NATIONAL BANK OF POLAND WORKING PAPER No. 152

... goods and services covered by these indices. Imbs et al. (2011) derived the sectoral NKPC and investigated the relationship between prices expressed as value-added deflators and sector-specific marginal costs for 16 sectors of French economy. However, the structure of the CPI basket is specified on ...

... goods and services covered by these indices. Imbs et al. (2011) derived the sectoral NKPC and investigated the relationship between prices expressed as value-added deflators and sector-specific marginal costs for 16 sectors of French economy. However, the structure of the CPI basket is specified on ...

Financial Cycles with Heterogeneous Intermediaries

... leverage and asset pricing implications which are unusual in our models but seem to bear some resemblance with reality. Contemporaneously, output and consumption vary monotonically with the interest rate while the underlying financial structure (and systemic risk) is non-monotonic. We explain here t ...

... leverage and asset pricing implications which are unusual in our models but seem to bear some resemblance with reality. Contemporaneously, output and consumption vary monotonically with the interest rate while the underlying financial structure (and systemic risk) is non-monotonic. We explain here t ...

The Labor Market, Unemployment, and Inflation

... explanation for unemployment that holds that the productivity of workers increases with the wage rate. If this is so, firms may have an incentive to pay wages above the marketclearing rate. ...

... explanation for unemployment that holds that the productivity of workers increases with the wage rate. If this is so, firms may have an incentive to pay wages above the marketclearing rate. ...

Business Cycles: The Role of Energy Prices

... aggregate economic activity for the United States and other countries. The latter research included James Hamilton’s findings (published in the Journal of Political Economy) that other economic forces could not account for the negative effect that rising oil prices had on U.S. economic activity. Eco ...

... aggregate economic activity for the United States and other countries. The latter research included James Hamilton’s findings (published in the Journal of Political Economy) that other economic forces could not account for the negative effect that rising oil prices had on U.S. economic activity. Eco ...

The Labor Market, Unemployment, and Inflation

... explanation for unemployment that holds that the productivity of workers increases with the wage rate. If this is so, firms may have an incentive to pay wages above the marketclearing rate. ...

... explanation for unemployment that holds that the productivity of workers increases with the wage rate. If this is so, firms may have an incentive to pay wages above the marketclearing rate. ...

The Keynesian Theory of Business Cycles and Macroeconomic

... • Since the firm is paying an efficiency wage, it can hire more workers at that wage to produce more goods when necessary • This means that the economy can produce an amount of output that is not on the FE line during the period in which prices haven't adjusted ...

... • Since the firm is paying an efficiency wage, it can hire more workers at that wage to produce more goods when necessary • This means that the economy can produce an amount of output that is not on the FE line during the period in which prices haven't adjusted ...

Free Full Text ( Final Version , 817kb )

... China has made great achievement in maintaining price stability and generating economic momentum during the post-reform period, even as China has experienced 3 times’ high inflation attacks and 3 times acute deflation. Recently, inflation has become the hottest economic topic again and China’s leade ...

... China has made great achievement in maintaining price stability and generating economic momentum during the post-reform period, even as China has experienced 3 times’ high inflation attacks and 3 times acute deflation. Recently, inflation has become the hottest economic topic again and China’s leade ...

Short-run Aggregate Supply, Long

... The Theor}'of T,ong-TermEconomicGrowth Long-run aggregate supply (LRAS) is all of the goods and services produced in the long-run (LR- four to five years out) by all of the firms in an economy using the available labor, capital, and technology . The curve is perfectly vertical because it reflects e ...

... The Theor}'of T,ong-TermEconomicGrowth Long-run aggregate supply (LRAS) is all of the goods and services produced in the long-run (LR- four to five years out) by all of the firms in an economy using the available labor, capital, and technology . The curve is perfectly vertical because it reflects e ...

The Small Open-Economy New Keynesian Phillips Curve: Empirical

... the generalized method of moments (GMM) to handle expectational terms. The purpose of this paper is, therefore, to evaluate empirically the small open-economy (SOE) version of the NKPC derived in Galí and Monacelli (2005), henceforth the SOE NKPC. Notably, the SOE NKPC links inflation dynamics to ex ...

... the generalized method of moments (GMM) to handle expectational terms. The purpose of this paper is, therefore, to evaluate empirically the small open-economy (SOE) version of the NKPC derived in Galí and Monacelli (2005), henceforth the SOE NKPC. Notably, the SOE NKPC links inflation dynamics to ex ...

Promoting active learning

... commodities. The basic commodities can be provided to the consumers at fixed prices. ...

... commodities. The basic commodities can be provided to the consumers at fixed prices. ...

Fiscal Consequences for Mexico of Adopting the Dollar

... While this equation assumes no uncertainty about the future values of the righthand-side variables, it is forward looking, so it is valid even if those variables are discontinuously different from what they have been before t. Since Bt cannot jump discontinuously at t,1 This equation offers a simple ...

... While this equation assumes no uncertainty about the future values of the righthand-side variables, it is forward looking, so it is valid even if those variables are discontinuously different from what they have been before t. Since Bt cannot jump discontinuously at t,1 This equation offers a simple ...

How Likely is Hyperinflation in the US? Part One

... Michael K. Salemi, economics professor at University of North Carolina at Chapel Hill, high debt, rising interest rates and monetization caused the Latin American high inflation of the 1980's. By some measures, Iran may have begun experiencing hyperinflation by October of 2012, when at least one sou ...

... Michael K. Salemi, economics professor at University of North Carolina at Chapel Hill, high debt, rising interest rates and monetization caused the Latin American high inflation of the 1980's. By some measures, Iran may have begun experiencing hyperinflation by October of 2012, when at least one sou ...

The Rate of Surplus Value, the Composition of Capital, and

... neglectable, the change in the rate of surplus value attributed mainly to the decline in the share of profit. And in the sequencial period, the rise of surlus value attributed to two factors: firstly, in this period the decling trend of share of profit was inversed and this contributed a great part ...

... neglectable, the change in the rate of surplus value attributed mainly to the decline in the share of profit. And in the sequencial period, the rise of surlus value attributed to two factors: firstly, in this period the decling trend of share of profit was inversed and this contributed a great part ...

Economics R. Glenn Hubbard, Anthony Patrick O`Brien, 2e.

... 15.1 Define fiscal policy. 15.2 Explain how fiscal policy affects aggregate demand and how the government can use fiscal policy to stabilize the economy. 15.3 Explain how the government purchases and tax multipliers work. 15.4 Discuss the difficulties that can arise in implementing fiscal policy. Th ...

... 15.1 Define fiscal policy. 15.2 Explain how fiscal policy affects aggregate demand and how the government can use fiscal policy to stabilize the economy. 15.3 Explain how the government purchases and tax multipliers work. 15.4 Discuss the difficulties that can arise in implementing fiscal policy. Th ...

Document

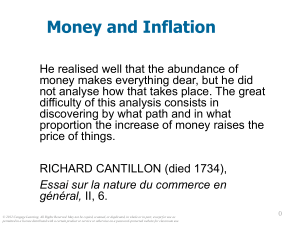

... People get rid of their excess money by spending it on g&s or by loaning it to others, who spend it. Result: increased demand for goods. But supply of goods does not increase, so prices must rise. (Other things happen in the short run, which we will study in later chapters.) © 2012 Cengage Learn ...

... People get rid of their excess money by spending it on g&s or by loaning it to others, who spend it. Result: increased demand for goods. But supply of goods does not increase, so prices must rise. (Other things happen in the short run, which we will study in later chapters.) © 2012 Cengage Learn ...

Macroeconomic Effects of Fiscal Policy

... new employees receive higher income and are able to increase their consumption, and also changes in e.g. the consumption and savings behaviour of households and firms. Therefore, the aggregate economic effects of fiscal policy can be determined only through an economic model and all models are based ...

... new employees receive higher income and are able to increase their consumption, and also changes in e.g. the consumption and savings behaviour of households and firms. Therefore, the aggregate economic effects of fiscal policy can be determined only through an economic model and all models are based ...

Chapter 29

... amount of consumption goods that people plan to buy today and increases aggregate demand. An increase in expected future inflation increases aggregate demand today because people decide to buy more goods and services now before their prices rise. An increase in expected future profit increases the i ...

... amount of consumption goods that people plan to buy today and increases aggregate demand. An increase in expected future inflation increases aggregate demand today because people decide to buy more goods and services now before their prices rise. An increase in expected future profit increases the i ...

Financial Markets

... contract, and if we know the current price of the bond, which we may be able to observe in the bond market, we can use the formula to determine the bond’s yield to maturity. ...

... contract, and if we know the current price of the bond, which we may be able to observe in the bond market, we can use the formula to determine the bond’s yield to maturity. ...

2008-I CENTRAL BANK OF THE REPUBLIC OF TURKEY

... However, these adjustments will also support lower inflation in the medium term as they contribute to a prudent fiscal stance and facilitate an expansion of the domestic energy production. Hence, the CBRT will not react to these price adjustments, except to contain second-round effects. Developments ...

... However, these adjustments will also support lower inflation in the medium term as they contribute to a prudent fiscal stance and facilitate an expansion of the domestic energy production. Hence, the CBRT will not react to these price adjustments, except to contain second-round effects. Developments ...

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.Further goals of a monetary policy are usually to contribute to economic growth and stability, to lower unemployment, and to maintain predictable exchange rates with other currencies.Monetary economics provides insight into how to craft optimal monetary policy.Monetary policy is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in order to avoid the resulting distortions and deterioration of asset values.Monetary policy differs from fiscal policy, which refers to taxation, government spending, and associated borrowing.