What We Still Don`t Know about Monetary and Fiscal Policy

... the rate of growth of the monetary base or by targeting the growth of some related measure of deposit money. But most central banks, including the Federal Reserve, gave up that practice some time ago. Instead most central banks today make monetary policy by setting some designated short-term interes ...

... the rate of growth of the monetary base or by targeting the growth of some related measure of deposit money. But most central banks, including the Federal Reserve, gave up that practice some time ago. Instead most central banks today make monetary policy by setting some designated short-term interes ...

Workshop on Macroeconomic Modelling in Asia and the Pacific 8‐11 December 2015 Bangkok, United Nations Conference Centre (UNCC)

... financial institutions and also other parties, within its competence; • ensuring a due level of protection of the rights and legitimate interests of consumers of financial services; • carrying out statistics activities in the area of monetary statistics and external sector statistics. ...

... financial institutions and also other parties, within its competence; • ensuring a due level of protection of the rights and legitimate interests of consumers of financial services; • carrying out statistics activities in the area of monetary statistics and external sector statistics. ...

'Integrating Financial Stability and Monetary Policy Analysis'

... time raising the level of the capital buffer. If, for instance, there are prospects that inflation will become too low at the same time as debt and house prices are rising rapidly, the key policy rate will be reduced, in line with its primary task of maintaining a nominal anchor for the economy. Unw ...

... time raising the level of the capital buffer. If, for instance, there are prospects that inflation will become too low at the same time as debt and house prices are rising rapidly, the key policy rate will be reduced, in line with its primary task of maintaining a nominal anchor for the economy. Unw ...

Ahmed Presentation - Carnegie Endowment for International Peace

... Financial markets remain highly stressed. The world economy will contract in 2009 by around 1¼ percent before recovering gradually in 2010. Emerging economies face dramatic drops in capital inflows, demand for their exports, and commodity prices. A third wave of the global financial crisis i ...

... Financial markets remain highly stressed. The world economy will contract in 2009 by around 1¼ percent before recovering gradually in 2010. Emerging economies face dramatic drops in capital inflows, demand for their exports, and commodity prices. A third wave of the global financial crisis i ...

Monetary Policy Instruments for Developing

... Shifting from direct ways of controlling monetary policy is by no means universally appealing, they conclude. Direct controls are simple to operate and seem to offer a sure handle on overall credit or money growth. Several observers have noted that moving away from direct controls oftcn involves a f ...

... Shifting from direct ways of controlling monetary policy is by no means universally appealing, they conclude. Direct controls are simple to operate and seem to offer a sure handle on overall credit or money growth. Several observers have noted that moving away from direct controls oftcn involves a f ...

The current foreign exchange control regime and implications

... address a rather difficult situation but their job is made more difficult and less effective due to the lack of complementing fiscal policy measures. Tax and fiscal policy implications Under the current exchange regime, businesses that incur foreign currency denominated costs and other obligations w ...

... address a rather difficult situation but their job is made more difficult and less effective due to the lack of complementing fiscal policy measures. Tax and fiscal policy implications Under the current exchange regime, businesses that incur foreign currency denominated costs and other obligations w ...

More

... Gross Domestic Product: a measure of all the final goods and services which a nation produces within its borders in one year. It is a measurement of output. What is GNP? Gross National Product: the dollar value of all final goods and services produced in a year with labor and property supplied by a ...

... Gross Domestic Product: a measure of all the final goods and services which a nation produces within its borders in one year. It is a measurement of output. What is GNP? Gross National Product: the dollar value of all final goods and services produced in a year with labor and property supplied by a ...

Economics, by R. Glenn Hubbard and Anthony Patrick O`Brien

... Low interest rates are suppose to mobilize resources, but it could misallocate resources. Low interest rates may boost the economy today, only to collapse it tomorrow. Low interest rates subsidize borrowers at the expense of savers. Competitive Quantitative Easing – Countries competing by printing m ...

... Low interest rates are suppose to mobilize resources, but it could misallocate resources. Low interest rates may boost the economy today, only to collapse it tomorrow. Low interest rates subsidize borrowers at the expense of savers. Competitive Quantitative Easing – Countries competing by printing m ...

Required Content

... The Department of Economics is accountable for the content of each of the core courses including the Principles of Macroeconomics course (ECON 2020). This means that we require a common content in each of the Principles courses taught. In addition, the Principles of Microeconomics (ECON 2010) is a p ...

... The Department of Economics is accountable for the content of each of the core courses including the Principles of Macroeconomics course (ECON 2020). This means that we require a common content in each of the Principles courses taught. In addition, the Principles of Microeconomics (ECON 2010) is a p ...

Presentation to the members of Parliament at the Conference on... by the European Economics and Financial Centre

... storm, the U.S. unemployment rate was at 4.9 percent, a number that’s near conventional estimates consistent with so-called “full employment.” As this scenario has unfolded—above-trend growth and diminishing slack—the FOMC has been able to lift its foot off the accelerator bit by bit, gradually rem ...

... storm, the U.S. unemployment rate was at 4.9 percent, a number that’s near conventional estimates consistent with so-called “full employment.” As this scenario has unfolded—above-trend growth and diminishing slack—the FOMC has been able to lift its foot off the accelerator bit by bit, gradually rem ...

Monetary Economics and the European Union Lecture: Week 1

... Fisher and his 1911 book entitled “The Purchasing Power of Money”. It starts from the following equation of exchange: MV = PY M = money supply V = velocity of circulation of money (spent on final goods) P = price level Y = real income (or output) ...

... Fisher and his 1911 book entitled “The Purchasing Power of Money”. It starts from the following equation of exchange: MV = PY M = money supply V = velocity of circulation of money (spent on final goods) P = price level Y = real income (or output) ...

nal Review Question Sheet.

... What will happen to the economy? Illustrate the adjustment. 5) From Question 3), alternatively, suppose that the government adopts Flexible Foreign Exchange Rate System. What will happen to the economy? Illustrate the adjustment. 6) Explain why any additional expansionary economic policies are NOT n ...

... What will happen to the economy? Illustrate the adjustment. 5) From Question 3), alternatively, suppose that the government adopts Flexible Foreign Exchange Rate System. What will happen to the economy? Illustrate the adjustment. 6) Explain why any additional expansionary economic policies are NOT n ...

Macroeconomics

... National output is the total value of everything a country produces in a given time period. Everything that is produced and sold generates income. Therefore, output and income are usually considered equivalent and the two terms are often used interchangeably. Output can be measured as total income, ...

... National output is the total value of everything a country produces in a given time period. Everything that is produced and sold generates income. Therefore, output and income are usually considered equivalent and the two terms are often used interchangeably. Output can be measured as total income, ...

ECON 612-001 Monetary Theory

... This is a course in advanced monetary theory. It is designed to serve as part of a sequence with Econ. 611, though it can be taken independently. The purpose of the sequence as I see it is to acquaint participants with various issues and contributions within the domain of monetary theory, i.e., the ...

... This is a course in advanced monetary theory. It is designed to serve as part of a sequence with Econ. 611, though it can be taken independently. The purpose of the sequence as I see it is to acquaint participants with various issues and contributions within the domain of monetary theory, i.e., the ...

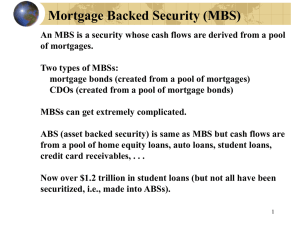

Chapter Five POF - HCC Learning Web

... European Central Bank (ECB): focuses on maintaining price stability while each member country is responsible for its own fiscal policy ...

... European Central Bank (ECB): focuses on maintaining price stability while each member country is responsible for its own fiscal policy ...

Money, Growth and Inflation – Chap 17

... a. In which case does the real value of your deposit grow the most? Assume the tax rate is 25%. b. In which case do you pay the most taxes? c. Compute the after-tax nominal interest rate, then subtract off inflation to get the after-tax real interest rate for both cases. ...

... a. In which case does the real value of your deposit grow the most? Assume the tax rate is 25%. b. In which case do you pay the most taxes? c. Compute the after-tax nominal interest rate, then subtract off inflation to get the after-tax real interest rate for both cases. ...

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.Further goals of a monetary policy are usually to contribute to economic growth and stability, to lower unemployment, and to maintain predictable exchange rates with other currencies.Monetary economics provides insight into how to craft optimal monetary policy.Monetary policy is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in order to avoid the resulting distortions and deterioration of asset values.Monetary policy differs from fiscal policy, which refers to taxation, government spending, and associated borrowing.