Principles of Economics

... enters graduate school. She has received 2 job offers with the following salary structures: JOB A : pays $ 25,000 in 2012 and $25,350 in 2013 JOB B : pays $ 25,000 in 2012; 2013’s salary will be equal to $25,000 plus a cost of living adjustment ( i.e., a raise equal to the inflation rate in 2013) Su ...

... enters graduate school. She has received 2 job offers with the following salary structures: JOB A : pays $ 25,000 in 2012 and $25,350 in 2013 JOB B : pays $ 25,000 in 2012; 2013’s salary will be equal to $25,000 plus a cost of living adjustment ( i.e., a raise equal to the inflation rate in 2013) Su ...

Measuring Unemployment Measuring Unemployment (cont.)

... • Two competing ideas have developed concerning inflation: – The demand-pull theory demand-pull inflation: theory that prices rise as the result of excessive business and consumer demand; demand increases faster than total supply, resulting in shortages that lead to higher prices • Fed allows the mo ...

... • Two competing ideas have developed concerning inflation: – The demand-pull theory demand-pull inflation: theory that prices rise as the result of excessive business and consumer demand; demand increases faster than total supply, resulting in shortages that lead to higher prices • Fed allows the mo ...

Presentation to the University of California at Berkeley Boalt School... San Francisco, California

... this reflects the market’s view that the Fed will continue to demonstrate that it’s willing to do what’s necessary to ensure U.S. price stability. Worry #2—the trade gap. This has risen from near balance in the mid-1990s to a (nominal) deficit of almost $700 billion now. By reducing the need for do ...

... this reflects the market’s view that the Fed will continue to demonstrate that it’s willing to do what’s necessary to ensure U.S. price stability. Worry #2—the trade gap. This has risen from near balance in the mid-1990s to a (nominal) deficit of almost $700 billion now. By reducing the need for do ...

File

... Frictional Unemployment – Temporary unemployment between jobs because of firings, layoffs, voluntary searches for new jobs, or retraining. ...

... Frictional Unemployment – Temporary unemployment between jobs because of firings, layoffs, voluntary searches for new jobs, or retraining. ...

Global Overview: Inflation as an Investment Tool

... Both inflation and deflation can impact an economy’s performance, but generally speaking, some inflation is more beneficial than deflation for a variety of reasons: 1) Prices are primarily determined by supply and demand. If prices are rising, this generally means supply is not quite meeting demand. ...

... Both inflation and deflation can impact an economy’s performance, but generally speaking, some inflation is more beneficial than deflation for a variety of reasons: 1) Prices are primarily determined by supply and demand. If prices are rising, this generally means supply is not quite meeting demand. ...

Macro Semester Topics

... 44. “Full Employment Unemployment” (FE) is the ________ ____ __ __________ for a country. CPI, GDP Deflators, Inflation 45. An Index Year is always made equal to _______. Real change of values over time can always be calculated with the formula: Later Year – Earlier Year/Earlier Year. This = the Rat ...

... 44. “Full Employment Unemployment” (FE) is the ________ ____ __ __________ for a country. CPI, GDP Deflators, Inflation 45. An Index Year is always made equal to _______. Real change of values over time can always be calculated with the formula: Later Year – Earlier Year/Earlier Year. This = the Rat ...

File - Mr. Trevino Economics

... Inflation is a general increase in prices. In a period of inflation, as prices rise, the same amount of money buys less. Inflation reduces people’s purchasing power, their ability to buy goods and services. To track inflation, economists use a price index, a measurement that shows how the average pr ...

... Inflation is a general increase in prices. In a period of inflation, as prices rise, the same amount of money buys less. Inflation reduces people’s purchasing power, their ability to buy goods and services. To track inflation, economists use a price index, a measurement that shows how the average pr ...

AS Function

... and services purchased by households Producer price index: the wholesale prices of approximately 3000 items GDP Deflator: the prices of all goods and services currently produced. ...

... and services purchased by households Producer price index: the wholesale prices of approximately 3000 items GDP Deflator: the prices of all goods and services currently produced. ...

A post-Keynesian alternative to the New consensus on monetary

... • Central banks tell us that they are doing a good job. But lower interest rates could have been set, without inflation rising. In other words, high rates of capacity utilization may not have the inflationary effects that central banks presume they have. ...

... • Central banks tell us that they are doing a good job. But lower interest rates could have been set, without inflation rising. In other words, high rates of capacity utilization may not have the inflationary effects that central banks presume they have. ...

PRESS RELEASE SUMMARY OF THE MONETARY POLICY COMMITTEE MEETING No: 2015-06

... 13. Downside risks regarding economic activity continue to be important for the upcoming period. The lingering volatility across global financial markets and the sluggish course of confidence indices may cause private final demand to provide limited support to growth. In the case of an additional s ...

... 13. Downside risks regarding economic activity continue to be important for the upcoming period. The lingering volatility across global financial markets and the sluggish course of confidence indices may cause private final demand to provide limited support to growth. In the case of an additional s ...

gross domestic product

... over a give period of time. the total output of a nation measurement of a national income and output all the goods and services produced the amount of goods and services produced by the firms in the product market ...

... over a give period of time. the total output of a nation measurement of a national income and output all the goods and services produced the amount of goods and services produced by the firms in the product market ...

AP Macro Syllabus

... Gross Domestic Product, the components of GDP (C+I+G+NX), real vs. nominal GDP, Consumer Price Index (how it’s calculated, problems with measuring CPI, GDP deflator vs. CPI, real and nominal interest rates, other price indices) ...

... Gross Domestic Product, the components of GDP (C+I+G+NX), real vs. nominal GDP, Consumer Price Index (how it’s calculated, problems with measuring CPI, GDP deflator vs. CPI, real and nominal interest rates, other price indices) ...

Money Growth and Inflation

... adjustment of the nominal interest rate to the inflation rate. According to the Fisher effect, when the rate of inflation rises, the nominal interest rate rises by the same amount. The real interest rate stays the same. ...

... adjustment of the nominal interest rate to the inflation rate. According to the Fisher effect, when the rate of inflation rises, the nominal interest rate rises by the same amount. The real interest rate stays the same. ...

MTR

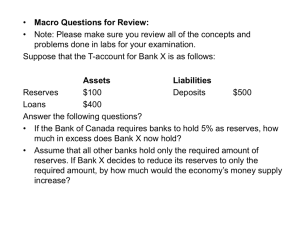

... • If the Bank of Canada requires banks to hold 5% as reserves, how much in excess does Bank X now hold? • Assume that all other banks hold only the required amount of reserves. If Bank X decides to reduce its reserves to only the required amount, by how much would the economy’s money supply increase ...

... • If the Bank of Canada requires banks to hold 5% as reserves, how much in excess does Bank X now hold? • Assume that all other banks hold only the required amount of reserves. If Bank X decides to reduce its reserves to only the required amount, by how much would the economy’s money supply increase ...

ECON 3560/5040 Homework #6 (Answers)

... (2) [14 points] The Model of AD and AS Assume that an economy is initially operating at the natural rate of output (Y ). A short-run aggregate supply equation is given by Yt = Y + α(Pt − Pte ), where Y is output, P is the price level, P e is the expected price level, and α > 0 (a) [3 points] What i ...

... (2) [14 points] The Model of AD and AS Assume that an economy is initially operating at the natural rate of output (Y ). A short-run aggregate supply equation is given by Yt = Y + α(Pt − Pte ), where Y is output, P is the price level, P e is the expected price level, and α > 0 (a) [3 points] What i ...

Aggregate Supply & Demand

... • Aggregate-demand curve (AD)- how demand for the entire economy changes with inflation (price level) – demand from households, firms, exports & government at each price level ...

... • Aggregate-demand curve (AD)- how demand for the entire economy changes with inflation (price level) – demand from households, firms, exports & government at each price level ...

lecture notes chapter 16

... lower rates should reduce periods of unemployment and raise capital investment, which increases worker productivity. Aggregate supply will expand and keep inflation low. B. The Laffer Curve is an idea relating tax rates and tax revenues. It is named after economist Arthur Laffer, who originated the ...

... lower rates should reduce periods of unemployment and raise capital investment, which increases worker productivity. Aggregate supply will expand and keep inflation low. B. The Laffer Curve is an idea relating tax rates and tax revenues. It is named after economist Arthur Laffer, who originated the ...

Review Sheet - Syracuse University

... 1. A medium of exchange is: (a) what sellers generally accept and buyers generally use to pay for goods and services. (b) an asset that can be used to transport purchasing power from one period of time to another. (c) a standard unit that provides a consistent way of quoting prices. (d) the ability ...

... 1. A medium of exchange is: (a) what sellers generally accept and buyers generally use to pay for goods and services. (b) an asset that can be used to transport purchasing power from one period of time to another. (c) a standard unit that provides a consistent way of quoting prices. (d) the ability ...

Inflation

In economics, inflation is a sustained increase in the general price level of goods and services in an economy over a period of time.When the price level rises, each unit of currency buys fewer goods and services. Consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy. A chief measure of price inflation is the inflation rate, the annualized percentage change in a general price index (normally the consumer price index) over time. The opposite of inflation is deflation.Inflation affects an economy in various ways, both positive and negative. Negative effects of inflation include an increase in the opportunity cost of holding money, uncertainty over future inflation which may discourage investment and savings, and if inflation were rapid enough, shortages of goods as consumers begin hoarding out of concern that prices will increase in the future.Inflation also has positive effects: Fundamentally, inflation gives everyone an incentive to spend and invest, because if they don't, their money will be worth less in the future. This increase in spending and investment can benefit the economy. However it may also lead to sub-optimal use of resources. Inflation reduces the real burden of debt, both public and private. If you have a fixed-rate mortgage on your house, your salary is likely to increase over time due to wage inflation, but your mortgage payment will stay the same. Over time, your mortgage payment will become a smaller percentage of your earnings, which means that you will have more money to spend. Inflation keeps nominal interest rates above zero, so that central banks can reduce interest rates, when necessary, to stimulate the economy. Inflation reduces unemployment to the extent that unemployment is caused by nominal wage rigidity. When demand for labor falls but nominal wages do not, as typically occurs during a recession, the supply and demand for labor cannot reach equilibrium, and unemployment results. By reducing the real value of a given nominal wage, inflation increases the demand for labor, and therefore reduces unemployment.Economists generally believe that high rates of inflation and hyperinflation are caused by an excessive growth of the money supply. However, money supply growth does not necessarily cause inflation. Some economists maintain that under the conditions of a liquidity trap, large monetary injections are like ""pushing on a string"". Views on which factors determine low to moderate rates of inflation are more varied. Low or moderate inflation may be attributed to fluctuations in real demand for goods and services, or changes in available supplies such as during scarcities. However, the consensus view is that a long sustained period of inflation is caused by money supply growing faster than the rate of economic growth.Today, most economists favor a low and steady rate of inflation. Low (as opposed to zero or negative) inflation reduces the severity of economic recessions by enabling the labor market to adjust more quickly in a downturn, and reduces the risk that a liquidity trap prevents monetary policy from stabilizing the economy. The task of keeping the rate of inflation low and stable is usually given to monetary authorities. Generally, these monetary authorities are the central banks that control monetary policy through the setting of interest rates, through open market operations, and through the setting of banking reserve requirements.