

Older Worker Labor Force Participation Often Part of Other

... • Current national policy largely driven by a “binary”notion of retirement - that one is either completely retired or working full time • Few employers now taking action to provide phased retirement, flexible employment options • Concepts of lifelong learning, quality of work-life still to be fully ...

... • Current national policy largely driven by a “binary”notion of retirement - that one is either completely retired or working full time • Few employers now taking action to provide phased retirement, flexible employment options • Concepts of lifelong learning, quality of work-life still to be fully ...

Prospects for the UK economy

... – It can be operated as (equivalent to) a DSGE with fully forward looking behaviour by ...

... – It can be operated as (equivalent to) a DSGE with fully forward looking behaviour by ...

FACT SHEET History of Australia’s tax-transfer system

... period, from federation to the mid-1970s, the focus was largely on revenue adequacy to fund increasing levels of social provision of goods and services. In the second period, since the mid-1970s, there has been a greater focus on improving the equity, efficiency and simplicity of the tax system. • T ...

... period, from federation to the mid-1970s, the focus was largely on revenue adequacy to fund increasing levels of social provision of goods and services. In the second period, since the mid-1970s, there has been a greater focus on improving the equity, efficiency and simplicity of the tax system. • T ...

Who is who in the EU?

... for investors these countries should focus its effort on: creation of jobs through new investments: business environment easing the access to markets and flow of goods: Infrastructure ...

... for investors these countries should focus its effort on: creation of jobs through new investments: business environment easing the access to markets and flow of goods: Infrastructure ...

Pension entitlements

... 4b. Approach provides estimates of government pension obligations General government debt and contingent pension obligations in the euro area and in the United States Multiples of annual gross domestic product (GDP), end-2007 ...

... 4b. Approach provides estimates of government pension obligations General government debt and contingent pension obligations in the euro area and in the United States Multiples of annual gross domestic product (GDP), end-2007 ...

Y BRIEFS MPDD POLIC Providing Income Security for the Elderly

... Russian Federation, a plateau of 2.6% of GDP would be reached by 2055, after which the expenditure would decline as the proportion of the population aged 65 and above decreases; in Thailand expenditure would reach 4.2% of GDP before declining after 2075. In Turkey, however, costs would reach almost ...

... Russian Federation, a plateau of 2.6% of GDP would be reached by 2055, after which the expenditure would decline as the proportion of the population aged 65 and above decreases; in Thailand expenditure would reach 4.2% of GDP before declining after 2075. In Turkey, however, costs would reach almost ...

Would Poland Benefit From a Fiscal Responsibility Law?

... István P. Székely IMF, European Department ...

... István P. Székely IMF, European Department ...

Second pillar pension benefits

... National Bank of the Republic of Macedonia, as a transitional solution ...

... National Bank of the Republic of Macedonia, as a transitional solution ...

CHAPTER 2 FINANCIAL PLANNING PROBLEMS

... 1. Jenny Franklin estimates that as a result of completing her Masters degree she will earn $6,000 a year more for the next 40 years. a. What would be the total amount of these additional earnings? b. What would be the future value of these additional earnings based on an annual interest rate of 6 p ...

... 1. Jenny Franklin estimates that as a result of completing her Masters degree she will earn $6,000 a year more for the next 40 years. a. What would be the total amount of these additional earnings? b. What would be the future value of these additional earnings based on an annual interest rate of 6 p ...

Modigliani, Miller and Microinsurance

... • Problem: Derive an optimal series of payments, with Pt being the present value at time 0 of payment to be made at time t – 1 (insurance premium is paid at the beginning of the year). ...

... • Problem: Derive an optimal series of payments, with Pt being the present value at time 0 of payment to be made at time t – 1 (insurance premium is paid at the beginning of the year). ...

powerpoint

... An easily understood indicator is the aging index, defined here as the ratio of persons aged 60 and over to the number of youths under age 15. In the Americas in 1997, this ratio ranged from a high of 82 in Canada to a low of 9 in Nicaragua. Over the next 3 decades, it will double or triple in most ...

... An easily understood indicator is the aging index, defined here as the ratio of persons aged 60 and over to the number of youths under age 15. In the Americas in 1997, this ratio ranged from a high of 82 in Canada to a low of 9 in Nicaragua. Over the next 3 decades, it will double or triple in most ...

![[Presentación en inglés]](http://s1.studyres.com/store/data/008826181_1-10bb349b42eecc7c1dc26efb2d26978d-300x300.png)