MACROECONOMICS 1. A supply curve slopes upward - FBLA-PBL

... a. decrease in response to the introduction of new technologies that make possible advanced consumer products, thus reducing aggregate demand b. increase in response to new technologies that will help cut the costs of production of existing products, thus raising aggregate demand c. increase in resp ...

... a. decrease in response to the introduction of new technologies that make possible advanced consumer products, thus reducing aggregate demand b. increase in response to new technologies that will help cut the costs of production of existing products, thus raising aggregate demand c. increase in resp ...

Chapter 20: The Government and Fiscal Policy

... The Economy’s Influence on the Government Budget • Tax revenues depend on the state of the economy. • Some government expenditures depend on the state of the economy. • Automatic stabilizers are revenue and expenditure items in the federal budget that automatically change with the state of the econ ...

... The Economy’s Influence on the Government Budget • Tax revenues depend on the state of the economy. • Some government expenditures depend on the state of the economy. • Automatic stabilizers are revenue and expenditure items in the federal budget that automatically change with the state of the econ ...

Midterm Exam #2 Econ 219 Fall 2005 This is a closed book exam

... 5. All of the following are causes of structural unemployment except: A) minimum-wage laws. B) the monopoly power of unions. C) unemployment insurance. D) efficiency wages. 6. In the IS-LM analysis, the increase in income resulting from a tax cut is usually _____ the increase in income resulting fr ...

... 5. All of the following are causes of structural unemployment except: A) minimum-wage laws. B) the monopoly power of unions. C) unemployment insurance. D) efficiency wages. 6. In the IS-LM analysis, the increase in income resulting from a tax cut is usually _____ the increase in income resulting fr ...

Why has the UK recovery been so weak in recent years

... What is meant by hysteresis? What are some of the main causes of hysteresis? • The dictionary definition of hysteresis is “the lagging of an effect behind its cause.” In mainstream macroeconomics it has become common to explain hysteresis as a tough problem caused by a deep recession and persistent ...

... What is meant by hysteresis? What are some of the main causes of hysteresis? • The dictionary definition of hysteresis is “the lagging of an effect behind its cause.” In mainstream macroeconomics it has become common to explain hysteresis as a tough problem caused by a deep recession and persistent ...

dhakatribune18.6.2014

... Regarding the budgetary allocations, Salehuddin noted that the allocations for the different ministries are now made without considering their performances, so the allocations, in most cases, failed to serve the purposes. Citing an example, Ahmed said: If a ministry gets Tk10 crore in a fiscal year, ...

... Regarding the budgetary allocations, Salehuddin noted that the allocations for the different ministries are now made without considering their performances, so the allocations, in most cases, failed to serve the purposes. Citing an example, Ahmed said: If a ministry gets Tk10 crore in a fiscal year, ...

Document

... - the year 2010 a year of rebounding economic activity but shadowed by serious public debt crisis in Europe ...

... - the year 2010 a year of rebounding economic activity but shadowed by serious public debt crisis in Europe ...

FRBSF E L CONOMIC ETTER

... However, in contrast to those results, Souleles and his coauthors found that more than two-thirds is spent by the end of the third quarter after receipt. In a second study,Agarwal, Liu, and Souleles (2007) looked at credit card data from a large, national credit card company. Using a representative ...

... However, in contrast to those results, Souleles and his coauthors found that more than two-thirds is spent by the end of the third quarter after receipt. In a second study,Agarwal, Liu, and Souleles (2007) looked at credit card data from a large, national credit card company. Using a representative ...

chapter 16

... A. Majoritarian politics yields conflicting recommendations: lower taxes, less debt, new programs are all wanted B. Economic theories and political needs ...

... A. Majoritarian politics yields conflicting recommendations: lower taxes, less debt, new programs are all wanted B. Economic theories and political needs ...

price level

... predict here. This equation gives us an upper bound. The actual value (somewhere between zero and 2.5) is lower because… i. New income is dissipated in the form of taxes and imports. ii. Inflation from extra spending reduces the real GDP gains. iii. Savings becomes investment, which is also spent bu ...

... predict here. This equation gives us an upper bound. The actual value (somewhere between zero and 2.5) is lower because… i. New income is dissipated in the form of taxes and imports. ii. Inflation from extra spending reduces the real GDP gains. iii. Savings becomes investment, which is also spent bu ...

Quiz: Introductory Macroeconomics

... deficit without causing output to fall. If the Central Bank and the government coordinate policies, can they achieve this goal? If not, why not? If so, what combination of policies would work? (10 points) A combination of a reduction in government spending (or an increase in taxes) and an increase i ...

... deficit without causing output to fall. If the Central Bank and the government coordinate policies, can they achieve this goal? If not, why not? If so, what combination of policies would work? (10 points) A combination of a reduction in government spending (or an increase in taxes) and an increase i ...

National Accounts - continuously struggling to catch

... Would an income concept be preferable? ...

... Would an income concept be preferable? ...

Imports

... Both are price indices but they have different market baskets. The CPI includes consumer goods whereas the GDP deflator contains all items that are produced domestically. ...

... Both are price indices but they have different market baskets. The CPI includes consumer goods whereas the GDP deflator contains all items that are produced domestically. ...

Quiz 1 Solution Set 14.02 Macroeconomics March 8, 2006

... less than 1. Lower taxes increase individuals’ disposable income. They spend only some of that additional income, while saving the rest. An increase in government spending on the other hand, is entirely translated into an increase in spending. We do not know (without further information) which polic ...

... less than 1. Lower taxes increase individuals’ disposable income. They spend only some of that additional income, while saving the rest. An increase in government spending on the other hand, is entirely translated into an increase in spending. We do not know (without further information) which polic ...

Chapter 29 Power Point Notes - Mr. Lamb

... be forced to run a balanced budget every year because this would undermine the role of taxes and transfers as ...

... be forced to run a balanced budget every year because this would undermine the role of taxes and transfers as ...

Economics 102-1 - Iowa State University Department of Economics

... 23. The most difficult to measure determinant of investment spending is a. business confidence. b. real interest rates. c. aggregate demand. d. foreign exchange rates 24. Under what conditions are business firms most likely to increase investment expenditures? a. Firms have plenty of capacity to exp ...

... 23. The most difficult to measure determinant of investment spending is a. business confidence. b. real interest rates. c. aggregate demand. d. foreign exchange rates 24. Under what conditions are business firms most likely to increase investment expenditures? a. Firms have plenty of capacity to exp ...

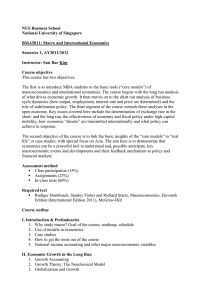

NUS Business School National University of Singapore BMA5011

... open economy. Key issues covered here include the determination of exchange rate in the short- and the long run, the effectiveness of monetary and fiscal policy under high capital mobility, how economic “shocks” are transmitted internationally and what policy can achieve in response. The second obje ...

... open economy. Key issues covered here include the determination of exchange rate in the short- and the long run, the effectiveness of monetary and fiscal policy under high capital mobility, how economic “shocks” are transmitted internationally and what policy can achieve in response. The second obje ...

Spain Becomes One of Europe’s Highest Taxed Countries • February 29

... budget deficit target for 2011. While the previous Socialist Party government had promised the figure would be 6 percent of GDP, the revised data showed a budget deficit of 8 percent, a difference of approximately 20 billion euros ($26.3 billion).1 That change makes it more challenging for the gover ...

... budget deficit target for 2011. While the previous Socialist Party government had promised the figure would be 6 percent of GDP, the revised data showed a budget deficit of 8 percent, a difference of approximately 20 billion euros ($26.3 billion).1 That change makes it more challenging for the gover ...

WOOHOO! finished first outcome (1a)

... the AD curve and its respective shift and give reasons why : Governments impose a higher income tax Investment in businesses decrease Interests rates increases Government injects funds into the education system A drop in confidence in the sharemarket ...

... the AD curve and its respective shift and give reasons why : Governments impose a higher income tax Investment in businesses decrease Interests rates increases Government injects funds into the education system A drop in confidence in the sharemarket ...

PP--Fiscal Policy - Tamalpais Union High School District

... #2: What did the classical economists believe about the economy? ...

... #2: What did the classical economists believe about the economy? ...

Ch 10 Notes

... Short run: Price of goods and services is fixed (no inflation), and input price, such as wage, is also fixed. All variables are real variables. (ii) Medium/Long run: At least one of the prices is flexible. We can then examine inflation – in chapters to come. ...

... Short run: Price of goods and services is fixed (no inflation), and input price, such as wage, is also fixed. All variables are real variables. (ii) Medium/Long run: At least one of the prices is flexible. We can then examine inflation – in chapters to come. ...