Download paper (PDF)

... and Greenspan. This implies that our estimate of 1.5 for the open economy relative multiplier is perfectly consistent with much lower existing estimates of the closed economy aggregate multiplier (e.g., those of Barro and Redlick 2011). Since the nominal interest rate is fixed across regions in our ...

... and Greenspan. This implies that our estimate of 1.5 for the open economy relative multiplier is perfectly consistent with much lower existing estimates of the closed economy aggregate multiplier (e.g., those of Barro and Redlick 2011). Since the nominal interest rate is fixed across regions in our ...

mmi14-vanveen 19106661 en

... becomes insignificantly different from zero (see for example Kool and Keijzer, 2009). The 2008 global financial crisis and the subsequent sovereign debt crisis in the euro area have destroyed the previous consensus that cross- country macroeconomic imbalances are innocuous or even exclusively advant ...

... becomes insignificantly different from zero (see for example Kool and Keijzer, 2009). The 2008 global financial crisis and the subsequent sovereign debt crisis in the euro area have destroyed the previous consensus that cross- country macroeconomic imbalances are innocuous or even exclusively advant ...

Chapter 16

... Monetary Stability If the government picks an exchange rate that is too low, it is paying more for its imports than it needs to and is building up official reserves. Some other country is losing official reserves. ...

... Monetary Stability If the government picks an exchange rate that is too low, it is paying more for its imports than it needs to and is building up official reserves. Some other country is losing official reserves. ...

Optimal Time-Consistent Monetary, Fiscal and Debt Maturity Policy ∗ Eric M. Leeper

... consumption and eliminate tax and other distortions (the so-called ‘war chest’ level). Secondly, starting from levels of debt consistent with currently observed debt to GDP ratios, the optimal time-consistent policy will gradually reduce that debt, but with large increases in inflation and radical c ...

... consumption and eliminate tax and other distortions (the so-called ‘war chest’ level). Secondly, starting from levels of debt consistent with currently observed debt to GDP ratios, the optimal time-consistent policy will gradually reduce that debt, but with large increases in inflation and radical c ...

INFLATION IN VIETNAM

... most prominent success of this innovation was the success of combined various supply-side policies somewhat helped ease the excess demand strain and eventually the inflation rate suddenly dropped to 37.7% in 1989. This can be considered as the initial success of the innovation program, triggering a ...

... most prominent success of this innovation was the success of combined various supply-side policies somewhat helped ease the excess demand strain and eventually the inflation rate suddenly dropped to 37.7% in 1989. This can be considered as the initial success of the innovation program, triggering a ...

Buford High School CURRICULUM CALENDAR 2015

... Activity: "Division of Labor" using paper activity Vocabulary (voluntary trade, assembly line production, efficiency, productivity - how are they all similar) - Discussion Intro/Review: How does specialization make an economy more efficient? Written assignment Show GCEE clip on how the three ...

... Activity: "Division of Labor" using paper activity Vocabulary (voluntary trade, assembly line production, efficiency, productivity - how are they all similar) - Discussion Intro/Review: How does specialization make an economy more efficient? Written assignment Show GCEE clip on how the three ...

Fiscal Multiplier in a Liquidity Constrained New Keynesian Economy∗

... savings by holding more liquid government bonds. In the standard model, investment falls since the higher real interest rate increases the opportunity cost of investing in physical capital, thus the …scal multiplier is less than 1. In the DEFK model, the multiplier is large for two reasons. First, u ...

... savings by holding more liquid government bonds. In the standard model, investment falls since the higher real interest rate increases the opportunity cost of investing in physical capital, thus the …scal multiplier is less than 1. In the DEFK model, the multiplier is large for two reasons. First, u ...

The Education of Ben Bernanke

... be made that he has made many more right moves than wrong ones. The current crisis is a hangover from a half-decade of heady speculation in both housing and home mortgages and does not necessarily admit to a speedy fix. Moreover, it has fallen into Bernanke’s lap just as oil prices have spiked to a ...

... be made that he has made many more right moves than wrong ones. The current crisis is a hangover from a half-decade of heady speculation in both housing and home mortgages and does not necessarily admit to a speedy fix. Moreover, it has fallen into Bernanke’s lap just as oil prices have spiked to a ...

FREE Sample Here - We can offer most test bank and

... http://gettestbank.eu/Test-Bank-for-Macroeconomics,-4th-Edition-Stephen-Williamson 42) Unemployment, at the aggregate level., A) is avoidable. B) is part of a well-functioning economy. C) is always a sign of market failure. D) would not happen with good policy. Answer: B Question Status: New 43) A t ...

... http://gettestbank.eu/Test-Bank-for-Macroeconomics,-4th-Edition-Stephen-Williamson 42) Unemployment, at the aggregate level., A) is avoidable. B) is part of a well-functioning economy. C) is always a sign of market failure. D) would not happen with good policy. Answer: B Question Status: New 43) A t ...

Government Spending Effects in Low-income Countries

... Government spending is an important policy tool for countries of all income levels. Relative to other countries, low-income countries (LICs), however, have specific features and needs that may shape the macroeconomic effects of fiscal policy in a particular way. In LICs, for instance, pressing devel ...

... Government spending is an important policy tool for countries of all income levels. Relative to other countries, low-income countries (LICs), however, have specific features and needs that may shape the macroeconomic effects of fiscal policy in a particular way. In LICs, for instance, pressing devel ...

Investment Hangover and the Great Recession

... policy plays a central role in the aggregate reallocation mechanism. If in‡ation cannot increase in the short run— an assumption that we maintain— then the real interest rate can fall and counter the demand shock only if the monetary policy lowers the nominal interest rate. In practice, many constra ...

... policy plays a central role in the aggregate reallocation mechanism. If in‡ation cannot increase in the short run— an assumption that we maintain— then the real interest rate can fall and counter the demand shock only if the monetary policy lowers the nominal interest rate. In practice, many constra ...

Core Inflation: Concepts, Uses and Measurement

... First, as Keynes notes “[c]hanges in relative prices may, of course, affect partial indexnumbers which represent price changes in particular classes of things, e.g. the index of the cost of living of the working classes.”12 Since all price indices produced by statistical agencies can be regarded as ...

... First, as Keynes notes “[c]hanges in relative prices may, of course, affect partial indexnumbers which represent price changes in particular classes of things, e.g. the index of the cost of living of the working classes.”12 Since all price indices produced by statistical agencies can be regarded as ...

chapter 6 - McGraw

... Of course, the art of using a simplified model lies in knowing when the simplifications are safe to make and when they are not. As Box 6-1 explains, when output is well above potential output the short-run aggregate supply curve slopes upward significantly. In this situation the assumption of a hori ...

... Of course, the art of using a simplified model lies in knowing when the simplifications are safe to make and when they are not. As Box 6-1 explains, when output is well above potential output the short-run aggregate supply curve slopes upward significantly. In this situation the assumption of a hori ...

"Fiscal Stimulus in a Monetary Union: Evidence from U.S. Regions"

... and Greenspan. This implies that our estimate of 1.5 for the open economy relative multiplier is perfectly consistent with much lower existing estimates of the closed economy aggregate multiplier (e.g., those of Barro and Redlick 2011). Since the nominal interest rate is fixed across regions in our ...

... and Greenspan. This implies that our estimate of 1.5 for the open economy relative multiplier is perfectly consistent with much lower existing estimates of the closed economy aggregate multiplier (e.g., those of Barro and Redlick 2011). Since the nominal interest rate is fixed across regions in our ...

Can Government Really Stabilize the Economy?

... 3. How does the classical school use the quantity theory of money equation to find the money supply growth rate that is consistent with zero inflation? • In this view, inflation occurs when the annual rate of growth in the money supply exceeds the annual rate of growth of fullemployment real GDP. Go ...

... 3. How does the classical school use the quantity theory of money equation to find the money supply growth rate that is consistent with zero inflation? • In this view, inflation occurs when the annual rate of growth in the money supply exceeds the annual rate of growth of fullemployment real GDP. Go ...

PDF Download

... countries can still be identified accounting wise to measure and evaluate current account imbalances and net capital flows. A more accommodative environment for the emergence of such imbalances can hardly be envisaged. Second, the euro area suffers more from the absence of automatic adjustment mecha ...

... countries can still be identified accounting wise to measure and evaluate current account imbalances and net capital flows. A more accommodative environment for the emergence of such imbalances can hardly be envisaged. Second, the euro area suffers more from the absence of automatic adjustment mecha ...

Inflation`s next phase - JP Morgan Asset Management

... 1970s and into the 1980s are overlaid, essentially on top of each other. EXHIBIT 7 also illustrates this idea, by comparing overall U.S. CPI inflation rates for the 1958–92 period with core inflation rates lagged three months. The strong relationship shown in the exhibit suggests that shocks to the ...

... 1970s and into the 1980s are overlaid, essentially on top of each other. EXHIBIT 7 also illustrates this idea, by comparing overall U.S. CPI inflation rates for the 1958–92 period with core inflation rates lagged three months. The strong relationship shown in the exhibit suggests that shocks to the ...

the aggregate demand curve

... curve—a curve that traces out the price decisions and output decisions of all the markets and firms in the economy under a given set of circumstances • The AS curve is not the sum of all the individual supply curves in ...

... curve—a curve that traces out the price decisions and output decisions of all the markets and firms in the economy under a given set of circumstances • The AS curve is not the sum of all the individual supply curves in ...

CHAPTER 1

... 60. When the price level changes for a given supply of nominal money balances, the supply of real balances changes. This effect is called the a. wealth effect. b. constant nominal income effect. c. substitution of foreign goods effect. d. investment effect. ANSWER: a 61. Changes in the price level n ...

... 60. When the price level changes for a given supply of nominal money balances, the supply of real balances changes. This effect is called the a. wealth effect. b. constant nominal income effect. c. substitution of foreign goods effect. d. investment effect. ANSWER: a 61. Changes in the price level n ...

PRIVATE CAPITAL FLOWS AND THE REAL EXCHANGE RATE IN

... with the appreciation of the real exchange rate. However, other case studies do not conclude to a real appreciation of the exchange rate associated with public flows [Bandara (1995) in Sri Lanka; Nyoni (1998) and Li and Rowe (2007) in Tanzania; Aiyar et al., (2007) in Ethiopia, Ghana, Mozambique, Ta ...

... with the appreciation of the real exchange rate. However, other case studies do not conclude to a real appreciation of the exchange rate associated with public flows [Bandara (1995) in Sri Lanka; Nyoni (1998) and Li and Rowe (2007) in Tanzania; Aiyar et al., (2007) in Ethiopia, Ghana, Mozambique, Ta ...

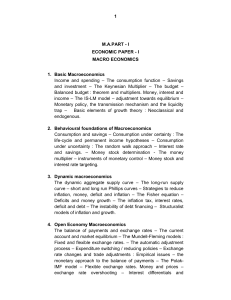

1 M.A.PART - I ECONOMIC PAPER

... The concept of Investment has much significance in macro economic analysis. Investment is linked to the concept of savings. This concept of Investment has different meanings. Generally, it is considered as that part of money which is used for purchasing assets. It can also be termed as money spent o ...

... The concept of Investment has much significance in macro economic analysis. Investment is linked to the concept of savings. This concept of Investment has different meanings. Generally, it is considered as that part of money which is used for purchasing assets. It can also be termed as money spent o ...

Monetary policy

Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting an inflation rate or interest rate to ensure price stability and general trust in the currency.Further goals of a monetary policy are usually to contribute to economic growth and stability, to lower unemployment, and to maintain predictable exchange rates with other currencies.Monetary economics provides insight into how to craft optimal monetary policy.Monetary policy is referred to as either being expansionary or contractionary, where an expansionary policy increases the total supply of money in the economy more rapidly than usual, and contractionary policy expands the money supply more slowly than usual or even shrinks it. Expansionary policy is traditionally used to try to combat unemployment in a recession by lowering interest rates in the hope that easy credit will entice businesses into expanding. Contractionary policy is intended to slow inflation in order to avoid the resulting distortions and deterioration of asset values.Monetary policy differs from fiscal policy, which refers to taxation, government spending, and associated borrowing.