D.C.A. Curtis. Monetary Policy Rules in Canada in the 1990s.

... inflation while stimulating growth and employment. The data on price shocks in the upper panel of Table 2 illustrate conditions in Canada in the 1990’s and offer a comparison with earlier decades and with the experience in the United States. They show that both countries enjoyed stable supply side c ...

... inflation while stimulating growth and employment. The data on price shocks in the upper panel of Table 2 illustrate conditions in Canada in the 1990’s and offer a comparison with earlier decades and with the experience in the United States. They show that both countries enjoyed stable supply side c ...

SP227: Lost at Sea: The Euro Needs a Euro Treasury

... credibility of monetary and fiscal policies would add stability to the policy regime. Macroeconomic policies focused on price stability and constrained by balanced-budget rules suggest themselves as “sound”, on this view. Arguably, the preoccupations of OCA theory have been of rather limited value ...

... credibility of monetary and fiscal policies would add stability to the policy regime. Macroeconomic policies focused on price stability and constrained by balanced-budget rules suggest themselves as “sound”, on this view. Arguably, the preoccupations of OCA theory have been of rather limited value ...

NBER WORKING PAPER SERIES GOLD STERILIZATION AND THE RECESSION OF 1937-38

... sign to the change in gold holdings. In September 1937, at the request of the Federal Reserve, the Treasury desterilized $300 million to meet seasonal demand for currency, not to address the economic downturn. It resumed sterilization in October. By this time, the U.S. economy was clearly in a reces ...

... sign to the change in gold holdings. In September 1937, at the request of the Federal Reserve, the Treasury desterilized $300 million to meet seasonal demand for currency, not to address the economic downturn. It resumed sterilization in October. By this time, the U.S. economy was clearly in a reces ...

2004:1 The general government structural budget balance by

... discretionary changes in revenues or expenditures that affect the central government budget. However, the structural balance can also be affected by rule changes in the local government and social security sectors. All else equal and unless they follow the business cycle, increases to local taxes, f ...

... discretionary changes in revenues or expenditures that affect the central government budget. However, the structural balance can also be affected by rule changes in the local government and social security sectors. All else equal and unless they follow the business cycle, increases to local taxes, f ...

Chapter 5

... With CGE models an exact welfare comparison between two equilibrium situations may be achieved. The equivalent variation (EV) (as initially defined by Hicks (1939)) is often used to determine the welfare effect. The equivalent variation asks the question: “How much money is a particular change equiv ...

... With CGE models an exact welfare comparison between two equilibrium situations may be achieved. The equivalent variation (EV) (as initially defined by Hicks (1939)) is often used to determine the welfare effect. The equivalent variation asks the question: “How much money is a particular change equiv ...

mexico - Inter-American Development Bank

... in regards of how the government will conduct the public finances over time. The design of fiscal rules must be such that they do not constitute an incentive to find ways to circumvent them through arrears (if it is defined on a cash basis), over or under budgetary estimates (if it is applied on the ...

... in regards of how the government will conduct the public finances over time. The design of fiscal rules must be such that they do not constitute an incentive to find ways to circumvent them through arrears (if it is defined on a cash basis), over or under budgetary estimates (if it is applied on the ...

Y - McGraw Hill Higher Education

... changes in monetary or fiscal policy Whether stabilization policies are needed depends on the speed of the self-correction process ...

... changes in monetary or fiscal policy Whether stabilization policies are needed depends on the speed of the self-correction process ...

effectiveness of monetary policy tools in

... The effect of monetary policy actions affects the general levels of retail prices prevailing in the Country from time to time. Through its monetary policy tools the Government of Kenya is able to control the levels of inflation reported in Kenya. The Central Bank of Kenya (CBK), like most other cent ...

... The effect of monetary policy actions affects the general levels of retail prices prevailing in the Country from time to time. Through its monetary policy tools the Government of Kenya is able to control the levels of inflation reported in Kenya. The Central Bank of Kenya (CBK), like most other cent ...

Macroeconomic Policy Advice and the Article IV Consultations:

... employment protections), reduce labor’s share of national income, and possibly increase poverty, social exclusion, and economic and social inequality as a result. Fiscal consolidation is recommended for all 27 EU countries, and expenditure cuts are generally preferred to tax increases. In some cases ...

... employment protections), reduce labor’s share of national income, and possibly increase poverty, social exclusion, and economic and social inequality as a result. Fiscal consolidation is recommended for all 27 EU countries, and expenditure cuts are generally preferred to tax increases. In some cases ...

An Economic Evaluation of the Economic Growth and

... makes the tax system less progressive with respect to current income and provides particularly large benefits to households in the top 1 percent of the income distribution. This redistribution comes just after a twenty-year period when pre- and post-tax income became significantly less equal. Two ad ...

... makes the tax system less progressive with respect to current income and provides particularly large benefits to households in the top 1 percent of the income distribution. This redistribution comes just after a twenty-year period when pre- and post-tax income became significantly less equal. Two ad ...

Trying to Make Sense of the Principle of Effective Demand

... Perhaps the most influential textbook ever written is Paul A. Samuelson’s Economics. But although the macroeconomic framework of Economics evolves from a simple IncomeExpenditure model (SAMUELSON 1948, Chapter 12) via the same model supplemented by an IS/LM-analysis (SAMUELSON 1973, Chapter 12 plus ...

... Perhaps the most influential textbook ever written is Paul A. Samuelson’s Economics. But although the macroeconomic framework of Economics evolves from a simple IncomeExpenditure model (SAMUELSON 1948, Chapter 12) via the same model supplemented by an IS/LM-analysis (SAMUELSON 1973, Chapter 12 plus ...

Document

... …either deliberately or because the register updating sources do not include details of such person …involves under-reporting gross output and/or over-reporting intermediate consumption Data that are incomplete or cannot be directly collected from surveys, or data that are incorrectly compiled durin ...

... …either deliberately or because the register updating sources do not include details of such person …involves under-reporting gross output and/or over-reporting intermediate consumption Data that are incomplete or cannot be directly collected from surveys, or data that are incorrectly compiled durin ...

Chapter 6 - Matt Golder

... of our theory is not a good reason to reject it—we have to ask what the empirical evidence says. Is classic modernization theory falsified or not? One of the central implications of modernization theory is that there should be a strong relationship between how economically developed a country is and ...

... of our theory is not a good reason to reject it—we have to ask what the empirical evidence says. Is classic modernization theory falsified or not? One of the central implications of modernization theory is that there should be a strong relationship between how economically developed a country is and ...

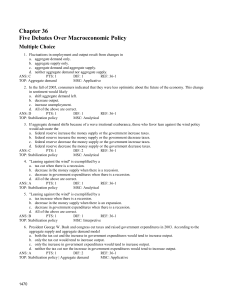

Chapter 36 MC — Five Debates Over Macroeconomic Policy

... 10. The Federal Reserve will tend to tighten monetary policy when a. interest rates are rising too rapidly. b. it thinks the unemployment rate is too high. c. the growth rate of real GDP is quite sluggish. d. it thinks inflation is too high today, or will become too high in the future. ANS: D PTS: 1 ...

... 10. The Federal Reserve will tend to tighten monetary policy when a. interest rates are rising too rapidly. b. it thinks the unemployment rate is too high. c. the growth rate of real GDP is quite sluggish. d. it thinks inflation is too high today, or will become too high in the future. ANS: D PTS: 1 ...

Macroeconomics - University of London International Programmes

... The IS–LM model: key assumptions............................................................................... 15 The IS–LM model: behavioural equations and identities................................................. 16 Income accounting in a closed economy.......................................... ...

... The IS–LM model: key assumptions............................................................................... 15 The IS–LM model: behavioural equations and identities................................................. 16 Income accounting in a closed economy.......................................... ...

Recent Studies Find Raising Taxes on High

... of small changes in the marginal tax rates. This is for three reasons. First, small businesses can expense (immediately deduct in full) the cost of investment. This alone brings the effective tax rate on new investment to zero, regardless of the statutory rate. Second, if they can finance the invest ...

... of small changes in the marginal tax rates. This is for three reasons. First, small businesses can expense (immediately deduct in full) the cost of investment. This alone brings the effective tax rate on new investment to zero, regardless of the statutory rate. Second, if they can finance the invest ...

INTRODUCTION TO THE HISTORICAL TABLES

... Because the Historical Tables publication provides a large volume and wide array of data on Federal Government finances, it is sometimes difficult to perceive the long- term patterns in various budget aggregates and components. To assist the reader in understanding some of these long-term patterns, ...

... Because the Historical Tables publication provides a large volume and wide array of data on Federal Government finances, it is sometimes difficult to perceive the long- term patterns in various budget aggregates and components. To assist the reader in understanding some of these long-term patterns, ...

El proceso de cambio de año de referencia e integración de las estadísticas económicas en Jamaica (STATIN, Jamaica)

... We already capture part of the informal sector in some estimates however there is a need to allocate between formal and informal by industries. ...

... We already capture part of the informal sector in some estimates however there is a need to allocate between formal and informal by industries. ...

Marco Cangiano , E. Baldacci , S. Mahfouz , andAxel Schimmelpfenning The Effectiveness of Fiscal Policy in Stimulating Economic Activity: An Empirical Investigation (Second IMF Research Conference)..

... Recent years have seen a revival of the debate about the role of fiscal policy in stimulating economic activity, particularly given the recessions in Asian crisis countries, the prolonged slump in Japan and, more recently, the slowdown in the United States. Lane and others (1999), while noting fisca ...

... Recent years have seen a revival of the debate about the role of fiscal policy in stimulating economic activity, particularly given the recessions in Asian crisis countries, the prolonged slump in Japan and, more recently, the slowdown in the United States. Lane and others (1999), while noting fisca ...