aggregate supply (AS) curve

... Sustained Inflation as a Purely Monetary Phenomenon Virtually all economists agree that an increase in the price level can be caused by anything that causes the AD curve to shift to the right or the AS curve to shift to the left. It is also generally agreed that for a sustained inflation to occur, t ...

... Sustained Inflation as a Purely Monetary Phenomenon Virtually all economists agree that an increase in the price level can be caused by anything that causes the AD curve to shift to the right or the AS curve to shift to the left. It is also generally agreed that for a sustained inflation to occur, t ...

Exercise 6 (+additional question) in Mankiw

... total factor productivity between the years? Problem 8.3: Assume an economy which is characterized by perfect competition in the goods and labor market, in which the owners of capital get one-third of national income, and the workers receive two-thirds. Assume a Cobb-Douglas aggregate production fun ...

... total factor productivity between the years? Problem 8.3: Assume an economy which is characterized by perfect competition in the goods and labor market, in which the owners of capital get one-third of national income, and the workers receive two-thirds. Assume a Cobb-Douglas aggregate production fun ...

increase

... b. It is more important to reduce world inflation than to reduce U.S. unemployment. c. Workers are not affected; only business suffer. d. The long-run gains to consumers & some producers exceed the losses to other producers. e. Government can protect U.S. industries while encouraging free trade. ...

... b. It is more important to reduce world inflation than to reduce U.S. unemployment. c. Workers are not affected; only business suffer. d. The long-run gains to consumers & some producers exceed the losses to other producers. e. Government can protect U.S. industries while encouraging free trade. ...

NBER WORKING PAPER SERIES REAL BUSINESS CYCLES AND THE LUCAS PARADIGM

... level, aside from the other factors in (11). If ).. ...

... level, aside from the other factors in (11). If ).. ...

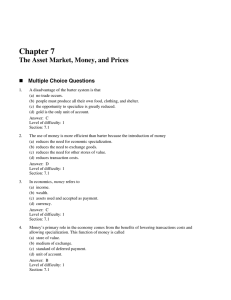

Chapter 7 The Asset Market, Money, and Prices

... An increase in the real interest rate would cause an increase in the real demand for money (a) no matter what the change in expected inflation. (b) if expected inflation fell by less than the rise in the real interest rate. (c) if expected inflation fell by the same amount as the rise in the real in ...

... An increase in the real interest rate would cause an increase in the real demand for money (a) no matter what the change in expected inflation. (b) if expected inflation fell by less than the rise in the real interest rate. (c) if expected inflation fell by the same amount as the rise in the real in ...

Microeconomics and Macroeconomics

... unchecked by government. When labor unions were weak and minimum wages and unemployment benefits were unheard of, wages fluctuated depending on market demand for labor. When spending in the economy was strong, wages were driven up and firms restricted their output in response to higher costs, keepin ...

... unchecked by government. When labor unions were weak and minimum wages and unemployment benefits were unheard of, wages fluctuated depending on market demand for labor. When spending in the economy was strong, wages were driven up and firms restricted their output in response to higher costs, keepin ...

Lesson 2 - uwcentre

... Electronic Funds and Electronic Cash • Electronic funds transfer systems have greatly improved the efficiency in settling and clearing transactions. Here is how: • Cash registers are linked to bank computers, so when a customer uses a debit card, his bank instantly credits the store’s account. In t ...

... Electronic Funds and Electronic Cash • Electronic funds transfer systems have greatly improved the efficiency in settling and clearing transactions. Here is how: • Cash registers are linked to bank computers, so when a customer uses a debit card, his bank instantly credits the store’s account. In t ...

Money in Economic Analysis

... silver. This is a semi theoretical/semi historical consideration of the origin of money. Needless to say, in modern society money is not commodity money but paper money and/or credit money. But, it is true that they are still the commodities with the highest salability/marketability in modern societ ...

... silver. This is a semi theoretical/semi historical consideration of the origin of money. Needless to say, in modern society money is not commodity money but paper money and/or credit money. But, it is true that they are still the commodities with the highest salability/marketability in modern societ ...

5.ThieuHutNSNN

... instantaneously, and since dynamic forces are constantly influencing private demand, proper timing of fiscal policy is not an easy task. • Further, political incentives also influence fiscal policy. Public choice analysis indicates that legislators are delighted to spend money on programs that direc ...

... instantaneously, and since dynamic forces are constantly influencing private demand, proper timing of fiscal policy is not an easy task. • Further, political incentives also influence fiscal policy. Public choice analysis indicates that legislators are delighted to spend money on programs that direc ...

Stabilization Theory and Policy: 50 Years after the Phillips

... can be expressed in discrete time, as employed by Samuelson and Hicks, or in continuous time, as for example illustrated by Allen (1956) and used by Phillips himself. Phillips took these simple aggregate models and showed how , if one introduces a government that instead of remaining passive follows ...

... can be expressed in discrete time, as employed by Samuelson and Hicks, or in continuous time, as for example illustrated by Allen (1956) and used by Phillips himself. Phillips took these simple aggregate models and showed how , if one introduces a government that instead of remaining passive follows ...

What has Happened to Monetarism? An Investigation into the

... rejecting the idea that velocity might be some "natural constant," an overstatement of the quantity theory which had contributed to its downfall, Friedman (1956, 21) refers to the "extraordinary empirical stability and regularity" of income velocity--when properly specified as a stable function of c ...

... rejecting the idea that velocity might be some "natural constant," an overstatement of the quantity theory which had contributed to its downfall, Friedman (1956, 21) refers to the "extraordinary empirical stability and regularity" of income velocity--when properly specified as a stable function of c ...

about the authors - Macmillan Learning

... 1982–1983. His research is mainly in the area of international trade, where he is one of the founders of the “new trade theory,” which focuses on increasing returns and imperfect competition. He also works in international finance, with a concentration in currency crises. In 1991, Krugman received t ...

... 1982–1983. His research is mainly in the area of international trade, where he is one of the founders of the “new trade theory,” which focuses on increasing returns and imperfect competition. He also works in international finance, with a concentration in currency crises. In 1991, Krugman received t ...

Deflation August26

... A. A fall in the general price level, but harmful deflation is about more than that Technically, deflation is defined as a decline in the general price level. However, not all forms of deflation are created equal. As illustrated in 2009, total inflation can be pushed below zero because of large fluc ...

... A. A fall in the general price level, but harmful deflation is about more than that Technically, deflation is defined as a decline in the general price level. However, not all forms of deflation are created equal. As illustrated in 2009, total inflation can be pushed below zero because of large fluc ...

Exercise 6 (+additional question) in Mankiw:

... total factor productivity between the years? Problem 8.3: Assume an economy which is characterized by perfect competition in the goods and labor market, in which the owners of capital get one-third of national income, and the workers receive two-thirds. Assume a Cobb-Douglas aggregate production fun ...

... total factor productivity between the years? Problem 8.3: Assume an economy which is characterized by perfect competition in the goods and labor market, in which the owners of capital get one-third of national income, and the workers receive two-thirds. Assume a Cobb-Douglas aggregate production fun ...

Aggregate Demand/Aggregate Supply

... assets rises, while the real value of assets remains the same. d. All of the above. ...

... assets rises, while the real value of assets remains the same. d. All of the above. ...

Latin America’s Road to Inflation Targeting

... NB1: The frictions that limit factor mobility also limit the substitutability between foreign and domestic saving, which is why domestic saving matters for the real exchange rate and, hence, growth. NB2: SD and e reinforce each other (endogeneity and multiplier effect). NB3: Whether the current acco ...

... NB1: The frictions that limit factor mobility also limit the substitutability between foreign and domestic saving, which is why domestic saving matters for the real exchange rate and, hence, growth. NB2: SD and e reinforce each other (endogeneity and multiplier effect). NB3: Whether the current acco ...

The Impact of Foreign Interest Rates on the Economy

... addition, the results are presented across different empirical models (fixed effect panel and random coefficients models) and hold even more strongly when using investment growth rather than GDP growth. The main finding thus implies that there are real costs to the loss of monetary autonomy that com ...

... addition, the results are presented across different empirical models (fixed effect panel and random coefficients models) and hold even more strongly when using investment growth rather than GDP growth. The main finding thus implies that there are real costs to the loss of monetary autonomy that com ...

Risk-adjusted Covered Interest Parity: Theory and Evidence

... In the literature, the distinction between counterparty and liquidity risks can be traced back to the theoretical exposition put forward by Brunnermeier and Pedersen (2008), which was followed by a heated debate about the shares of the two risk premiums embedded in the Libor-OIS spread (McAndrews et ...

... In the literature, the distinction between counterparty and liquidity risks can be traced back to the theoretical exposition put forward by Brunnermeier and Pedersen (2008), which was followed by a heated debate about the shares of the two risk premiums embedded in the Libor-OIS spread (McAndrews et ...

Macro2

... country with GDP in another country is problematic because prices of particular products in one country may be much less or much more than in the other country. – For example, using the market exchange rate to value Chinese GDP in dollars leads to an estimate that in 2006, U.S. real GDP per person w ...

... country with GDP in another country is problematic because prices of particular products in one country may be much less or much more than in the other country. – For example, using the market exchange rate to value Chinese GDP in dollars leads to an estimate that in 2006, U.S. real GDP per person w ...

18.6 Problems In Implementing Monetary Policy

... The Board of Governors of the Fed and the Federal Open Market Committee are the prime decision makers for monetary policy in the United States. They decide whether to change policies to expand the supply of money and, hopefully, the real level of economic activity, or to contract the money supply, h ...

... The Board of Governors of the Fed and the Federal Open Market Committee are the prime decision makers for monetary policy in the United States. They decide whether to change policies to expand the supply of money and, hopefully, the real level of economic activity, or to contract the money supply, h ...

A Theory of Macroprudential Policies in the Presence of Nominal Rigidities

... markets as a function of primitives and sufficient statistics. In particular, within each state of the world there is a sub-equilibrium in goods and labor markets affected by nominal rigidities. One can define wedges that measure the departure of these allocations from the first best outcome. In sim ...

... markets as a function of primitives and sufficient statistics. In particular, within each state of the world there is a sub-equilibrium in goods and labor markets affected by nominal rigidities. One can define wedges that measure the departure of these allocations from the first best outcome. In sim ...

Schelkle , Waltraud (2002) 'Disciplining Device or Insurance Arrangement? Two Approaches to the Political Economy of EMU Policy Coordination', EI WP 2002-01 (December)

... convention on a future European constitution. At the end of November, the monetary and financial affairs Commissioner Pedro Solbes suggested some fundamental reforms, such as differentiating between countries with high and low levels of public debt. This row indicates that the institutionalisation o ...

... convention on a future European constitution. At the end of November, the monetary and financial affairs Commissioner Pedro Solbes suggested some fundamental reforms, such as differentiating between countries with high and low levels of public debt. This row indicates that the institutionalisation o ...

A Theory of Macroprudential Policies in the Presence of Nominal Rigidities ∗

... markets as a function of primitives and sufficient statistics. In particular, within each state of the world there is a sub-equilibrium in goods and labor markets affected by nominal rigidities. One can define wedges that measure the departure of these allocations from the first best outcome. In sim ...

... markets as a function of primitives and sufficient statistics. In particular, within each state of the world there is a sub-equilibrium in goods and labor markets affected by nominal rigidities. One can define wedges that measure the departure of these allocations from the first best outcome. In sim ...

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.Further goals of a monetary policy are usually to contribute to economic growth and stability, to lower unemployment, and to maintain predictable exchange rates with other currencies.Monetary economics provides insight into how to craft optimal monetary policy.Monetary policy is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in order to avoid the resulting distortions and deterioration of asset values.Monetary policy differs from fiscal policy, which refers to taxation, government spending, and associated borrowing.