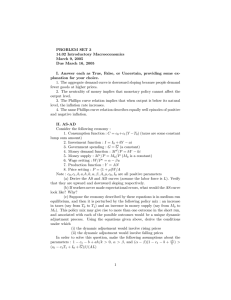

PROBLEM SET 3 14.02 Introductory Macroeconomics March 9, 2005 Due March 16, 2005

... equilibrium, and then it is perturbed by the following policy mix : an increase in taxes (say from T0 to T1 ) and an increase in money supply (say from M0 to M1 ). This policy mix may give rise to more than one outcome in the short run, and associated with each of the possible outcomes would be a un ...

... equilibrium, and then it is perturbed by the following policy mix : an increase in taxes (say from T0 to T1 ) and an increase in money supply (say from M0 to M1 ). This policy mix may give rise to more than one outcome in the short run, and associated with each of the possible outcomes would be a un ...

Bowling Green, Kentucky AP Macro Economics Summer Institute

... • Introductions/Experience/Expectations • What is the AP test? • Resources • Course overview: The Acorn Book; The AP exams: What to assign; How much can you expect to cover; Evaluation of textbooks, Discussion of College Board open admission policies and course audit. Basic concepts for both Micro a ...

... • Introductions/Experience/Expectations • What is the AP test? • Resources • Course overview: The Acorn Book; The AP exams: What to assign; How much can you expect to cover; Evaluation of textbooks, Discussion of College Board open admission policies and course audit. Basic concepts for both Micro a ...

the fed, fiscal, monetary policy, keynes

... Hayek said booms and busts were a regular economic cycle and should NOT be regulated by the government. Booms are a result of overspending (through credit) and the bust is the natural way the economy corrects itself. Keynes v. Hayek rap Keynes v. Hayek rap pt. 2 ...

... Hayek said booms and busts were a regular economic cycle and should NOT be regulated by the government. Booms are a result of overspending (through credit) and the bust is the natural way the economy corrects itself. Keynes v. Hayek rap Keynes v. Hayek rap pt. 2 ...

The Government and Fiscal Policy

... output but by how much? balanced-budget multiplier The ratio of change in the equilibrium level of output to a change in government spending where the change in government spending is balanced by a change in taxes so as not to create any deficit • The balanced-budget multiplier is equal to 1: The ...

... output but by how much? balanced-budget multiplier The ratio of change in the equilibrium level of output to a change in government spending where the change in government spending is balanced by a change in taxes so as not to create any deficit • The balanced-budget multiplier is equal to 1: The ...

The Goods Market

... • Short run - period too short to allow prices to adjust - fixed prices - unemployment possible • Medium run - economy is always at full employment (labor market must adjust) prices adjust to bring economy back to full employment - capital stock is fixed • Long run - growth theory - capital stock in ...

... • Short run - period too short to allow prices to adjust - fixed prices - unemployment possible • Medium run - economy is always at full employment (labor market must adjust) prices adjust to bring economy back to full employment - capital stock is fixed • Long run - growth theory - capital stock in ...

Chapter 01 Economics: The Study of Opportunity Cost

... 9. M2 is the total amount of ____________________ in the economy. A. coin and paper currency B. coin, paper currency, and savings accounts C. coin, paper currency, savings accounts, and small CDs D. coin, paper currency, savings accounts, small CDs, and large CDs 10. M3 is the total amount of ______ ...

... 9. M2 is the total amount of ____________________ in the economy. A. coin and paper currency B. coin, paper currency, and savings accounts C. coin, paper currency, savings accounts, and small CDs D. coin, paper currency, savings accounts, small CDs, and large CDs 10. M3 is the total amount of ______ ...

Ch. 3 Notes

... An important measure of a country’s economic health is its _____________ ___________, or _________________ The total value of the goods and services produced in a country in a given year is called its gross domestic product. The United States has a very ______ GDP. Calculating GDP (4 main areas) ...

... An important measure of a country’s economic health is its _____________ ___________, or _________________ The total value of the goods and services produced in a country in a given year is called its gross domestic product. The United States has a very ______ GDP. Calculating GDP (4 main areas) ...

International Finance

... The three markets are required to be in equilibrium: the supply should equal demand in all those markets. Otherwise, the economy will face problems such as unemployment, inflation etc. ...

... The three markets are required to be in equilibrium: the supply should equal demand in all those markets. Otherwise, the economy will face problems such as unemployment, inflation etc. ...

aemodel

... Excess supply and excess demand are not equally strong forces in the labor market. The supply of workers is such that firms can always get the labor they require (at some price), but workers can do nothing to promote their own employment. He argues that the supply curve of labor may have no influenc ...

... Excess supply and excess demand are not equally strong forces in the labor market. The supply of workers is such that firms can always get the labor they require (at some price), but workers can do nothing to promote their own employment. He argues that the supply curve of labor may have no influenc ...

Adam Czerniak, Ph.D. Department of Economics II - E-SGH

... Does the government run a budget deficit or surplus? What about the trade balance? How would the situation (income, budget and trade balance) change, if the marginal propensity to import increased to 0.2? e) How would the situation (income, budget and trade balance) change, if the marginal propensit ...

... Does the government run a budget deficit or surplus? What about the trade balance? How would the situation (income, budget and trade balance) change, if the marginal propensity to import increased to 0.2? e) How would the situation (income, budget and trade balance) change, if the marginal propensit ...

Chapter 16 Review - Duluth High School

... No role in the economy An expanded role in the economy A reduced role in the economy A role in monetary policies only ...

... No role in the economy An expanded role in the economy A reduced role in the economy A role in monetary policies only ...

BSF and the squeeze on capital spending July 20 2010

... • Trends in education spending and coming cuts • Changes in elements of schools spending • Implications of planned cuts in overall net investment • Tensions and challenges facing new government ...

... • Trends in education spending and coming cuts • Changes in elements of schools spending • Implications of planned cuts in overall net investment • Tensions and challenges facing new government ...

Fiscal Policy

... • Every dollar spent on a government bond is one fewer dollar that is available for businesses to borrow and invest. This encroachment on investment in the private sector is known as the crowding-out effect. • The larger the national debt, the more interest the government owes to bondholders. Dollar ...

... • Every dollar spent on a government bond is one fewer dollar that is available for businesses to borrow and invest. This encroachment on investment in the private sector is known as the crowding-out effect. • The larger the national debt, the more interest the government owes to bondholders. Dollar ...

Practice Test - MDC Faculty Web Pages

... 26. Suppose a government finances its expansionary fiscal policy by borrowing from the public. Joseph is concerned that this will increase the demand for loanable funds, drive up interest rates, and leave less loanable money available for consumers and businesses. Joseph is concerned about the: A) ...

... 26. Suppose a government finances its expansionary fiscal policy by borrowing from the public. Joseph is concerned that this will increase the demand for loanable funds, drive up interest rates, and leave less loanable money available for consumers and businesses. Joseph is concerned about the: A) ...

Chapter 19 Practice Quiz

... d. Change in equilibrium output (DY) = spending multiplier x change in investment expenditure. Rewritten, DY = 1/(1-0.90) x $100 billion = 10 x $100 billion. 9. Keynes’ criticism of the classical theory was that the Great Depression would not correct itself. The multiplier effect would restore an ec ...

... d. Change in equilibrium output (DY) = spending multiplier x change in investment expenditure. Rewritten, DY = 1/(1-0.90) x $100 billion = 10 x $100 billion. 9. Keynes’ criticism of the classical theory was that the Great Depression would not correct itself. The multiplier effect would restore an ec ...

Chapter 19 Practice Quiz

... d. Change in equilibrium output (DY) = spending multiplier x change in investment expenditure. Rewritten, DY = 1/(1-0.90) x $100 billion = 10 x $100 billion. 9. Keynes’ criticism of the classical theory was that the Great Depression would not correct itself. The multiplier effect would restore an ec ...

... d. Change in equilibrium output (DY) = spending multiplier x change in investment expenditure. Rewritten, DY = 1/(1-0.90) x $100 billion = 10 x $100 billion. 9. Keynes’ criticism of the classical theory was that the Great Depression would not correct itself. The multiplier effect would restore an ec ...

lecture notes - Livingston Public Schools

... Fiscal Policy, Deficits, and Debt 2. State and local finance policies may offset federal stabilization policies. They are often procyclical, because balanced-budget requirements cause states and local governments to raise taxes in a recession or cut spending making the recession possibly worse. In ...

... Fiscal Policy, Deficits, and Debt 2. State and local finance policies may offset federal stabilization policies. They are often procyclical, because balanced-budget requirements cause states and local governments to raise taxes in a recession or cut spending making the recession possibly worse. In ...

Economics on Main Street: Concepts for American Voters

... • if we spend like Canada and tax like Mexico . . . (current debate regarding extent of public sector) (starving the beast, or simply not paying our bills) ...

... • if we spend like Canada and tax like Mexico . . . (current debate regarding extent of public sector) (starving the beast, or simply not paying our bills) ...

Economics Principles and Applications - YSU

... • For now, in the short-run macro model, planned investment spending, government purchases, and net exports are all treated as given or fixed values ...

... • For now, in the short-run macro model, planned investment spending, government purchases, and net exports are all treated as given or fixed values ...

Unit 5 Review

... money supply, and interest rates. It will be especially effective when painful and unpopular decisions need to be made and will make them in a timely manner. This can be the central banking system. During recessions, impact the overall investment demand through tools that increase the incentive to b ...

... money supply, and interest rates. It will be especially effective when painful and unpopular decisions need to be made and will make them in a timely manner. This can be the central banking system. During recessions, impact the overall investment demand through tools that increase the incentive to b ...

Macroeconomics

... If AD decreases, recession and cyclical unemployment may result Wage contracts are not flexible, business can’t afford to reduce prices Employers are reluctant to cut wages b/c impact on EE effort Minimum Wage Laws keep wages up Menu Costs are difficult to change Fear of price wars keeps prices from ...

... If AD decreases, recession and cyclical unemployment may result Wage contracts are not flexible, business can’t afford to reduce prices Employers are reluctant to cut wages b/c impact on EE effort Minimum Wage Laws keep wages up Menu Costs are difficult to change Fear of price wars keeps prices from ...

Transcript

... You know what Congress can do in terms of fiscal policy: change taxes and/or government spending. And you know the tools available to the FED in its conduct of monetary policy: Change the required reserve ratio, the discount rate, or either buy or sell government securities in the open market. But i ...

... You know what Congress can do in terms of fiscal policy: change taxes and/or government spending. And you know the tools available to the FED in its conduct of monetary policy: Change the required reserve ratio, the discount rate, or either buy or sell government securities in the open market. But i ...

Chapter 23 Fiscal Policy

... b. If government spending falls, or taxes rise, we expect the level of income to fall. c. If MPS is 1/3 and government spending is reduced by $200 billion, GDP will fall by $200 billion times the multiplier of 3, or $600 billion dollars. Employment will also fall by a large amount. This solution wil ...

... b. If government spending falls, or taxes rise, we expect the level of income to fall. c. If MPS is 1/3 and government spending is reduced by $200 billion, GDP will fall by $200 billion times the multiplier of 3, or $600 billion dollars. Employment will also fall by a large amount. This solution wil ...