Document

... Experience of other emerging markets suggests it is better to exit from a peg in good times, when the BoP is strong, than to wait until the currency is under attack. ...

... Experience of other emerging markets suggests it is better to exit from a peg in good times, when the BoP is strong, than to wait until the currency is under attack. ...

SPDR Advisor Education - View All Advisor Education | State Street

... 1, 2016. Consumer Price Index for All Urban Consumers: All Items. Monthly percent change from a year earlier. ...

... 1, 2016. Consumer Price Index for All Urban Consumers: All Items. Monthly percent change from a year earlier. ...

Cameroon Business Forecast Report Q2 2011 Brochure

... looking to the wider central African economy, we see little in the way of changes over 2011. The extreme rarity of adjustments to the peg of the CFA franc to the euro has helped keep inflation and perceptions of exchange rate risk low, and in the absence of macroeconomic tensions and the promising o ...

... looking to the wider central African economy, we see little in the way of changes over 2011. The extreme rarity of adjustments to the peg of the CFA franc to the euro has helped keep inflation and perceptions of exchange rate risk low, and in the absence of macroeconomic tensions and the promising o ...

Chapter 16

... potential level of real GDP, which no one knows with certainty. 3. Policy Lags and the Forecast Horizon a) The effects of policy actions operate with lags. b) These lags may be longer than policymakers can forecast so that actions taken in response to actual or forecasted events may have their maxim ...

... potential level of real GDP, which no one knows with certainty. 3. Policy Lags and the Forecast Horizon a) The effects of policy actions operate with lags. b) These lags may be longer than policymakers can forecast so that actions taken in response to actual or forecasted events may have their maxim ...

Why Has Nominal Income Growth Been So Slow?

... First, the Fed implemented QE at the same time that it began paying interest to banks on their holdings of reserves. The quantitative analysis in Ireland (2014) shows that there can be an enormous expansion in banks’ demand for real excess reserves during the transition between an initial steady st ...

... First, the Fed implemented QE at the same time that it began paying interest to banks on their holdings of reserves. The quantitative analysis in Ireland (2014) shows that there can be an enormous expansion in banks’ demand for real excess reserves during the transition between an initial steady st ...

Course Number (including Section) and Course Name

... Explain macroeconomic concepts including national income accounting, inflation, unemployment, and the monetary system Utilize knowledge of the global economy, including the international monetary system, trade and exchange rates to analyze the economic implications of alternative trade policies ...

... Explain macroeconomic concepts including national income accounting, inflation, unemployment, and the monetary system Utilize knowledge of the global economy, including the international monetary system, trade and exchange rates to analyze the economic implications of alternative trade policies ...

International Economic Integration

... Monetary restraint requires fiscal discipline Monetary policy under floating exchange rates and perfect capital mobility Increased independence of central banks, and increased accountability Banking supervision Inflation targeting ...

... Monetary restraint requires fiscal discipline Monetary policy under floating exchange rates and perfect capital mobility Increased independence of central banks, and increased accountability Banking supervision Inflation targeting ...

- Wasatch Advisors

... must hold an amount of highly liquid assets (such as reserve balances at Federal Reserve Banks or Treasury securities) equal to or greater than the difference between their cash outflows and inflows over a 30-day stress period. Thus, excess reserves are irrelevant to the money-creation process if th ...

... must hold an amount of highly liquid assets (such as reserve balances at Federal Reserve Banks or Treasury securities) equal to or greater than the difference between their cash outflows and inflows over a 30-day stress period. Thus, excess reserves are irrelevant to the money-creation process if th ...

Monetary - Harvard Kennedy School

... to appreciate the currency (“accommodating the terms of trade”). • But CPI targeting instead tells the central bank to appreciate in response to an increase in the world price of import commodities -- exactly the opposite of accommodating the adverse shift in the terms of trade. – E.g., it is suspec ...

... to appreciate the currency (“accommodating the terms of trade”). • But CPI targeting instead tells the central bank to appreciate in response to an increase in the world price of import commodities -- exactly the opposite of accommodating the adverse shift in the terms of trade. – E.g., it is suspec ...

Meeting Date: August 16, 2012

... expected to follow a downward trend. Although, aggregate demand conditions contain the second round effects, pricing behavior should be closely monitored as inflation will continue to stay above the target for some time. 12. In order to support financial stability, the Committee has approved an addi ...

... expected to follow a downward trend. Although, aggregate demand conditions contain the second round effects, pricing behavior should be closely monitored as inflation will continue to stay above the target for some time. 12. In order to support financial stability, the Committee has approved an addi ...

Spending Money

... • How is monetary policy different than fiscal policy? • Is your local bank part of the Fed? • Video: “In Plain English” from the St. Louis ...

... • How is monetary policy different than fiscal policy? • Is your local bank part of the Fed? • Video: “In Plain English” from the St. Louis ...

Reaction Function - NRI Financial Solutions

... cases. In fact, according to a press report, such combination of events already occurred four times under the QQE. Nevertheless, high ranking officials of the BOJ including Governor Kuroda implied no policy actions in advance at various occasions such as international financial forum and parliamenta ...

... cases. In fact, according to a press report, such combination of events already occurred four times under the QQE. Nevertheless, high ranking officials of the BOJ including Governor Kuroda implied no policy actions in advance at various occasions such as international financial forum and parliamenta ...

Lecture 8 - Central Web Server 2

... the value of exports will fall, worsening the trade balance. Over the longer term, prices can adjust. (Export demand is more elastic in the long run.) So longer term, the trade balance would improve. In fact, the longer the elapsed time since the devaluation or depreciation, the more likely the trad ...

... the value of exports will fall, worsening the trade balance. Over the longer term, prices can adjust. (Export demand is more elastic in the long run.) So longer term, the trade balance would improve. In fact, the longer the elapsed time since the devaluation or depreciation, the more likely the trad ...

FRBSF E L CONOMIC ETTER

... Therefore, Figure 2 suggests that the Fed does influence long-term rates significantly, and it does so by setting a target for the overnight rate. Furthermore, the absence of significant premiums on longer-term Treasuries is a public vote of confidence on the Fed’s stewardship of its control of infl ...

... Therefore, Figure 2 suggests that the Fed does influence long-term rates significantly, and it does so by setting a target for the overnight rate. Furthermore, the absence of significant premiums on longer-term Treasuries is a public vote of confidence on the Fed’s stewardship of its control of infl ...

Introduction to Macroeconomics · Final exam · 22 June 2015 1

... determined in the currency market. (c) The liquidity market model is not useful to determine the value of the unemployment rate but it is to represent the effect of open market operations. (d) Taylor’s rule is an equation stating how a central bank would set the interest rate. 7. An aggregate demand ...

... determined in the currency market. (c) The liquidity market model is not useful to determine the value of the unemployment rate but it is to represent the effect of open market operations. (d) Taylor’s rule is an equation stating how a central bank would set the interest rate. 7. An aggregate demand ...

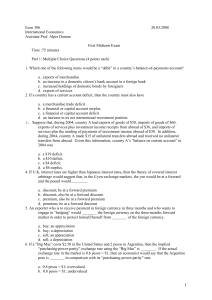

Econ 306

... Interest rate on 1-year dollar denominated bonds: 5% Interest rate on 1-year euro denominated bonds: 4% a. Is the dollar at a forward premium or discount? b. Should a US investor make a covered investment in euro-denominated bonds? Explain why? c. If the covered interest parity holds, what should be ...

... Interest rate on 1-year dollar denominated bonds: 5% Interest rate on 1-year euro denominated bonds: 4% a. Is the dollar at a forward premium or discount? b. Should a US investor make a covered investment in euro-denominated bonds? Explain why? c. If the covered interest parity holds, what should be ...

(G – T) + (X – M)

... Market Rate 市場匯率 Licensed Bank buy US$ from Exchange Fund and sell it to the market for the HK$ arbitrage 持牌銀行 ...

... Market Rate 市場匯率 Licensed Bank buy US$ from Exchange Fund and sell it to the market for the HK$ arbitrage 持牌銀行 ...

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.Further goals of a monetary policy are usually to contribute to economic growth and stability, to lower unemployment, and to maintain predictable exchange rates with other currencies.Monetary economics provides insight into how to craft optimal monetary policy.Monetary policy is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in order to avoid the resulting distortions and deterioration of asset values.Monetary policy differs from fiscal policy, which refers to taxation, government spending, and associated borrowing.