Mohan Bijapur Are credit crunches supply or demand shocks?

... recent decades. However, the inflation response has become weaker. We interpret these findings in the context of the broader debate on the causes of the “Great Moderation”. Our results also inform the ongoing policy debate during the global credit crunch. A key question being raised by policymakers ...

... recent decades. However, the inflation response has become weaker. We interpret these findings in the context of the broader debate on the causes of the “Great Moderation”. Our results also inform the ongoing policy debate during the global credit crunch. A key question being raised by policymakers ...

The effects of Monetary Policy shocks across the Greek Regions

... responsive to monetary policy innovations (see, for example, Hayo and Uhlenbrock, 2000). Ber et al. (2001) find that export-intensive firms are cushioned from monetary policy shocks. When domestic interest rates are tightened, exporting firms are able to raise credit on foreign currency markets (whe ...

... responsive to monetary policy innovations (see, for example, Hayo and Uhlenbrock, 2000). Ber et al. (2001) find that export-intensive firms are cushioned from monetary policy shocks. When domestic interest rates are tightened, exporting firms are able to raise credit on foreign currency markets (whe ...

Fiscal Policy as a Stabilization Tool

... Since 2007 this framework has given way to one of grave concern about the sustainability of public finances and even the fear of sovereign default, combined with a growing pressure for fiscal policy to become a key instrument in economic recovery. There are many sides to the current debate on fisca ...

... Since 2007 this framework has given way to one of grave concern about the sustainability of public finances and even the fear of sovereign default, combined with a growing pressure for fiscal policy to become a key instrument in economic recovery. There are many sides to the current debate on fisca ...

How Powerful Is Monetary Policy in the Long Run?

... believed fiscal policy was the most powerful tool a government could use to lift the economy out of a recession or depression. In fact, his theory predicted that under certain conditions increases in the money supply would be unable to drive interest rates down low enough to stimulate economic activ ...

... believed fiscal policy was the most powerful tool a government could use to lift the economy out of a recession or depression. In fact, his theory predicted that under certain conditions increases in the money supply would be unable to drive interest rates down low enough to stimulate economic activ ...

This PDF is a selection from a published volume from

... The descriptive analysis above suggests that output variables, aggregate price indexes, and the federal funds rate exhibit a higher than average degree of commonality: more than 70% of the variance of these variables can be explained by a projection on two aggregates.4 This in turn suggests that a m ...

... The descriptive analysis above suggests that output variables, aggregate price indexes, and the federal funds rate exhibit a higher than average degree of commonality: more than 70% of the variance of these variables can be explained by a projection on two aggregates.4 This in turn suggests that a m ...

Financial shocks and macroeconomic policies during the Argentine

... abandoned its exchange rate peg while Argentina and Uruguay opted for maintaining their stabilisation plans. A long lasting recession started in Argentina and Uruguay, that nally led to an important economic crisis and to problems with the management of public debt. In a companion paper, Mourelle ( ...

... abandoned its exchange rate peg while Argentina and Uruguay opted for maintaining their stabilisation plans. A long lasting recession started in Argentina and Uruguay, that nally led to an important economic crisis and to problems with the management of public debt. In a companion paper, Mourelle ( ...

MacroChap006

... NDP is actually preferable to GDP as an expression of a nation's domestic output. ...

... NDP is actually preferable to GDP as an expression of a nation's domestic output. ...

5th Edition

... Besides, wages and prices don’t adjust fast enough anyway; so even if people anticipated the inflation, they couldn’t do enough about it to make the short-run Phillips curve vertical. © 2015 Pearson Education, Inc. ...

... Besides, wages and prices don’t adjust fast enough anyway; so even if people anticipated the inflation, they couldn’t do enough about it to make the short-run Phillips curve vertical. © 2015 Pearson Education, Inc. ...

National Fiscal Policy and Local Government during the Economic

... efforts to increase demand for goods and services through some combination of increased public spending financed through borrowing and tax reductions that leave consumers with more effective buying power. Why does this matter? If a national government does not pursue a counter-cyclical economic poli ...

... efforts to increase demand for goods and services through some combination of increased public spending financed through borrowing and tax reductions that leave consumers with more effective buying power. Why does this matter? If a national government does not pursue a counter-cyclical economic poli ...

Macroeconomic Management When Policy Space is Constrained

... Recovery in GDP growth since the global financial crisis has been halting and weak. An aggressive and internationally–coordinated policy stimulus in 2009–10 turned around a severe recession. Since then, however, while monetary conditions have remained easy, many governments have withdrawn fiscal sti ...

... Recovery in GDP growth since the global financial crisis has been halting and weak. An aggressive and internationally–coordinated policy stimulus in 2009–10 turned around a severe recession. Since then, however, while monetary conditions have remained easy, many governments have withdrawn fiscal sti ...

Unemployment and Economic Policy in Denmark in the 1930s Niels

... balance of payments and the political disagreements in parliament. The macroeconomic policy did produce favourable results with respect to unemployment, but the unemployment never became the main target. It was primarily the concern for the balance of payments and the intentions to help the depress ...

... balance of payments and the political disagreements in parliament. The macroeconomic policy did produce favourable results with respect to unemployment, but the unemployment never became the main target. It was primarily the concern for the balance of payments and the intentions to help the depress ...

The GOOd, The Bad, and The UGly: 100 years Of dealinG

... primary deficit–to-GDP ratio, dt . The relationships among these variables are described by the following formula: 1 + it bt = —————— b + dt + et, (3.1) (1 + pt)(1 + gt ) t–1 in which et is a residual that takes into account valuation effects and other accounting adjustments not ...

... primary deficit–to-GDP ratio, dt . The relationships among these variables are described by the following formula: 1 + it bt = —————— b + dt + et, (3.1) (1 + pt)(1 + gt ) t–1 in which et is a residual that takes into account valuation effects and other accounting adjustments not ...

Evolving post-World War II UK economic

... Markov-switching model for real GDP growth via Bayesian methods, identifying a break date in 1984:1, and both a decline in the volatility of reduced-form shocks, and a narrowing of the difference between the mean growth rate in expansions and recessions, over the most recent period. McConnell and Pe ...

... Markov-switching model for real GDP growth via Bayesian methods, identifying a break date in 1984:1, and both a decline in the volatility of reduced-form shocks, and a narrowing of the difference between the mean growth rate in expansions and recessions, over the most recent period. McConnell and Pe ...

Can the president really affect economic growth?

... A large literature exists on the “political business cycle,” and the extent to which growth rises in election years. Previous work on the United States has generally used data from only a few decades and has found mixed results, with some researchers finding large effects (Drazen 2000; Grier 2008; N ...

... A large literature exists on the “political business cycle,” and the extent to which growth rises in election years. Previous work on the United States has generally used data from only a few decades and has found mixed results, with some researchers finding large effects (Drazen 2000; Grier 2008; N ...

Fiscal Fallacies: The Failure of Activist Fiscal Policy

... forward demand through unfunded spending measures or tax cuts that reduce the budget balance. The change in the budget balance as a share of GDP measures the ‘fiscal impulse’ that government spending and tax changes are supposed to impart to the economy. The ability of activist fiscal policy to stim ...

... forward demand through unfunded spending measures or tax cuts that reduce the budget balance. The change in the budget balance as a share of GDP measures the ‘fiscal impulse’ that government spending and tax changes are supposed to impart to the economy. The ability of activist fiscal policy to stim ...

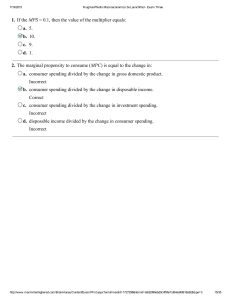

1. If the MPS = 0.1, then the value of the multiplier

... show consumption spending (C) and planned investment (Iplanned). a. What is the MPC in this economy? b. At what level of real GDP will the economy find its income–expenditure equilibrium? ...

... show consumption spending (C) and planned investment (Iplanned). a. What is the MPC in this economy? b. At what level of real GDP will the economy find its income–expenditure equilibrium? ...

The Federal Reserve`s Dual Mandate: Balancing Act or Inflation

... began to question the validity of the Phillips Curve as the U.S. economy faced simultaneously ...

... began to question the validity of the Phillips Curve as the U.S. economy faced simultaneously ...

Household Expectations and Household Consumption Expenditures: The Case of Turkey Evren CERİTOĞLU

... REPIH such as the bequest motive or myopia (Modigliani, 1986; Garcia et al., 1997; Attanasio and Weber, 2010). To illustrate, Zeldes (1989) shows that even if the liquidity constraints are not binding in the current period, the possibility that they might bind in the future can force households post ...

... REPIH such as the bequest motive or myopia (Modigliani, 1986; Garcia et al., 1997; Attanasio and Weber, 2010). To illustrate, Zeldes (1989) shows that even if the liquidity constraints are not binding in the current period, the possibility that they might bind in the future can force households post ...

A New Stock Index to Better Predict the United States` Real GDP

... However, there is evidence that shows that the S&P 500 could use more service exposure to better reflect the overall economy. The Standard and Poor’s S&P 500 index might not enough stocks from the services sector because portfolio managers and economists want a consistent, stable index that they can ...

... However, there is evidence that shows that the S&P 500 could use more service exposure to better reflect the overall economy. The Standard and Poor’s S&P 500 index might not enough stocks from the services sector because portfolio managers and economists want a consistent, stable index that they can ...

will flat-lining become normal?

... In 1970 and 1980 employee compensation was around 59 per cent of GDP, but by 1990 this had fallen to 55 per cent. Since 1990 the proportion has been very stable. If a period of elevated returns is relatively brief - for example, if it occurs only for a year or two in the recovery phase from a recess ...

... In 1970 and 1980 employee compensation was around 59 per cent of GDP, but by 1990 this had fallen to 55 per cent. Since 1990 the proportion has been very stable. If a period of elevated returns is relatively brief - for example, if it occurs only for a year or two in the recovery phase from a recess ...

Stone2eCT_CH10_Mac_Layout 1

... Discretionary spending: The part of the budget that works its way through the appropriations process of Congress each year and includes such programs as national defense, transportation, science, environment, and income security. Mandatory spending: Spending authorized by permanent laws that does no ...

... Discretionary spending: The part of the budget that works its way through the appropriations process of Congress each year and includes such programs as national defense, transportation, science, environment, and income security. Mandatory spending: Spending authorized by permanent laws that does no ...

National Saving - Cloudfront.net

... what the term “investment” means to macroeconomists. Outside of the economics profession, most people use the terms “saving” and “investing” interchangeably. • In macroeconomics, investment refers to the purchase of new capital, such as equipment or buildings. (factories) • If an individual spends l ...

... what the term “investment” means to macroeconomists. Outside of the economics profession, most people use the terms “saving” and “investing” interchangeably. • In macroeconomics, investment refers to the purchase of new capital, such as equipment or buildings. (factories) • If an individual spends l ...

Budget Deficits, National Saving, and Interest Rates

... second model, the small open economy view, suggests that budget deficits do reduce national saving but, at the same time, induce increased capital inflows from abroad that finance the entire reduction. As a result, domestic production does not decline and interest rates do not rise, but future natio ...

... second model, the small open economy view, suggests that budget deficits do reduce national saving but, at the same time, induce increased capital inflows from abroad that finance the entire reduction. As a result, domestic production does not decline and interest rates do not rise, but future natio ...

The Theoretical Weaknesses of the Expansionary Austerity Doctrine

... discretionary expansionary or restrictive fiscal policies. The authors then use the identified episodes of fiscal adjustments to econometrically explain cross-country growth performances and public debt dynamics in the years following the launch of discretionary fiscal packages. Criticisms to such a ...

... discretionary expansionary or restrictive fiscal policies. The authors then use the identified episodes of fiscal adjustments to econometrically explain cross-country growth performances and public debt dynamics in the years following the launch of discretionary fiscal packages. Criticisms to such a ...

Euro-indicators Working Group - United Nations Statistics Division

... 16 indicators included: coincident indicators (C), leading indicators (A), their components (C1, C2… etc and A1, A2,… etc), two sentiment indicators (not included before in the composite indicators because of their short length, but here included as indicative of the economic situation), which are ...

... 16 indicators included: coincident indicators (C), leading indicators (A), their components (C1, C2… etc and A1, A2,… etc), two sentiment indicators (not included before in the composite indicators because of their short length, but here included as indicative of the economic situation), which are ...