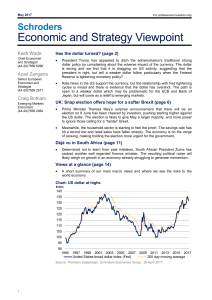

Economic and Strategy Viewpoint

... Theresa May has complained that “other parties and members of the House of Lords have sought to frustrate the process”. However, while there has been some protest over May’s relatively “hard” Brexit plans, the House of Commons voted to back the triggering of Article 50, and the House of Lords did li ...

... Theresa May has complained that “other parties and members of the House of Lords have sought to frustrate the process”. However, while there has been some protest over May’s relatively “hard” Brexit plans, the House of Commons voted to back the triggering of Article 50, and the House of Lords did li ...

Currency Depreciation, Speculation, Economic fundamentals

... b) Spot Speculation: According to Ghosh (2003), spot speculation is the instance where the investor buys or sells forex in the spot market today in the hopes of making profits in the future by taking the opposite position in the future spot market. If a participant speculates in the spot market, his ...

... b) Spot Speculation: According to Ghosh (2003), spot speculation is the instance where the investor buys or sells forex in the spot market today in the hopes of making profits in the future by taking the opposite position in the future spot market. If a participant speculates in the spot market, his ...

Lecture 15

... The government spending multiplier measures the change in GDP caused by a given change in government spending or net taxes. Because it takes time for the multiplier to reach its full value, there is a lag between the time a fiscal policy action is initiated and the time the full change in GDP is rea ...

... The government spending multiplier measures the change in GDP caused by a given change in government spending or net taxes. Because it takes time for the multiplier to reach its full value, there is a lag between the time a fiscal policy action is initiated and the time the full change in GDP is rea ...

Measuring Unemployment

... Reduces the ability to make long-term plans • The more variable and unpredictable inflation is, the greater the difficulty of negotiating long-term ...

... Reduces the ability to make long-term plans • The more variable and unpredictable inflation is, the greater the difficulty of negotiating long-term ...

PART I: Multiple Choice/Fill-In

... Keynesians, what phenomenon increases the volatility of firms’ investment decisions? Three factors that affect firms’ investment and employment decisions are: 1) the wage rate and the rental rate of capital; 2) firms’ expectations of future output levels; and 3) the amount of excess labor and excess ...

... Keynesians, what phenomenon increases the volatility of firms’ investment decisions? Three factors that affect firms’ investment and employment decisions are: 1) the wage rate and the rental rate of capital; 2) firms’ expectations of future output levels; and 3) the amount of excess labor and excess ...

Page 122 (4,11,12,13) Page 144 (2, 4, 6, 9, 10,11) 6‑4 What is the

... to get unemployment down from the unforgivable 8 percent. However, the weakness in spending resulting from an 8% unemployment rate might push the economy into deflation, which would ultimately exacerbate the weak economic conditions. ...

... to get unemployment down from the unforgivable 8 percent. However, the weakness in spending resulting from an 8% unemployment rate might push the economy into deflation, which would ultimately exacerbate the weak economic conditions. ...

Macro Quiz 5.tst

... 23) A decrease in the expected inflation rate shifts the short-run Phillips curve A) downward and shifts the long-run Phillips curve leftward. B) upward and shifts long-run Phillips curve rightward. C) upward and creates a movement upward along the long-run Phillips curve. D) downward and creates a ...

... 23) A decrease in the expected inflation rate shifts the short-run Phillips curve A) downward and shifts the long-run Phillips curve leftward. B) upward and shifts long-run Phillips curve rightward. C) upward and creates a movement upward along the long-run Phillips curve. D) downward and creates a ...

NBER WORKING PAPER SERIES INTERNATIONAL BALANCE OF PAYMENTS FINANCING AND Willem H. Buiter

... there are two types of countries, one characterized by a low inflation rate under financial autarky and another by a high inflation rate under financiai. autarky. We distinguish two cases, one in which gross international lending is always denominated in the currency of the lender, in which case res ...

... there are two types of countries, one characterized by a low inflation rate under financial autarky and another by a high inflation rate under financiai. autarky. We distinguish two cases, one in which gross international lending is always denominated in the currency of the lender, in which case res ...

Macroeconomic management and fiscal policy

... Central Bank must offset incipient appreciation by expanding money supply, thereby reinforcing initial fiscal stimulus Otherwise, exchange rate could not remain fixed ...

... Central Bank must offset incipient appreciation by expanding money supply, thereby reinforcing initial fiscal stimulus Otherwise, exchange rate could not remain fixed ...

a.s 3.4 - GHEconomics

... Why do you think investment and savings are so important in an economies growth? ...

... Why do you think investment and savings are so important in an economies growth? ...

Syllabus - Hill College

... depository institution funds transferred from a transactions account at another depository institution. 67. Explain why the money supply changes when someone deposits in a depository institution funds transferred from the Federal Reserve System. 68. Determine the maximum potential extent to which th ...

... depository institution funds transferred from a transactions account at another depository institution. 67. Explain why the money supply changes when someone deposits in a depository institution funds transferred from the Federal Reserve System. 68. Determine the maximum potential extent to which th ...

Money, Output, and Prices

... Initially, both markets are in equilibrium. Now, suppose that the Fed increases the money supply by 10%. With prices fixed in the short run, real money supply increases – this pushes interest rates down Lower interest rates raise consumer expenditures (savings rate falls) and raises investment expen ...

... Initially, both markets are in equilibrium. Now, suppose that the Fed increases the money supply by 10%. With prices fixed in the short run, real money supply increases – this pushes interest rates down Lower interest rates raise consumer expenditures (savings rate falls) and raises investment expen ...

Power Point ( 594K ) - St. Louis Fed

... The Federal Open Market Committee decided today to lower its target for the federal funds rate 50 basis points to 3 percent. Financial markets remain under considerable stress, and credit has tightened further for some businesses and households. Moreover, recent information indicates a deepening of ...

... The Federal Open Market Committee decided today to lower its target for the federal funds rate 50 basis points to 3 percent. Financial markets remain under considerable stress, and credit has tightened further for some businesses and households. Moreover, recent information indicates a deepening of ...

5 - Weber State University

... 4) In Figure 5-1, if the budget line is BB0 and the natural real GDP is $5300, the structural surplus or deficit is A) FC. B) AD. C) FA. D) none of the above. 5) In Figure 5-1, if the budget line BB0, the natural real GDP is $5300, and actual real GDP is $5000, then the cyclical budget surplus or d ...

... 4) In Figure 5-1, if the budget line is BB0 and the natural real GDP is $5300, the structural surplus or deficit is A) FC. B) AD. C) FA. D) none of the above. 5) In Figure 5-1, if the budget line BB0, the natural real GDP is $5300, and actual real GDP is $5000, then the cyclical budget surplus or d ...

Inflation

... The use of nominal dollars rather than real dollars to gauge changes in one’s income or wealth is called the money illusion. Even people whose nominal incomes keep up with inflation often feel oppressed by rising prices. They feel cheated when they discover that their higher nominal wages don’t buy ...

... The use of nominal dollars rather than real dollars to gauge changes in one’s income or wealth is called the money illusion. Even people whose nominal incomes keep up with inflation often feel oppressed by rising prices. They feel cheated when they discover that their higher nominal wages don’t buy ...

And Don`t Forget Your Final Project (worth 25 points)!

... Over these past few weeks you have learned about economics in general and what impact that it can affect you. As we help you transition to either the personal finance portion of this course or your own economic independence we wanted you to practice some of the skills necessary as part of your final ...

... Over these past few weeks you have learned about economics in general and what impact that it can affect you. As we help you transition to either the personal finance portion of this course or your own economic independence we wanted you to practice some of the skills necessary as part of your final ...

In 2000 in the United Kingdom, the adult population was about 46

... 5. If the reserve ratio is 100 percent, depositing $500 of paper money in a bank will eventually increase the money supply by a. $5,000. b. $1,000. c. $500. d. $0. ...

... 5. If the reserve ratio is 100 percent, depositing $500 of paper money in a bank will eventually increase the money supply by a. $5,000. b. $1,000. c. $500. d. $0. ...

In 2000 in the United Kingdom, the adult population was about 46

... a36. In recent years, inflation expectations have fallen. This has shifted the short-run Phillips curve a. left, meaning that at any given inflation rate unemployment will be lower in the short run than before. b. right, meaning that at any given inflation rate unemployment will be lower in the sho ...

... a36. In recent years, inflation expectations have fallen. This has shifted the short-run Phillips curve a. left, meaning that at any given inflation rate unemployment will be lower in the short run than before. b. right, meaning that at any given inflation rate unemployment will be lower in the sho ...

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.Further goals of a monetary policy are usually to contribute to economic growth and stability, to lower unemployment, and to maintain predictable exchange rates with other currencies.Monetary economics provides insight into how to craft optimal monetary policy.Monetary policy is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in order to avoid the resulting distortions and deterioration of asset values.Monetary policy differs from fiscal policy, which refers to taxation, government spending, and associated borrowing.