Jeffrey Naoko Ishii McKibbin

... the first year. This is less than for the U.S. case because of the assumption of a larger propensity to save in Japan. An interesting point to note is that the Yen appreciates in the case of a Japanese fiscal expansion (as does the U.S. dollar in the case of a U.S. Fiscal expansion). This comes from ...

... the first year. This is less than for the U.S. case because of the assumption of a larger propensity to save in Japan. An interesting point to note is that the Yen appreciates in the case of a Japanese fiscal expansion (as does the U.S. dollar in the case of a U.S. Fiscal expansion). This comes from ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... interact with, long growth trends which dominate developments across decades. Peacetime expansions in the United States averaged about 3 years in the last half-century, 2 years in the earlier periods containing 10 cycles each (table 2.1). Each of the wartime expansions was much longer. Contractions ...

... interact with, long growth trends which dominate developments across decades. Peacetime expansions in the United States averaged about 3 years in the last half-century, 2 years in the earlier periods containing 10 cycles each (table 2.1). Each of the wartime expansions was much longer. Contractions ...

China`s new monetary policy framework

... interest rates and provide an accommodative credit environment (see More onbalance-sheet easing needed amid shadow-banking consolidation, 15 April). In our view, these new monetary policy instruments could have important drawbacks to China’s policy reform and RMB internationalization (see PSL: Innov ...

... interest rates and provide an accommodative credit environment (see More onbalance-sheet easing needed amid shadow-banking consolidation, 15 April). In our view, these new monetary policy instruments could have important drawbacks to China’s policy reform and RMB internationalization (see PSL: Innov ...

Inflation: The Influence of Inflation on Equity Returns

... The higher yields result in lower bond prices in secondary markets, higher coupons on new issues, and higher reinvestment rates for the interest received. While this relationship is fairly straightforward, how inflation affects equity investment returns is a much more complex topic and subject to di ...

... The higher yields result in lower bond prices in secondary markets, higher coupons on new issues, and higher reinvestment rates for the interest received. While this relationship is fairly straightforward, how inflation affects equity investment returns is a much more complex topic and subject to di ...

macroeconomic policy - Faculty of Business and Economics Courses

... idle (unemployed) resources such as labor and physical capital which can be put into production process if necessary. ...

... idle (unemployed) resources such as labor and physical capital which can be put into production process if necessary. ...

Macroeconomics of the Government Budget

... for base money is growing, as in a growing economy, governments can print money without raising inflation. If elasticity of money demand is unity, base money could be increased at the same rate as GDP growth. Increasing base money at a higher rate can spur inflation. Inflation reduces the value of g ...

... for base money is growing, as in a growing economy, governments can print money without raising inflation. If elasticity of money demand is unity, base money could be increased at the same rate as GDP growth. Increasing base money at a higher rate can spur inflation. Inflation reduces the value of g ...

NBER WORKING PAPER SERIES ARE DEVALUATIONS CONTRACTIONARY? Sebastian Edwards Working Paper No. 1676

... because of data availability: They were the only developing countries ...

... because of data availability: They were the only developing countries ...

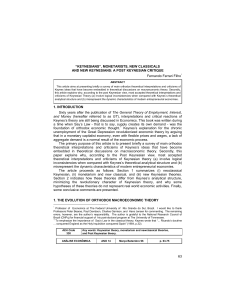

63 “KEYNESIANS”, MONETARISTS, NEW CLASSICALS AND NEW

... adjust slowly to bring supply and demand back into a market-clearing equilibrium. In this context, the disequilibrum theory seems to accept the theory of the existence of the Walrasian equilibrium of long run as a matter of faith. 1.2 The classical counter-revolution 1.2.1 Friedman and the Monetari ...

... adjust slowly to bring supply and demand back into a market-clearing equilibrium. In this context, the disequilibrum theory seems to accept the theory of the existence of the Walrasian equilibrium of long run as a matter of faith. 1.2 The classical counter-revolution 1.2.1 Friedman and the Monetari ...

Mankiw 5/e Chapter 13: Aggregate Supply

... Rational expectations Ways of modeling the formation of expectations: adaptive expectations: People base their expectations of future inflation on recently observed inflation. rational expectations: People base their expectations on all available information, including information about current ...

... Rational expectations Ways of modeling the formation of expectations: adaptive expectations: People base their expectations of future inflation on recently observed inflation. rational expectations: People base their expectations on all available information, including information about current ...

Fiscal Policy - Crawford's World

... New Classical economists emphasize that budget deficits merely substitute future taxes for current taxes. If households did not anticipate the higher future taxes, aggregate demand would increase (from AD1 to AD2). However, demand remains unchanged at AD1 when households fully anticipate the future ...

... New Classical economists emphasize that budget deficits merely substitute future taxes for current taxes. If households did not anticipate the higher future taxes, aggregate demand would increase (from AD1 to AD2). However, demand remains unchanged at AD1 when households fully anticipate the future ...

Fiscal policy and saving under distortionary taxation

... interest payments on the domestic public debt). This coefficient should be zero if one considers only the direct effect of transferring funds from one sector of the economy to another. However, since current tax rates are included in the regression, and are thus held constant, transfers today signal ...

... interest payments on the domestic public debt). This coefficient should be zero if one considers only the direct effect of transferring funds from one sector of the economy to another. However, since current tax rates are included in the regression, and are thus held constant, transfers today signal ...

House Prices, Interest Rates and Macroeconomic Fluctuations: International Evidence

... 1980s, the recession of the early 1990s, the long-boom of the 1990s, and the mild-recession of 2001.12 Of particular interest is the house factor which reflects the main developments in global housing markets of the last 25 years remarkably well, including the housing price bust of the early 1980s, ...

... 1980s, the recession of the early 1990s, the long-boom of the 1990s, and the mild-recession of 2001.12 Of particular interest is the house factor which reflects the main developments in global housing markets of the last 25 years remarkably well, including the housing price bust of the early 1980s, ...

Ch 15 Net Exports and International Finance

... restrict or encourage imports. The United States, for example, has sought changes in Japanese policies toward products such as U.S.-grown rice. Japan banned rice imports in the past, arguing it needed to protect its own producers. That has been a costly strategy; consumers in Japan typically pay as ...

... restrict or encourage imports. The United States, for example, has sought changes in Japanese policies toward products such as U.S.-grown rice. Japan banned rice imports in the past, arguing it needed to protect its own producers. That has been a costly strategy; consumers in Japan typically pay as ...

The Effects of Government Spending Shocks on Consumption under

... Analyzing the e¤ects of changes in government spending on private consumption is important for understanding the e¤ects of …scal policy on people’s welfare. Private consumption is the largest component of aggregate demand and is also assumed to be a principal determinant of agents’welfare. Economic ...

... Analyzing the e¤ects of changes in government spending on private consumption is important for understanding the e¤ects of …scal policy on people’s welfare. Private consumption is the largest component of aggregate demand and is also assumed to be a principal determinant of agents’welfare. Economic ...

A Panel Approach for Developing Countries

... than those of the central government, and the time, savings and foreign currency deposits of resident sectors other than the central government. The theory predicts a positive sign for the coefficient of this variable. The GDP in this study is the gross domestic product calculated in terms of the Sp ...

... than those of the central government, and the time, savings and foreign currency deposits of resident sectors other than the central government. The theory predicts a positive sign for the coefficient of this variable. The GDP in this study is the gross domestic product calculated in terms of the Sp ...

Présentation PowerPoint - McGraw Hill Higher Education

... Budget Deficit = Sales of Bonds + Increase in Monetary Base o Links between deficits and money growth: o Higher deficits in the short run caused by expansionary fiscal policy will rise nominal and real interest rates. The Bank may raise the supply of money to keep interest rates in check. o Increase ...

... Budget Deficit = Sales of Bonds + Increase in Monetary Base o Links between deficits and money growth: o Higher deficits in the short run caused by expansionary fiscal policy will rise nominal and real interest rates. The Bank may raise the supply of money to keep interest rates in check. o Increase ...

Global liquidity

... There is a broad consensus, however, that in the run-up to the financial crisis the level of global liquidity was an important determinant of asset price and consumer price dynamics in several economic regions. There is also evidence that, more generally, measures of global liquidity are one of the ...

... There is a broad consensus, however, that in the run-up to the financial crisis the level of global liquidity was an important determinant of asset price and consumer price dynamics in several economic regions. There is also evidence that, more generally, measures of global liquidity are one of the ...

The Balance of Payments and Exchange Rates

... During recessions, people in many countries become more protectionist and seek to protect jobs in their own home industries by limiting ...

... During recessions, people in many countries become more protectionist and seek to protect jobs in their own home industries by limiting ...

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.Further goals of a monetary policy are usually to contribute to economic growth and stability, to lower unemployment, and to maintain predictable exchange rates with other currencies.Monetary economics provides insight into how to craft optimal monetary policy.Monetary policy is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in order to avoid the resulting distortions and deterioration of asset values.Monetary policy differs from fiscal policy, which refers to taxation, government spending, and associated borrowing.