Presentation

... BBR (since 1967): The consolidated national and local government budget deficit is limited to 3 % of GDP in any given year. Before 2004, BBR was set based on the principle that the budget deficit was not allowed to financed by domestic sources sources. However it could be financed by foreign loan. l ...

... BBR (since 1967): The consolidated national and local government budget deficit is limited to 3 % of GDP in any given year. Before 2004, BBR was set based on the principle that the budget deficit was not allowed to financed by domestic sources sources. However it could be financed by foreign loan. l ...

PDF

... This study uses a dynamic computable general equilibrium (CGE) model linked to a microsimulation module that traces the channels in which public infrastructure investment filters into the Philippine economy. ...

... This study uses a dynamic computable general equilibrium (CGE) model linked to a microsimulation module that traces the channels in which public infrastructure investment filters into the Philippine economy. ...

Slide 1

... financial sector reforms • Fiscal policy • International trade & finance • Public sector reforms/modernization • Economic policy management (with the view to addressing employment and earnings) ...

... financial sector reforms • Fiscal policy • International trade & finance • Public sector reforms/modernization • Economic policy management (with the view to addressing employment and earnings) ...

External Environment (Unit 1.5)

... Growth is said to occur if there is an increase in GDP for two consecutive quarters. Ethics- the moral values and judgments (what is right and just) that society believes organizations should consider in their decision-making. Exchange rate- refers to the value of country's currency in terms of ...

... Growth is said to occur if there is an increase in GDP for two consecutive quarters. Ethics- the moral values and judgments (what is right and just) that society believes organizations should consider in their decision-making. Exchange rate- refers to the value of country's currency in terms of ...

Course Syllabus Principles of Macroeconomics Revision Date

... Identify and define different price level indexes Calculation of the CPI and rate of inflation Difference between nominal and real gross domestic product Definition and shifters of Aggregate Demand and Aggregate Supply Definitions and illustrations of demand-pull and cost-push inflation Calculation ...

... Identify and define different price level indexes Calculation of the CPI and rate of inflation Difference between nominal and real gross domestic product Definition and shifters of Aggregate Demand and Aggregate Supply Definitions and illustrations of demand-pull and cost-push inflation Calculation ...

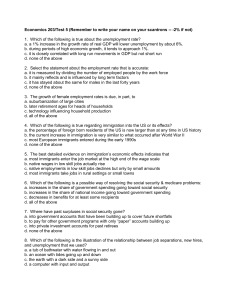

Economics 203/Test 5 (Remember to write your name on your

... b. increases in the share of national income going toward government spending c. decreases in benefits for at least some recipients d. all of the above 7. Where have past surpluses in social security gone? a. into government accounts that have been building up to cover future shortfalls b. to pay fo ...

... b. increases in the share of national income going toward government spending c. decreases in benefits for at least some recipients d. all of the above 7. Where have past surpluses in social security gone? a. into government accounts that have been building up to cover future shortfalls b. to pay fo ...

Chapter 16- Government Spends, Collects, and Owes

... Financing World War II caused more government growth. The country’s increasing wealth may have led to demands for evening out inequities through more government services. ...

... Financing World War II caused more government growth. The country’s increasing wealth may have led to demands for evening out inequities through more government services. ...

6. Public Finance

... government investment multiplier being more effective than the government consumption multiplier with respect to the impact multiplier (first quarter) and peak multiplier (second-quarter). Meanwhile, the oneyear cumulative fiscal multiplier is similar across both sub-items. ...

... government investment multiplier being more effective than the government consumption multiplier with respect to the impact multiplier (first quarter) and peak multiplier (second-quarter). Meanwhile, the oneyear cumulative fiscal multiplier is similar across both sub-items. ...

Macroeconomics, 11e (Gordon)

... 10) Assuming that there are NO income taxes, if both autonomous taxes, and government expenditures were to rise by $100 million, we would expect equilibrium GDP to A) rise by $100 million. B) rise, but by a multiple of $100 million. C) rise by less than $100 million. D) remain unaffected because lea ...

... 10) Assuming that there are NO income taxes, if both autonomous taxes, and government expenditures were to rise by $100 million, we would expect equilibrium GDP to A) rise by $100 million. B) rise, but by a multiple of $100 million. C) rise by less than $100 million. D) remain unaffected because lea ...

excess demand for tradables

... You cannot be a borrower for ever, but you can be a creditor as long as you wish to be. The creditors may change their minds given that risk exposure is rising and the return to their investments is very low. In China, reserves make up half of GDP. ...

... You cannot be a borrower for ever, but you can be a creditor as long as you wish to be. The creditors may change their minds given that risk exposure is rising and the return to their investments is very low. In China, reserves make up half of GDP. ...

Should Obama withdraw the Stimulus Package NOW?

... history of the US). Interestingly, this was simultaneous to a substantial slowdown in the non-residential investment. Therefore, one can safely argue that even though technically a large part of the high growth could be seen as `investment-driven', it was actually purely residential investment drive ...

... history of the US). Interestingly, this was simultaneous to a substantial slowdown in the non-residential investment. Therefore, one can safely argue that even though technically a large part of the high growth could be seen as `investment-driven', it was actually purely residential investment drive ...

Notes on government policy

... Examples of manipulation: Politicians may change tax rates and spending around the time of elections to make the economy stronger during the election to increase the chance of incumbents getting re-elected. Changing fiscal policy around elections would cause AD to change and thus stimulate the econo ...

... Examples of manipulation: Politicians may change tax rates and spending around the time of elections to make the economy stronger during the election to increase the chance of incumbents getting re-elected. Changing fiscal policy around elections would cause AD to change and thus stimulate the econo ...

economics jeopardy review game

... on one task enabling you to be more efficient and productive. ...

... on one task enabling you to be more efficient and productive. ...

Colombia_en.pdf

... likely to be equal to 1.6% of GDP —up 0.5 percentage points over 2013. The reason is a central government deficit that, at 2.4% of GDP, is similar to the figure posted for 2013, combined with a decentralized sector surplus that fell to 0.9% of GDP over the same period. Central government tax revenue ...

... likely to be equal to 1.6% of GDP —up 0.5 percentage points over 2013. The reason is a central government deficit that, at 2.4% of GDP, is similar to the figure posted for 2013, combined with a decentralized sector surplus that fell to 0.9% of GDP over the same period. Central government tax revenue ...

14.02 Principles of Macroeconomics Spring 06 Quiz 1

... I. Answer each as True, False, or Uncertain, and explain your choice. (30 points. Each question counts for 5 points.) 1. After Hurricane Katrina the Government spent $500 million rebuilding New Orleans and $100 million in transfers to displaced individuals. The direct effect of these policies was an ...

... I. Answer each as True, False, or Uncertain, and explain your choice. (30 points. Each question counts for 5 points.) 1. After Hurricane Katrina the Government spent $500 million rebuilding New Orleans and $100 million in transfers to displaced individuals. The direct effect of these policies was an ...

14.02 Principles of Macroeconomics Problem Set 3 Solutions Fall 2004

... False. In an open economy with fixed exchange rates, fiscal policy is, indeed, more effective than monetary policy. In fact, monetary policy has absolutely no effect. (See pages 429-430.) However, in an open economy with flexible exchange rates, monetary policy should actually be more effective, sin ...

... False. In an open economy with fixed exchange rates, fiscal policy is, indeed, more effective than monetary policy. In fact, monetary policy has absolutely no effect. (See pages 429-430.) However, in an open economy with flexible exchange rates, monetary policy should actually be more effective, sin ...

The Federal Reserve must prolong the party

... Ronald McKinnon: Martin Wolf has provided a masterly summary of US sectoral imbalances. The huge net deficit of the household sector, including residential construction, of the order of 4 per cent of GDP is indeed without historical parallel. With the subprime crisis and new restraints on mortgage l ...

... Ronald McKinnon: Martin Wolf has provided a masterly summary of US sectoral imbalances. The huge net deficit of the household sector, including residential construction, of the order of 4 per cent of GDP is indeed without historical parallel. With the subprime crisis and new restraints on mortgage l ...

3. Mixed Economies

... Housing: • Housing subsidies for families with children. • Construction regulated by government to ensure safety. ...

... Housing: • Housing subsidies for families with children. • Construction regulated by government to ensure safety. ...

ECON 521 Special Topics in Economic Policy

... Y* (maybe > YN) Tax Revenues helps to cool the economy Y* (maybe < YN) Tax Revenues helps to stimulate the economy Note -- all this takes place without any change in the tax structure, as prescribed by fiscal policy. ...

... Y* (maybe > YN) Tax Revenues helps to cool the economy Y* (maybe < YN) Tax Revenues helps to stimulate the economy Note -- all this takes place without any change in the tax structure, as prescribed by fiscal policy. ...

M P G F

... challenges will provide an important opportunity for additions to the Fed’s current monetary policy framework. As a practical matter, Europe and Japan face larger and more immediate fiscal imbalances (Table 1), so the Fed will gain from their experiences dealing with them. The European Central Bank ...

... challenges will provide an important opportunity for additions to the Fed’s current monetary policy framework. As a practical matter, Europe and Japan face larger and more immediate fiscal imbalances (Table 1), so the Fed will gain from their experiences dealing with them. The European Central Bank ...

ECON 2020 – 200 Spring 2003 Homework #10: Chapter 14

... Multiple Choice Questions. [1 point each] 2. Which of the following statement about economic fluctuations is true? a. A recession is when output rises above the natural rate of output. b. A depression is a mild recession. c. Economics fluctuations have been terms the “business cycle” because the mov ...

... Multiple Choice Questions. [1 point each] 2. Which of the following statement about economic fluctuations is true? a. A recession is when output rises above the natural rate of output. b. A depression is a mild recession. c. Economics fluctuations have been terms the “business cycle” because the mov ...

Term Test 2 - Queen`s Economics Department

... 11. Refer to the above diagram. Initially assume that the investment demand curve is Id1. Which of the following effects of a budget deficit might shift the investment demand curve from Id1 to Id2, wholly offsetting any crowding-out effect? A) an improvement in profit expectations by businesses B) a ...

... 11. Refer to the above diagram. Initially assume that the investment demand curve is Id1. Which of the following effects of a budget deficit might shift the investment demand curve from Id1 to Id2, wholly offsetting any crowding-out effect? A) an improvement in profit expectations by businesses B) a ...

02- Unit Three Problem Sets

... b. To support your answer in part a, draw a recessionary gap and an inflationary gap. Draw and explain how fiscal policy is used to close the gaps using accurate numbers. ( ____/5) ...

... b. To support your answer in part a, draw a recessionary gap and an inflationary gap. Draw and explain how fiscal policy is used to close the gaps using accurate numbers. ( ____/5) ...