fiscal policy

... investment spending because of its volatility. But changes in consumption, net exports, and government purchases can also lead to the multiplier effect. 2) “Initial change in spending” refers to an upshift or downshift of the aggregate expenditures schedule due to an upshift or downshift of one of i ...

... investment spending because of its volatility. But changes in consumption, net exports, and government purchases can also lead to the multiplier effect. 2) “Initial change in spending” refers to an upshift or downshift of the aggregate expenditures schedule due to an upshift or downshift of one of i ...

Government Spending

... Competing with Private Sector: Public College Costs increases with Pell Grant increases. Obamacare mandates and health ...

... Competing with Private Sector: Public College Costs increases with Pell Grant increases. Obamacare mandates and health ...

Macroeconomics

... - An increase in government spending results in an increase in AD, increase in price level, increase in output, and decrease in unemployment. - A decrease in personal income taxes results in an increase in disposable income, increase in consumption, increase in AD, increase in price level, increase ...

... - An increase in government spending results in an increase in AD, increase in price level, increase in output, and decrease in unemployment. - A decrease in personal income taxes results in an increase in disposable income, increase in consumption, increase in AD, increase in price level, increase ...

some questions

... multiplier? Why will Central Bank open market operations have a bigger effect on the money supply than transactions by individuals? ...

... multiplier? Why will Central Bank open market operations have a bigger effect on the money supply than transactions by individuals? ...

Haiti_en.pdf

... Tax income declined by 0.8% in real terms. Budgetary targets could not be met because production levels were down and because the suspension of the mechanism for automatic adjustment of local fuel prices in line with oil prices on the international market resulted in a loss of revenue from the tax o ...

... Tax income declined by 0.8% in real terms. Budgetary targets could not be met because production levels were down and because the suspension of the mechanism for automatic adjustment of local fuel prices in line with oil prices on the international market resulted in a loss of revenue from the tax o ...

UK Households - Economics Today

... • Keynesians refute the classical assertion that the economy is self-regulating, believing that it will stay in recession unless the government or central bank take action to boost aggregate demand. ...

... • Keynesians refute the classical assertion that the economy is self-regulating, believing that it will stay in recession unless the government or central bank take action to boost aggregate demand. ...

Lesson Number 4: Objectives - The Learning House

... The Paradox of Thrift- 60 Second Economics. http://youtu.be/qrHyDztQlBY Discussion Assignments 1. Why do economists pay so much attention to investment, even though it is a relatively small component of aggregate spending? 2. What measures have been taken to increase demand in the recent recession? ...

... The Paradox of Thrift- 60 Second Economics. http://youtu.be/qrHyDztQlBY Discussion Assignments 1. Why do economists pay so much attention to investment, even though it is a relatively small component of aggregate spending? 2. What measures have been taken to increase demand in the recent recession? ...

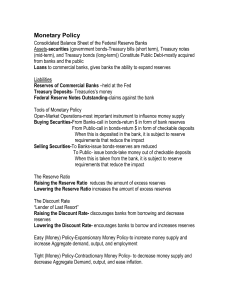

Monetary Policy

... moving the economy out of recession and low employment may be more difficult than “cooling off” the economy. Changes in velocity: An easy money policy will increase velocity (turnovers) since the cost of holding money is lower. A tight money policy will work in the opposite direction. Investment imp ...

... moving the economy out of recession and low employment may be more difficult than “cooling off” the economy. Changes in velocity: An easy money policy will increase velocity (turnovers) since the cost of holding money is lower. A tight money policy will work in the opposite direction. Investment imp ...

asad - Stephen Kinsella

... Stylised Facts 3. Monetary policy and fiscal policy approaches to job creation are both effective and in different ways, and they may work at cross purposes. 4. Sustained high employment levels are possible, but we have to change the policy mix as we move through the business cycle. ...

... Stylised Facts 3. Monetary policy and fiscal policy approaches to job creation are both effective and in different ways, and they may work at cross purposes. 4. Sustained high employment levels are possible, but we have to change the policy mix as we move through the business cycle. ...

Topic 1: Introduction to Economics 1 (The Price System)

... equilibrium, firms experience unplanned stock accumulation which acts as a signal for them to change production. ...

... equilibrium, firms experience unplanned stock accumulation which acts as a signal for them to change production. ...

ECON 10 5.24.16

... 6. The first modern economist: Adam Smith 7. Economic policy 8. Why economists disagree--The role of ideology B. Scarcity, choice, and the economic problem 1. The economic problem 2. Basic problems for any economy 3. Defense spending--How much does it cost? 4. The variety of economic systems C. The ...

... 6. The first modern economist: Adam Smith 7. Economic policy 8. Why economists disagree--The role of ideology B. Scarcity, choice, and the economic problem 1. The economic problem 2. Basic problems for any economy 3. Defense spending--How much does it cost? 4. The variety of economic systems C. The ...

Budget Simulation

... 10. Minister should focus on politics (contact with electorate) rather than details of administration 11. i) ongoing provision of public service, policy advice to the new government, whatever party it is 12. Ritz must see that his officials fix the problem but he is not expected to resign 13. A cabi ...

... 10. Minister should focus on politics (contact with electorate) rather than details of administration 11. i) ongoing provision of public service, policy advice to the new government, whatever party it is 12. Ritz must see that his officials fix the problem but he is not expected to resign 13. A cabi ...

Chapter 16 Government Spending

... at the same time without reducing the benefit each person receives, like streetlights. Different levels of government share responsibility for public goods ...

... at the same time without reducing the benefit each person receives, like streetlights. Different levels of government share responsibility for public goods ...

Chapter 7

... level before inflationary pressures accelerate • Economists generally consider optimal because a certain percentage of workforce is likely to be looking for better jobs at any point in time • Opinions on level have varied over time from about 4 percent to 6 percent. ...

... level before inflationary pressures accelerate • Economists generally consider optimal because a certain percentage of workforce is likely to be looking for better jobs at any point in time • Opinions on level have varied over time from about 4 percent to 6 percent. ...

Power Point Unit Four

... charge higher interest rates to get a REAL return on their loans. • Higher interest rates discourage consumer spending and business investment. • Ex: Increase in prices leads to an increase in the interest rate from 5% to 25%. You are less likely to take out loans to improve your business. • Result… ...

... charge higher interest rates to get a REAL return on their loans. • Higher interest rates discourage consumer spending and business investment. • Ex: Increase in prices leads to an increase in the interest rate from 5% to 25%. You are less likely to take out loans to improve your business. • Result… ...

BUDGET GLOSSARY - International Budget Partnership

... These are estimates of future revenues and expenditures. In multi-year budgets projections over several years and they are based on technical and economic assumptions. Budgets often will present “actual” expenditure and revenue from past years ...

... These are estimates of future revenues and expenditures. In multi-year budgets projections over several years and they are based on technical and economic assumptions. Budgets often will present “actual” expenditure and revenue from past years ...

Fiscal Policy Under Keynesian Models

... Credibility Problem, Cheating and Discount Factor of the Game Both gain by playing (C,C) But this solution is not credible. There is incentive to deviate. Trigger Strategy Game returns to Nash path in absence of credibility. If the game is played infinite number of times the optimal discount value ...

... Credibility Problem, Cheating and Discount Factor of the Game Both gain by playing (C,C) But this solution is not credible. There is incentive to deviate. Trigger Strategy Game returns to Nash path in absence of credibility. If the game is played infinite number of times the optimal discount value ...

Macro final exam study guide – True/False questions

... 2.An increase in the money supply will lead to a shift down and to the right of the money-market (LM) curve. TRUE 3.The study by Gilchrist, Natalucci and Zakrajsek finds that investment spending is highly responsive to interest rates, and will drop by more than one percent when interest rates increa ...

... 2.An increase in the money supply will lead to a shift down and to the right of the money-market (LM) curve. TRUE 3.The study by Gilchrist, Natalucci and Zakrajsek finds that investment spending is highly responsive to interest rates, and will drop by more than one percent when interest rates increa ...

Issue 2 - John Birchall

... allow export and import prices to be adjusted in the favour of what was thought best for the UK economy and after much discussion the return of demand management, or ‘fiscal stance’ as it came to be known. To those new to economics we now have the characteristics outlined in the opening paragraph bu ...

... allow export and import prices to be adjusted in the favour of what was thought best for the UK economy and after much discussion the return of demand management, or ‘fiscal stance’ as it came to be known. To those new to economics we now have the characteristics outlined in the opening paragraph bu ...

Define and Discuss on Fiscal Policy

... Secondary effects of fiscal policy. Classical economists point out that the Keynesian view of the effectiveness of fiscal policy tends to ignore the secondary effects that fiscal policy can have on credit market conditions. When the government pursues an expansionary fiscal policy, it finances its d ...

... Secondary effects of fiscal policy. Classical economists point out that the Keynesian view of the effectiveness of fiscal policy tends to ignore the secondary effects that fiscal policy can have on credit market conditions. When the government pursues an expansionary fiscal policy, it finances its d ...