Economics R. Glenn Hubbard, Anthony Patrick O'Brien, 2e.

... The monetarist model—also known as the neo-Quantity Theory of Money model—was developed beginning in the 1940s by Milton Friedman, an economist at the University of Chicago who was awarded the Nobel Prize in Economics in 1976. Monetary growth rule A plan for increasing the quantity of money at a fix ...

... The monetarist model—also known as the neo-Quantity Theory of Money model—was developed beginning in the 1940s by Milton Friedman, an economist at the University of Chicago who was awarded the Nobel Prize in Economics in 1976. Monetary growth rule A plan for increasing the quantity of money at a fix ...

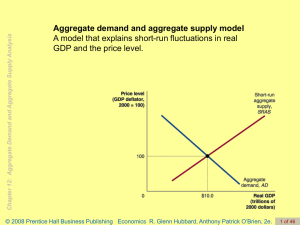

Lecture Notes on Macroeconomic Principles

... different points in time, the interest rates on these investments or loans must also be corrected for the effects of inflation to gauge their true economic significance. Suppose, for example, that you deposit $1,000 in a bank account that pays interest at a 10% annual rate: ...

... different points in time, the interest rates on these investments or loans must also be corrected for the effects of inflation to gauge their true economic significance. Suppose, for example, that you deposit $1,000 in a bank account that pays interest at a 10% annual rate: ...

Commodity Price Supercycles: What Are They and

... Bahattin Büyükşahin, Kun Mo and Konrad Zmitrowicz, International Economic Analysis Department Commodity prices tend to go through extended periods of boom and bust, known as supercycles. In general, commodity price movements are important for Canada because they help determine the country’s terms ...

... Bahattin Büyükşahin, Kun Mo and Konrad Zmitrowicz, International Economic Analysis Department Commodity prices tend to go through extended periods of boom and bust, known as supercycles. In general, commodity price movements are important for Canada because they help determine the country’s terms ...

Macro Review - Harvard Kennedy School

... • is another instrument to affect the level of spending. • It can be defined in terms of the interest rate i, which in turn affects i-sensitive components E.g., Taylor Rule sets i. such as I & consumer durables. • Or it can be defined in terms of money supply M. – In which case an expansion is a rig ...

... • is another instrument to affect the level of spending. • It can be defined in terms of the interest rate i, which in turn affects i-sensitive components E.g., Taylor Rule sets i. such as I & consumer durables. • Or it can be defined in terms of money supply M. – In which case an expansion is a rig ...

Title Tales of Expansionary Fiscal Contractions in Two European

... It might be noted at this stage that the channel through which an expansionary effect is produced. It was through an increase in wealth and consumption. Later it will be explained that for Keynes and his contemporary emphasis the investment channel was seen as the important one for confidence. Turne ...

... It might be noted at this stage that the channel through which an expansionary effect is produced. It was through an increase in wealth and consumption. Later it will be explained that for Keynes and his contemporary emphasis the investment channel was seen as the important one for confidence. Turne ...

MONETARY POLICY AND THE ECONOMY First

... On examining the structure of the Fed, you might naturally ask, “In which of the three branches of government does the Fed lie?” The answer is interesting. Although nominally a corporation owned by the commercial banks that are members of the Federal Reserve System, the Federal Reserve is in practic ...

... On examining the structure of the Fed, you might naturally ask, “In which of the three branches of government does the Fed lie?” The answer is interesting. Although nominally a corporation owned by the commercial banks that are members of the Federal Reserve System, the Federal Reserve is in practic ...

Government Size and Economic Growth in Italy: A Time

... of the public sector (measured by the share of government expenditure over GDP) and the economic growth rate for Italy. In general, the presence of an inverted “U-shape” curve, which emerges for the last two decades, suggests that expenditure cuts might be faster than GDP dynamic. This result is in ...

... of the public sector (measured by the share of government expenditure over GDP) and the economic growth rate for Italy. In general, the presence of an inverted “U-shape” curve, which emerges for the last two decades, suggests that expenditure cuts might be faster than GDP dynamic. This result is in ...

Harvard Kennedy School

... You lend to the Indian company in the form of cash dollars, which they don’t have to pay back for 30 days => debit appears on US short-term capital account. You are the Central Bank, and you buy securities of the Indian company (an improbable example for the Fed – but “Sovereign Wealth Funds,” f ...

... You lend to the Indian company in the form of cash dollars, which they don’t have to pay back for 30 days => debit appears on US short-term capital account. You are the Central Bank, and you buy securities of the Indian company (an improbable example for the Fed – but “Sovereign Wealth Funds,” f ...

banking crises in latin america and the political economy

... The countries of Latin America and Caribbean (LAC) have suffered numerous episodes of financial sector difficulties. While it is not clear that these countries have suffered a disproportionate number of such episodes in relation to comparable developing countries, their frequency, severity and tende ...

... The countries of Latin America and Caribbean (LAC) have suffered numerous episodes of financial sector difficulties. While it is not clear that these countries have suffered a disproportionate number of such episodes in relation to comparable developing countries, their frequency, severity and tende ...

UNIVERSITY OF CALICUT (Abstract)

... more about himself and his societal environment. Economics is no exception to this process of evolution. A number of developments in the form of new theories and applications have already taken place in economics during the past few decades with a view to understand the economy, its actors their beh ...

... more about himself and his societal environment. Economics is no exception to this process of evolution. A number of developments in the form of new theories and applications have already taken place in economics during the past few decades with a view to understand the economy, its actors their beh ...

PDF file

... and opening up the goods and Þnancial markets. In particular there was a shift from a managed exchange rate regime to an almost entirely ßexible exchange rate (within a very wide band of more that 50%), with practically no intervention in the market. ...

... and opening up the goods and Þnancial markets. In particular there was a shift from a managed exchange rate regime to an almost entirely ßexible exchange rate (within a very wide band of more that 50%), with practically no intervention in the market. ...

Entrepreneurship Impact on Economic Growth in Emerging Countries

... defined and simultaneously the stage of economic development. (Klapper, L.F.and Love, I., 2011). As entrepreneurship can either be defined as “necessity entrepreneurship,” which is having to become an entrepreneur because you have no other better job opportunities ( the refugee effect), or as “oppor ...

... defined and simultaneously the stage of economic development. (Klapper, L.F.and Love, I., 2011). As entrepreneurship can either be defined as “necessity entrepreneurship,” which is having to become an entrepreneur because you have no other better job opportunities ( the refugee effect), or as “oppor ...

The Wheat Boom and Economic Prosperity in Early 20th Century

... boom of 1896to 1913had contributed to the rapid economic development experienced in Canada during the early 20th century. The period from 1896 to 1913 was one in which Canadaexperiencedboth an increasein wheat production and exports as well as rapid intensive and extensive economic growth throughout ...

... boom of 1896to 1913had contributed to the rapid economic development experienced in Canada during the early 20th century. The period from 1896 to 1913 was one in which Canadaexperiencedboth an increasein wheat production and exports as well as rapid intensive and extensive economic growth throughout ...

effectiveness of monetary policy tools in

... maintain a sound market-based financial system. This study set to establish the effectiveness of monetary policy tools in countering inflation in Kenya. The study employed correlational research design. The study used time series empirical data on the variables to describe and examine the effectiven ...

... maintain a sound market-based financial system. This study set to establish the effectiveness of monetary policy tools in countering inflation in Kenya. The study employed correlational research design. The study used time series empirical data on the variables to describe and examine the effectiven ...

1. Introduction Well documented stylized facts regarding observed

... the stylized facts, standard RBC models consistently generate lower variability in employment and lower persistence in unemployment. Prescott (1986) reported that observed employment is twice as volatile as the one simulated from the standard RBC economy. Standard RBC models generate a substantially ...

... the stylized facts, standard RBC models consistently generate lower variability in employment and lower persistence in unemployment. Prescott (1986) reported that observed employment is twice as volatile as the one simulated from the standard RBC economy. Standard RBC models generate a substantially ...

The Impact of the Financial Crisis on the Real Economy

... What is the reason for these differences? German enterprises have invested greatly in the skills of their labour force and therefore hold on to their skilled workers even if some of them are temporarily not needed. Generous provisions ...

... What is the reason for these differences? German enterprises have invested greatly in the skills of their labour force and therefore hold on to their skilled workers even if some of them are temporarily not needed. Generous provisions ...

monthly and quarterly gdp estimates for interwar britain

... sustained recovery is not clear until well into 1933. The turning points of the 1937-8 recession are also different from those outlined in Burns and Mitchell who date the peak as September 1937. The new data suggest that GDP continued to expand until January 1938. Such differences may seem minor in ...

... sustained recovery is not clear until well into 1933. The turning points of the 1937-8 recession are also different from those outlined in Burns and Mitchell who date the peak as September 1937. The new data suggest that GDP continued to expand until January 1938. Such differences may seem minor in ...

The Impact of the Financial Crisis on the Real Economy

... What is the reason for these differences? German enterprises have invested greatly in the skills of their labour force and therefore hold on to their skilled workers even if some of them are temporarily not needed. Generous provisions ...

... What is the reason for these differences? German enterprises have invested greatly in the skills of their labour force and therefore hold on to their skilled workers even if some of them are temporarily not needed. Generous provisions ...