Sample Chapter 2 (PDF, 28 Pages

... there are many types of capital goods that depreciate at different rates. Second, even identical capital goods may be used with different intensity. Third, capital goods may be used for a shorter or a longer period of time than their expected lifetime. For example, the chair on which you are sitting ...

... there are many types of capital goods that depreciate at different rates. Second, even identical capital goods may be used with different intensity. Third, capital goods may be used for a shorter or a longer period of time than their expected lifetime. For example, the chair on which you are sitting ...

The Government Spending Multiplier in a Deep Recession

... the behavior of the economy in a recession since it will shape the dynamics of the model at the Zero Lower Bound. Furthermore, these papers rely extensively on an expected inflation channel that does not seem to be present in the data. In this paper, I provide evidence showing that a government spen ...

... the behavior of the economy in a recession since it will shape the dynamics of the model at the Zero Lower Bound. Furthermore, these papers rely extensively on an expected inflation channel that does not seem to be present in the data. In this paper, I provide evidence showing that a government spen ...

Aggregate Demand II: Applying the IS–LM Model

... causes them to build fewer new factories. This reduction in the demand for investment goods causes a contractionary shift in the investment function: at every interest rate, firms want to invest less.The fall in investment reduces planned expenditure and shifts the IS curve to the left, reducing inc ...

... causes them to build fewer new factories. This reduction in the demand for investment goods causes a contractionary shift in the investment function: at every interest rate, firms want to invest less.The fall in investment reduces planned expenditure and shifts the IS curve to the left, reducing inc ...

Chapter 24: Aggregate Demand, Aggregate Supply, and Inflation

... The Aggregate Supply Curve: A Warning • When we draw a firm’s supply curve, we assume that input prices are constant. In macroeconomics, an increase in the overall price level means that at least some input prices will be rising as well. • The outputs of some firms are the inputs of other firms. ...

... The Aggregate Supply Curve: A Warning • When we draw a firm’s supply curve, we assume that input prices are constant. In macroeconomics, an increase in the overall price level means that at least some input prices will be rising as well. • The outputs of some firms are the inputs of other firms. ...

Quantitative Easing and the Liquidity Channel of Monetary Policy

... is especially relevant to the current policy discussion because it resembles the original conception of a “liquidity trap” as a region where the relative demand of bonds and money is flat (Robertson, 1940); having been derived in a model where bonds are real and prices are perfectly flexible and det ...

... is especially relevant to the current policy discussion because it resembles the original conception of a “liquidity trap” as a region where the relative demand of bonds and money is flat (Robertson, 1940); having been derived in a model where bonds are real and prices are perfectly flexible and det ...

Sec 4, Mod 18, 19 Aggregate Supply

... supply curve, part or all of any initial increase in aggregate demand will be dissipated in inflation and therefore NOT be reflected in increased real output and employment. Below, the shift from AD2 to AD3 is of the same magnitude as AD1 to AD2. Because we are in the intermediate range of the aggre ...

... supply curve, part or all of any initial increase in aggregate demand will be dissipated in inflation and therefore NOT be reflected in increased real output and employment. Below, the shift from AD2 to AD3 is of the same magnitude as AD1 to AD2. Because we are in the intermediate range of the aggre ...

GDP

... the CPI to overstate the true cost of living. • The issue is important because many government programs use the CPI to adjust for changes in the overall level of prices. ...

... the CPI to overstate the true cost of living. • The issue is important because many government programs use the CPI to adjust for changes in the overall level of prices. ...

Working Paper 142

... deregulation. For instance, Borio (2006) and Goodhart and Hofmann (2007) argue that financial liberalization can strengthen the link between liquidity and asset prices. The latter has empirically also been confirmed by Borio, Kennedy and Prowse (1994) and Goodhart, Hofmann and Segoviano (2004) who f ...

... deregulation. For instance, Borio (2006) and Goodhart and Hofmann (2007) argue that financial liberalization can strengthen the link between liquidity and asset prices. The latter has empirically also been confirmed by Borio, Kennedy and Prowse (1994) and Goodhart, Hofmann and Segoviano (2004) who f ...

PLAN, SIPHONING, AND CORRUPTION IN THE

... that date was used. Finally, where products were designated for retail trade they also carried a retail price; the difference between the retail price and the factory wholesale price was the trade markup plus a variable–rate turnover tax (or minus a subsidy). Consider first the importance of plan pr ...

... that date was used. Finally, where products were designated for retail trade they also carried a retail price; the difference between the retail price and the factory wholesale price was the trade markup plus a variable–rate turnover tax (or minus a subsidy). Consider first the importance of plan pr ...

IB/AP Economics Unit 3.3 Macroeconomic Models

... small businesses in 2008 and let large businesses deduct 50% more of their assets if purchased and put into use this year. ...

... small businesses in 2008 and let large businesses deduct 50% more of their assets if purchased and put into use this year. ...

If the total surplus in a market with no government

... 1. It is because the price of alternative goods rises. The steeper the slope on the production possibilities curve, the ________. 1. greater the opportunity cost* 1. smaller the opportunity cost 1. cheaper the price Opportunity cost is best defined as: All of the possible alternatives given up. The ...

... 1. It is because the price of alternative goods rises. The steeper the slope on the production possibilities curve, the ________. 1. greater the opportunity cost* 1. smaller the opportunity cost 1. cheaper the price Opportunity cost is best defined as: All of the possible alternatives given up. The ...

What`s so Great about the Great Moderation?

... particular structural shock in the same way qualitatively. In other words, all types of disturbance to aggregate supply must affect output growth and the unemployment rate in qualitatively the same way, and all types of disturbance to aggregate demand must affect the two variables in qualitatively t ...

... particular structural shock in the same way qualitatively. In other words, all types of disturbance to aggregate supply must affect output growth and the unemployment rate in qualitatively the same way, and all types of disturbance to aggregate demand must affect the two variables in qualitatively t ...

Fiscal Policy in an Unemployment Crisis

... spending reduces private wealth and stimulates labor supply (e.g. Barro and King (1984) and Aiyagari, Christiano, and Eichenbaum (1992)). Yet the same wealth effect which instills a rise in output crowds out private consumption and the multiplier must fall short of unity. Alternatively, in the new K ...

... spending reduces private wealth and stimulates labor supply (e.g. Barro and King (1984) and Aiyagari, Christiano, and Eichenbaum (1992)). Yet the same wealth effect which instills a rise in output crowds out private consumption and the multiplier must fall short of unity. Alternatively, in the new K ...

FREE Sample Here

... 42. The advantages claimed for a bimetallic standard were not gained in actual practice because: a. one of the metals disappeared from circulation because the mint and market ratios were not the same b. the supply of gold was inadequate c. the supply of silver and gold was not balanced among the nat ...

... 42. The advantages claimed for a bimetallic standard were not gained in actual practice because: a. one of the metals disappeared from circulation because the mint and market ratios were not the same b. the supply of gold was inadequate c. the supply of silver and gold was not balanced among the nat ...

Chapter 17

... The People’s Bank of China Learns About the Real Interest Rate • In 2003 and 2005 the People’s Bank of China engaged in monetary policy actions that pushed up market interest rates for the first time in nine years. • The objective of the interest rate increase was to try to reduce the growth of aggr ...

... The People’s Bank of China Learns About the Real Interest Rate • In 2003 and 2005 the People’s Bank of China engaged in monetary policy actions that pushed up market interest rates for the first time in nine years. • The objective of the interest rate increase was to try to reduce the growth of aggr ...

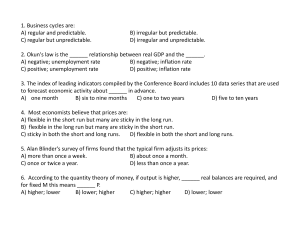

1. Business cycles are: A) regular and predictable. B) irregular but

... 2. Okun's law is the ______ relationship between real GDP and the ______. A) negative; unemployment rate B) negative; inflation rate C) positive; unemployment rate )p p y D) positive; inflation rate )p 3. The index of leading indicators compiled by the Conference Board includes 10 data series that a ...

... 2. Okun's law is the ______ relationship between real GDP and the ______. A) negative; unemployment rate B) negative; inflation rate C) positive; unemployment rate )p p y D) positive; inflation rate )p 3. The index of leading indicators compiled by the Conference Board includes 10 data series that a ...

Parkin-Bade Chapter 22

... Expectations Expectations about future income, future inflation, and future profits change aggregate demand. Increases in expected future income increase people’s consumption today and increases aggregate demand. A rise in the expected inflation rate makes buying goods cheaper today and increases ag ...

... Expectations Expectations about future income, future inflation, and future profits change aggregate demand. Increases in expected future income increase people’s consumption today and increases aggregate demand. A rise in the expected inflation rate makes buying goods cheaper today and increases ag ...

Optimal Mane~ary Palicy and Sacrifice Ra~ia Jeffrey C. Fuhrer*

... was 10.1 percent. By 1984, the same measure had dropped to 4.4 percent, and from 1990 through the end of 1993, the rate of inflation has averaged 3.2 percent, deviating only moderately from that average over the period. From 1981 to 1984, the civilian unemployment rate averaged 8.6 percent, peaking ...

... was 10.1 percent. By 1984, the same measure had dropped to 4.4 percent, and from 1990 through the end of 1993, the rate of inflation has averaged 3.2 percent, deviating only moderately from that average over the period. From 1981 to 1984, the civilian unemployment rate averaged 8.6 percent, peaking ...

International Pricing Strategy: Why Prices Rise and How Prices

... of those goods, which could be exported, but are still traded domestically, as long as their prices in the internal market stay sufficiently high. This idea sustains the simplest and wellknown model for international pricing. The “Law of One Price” states that identical goods which can be moved arou ...

... of those goods, which could be exported, but are still traded domestically, as long as their prices in the internal market stay sufficiently high. This idea sustains the simplest and wellknown model for international pricing. The “Law of One Price” states that identical goods which can be moved arou ...

Chapter 10: Classical Business Cycle Analysis: Market

... which seems to be inconsistent with the data. But Kydland and Prescott, when using some newer statistical techniques for calculating the trends in inflation and output, find evidence that the price level is countercyclical. Though the Great Depression appears to have been caused by a sequence of lar ...

... which seems to be inconsistent with the data. But Kydland and Prescott, when using some newer statistical techniques for calculating the trends in inflation and output, find evidence that the price level is countercyclical. Though the Great Depression appears to have been caused by a sequence of lar ...

Swedish Quantitative Easing

... representative year of the seven years following the GFC. For this reason, it would have been more suitable to compare 2015 with data from all years seceding 2009. However, data before 2014 was harder to obtain than from 2014 and after. It was occasionally difficult to state if a certain macroeconom ...

... representative year of the seven years following the GFC. For this reason, it would have been more suitable to compare 2015 with data from all years seceding 2009. However, data before 2014 was harder to obtain than from 2014 and after. It was occasionally difficult to state if a certain macroeconom ...

Goals of the Monetary Policy and the Stability of the Purchasing

... money on real economic trends. There are different, basically opposed views and opinions, regarding the mentioned issues in the monetary theory. According to ones, the development and changes of the real economic processes and trends are dependent on the factors of production, i.e. labour and the ca ...

... money on real economic trends. There are different, basically opposed views and opinions, regarding the mentioned issues in the monetary theory. According to ones, the development and changes of the real economic processes and trends are dependent on the factors of production, i.e. labour and the ca ...

Inflation

In economics, inflation is a sustained increase in the general price level of goods and services in an economy over a period of time.When the price level rises, each unit of currency buys fewer goods and services. Consequently, inflation reflects a reduction in the purchasing power per unit of money – a loss of real value in the medium of exchange and unit of account within the economy. A chief measure of price inflation is the inflation rate, the annualized percentage change in a general price index (normally the consumer price index) over time. The opposite of inflation is deflation.Inflation affects an economy in various ways, both positive and negative. Negative effects of inflation include an increase in the opportunity cost of holding money, uncertainty over future inflation which may discourage investment and savings, and if inflation were rapid enough, shortages of goods as consumers begin hoarding out of concern that prices will increase in the future.Inflation also has positive effects: Fundamentally, inflation gives everyone an incentive to spend and invest, because if they don't, their money will be worth less in the future. This increase in spending and investment can benefit the economy. However it may also lead to sub-optimal use of resources. Inflation reduces the real burden of debt, both public and private. If you have a fixed-rate mortgage on your house, your salary is likely to increase over time due to wage inflation, but your mortgage payment will stay the same. Over time, your mortgage payment will become a smaller percentage of your earnings, which means that you will have more money to spend. Inflation keeps nominal interest rates above zero, so that central banks can reduce interest rates, when necessary, to stimulate the economy. Inflation reduces unemployment to the extent that unemployment is caused by nominal wage rigidity. When demand for labor falls but nominal wages do not, as typically occurs during a recession, the supply and demand for labor cannot reach equilibrium, and unemployment results. By reducing the real value of a given nominal wage, inflation increases the demand for labor, and therefore reduces unemployment.Economists generally believe that high rates of inflation and hyperinflation are caused by an excessive growth of the money supply. However, money supply growth does not necessarily cause inflation. Some economists maintain that under the conditions of a liquidity trap, large monetary injections are like ""pushing on a string"". Views on which factors determine low to moderate rates of inflation are more varied. Low or moderate inflation may be attributed to fluctuations in real demand for goods and services, or changes in available supplies such as during scarcities. However, the consensus view is that a long sustained period of inflation is caused by money supply growing faster than the rate of economic growth.Today, most economists favor a low and steady rate of inflation. Low (as opposed to zero or negative) inflation reduces the severity of economic recessions by enabling the labor market to adjust more quickly in a downturn, and reduces the risk that a liquidity trap prevents monetary policy from stabilizing the economy. The task of keeping the rate of inflation low and stable is usually given to monetary authorities. Generally, these monetary authorities are the central banks that control monetary policy through the setting of interest rates, through open market operations, and through the setting of banking reserve requirements.