The bumper lane economy Monthly Commentary

... The problem is that without eliminating major deductions, the total cost of the tax proposal would likely be more than fiscal conservatives could swallow. Given all of this, and the sobering experience of the first attempt to repeal and replace the Affordable Care Act, prospects for significant tax- ...

... The problem is that without eliminating major deductions, the total cost of the tax proposal would likely be more than fiscal conservatives could swallow. Given all of this, and the sobering experience of the first attempt to repeal and replace the Affordable Care Act, prospects for significant tax- ...

Economic Activites

... Means you have lent money to the organization, so then in return bondholders are paid interest for the use of your money ...

... Means you have lent money to the organization, so then in return bondholders are paid interest for the use of your money ...

Aggregate Demand - KsuWeb Home Page

... Equilibrium in the IS/LM model occurs at the intersection of the IS curve and the LM curve. At every point on the IS curve, the capital market is in equilibrium. At every point on the LM curve, the money market is in equilibrium. Only at the intersection are both markets simultaneously in equilibriu ...

... Equilibrium in the IS/LM model occurs at the intersection of the IS curve and the LM curve. At every point on the IS curve, the capital market is in equilibrium. At every point on the LM curve, the money market is in equilibrium. Only at the intersection are both markets simultaneously in equilibriu ...

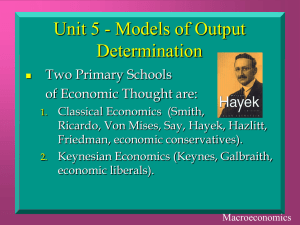

Unit 5 - Models of Output Determination

... Evaluation of the Keynesian Theory Let’s evaluate the effects of government spending. If the government increases spending, how does it pay for this? ...

... Evaluation of the Keynesian Theory Let’s evaluate the effects of government spending. If the government increases spending, how does it pay for this? ...

DO NOW: - Madison Central High School

... Changes in spending which DO NOT require deliberate action from policy makers Kick in when needed during an economic downturn Example: UNEMPLOYMENT BENEFITS in a recession ...

... Changes in spending which DO NOT require deliberate action from policy makers Kick in when needed during an economic downturn Example: UNEMPLOYMENT BENEFITS in a recession ...

gross domestic product

... where an economy is currently producing in relationship to full employment (where it wants to be) whether business inventories are building up (AD less that AS) or if they are selling most goods and services (AD greater than AS) if AD/SRAS intersect below LRAS, there is lack of use of resources (rec ...

... where an economy is currently producing in relationship to full employment (where it wants to be) whether business inventories are building up (AD less that AS) or if they are selling most goods and services (AD greater than AS) if AD/SRAS intersect below LRAS, there is lack of use of resources (rec ...

Test 2 - Dasha Safonova

... D. is unaffected by the amount of time that elapses. 18. The quantity of real GDP demanded equals $12.2 trillion when the GDP deflator is 90. If the GDP deflator rises to 95, the quantity of real GDP demanded equals A. less than $12.2 trillion. B. $12.2 trillion. C. more than $12.2 trillion. D. more ...

... D. is unaffected by the amount of time that elapses. 18. The quantity of real GDP demanded equals $12.2 trillion when the GDP deflator is 90. If the GDP deflator rises to 95, the quantity of real GDP demanded equals A. less than $12.2 trillion. B. $12.2 trillion. C. more than $12.2 trillion. D. more ...

Solutions for the selected problems:

... and I (and also Y) increases accordingly. Option 2 would come next, but involve some crowding out effect, because selling bonds to public would decrease the Ms and lead to an increase in r. Option 1 would be the least expansionary policy, because tax↑ → consumption expenditure and Y↓. ...

... and I (and also Y) increases accordingly. Option 2 would come next, but involve some crowding out effect, because selling bonds to public would decrease the Ms and lead to an increase in r. Option 1 would be the least expansionary policy, because tax↑ → consumption expenditure and Y↓. ...

AP Econ Study Guide

... will purchase more of everything including imports. More imports means that Aggregate Demand and GDP will decrease somewhat. (GDP = C+ I + G + X - M ) Remember “M” is a minus to AD / GDP. This is the "net export effect". If government pursues an expansionary fiscal policy of more spending and/or low ...

... will purchase more of everything including imports. More imports means that Aggregate Demand and GDP will decrease somewhat. (GDP = C+ I + G + X - M ) Remember “M” is a minus to AD / GDP. This is the "net export effect". If government pursues an expansionary fiscal policy of more spending and/or low ...

View Tom`s presentation here

... forecast. See income tax fall of 8% earlier. Current spending cuts all that’s left and spiral downwards will result. If economy was stimulated: govt tax receipts would rise and social welfare payments would fall. This would allow a modest increase in key public service spending which is always neces ...

... forecast. See income tax fall of 8% earlier. Current spending cuts all that’s left and spiral downwards will result. If economy was stimulated: govt tax receipts would rise and social welfare payments would fall. This would allow a modest increase in key public service spending which is always neces ...

`COMMENTARAO` IN “THE TELEGRAPH”, March 20 2012

... would have been better if Coal India merely held ownership of mines and leased them for operation to the private sector, and a Coal regulator determined coal prices. There is little to stimulate FDI in this Budget. Consumption expenditure will be hurt by higher indirect taxes (excise duties and serv ...

... would have been better if Coal India merely held ownership of mines and leased them for operation to the private sector, and a Coal regulator determined coal prices. There is little to stimulate FDI in this Budget. Consumption expenditure will be hurt by higher indirect taxes (excise duties and serv ...

AP Macroeconomics Syllabus AP Macroeconomics is a one

... 2. derivation of the AD curve from the AE model 3. determinants of AD – graphing and shifting B. aggregate supply defined 1. three ranges of the AS curve – in-depth analysis of each 2. determinants of AS – graphing and shifting C. equilibrium 1. changes in equilibrium 2. ratchet effect a. causes b. ...

... 2. derivation of the AD curve from the AE model 3. determinants of AD – graphing and shifting B. aggregate supply defined 1. three ranges of the AS curve – in-depth analysis of each 2. determinants of AS – graphing and shifting C. equilibrium 1. changes in equilibrium 2. ratchet effect a. causes b. ...

Syllabus203-1et Term 2015

... 5. to know the tools of the economic policies ; fiscal & monetary policies and their role in stabilizing the economy and promoting long run growth. 6. to use graphs & simple Algebra to express relationships among macroeconomic variables and measure them. Delivery Methods: This course is delivered i ...

... 5. to know the tools of the economic policies ; fiscal & monetary policies and their role in stabilizing the economy and promoting long run growth. 6. to use graphs & simple Algebra to express relationships among macroeconomic variables and measure them. Delivery Methods: This course is delivered i ...

Transfers, Capital, and Consumption over the Demographic

... Andrew Mason University of Hawaii at Manoa ...

... Andrew Mason University of Hawaii at Manoa ...

State Budget and Tax Actions 2000 for Annual Meeting

... increases finally kick in, but perhaps somewhat slower. • There will be no substantial federal tax legislation this year. Overall, tax revenue increases will be modest, perhaps only equal to inflation. ...

... increases finally kick in, but perhaps somewhat slower. • There will be no substantial federal tax legislation this year. Overall, tax revenue increases will be modest, perhaps only equal to inflation. ...

Chapters 23

... Other Determinants of Consumption The assumption that consumption depends only on income is obviously a simplification. ...

... Other Determinants of Consumption The assumption that consumption depends only on income is obviously a simplification. ...

Presentation to the Bay Area Council 2006 Outlook Conference

... likely to be reinforced by a related development—a significant moderation in the rate of appreciation of house prices. This could well restrict not only the pace of residential construction but also the pace of consumer spending. For example, some observers believe that consumer spending has been bo ...

... likely to be reinforced by a related development—a significant moderation in the rate of appreciation of house prices. This could well restrict not only the pace of residential construction but also the pace of consumer spending. For example, some observers believe that consumer spending has been bo ...

Fiscal Panorama - CEPAL Repositorio Digital

... Debt levels vary greatly between countries. Brazil has the highest public-debt-to-GDP ratio in Latin America, at 62% in 2014, although its net debt is much lower, as was noted in the previous edition of Fiscal Panorama1 and as recorded in the statistical annex of this edition (available online). Oth ...

... Debt levels vary greatly between countries. Brazil has the highest public-debt-to-GDP ratio in Latin America, at 62% in 2014, although its net debt is much lower, as was noted in the previous edition of Fiscal Panorama1 and as recorded in the statistical annex of this edition (available online). Oth ...

國立嘉義大學九十一學年度轉學生招生考試試題

... C. there is perfect price discrimination by a monopoly. D. there is no producer surplus. 22.As a competitive firm hires increasing amounts of labor the marginal revenue product of labor eventually A. decreases. B. increases. C. remains constant. D. decreases then increases. 23.If Joe receives an inc ...

... C. there is perfect price discrimination by a monopoly. D. there is no producer surplus. 22.As a competitive firm hires increasing amounts of labor the marginal revenue product of labor eventually A. decreases. B. increases. C. remains constant. D. decreases then increases. 23.If Joe receives an inc ...

From Shared Sacrifices to Constructive Contributions - Some Controversial Governmental, Corporate and Consumer Challenges (When Most of the Western World Is in Economic Troubles)

... much of the value added portion of the final prices went to pay for production and distribution costs in foreign countries and (b) much of the domestically added portion of the value created that led to the constitution of the final product prices was associated with shuffling the product among var ...

... much of the value added portion of the final prices went to pay for production and distribution costs in foreign countries and (b) much of the domestically added portion of the value created that led to the constitution of the final product prices was associated with shuffling the product among var ...