Introduction by Paul Krugman to The General Theory of Employment

... economics Keynes had to escape from. What we call the classical model today is really a post-Keynesian attempt to rationalize pre-Keynesian views. Change one assumption in our so-called classical model, that of perfect wage flexibility, and it turns back into The General Theory. If that had been all ...

... economics Keynes had to escape from. What we call the classical model today is really a post-Keynesian attempt to rationalize pre-Keynesian views. Change one assumption in our so-called classical model, that of perfect wage flexibility, and it turns back into The General Theory. If that had been all ...

Federal Reserve Bank of Boston © o

... variables exist, agreement on their macro effects should be widespread, and the discount rate recommendations should be highly correlated both across District Banks and with actual FOMC policy changes. In fact, most dismount rate changes were advocated without widespread agreement across the differe ...

... variables exist, agreement on their macro effects should be widespread, and the discount rate recommendations should be highly correlated both across District Banks and with actual FOMC policy changes. In fact, most dismount rate changes were advocated without widespread agreement across the differe ...

Phillips curve

... Aggregate Demand Shifts and the Phillips Curve • We can "explain" both the short-run and longrun Phillips curves by using the Aggregate Demand/Aggregate Supply model that we developed in Chapter 8. ...

... Aggregate Demand Shifts and the Phillips Curve • We can "explain" both the short-run and longrun Phillips curves by using the Aggregate Demand/Aggregate Supply model that we developed in Chapter 8. ...

Reconsidering the business cycle and stabilisation policies in South

... gate economic activity. Burns and Mitchell and others of their era did not have access to reliable time series of gross domestic product as a summary of economic activity, 2 and that is why these pioneers of formal business cycle analysis found it “...necessary to have recourse to other statistical ...

... gate economic activity. Burns and Mitchell and others of their era did not have access to reliable time series of gross domestic product as a summary of economic activity, 2 and that is why these pioneers of formal business cycle analysis found it “...necessary to have recourse to other statistical ...

NBER WORKING PAPER SERIES AN ALTERNATIVE INTERPRETATION

... historically typical inflation levels requires much stronger responses to inflation than anything observed in empirical estimates of central banks’ reaction functions. ...

... historically typical inflation levels requires much stronger responses to inflation than anything observed in empirical estimates of central banks’ reaction functions. ...

1999 South-Western College Publishing

... What is the Economics of Fine-Tuning? The government becoming more proficient at fiscal policy, managing deficit and surplus budgets to create full employment equilibrium with no inflation ©1999 South-Western College Publishing ...

... What is the Economics of Fine-Tuning? The government becoming more proficient at fiscal policy, managing deficit and surplus budgets to create full employment equilibrium with no inflation ©1999 South-Western College Publishing ...

On the Desirability of Nominal GDP Targeting

... it has not been scrutinized within the context of the quantitative frameworks commonly used by central banks. The objective of this paper is to study the desirability of nominal GDP targeting within the context of a New Keynesian model with both price and wage rigidity. In particular, we compare the ...

... it has not been scrutinized within the context of the quantitative frameworks commonly used by central banks. The objective of this paper is to study the desirability of nominal GDP targeting within the context of a New Keynesian model with both price and wage rigidity. In particular, we compare the ...

EU Economy Review 2006 – Adjustment Dynamics in the Euro Area

... explaining prolonged imbalances or gradual adjustment. Nonetheless, some overshooting of intra-area real exchange rates is not excluded, depending on policy responses and wage behaviour. Box 1: The New Keynesian DSGE model: methodology and simulations In recent years, the use of dynamic stochastic g ...

... explaining prolonged imbalances or gradual adjustment. Nonetheless, some overshooting of intra-area real exchange rates is not excluded, depending on policy responses and wage behaviour. Box 1: The New Keynesian DSGE model: methodology and simulations In recent years, the use of dynamic stochastic g ...

NBER WORKING PAPER SERIES DO FLEXIBLE DURABLE GOODS PRICES Robert Barsky

... monetary disturbances might have real effects; the intertemporal elasticity of substitution for purchases of durables is nearly infinite. The result is that a small, temporary increase in the relative price of durables causes a large shift of expenditure away from that sector.2 Monetary expansions i ...

... monetary disturbances might have real effects; the intertemporal elasticity of substitution for purchases of durables is nearly infinite. The result is that a small, temporary increase in the relative price of durables causes a large shift of expenditure away from that sector.2 Monetary expansions i ...

13.1 aggregate supply

... the same. Other things remaining the same, • When the price level rises, the quantity of real GDP demanded decreases. • When the price level falls, the quantity of real GDP demanded increases. ...

... the same. Other things remaining the same, • When the price level rises, the quantity of real GDP demanded decreases. • When the price level falls, the quantity of real GDP demanded increases. ...

time lags

... optimism on the part of households and firms or through very aggressive behavior on the part of the Fed, but because neither of these situations is very plausible, the multiplier is likely to be greater than zero. Thus, it is likely that to lower the deficit by a certain amount, the cut in governmen ...

... optimism on the part of households and firms or through very aggressive behavior on the part of the Fed, but because neither of these situations is very plausible, the multiplier is likely to be greater than zero. Thus, it is likely that to lower the deficit by a certain amount, the cut in governmen ...

MEASURING PRODUCTION AND INCOME, Chapter 2

... thereby private investment, aggregate demand and output. 9.1.2B. The small open economy with its own currency. The interest rate is fixed but the exchange rate is flexible. Main lesson: Fiscal policy is less effective in a small open economy. Increased government spending or lower net taxes increase ...

... thereby private investment, aggregate demand and output. 9.1.2B. The small open economy with its own currency. The interest rate is fixed but the exchange rate is flexible. Main lesson: Fiscal policy is less effective in a small open economy. Increased government spending or lower net taxes increase ...

2009-II CENTRAL BANK OF THE REPUBLIC OF TURKEY

... recovery” scenario (with recovery starting in the third quarter) was dropped because global economic growth forecasts were continuously revised downward over last three months. ...

... recovery” scenario (with recovery starting in the third quarter) was dropped because global economic growth forecasts were continuously revised downward over last three months. ...

International Trade and Capital

... tobacco, which is another inflationary component in the non-food product group, increased by 11% yoy due to increasing excises tariffs. Thereafter, prices for non-food stuffs grew by 5.9% yoy in March, contributing another third to the annual growth of inflation. Services tariffs grew by 10.7% yoy, ...

... tobacco, which is another inflationary component in the non-food product group, increased by 11% yoy due to increasing excises tariffs. Thereafter, prices for non-food stuffs grew by 5.9% yoy in March, contributing another third to the annual growth of inflation. Services tariffs grew by 10.7% yoy, ...

Rare Events and the Equity-Premium Puzzle

... demobilizations with substantial declines in government purchases, work effort, and capital utilization and—with the exception of Canada after World War I—did not feature substantial decreases in consumption.5 Therefore, except for Canada in 1917-21, these cases are not applicable to my analysis. Al ...

... demobilizations with substantial declines in government purchases, work effort, and capital utilization and—with the exception of Canada after World War I—did not feature substantial decreases in consumption.5 Therefore, except for Canada in 1917-21, these cases are not applicable to my analysis. Al ...

NBER WORKING PAPER SERIES ADJUSTING DEPRECIATION IN AN INFLATIONARY

... inflation rates reduce the real value of future depreciationdeductions and therefore raise the real net cost of investment. The calculations in this paper show that this rise in the net cost can be quite substantial at recent inflation rates; e.g., the real net cost of an equipment investment with a ...

... inflation rates reduce the real value of future depreciationdeductions and therefore raise the real net cost of investment. The calculations in this paper show that this rise in the net cost can be quite substantial at recent inflation rates; e.g., the real net cost of an equipment investment with a ...

The effect of asset price volatility on fiscal policy outcomes

... volatility has a positive effect on the volatility fiscal policy, though the effect is not significant. The bigger the government size the more volatile government spending is, which implies a more active stabilizing role for fiscal policy. More open economies have ...

... volatility has a positive effect on the volatility fiscal policy, though the effect is not significant. The bigger the government size the more volatile government spending is, which implies a more active stabilizing role for fiscal policy. More open economies have ...

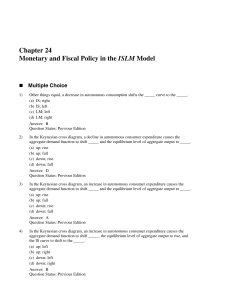

Chapter 24 Monetary and Fiscal Policy in the ISLM Model

... (a) changes in autonomous consumer spending. (b) changes in government spending. (c) changes in investment spending related to a change in the interest rate. (d) only (a) and (b) of the above. Answer: D Question Status: Previous Edition ...

... (a) changes in autonomous consumer spending. (b) changes in government spending. (c) changes in investment spending related to a change in the interest rate. (d) only (a) and (b) of the above. Answer: D Question Status: Previous Edition ...

This PDF is a selection from an out-of-print volume from the... of Economic Research

... we know that if agents have infinite horizons, interest rates may depend neither on debt nor on deficits. The main element of the model is thus the derivation of an aggregate consumption function which does not satisfy RicardoBarro equivalence. The model shows that long real rates depend on the anti ...

... we know that if agents have infinite horizons, interest rates may depend neither on debt nor on deficits. The main element of the model is thus the derivation of an aggregate consumption function which does not satisfy RicardoBarro equivalence. The model shows that long real rates depend on the anti ...

Assessing the Equilibrium Exchange Rate of the Cyprus Pound at

... Exchange rate policy in Cyprus was historically geared towards maintaining macroeconomic stability through the linkage of the Cyprus pound with a currency anchor, either a single currency or a basket of currencies. The currency anchor changed several times. During the period of 1963 – 1972 the Cypru ...

... Exchange rate policy in Cyprus was historically geared towards maintaining macroeconomic stability through the linkage of the Cyprus pound with a currency anchor, either a single currency or a basket of currencies. The currency anchor changed several times. During the period of 1963 – 1972 the Cypru ...

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.Further goals of a monetary policy are usually to contribute to economic growth and stability, to lower unemployment, and to maintain predictable exchange rates with other currencies.Monetary economics provides insight into how to craft optimal monetary policy.Monetary policy is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in order to avoid the resulting distortions and deterioration of asset values.Monetary policy differs from fiscal policy, which refers to taxation, government spending, and associated borrowing.