Aggregate Demand-Aggregate Supply Model and Long

... spending. Or, as unemployment rates increase, the number of people receiving unemployment compensation rises, and this enables people to spend more than they would otherwise be able to spend. In the case of expansions, the automatic stabilizers slow down spending; as people’s incomes rise, their tax ...

... spending. Or, as unemployment rates increase, the number of people receiving unemployment compensation rises, and this enables people to spend more than they would otherwise be able to spend. In the case of expansions, the automatic stabilizers slow down spending; as people’s incomes rise, their tax ...

The Keynesian Cross Model

... initial equilibrium level of Y such as Y1, where AE=AS. It is initiated by an autonomous change in spending that causes AE to exceed AS. We show that change as a shift in AE from AE1 to AE2. Now at Y1, AE is greater than AS by the amount BE1. At this point, inventories fall and are replaced with new ...

... initial equilibrium level of Y such as Y1, where AE=AS. It is initiated by an autonomous change in spending that causes AE to exceed AS. We show that change as a shift in AE from AE1 to AE2. Now at Y1, AE is greater than AS by the amount BE1. At this point, inventories fall and are replaced with new ...

Parkin-Bade Chapter 24

... A tax on capital income decreases the supply of loanable funds a tax wedge is driven between the interest rate and the after-tax interest rate Investment and saving decrease. ...

... A tax on capital income decreases the supply of loanable funds a tax wedge is driven between the interest rate and the after-tax interest rate Investment and saving decrease. ...

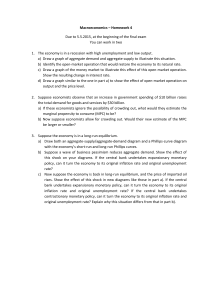

final exam sample from s2005

... 1. Justify, qualify, or repudiate the following two statements: “If the MPC for a society is zero, this means that households would save everything and spend nothing. Furthermore, it means that fiscal policy has no effect on the economy since the government expenditure multiplier will be zero.” ...

... 1. Justify, qualify, or repudiate the following two statements: “If the MPC for a society is zero, this means that households would save everything and spend nothing. Furthermore, it means that fiscal policy has no effect on the economy since the government expenditure multiplier will be zero.” ...

economic systems

... – Increases public’s incentive to work – Provides more money to spend – Increased production creates demand ...

... – Increases public’s incentive to work – Provides more money to spend – Increased production creates demand ...

AP Macroeconomics

... that use expansionary policy in a recession, and contractionary in inflationary phases. Discretionary Spending-Congress has to approve spending. In a recession: Tax receipts go down so taxes are in effect, CUT. ...

... that use expansionary policy in a recession, and contractionary in inflationary phases. Discretionary Spending-Congress has to approve spending. In a recession: Tax receipts go down so taxes are in effect, CUT. ...

Chapter 1

... for Business Managers • Understanding the economy • Realizing how changes in economic variables will affect your business • Understanding how changes in fiscal and monetary policy may affect sales and profits. • To a limited extent, forecasting the future, although that probably is impossible. But w ...

... for Business Managers • Understanding the economy • Realizing how changes in economic variables will affect your business • Understanding how changes in fiscal and monetary policy may affect sales and profits. • To a limited extent, forecasting the future, although that probably is impossible. But w ...

Practice Test questions for Spring, 2012 Fiscal/Monetary 1. Fiscal

... A) any change in government spending or taxes that destabilizes the economy. B) the authority that the President has to change personal income tax rates. C) changes in taxes and government expenditures made by Congress to stabilize the economy. D) the changes in taxes and transfers that occur as GDP ...

... A) any change in government spending or taxes that destabilizes the economy. B) the authority that the President has to change personal income tax rates. C) changes in taxes and government expenditures made by Congress to stabilize the economy. D) the changes in taxes and transfers that occur as GDP ...

Fiscal Policy:

... • The FED will control the money supply by raising or decreasing interest rates for banks. – Interest rates: the payment on a loan ...

... • The FED will control the money supply by raising or decreasing interest rates for banks. – Interest rates: the payment on a loan ...

topic_7a-chapter_10_dfs

... – More formally, S Y C (5) a budget constraint • Combining (4) and (5) yields the savings function: S Y C Y C cY C (1 c)Y (6) – Saving is an increasing function of the level of income because the marginal propensity to save (MPS), s = 1-c, is positive • Savings increases as in ...

... – More formally, S Y C (5) a budget constraint • Combining (4) and (5) yields the savings function: S Y C Y C cY C (1 c)Y (6) – Saving is an increasing function of the level of income because the marginal propensity to save (MPS), s = 1-c, is positive • Savings increases as in ...

Answers to Sample Short Free-Response Questions

... 4. In 1981, factories used 79 percent of their capacity. In 1982, factories used 71 percent of their capacity. In which year do you think the economy was on a steeper portion of its short-run aggregate supply curve? Explain. The economy would be on the steeper part of the aggregate supply curve in 1 ...

... 4. In 1981, factories used 79 percent of their capacity. In 1982, factories used 71 percent of their capacity. In which year do you think the economy was on a steeper portion of its short-run aggregate supply curve? Explain. The economy would be on the steeper part of the aggregate supply curve in 1 ...

Phillips Curve Practice

... an inflation rate of 3%. What open-market operation should the Federal Reserve undertake? D)Using a correctly labeled graph of the money market, show how the Federal Reserve’s action you identified in part (C) will affect the nominal interest rate. E) How will the interest rate change you identi ...

... an inflation rate of 3%. What open-market operation should the Federal Reserve undertake? D)Using a correctly labeled graph of the money market, show how the Federal Reserve’s action you identified in part (C) will affect the nominal interest rate. E) How will the interest rate change you identi ...

Chapter 9 Aggregate Demand and Economic Fluctuations

... (stylized fact #1). As producers increase their production, however, there’s more competition for the limited supply of workers and other inputs, which bids up wages and prices and results in an increase in the rate of inflation. Whereas during an economic contraction, there’s less pressure on wages ...

... (stylized fact #1). As producers increase their production, however, there’s more competition for the limited supply of workers and other inputs, which bids up wages and prices and results in an increase in the rate of inflation. Whereas during an economic contraction, there’s less pressure on wages ...

Answer Key - Syracuse University

... (c) Disagree, again. When the Fed buys bonds, it expands the money supply. The supply curve shifts to the right. When we experience a recession (Y falls) the demand for money falls, shifting the demand curve to the left. Both tend to push interest rates lower. 2. Chapter 11: Problem Set # 3. If hou ...

... (c) Disagree, again. When the Fed buys bonds, it expands the money supply. The supply curve shifts to the right. When we experience a recession (Y falls) the demand for money falls, shifting the demand curve to the left. Both tend to push interest rates lower. 2. Chapter 11: Problem Set # 3. If hou ...

Practice_paper_3

... 0.4% in the last quarter of 2008 reflecting the fact that Japanese households are slashing consumption. Firms in the country have responded in a similar manner with capital investment spending falling by 5.3% in the same quarter. Falling consumption, investment and exports is impacting hard upon the ...

... 0.4% in the last quarter of 2008 reflecting the fact that Japanese households are slashing consumption. Firms in the country have responded in a similar manner with capital investment spending falling by 5.3% in the same quarter. Falling consumption, investment and exports is impacting hard upon the ...

ECON 10020/20020 Principles of Macroeconomics

... (B) is a system whereby current retirees are paid from taxes collected from current workers. X B (C) has a greater number of workers per retiree today as compared to when it started. (D) currently pays retirees benefits equal to what they paid into the system. 9. If the economy is falling below pote ...

... (B) is a system whereby current retirees are paid from taxes collected from current workers. X B (C) has a greater number of workers per retiree today as compared to when it started. (D) currently pays retirees benefits equal to what they paid into the system. 9. If the economy is falling below pote ...

The paradox of progressivity in countries with low levels of taxation

... regressivity is only the result of the increased revenue capacity itself, rather than a narrowing of the gap between what is paid by high- and low-income taxpayers. In Guatemala, conventional indicators would suggest that taxation is less progressive. However, in both cases the differences in tax pa ...

... regressivity is only the result of the increased revenue capacity itself, rather than a narrowing of the gap between what is paid by high- and low-income taxpayers. In Guatemala, conventional indicators would suggest that taxation is less progressive. However, in both cases the differences in tax pa ...

Question_of_Macroeconomics

... 1. Identify three causes of cyclical instability for an economy such as the UK 2. Analyse whether the policies adopted by the UK government will reduce the length and depth of the UK recession 3. Discuss whether GDP per capita is the most appropriate measure of economic success 4. Discuss the relati ...

... 1. Identify three causes of cyclical instability for an economy such as the UK 2. Analyse whether the policies adopted by the UK government will reduce the length and depth of the UK recession 3. Discuss whether GDP per capita is the most appropriate measure of economic success 4. Discuss the relati ...

FISCAL MULTIPLIER: IMF AND EC/ECFIN OPINIONS

... more than an assessment regarding the size of short-term fiscal multipliers. Thus, our results should not be construed as arguing for any specific fiscal policy stance in any specific country. In particular, the results do not imply that fiscal consolidation is undesirable. Virtually all advanced ec ...

... more than an assessment regarding the size of short-term fiscal multipliers. Thus, our results should not be construed as arguing for any specific fiscal policy stance in any specific country. In particular, the results do not imply that fiscal consolidation is undesirable. Virtually all advanced ec ...

PPT

... Who appoints the members of the FED governing board? Once appointed, are they dependent or independent in terms of political pressure? ...

... Who appoints the members of the FED governing board? Once appointed, are they dependent or independent in terms of political pressure? ...

monetary reform

... May need net creation to cover currently unpriced transactions, or net destruction as we reduce throughput ...

... May need net creation to cover currently unpriced transactions, or net destruction as we reduce throughput ...