投影片 1

... — If people are victims of money illusion, then very important prices are distored (e.g. stocks: Modigliani Cohn, and bonds: if the Fisher hypothesis doesn’t hold) — For very low inflation (<1%): The aversion to nominal wage cut becomes a very big issue, and probably the major cost of inflation. ...

... — If people are victims of money illusion, then very important prices are distored (e.g. stocks: Modigliani Cohn, and bonds: if the Fisher hypothesis doesn’t hold) — For very low inflation (<1%): The aversion to nominal wage cut becomes a very big issue, and probably the major cost of inflation. ...

AP Macro Problem Set #3 Total: ______/55

... a. Define GDP, identify what is not included, define the four components, and give an example of each (_____/5) b. Explain the difference between nominal GDP and real GDP. Use a simplified numerical example with two different years to show your understanding. (_____/5) c. If someone told you that th ...

... a. Define GDP, identify what is not included, define the four components, and give an example of each (_____/5) b. Explain the difference between nominal GDP and real GDP. Use a simplified numerical example with two different years to show your understanding. (_____/5) c. If someone told you that th ...

Unit 3 Homework Packet

... 2. (_____/10 Points) Unemployment a. Define and give examples of the four types of unemployment discussed in class. (_____/5) b. How is the unemployment rate calculated? What is the Natural Rate of Unemployment? Do we want zero unemployment? (_____/5) 3. (_____/15 Points) Inflation a. Define and ide ...

... 2. (_____/10 Points) Unemployment a. Define and give examples of the four types of unemployment discussed in class. (_____/5) b. How is the unemployment rate calculated? What is the Natural Rate of Unemployment? Do we want zero unemployment? (_____/5) 3. (_____/15 Points) Inflation a. Define and ide ...

Principles of Macroeconomics - Southern State Community College

... rate of unemployment, the price level, the inflation rate, productivity and the rate of interest 6. Comprehend the supply and demand for money 7. Comprehend the Federal Reserve System 8. Comprehend the development of, and be able to apply aggregate demand and aggregate supply 9. Comprehend the effec ...

... rate of unemployment, the price level, the inflation rate, productivity and the rate of interest 6. Comprehend the supply and demand for money 7. Comprehend the Federal Reserve System 8. Comprehend the development of, and be able to apply aggregate demand and aggregate supply 9. Comprehend the effec ...

Naira Devaluation

... Simple Maths – less Dollars multiplied by higher exchange rate puts slightly more Naira in the hands of Government. Since Government is the biggest spender in the Economy, they can continue to pay salaries and give out the contracts that have a positive ripple effect on the economy. Effects of Dev ...

... Simple Maths – less Dollars multiplied by higher exchange rate puts slightly more Naira in the hands of Government. Since Government is the biggest spender in the Economy, they can continue to pay salaries and give out the contracts that have a positive ripple effect on the economy. Effects of Dev ...

tails and elephants

... Reducing equilibrium ownership rate? Renter burden? Rents Flat? – Buy to let – Gentrification? ...

... Reducing equilibrium ownership rate? Renter burden? Rents Flat? – Buy to let – Gentrification? ...

New Consensus - Levy Economics Institute of Bard College

... the public sector is a heavy provider of education, and education adds to human capital, the public sector is again seen to play a significant role in growth. Endogenous growth theory also postulates that there are overall increasing returns to scale, but that includes some factors of production whi ...

... the public sector is a heavy provider of education, and education adds to human capital, the public sector is again seen to play a significant role in growth. Endogenous growth theory also postulates that there are overall increasing returns to scale, but that includes some factors of production whi ...

Guatemala_en.pdf

... growth in domestic demand, the level and stability of interest rates, international price trends, an expected rise in external demand, especially in commerce, and the impact of tax reforms. Year-on-year inflation to May 2014 stood at 3.2%, within the established target range. The fiscal deficit is e ...

... growth in domestic demand, the level and stability of interest rates, international price trends, an expected rise in external demand, especially in commerce, and the impact of tax reforms. Year-on-year inflation to May 2014 stood at 3.2%, within the established target range. The fiscal deficit is e ...

Speech before an Australian Business Economists luncheon

... the trend rate of around two and a half percent. One argument on the side of slowing productivity growth is the recent moderation in the pace of price declines for high-tech goods. This could imply that technological progress is slowing to some extent. While this is a source of concern, it’s too soo ...

... the trend rate of around two and a half percent. One argument on the side of slowing productivity growth is the recent moderation in the pace of price declines for high-tech goods. This could imply that technological progress is slowing to some extent. While this is a source of concern, it’s too soo ...

2017-04-17 Econ 115 S 2017 PS 2 #TCEH.pages

... 5% as far as they could. But in general central bank reductions in the short-term safe nominal interest rate i induce only half as large a reduction in the real interest rate r: financiers and others believe that such monetary policy moves are not permanent but transitory, and will be reversed in re ...

... 5% as far as they could. But in general central bank reductions in the short-term safe nominal interest rate i induce only half as large a reduction in the real interest rate r: financiers and others believe that such monetary policy moves are not permanent but transitory, and will be reversed in re ...

The Real Rate of Interest

... Federal government budget surplus (if any) Federal Reserve increases the money supply (M) Demand for Loanable Funds (DSU) Consumer credit purchases Business investment Federal government budget deficits State and local government budget deficits ...

... Federal government budget surplus (if any) Federal Reserve increases the money supply (M) Demand for Loanable Funds (DSU) Consumer credit purchases Business investment Federal government budget deficits State and local government budget deficits ...

Minutes of the 196th Meeting of the Monetary Policy Committee

... favorable longer-term macroeconomic environment. In this respect, the Copom reassures that, under the inflation targeting regime, it guides its decisions according to the projected inflation by the BCB and based on the analysis of alternative scenarios for the evolution of the main variables that de ...

... favorable longer-term macroeconomic environment. In this respect, the Copom reassures that, under the inflation targeting regime, it guides its decisions according to the projected inflation by the BCB and based on the analysis of alternative scenarios for the evolution of the main variables that de ...

1 Solutions to End-of-Chapter Problems in

... Pursue an expansionary monetary policy, coupled with a “balanced budget” fiscal contraction (reduce both G and T by the same amounts), such that i increases but Y does not change. The rise in i will lead to a depreciation of the US dollar, causing the trade balance to improve while the budget defici ...

... Pursue an expansionary monetary policy, coupled with a “balanced budget” fiscal contraction (reduce both G and T by the same amounts), such that i increases but Y does not change. The rise in i will lead to a depreciation of the US dollar, causing the trade balance to improve while the budget defici ...

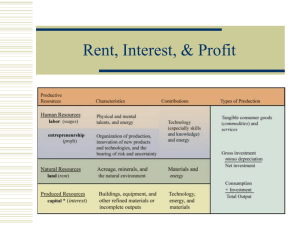

Rent, Interest, and Profit

... Interest is determined by the supply of and demand for funds available for lending and borrowing A supply & demand graph with interest on the y-axis and loanable funds on the x-axis Households rarely lend, but do put money in banks, which in turn lend money ...

... Interest is determined by the supply of and demand for funds available for lending and borrowing A supply & demand graph with interest on the y-axis and loanable funds on the x-axis Households rarely lend, but do put money in banks, which in turn lend money ...

Introduction to Macroeconomics

... • They propose a money-growth rule: The Fed should be required to target the growth rate of money such that it equals the growth rate of real GDP, leaving the price level unchanged. ...

... • They propose a money-growth rule: The Fed should be required to target the growth rate of money such that it equals the growth rate of real GDP, leaving the price level unchanged. ...

PRESS RELEASE SUMMARY OF THE MONETARY POLICY COMMITTEE MEETING No: 2015-37

... volatility in financial markets restrains the improvement of financial conditions. All these developments suggest that the recovery in private demand will be moderate and gradual. 10. In the first quarter of 2015, non-gold exports were down while non-gold imports were up from their past quarterly av ...

... volatility in financial markets restrains the improvement of financial conditions. All these developments suggest that the recovery in private demand will be moderate and gradual. 10. In the first quarter of 2015, non-gold exports were down while non-gold imports were up from their past quarterly av ...

PowerPoint presentation

... RTAs can complement the multilateral trading system, help to build and strengthen it. But by their very nature RTAs are discriminatory: they are a departure from the MFN principle, a cornerstone of the multilateral trading system. Their effects on global trade liberalization and economic growth are ...

... RTAs can complement the multilateral trading system, help to build and strengthen it. But by their very nature RTAs are discriminatory: they are a departure from the MFN principle, a cornerstone of the multilateral trading system. Their effects on global trade liberalization and economic growth are ...

Trinidad_and_Tobago.pdf

... The Central Bank of Trinidad and Tobago maintained its accommodative stance from previous years in 2013. The repo rate, which has remained unchanged since September 2012, was held at 2.75%. The average deposit rate fell from 8.75% at the end of 2012 to 8.51% at the end of 2013. The nominal deposit r ...

... The Central Bank of Trinidad and Tobago maintained its accommodative stance from previous years in 2013. The repo rate, which has remained unchanged since September 2012, was held at 2.75%. The average deposit rate fell from 8.75% at the end of 2012 to 8.51% at the end of 2013. The nominal deposit r ...

Chapter 14 – Credit and Financial Crises

... a need for money for current transactions, holding precautionary reserves and speculation. Keynes himself believed that the money supply was exogenous, but the post-Keynesians view the money supply as determined by the economy. Expansions increase output, which produces demand-side pressures for mor ...

... a need for money for current transactions, holding precautionary reserves and speculation. Keynes himself believed that the money supply was exogenous, but the post-Keynesians view the money supply as determined by the economy. Expansions increase output, which produces demand-side pressures for mor ...

ECON 775 Monetary Economics - University of Wisconsin Whitewater

... understanding of the connections between monetary theory and modern theories of short-run fluctuations (e.g. real business cycle theory and New Keynesian models). The course is divided into two main parts. The first part focuses on monetary theory, whilst the second part focuses on monetary policy a ...

... understanding of the connections between monetary theory and modern theories of short-run fluctuations (e.g. real business cycle theory and New Keynesian models). The course is divided into two main parts. The first part focuses on monetary theory, whilst the second part focuses on monetary policy a ...

... dramatic falls were seen in cotton fibres (-77%) and cereals (-20%), but the country’s core export sectors, such as soybeans (-8%) and electricity (-2.6%), also declined. The latter two sectors each account for around 23% of total exports. The country’s export structure shifted towards goods with gr ...

Финансиране и бюджетна

... sought in order to obtain higher value of public services for a unit spent on them Increased productivity of the public sector has to be targeted at all levels of administration ...

... sought in order to obtain higher value of public services for a unit spent on them Increased productivity of the public sector has to be targeted at all levels of administration ...

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.Further goals of a monetary policy are usually to contribute to economic growth and stability, to lower unemployment, and to maintain predictable exchange rates with other currencies.Monetary economics provides insight into how to craft optimal monetary policy.Monetary policy is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in order to avoid the resulting distortions and deterioration of asset values.Monetary policy differs from fiscal policy, which refers to taxation, government spending, and associated borrowing.