“Runaway” expenditures on health in the United

... the United States spent 13.6% of its GDP on goods and services associated with health care. This represents an enormous increase over time: the spending share was just 5.1% in 1960. It also represents a large number relative to other countries. The 1998 spending shares were 10.6% in Germany, 9.6% in ...

... the United States spent 13.6% of its GDP on goods and services associated with health care. This represents an enormous increase over time: the spending share was just 5.1% in 1960. It also represents a large number relative to other countries. The 1998 spending shares were 10.6% in Germany, 9.6% in ...

Transformation for inclusive growth

... years, is likely to increase moderately over the medium term. Yet this rate of growth will not be sufficient to markedly reduce unemployment, poverty and inequality. Government’s measured fiscal consolidation is working to narrow the budget deficit and stabilise debt, building confidence in the econ ...

... years, is likely to increase moderately over the medium term. Yet this rate of growth will not be sufficient to markedly reduce unemployment, poverty and inequality. Government’s measured fiscal consolidation is working to narrow the budget deficit and stabilise debt, building confidence in the econ ...

Economic Indicators and Measurements

... Population growth made up for shorter work week since early 1900s More important than size of labor force is its level of human capital ...

... Population growth made up for shorter work week since early 1900s More important than size of labor force is its level of human capital ...

NBER WORKING PAPER SERIES MULTILATERAL ECONOMIC COOPERATION AND THE INTERNATIONAL

... cycle model. Each country is assumed to specialize in the production of a specific set of intermediate goods which are consumed by private households and the government. In the model, while households act so as to maximize their welfare subject to constraints on prices and wage setting, monetary and ...

... cycle model. Each country is assumed to specialize in the production of a specific set of intermediate goods which are consumed by private households and the government. In the model, while households act so as to maximize their welfare subject to constraints on prices and wage setting, monetary and ...

Along with average income, equitable distribution of - DPS-MIS

... Ans. Average income i.e. per capita income is an important but not the only criterion for development. Along with average income, equitable distribution of income in a country should also be considered. If the national income is widely distributed among the people, it shows a better distribution of ...

... Ans. Average income i.e. per capita income is an important but not the only criterion for development. Along with average income, equitable distribution of income in a country should also be considered. If the national income is widely distributed among the people, it shows a better distribution of ...

The IMF is Panama`s Lender of First Resort

... programs--it exceeded a remarkable 7% of GDP. In fact, it has only been in the last few years that Panama has been able to put its fiscal accounts in order. Initially, very large fiscal deficits were financed through borrowing from abroad. But when the foreign debt became too high, the IMF stepped i ...

... programs--it exceeded a remarkable 7% of GDP. In fact, it has only been in the last few years that Panama has been able to put its fiscal accounts in order. Initially, very large fiscal deficits were financed through borrowing from abroad. But when the foreign debt became too high, the IMF stepped i ...

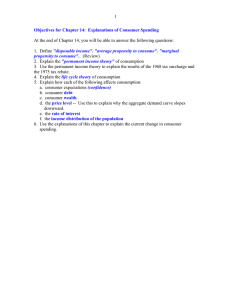

Objectives for Chapter 14: Explanations of Consumer Spending

... how this method of paying workers might contribute to the higher savings rate in Japan. ...

... how this method of paying workers might contribute to the higher savings rate in Japan. ...

Document

... aggregate demand curve other than some of the variables that affect one curve also affect the other. B. The C + I + G + X curve is used to derive the aggregate demand curve, but the C. C + I + G + X curve is drawn for one price level while price levels vary along the aggregate demand curve. D. The C ...

... aggregate demand curve other than some of the variables that affect one curve also affect the other. B. The C + I + G + X curve is used to derive the aggregate demand curve, but the C. C + I + G + X curve is drawn for one price level while price levels vary along the aggregate demand curve. D. The C ...

The Danish Model—Don’t Try This at Home • No. 24 December 31, 2015

... revenue stemming from the introduction of a value-added tax and withholding taxes on wage income. The 1970s saw a strong tax revolt, as Mogens Glistrup’s newly formed Progress Party became the second largest in the 1973 “landslide” election. Nevertheless, spending kept growing as the welfare state a ...

... revenue stemming from the introduction of a value-added tax and withholding taxes on wage income. The 1970s saw a strong tax revolt, as Mogens Glistrup’s newly formed Progress Party became the second largest in the 1973 “landslide” election. Nevertheless, spending kept growing as the welfare state a ...

Scott Brown`s Weekly Market Monitor

... implementation.” This was a process that began a year earlier. Given the wide range of tools used by central banks in recent years, it’s worthwhile to evaluate their effectiveness and their drawbacks. No firm conclusions were reached in late July, and nothing is expected to be settled in Jackson Hol ...

... implementation.” This was a process that began a year earlier. Given the wide range of tools used by central banks in recent years, it’s worthwhile to evaluate their effectiveness and their drawbacks. No firm conclusions were reached in late July, and nothing is expected to be settled in Jackson Hol ...

Understanding the National Deficit and Debt: A Primer

... (grants, contracts, loans and entitlement spending) and $288 billion of tax cuts over two years.3 The deficit effect of these temporary measures will largely disappear, however, at the end of this year. For each year the federal government has a budget deficit, it must borrow the amount of the diffe ...

... (grants, contracts, loans and entitlement spending) and $288 billion of tax cuts over two years.3 The deficit effect of these temporary measures will largely disappear, however, at the end of this year. For each year the federal government has a budget deficit, it must borrow the amount of the diffe ...

If you were invited to give a talk to a group of citizens in Shanghai

... Kydland and Prescott(1977): the inability of policymakers to commit themselves to such a lowinflation policy can give rise to excessive inflation despite the absence of a long-run tradeoff. ...

... Kydland and Prescott(1977): the inability of policymakers to commit themselves to such a lowinflation policy can give rise to excessive inflation despite the absence of a long-run tradeoff. ...

Aggregate Demand, Aggregate Supply, and Modern Macroeconomics

... The interest rate effect works as follows: a decrease in the price level increase of real cash banks have more money to lend interest rates fall ...

... The interest rate effect works as follows: a decrease in the price level increase of real cash banks have more money to lend interest rates fall ...

Required Reserves

... ChngDI = $10,000bn - $9,000bn = $1,000bn ChngC = 0.25 x -$1,000bn = -$250bn. Since C0 was $8,600bn, the ChngC of -$250bn will bring consumption down to C1 = $8,350bn (= $8,600bn - $250bn). If, S = DI – C1 At a national income of $9,000bn (S) = $9,000bn of DI - $8,350bn of C = $550bn. ...

... ChngDI = $10,000bn - $9,000bn = $1,000bn ChngC = 0.25 x -$1,000bn = -$250bn. Since C0 was $8,600bn, the ChngC of -$250bn will bring consumption down to C1 = $8,350bn (= $8,600bn - $250bn). If, S = DI – C1 At a national income of $9,000bn (S) = $9,000bn of DI - $8,350bn of C = $550bn. ...

AQA Economics Unit 4

... • This could be caused by excessive long-term interest rates, or low levels of research and development. Low levels of investment in human capital • This involves a lack of investment in education and training, which reduce skill levels relative to competitor countries and force countries to produce ...

... • This could be caused by excessive long-term interest rates, or low levels of research and development. Low levels of investment in human capital • This involves a lack of investment in education and training, which reduce skill levels relative to competitor countries and force countries to produce ...

How to Make Europe Prosper Again: the Challenges of

... unfeasible and ultimately counter-productive. And, indeed, it is the latter that has been carried out, until now (German GDP growth for 2015 is estimated at 1.6%, hardly a stellar growth). It is doubtful, however, whether fiscal expansion in Europe’s core economies would suffice to boost sustained g ...

... unfeasible and ultimately counter-productive. And, indeed, it is the latter that has been carried out, until now (German GDP growth for 2015 is estimated at 1.6%, hardly a stellar growth). It is doubtful, however, whether fiscal expansion in Europe’s core economies would suffice to boost sustained g ...

Keynesian AS-AD

... that they will not be re-evaluated for nominal wage changes for an extended period. This leads to a contractual view of the labor market. ...

... that they will not be re-evaluated for nominal wage changes for an extended period. This leads to a contractual view of the labor market. ...

Answers to homework questions

... Most economists believe that from 2010 to 2013, actual GDP in the United States grew slightly faster than potential GDP. What, then, should have happened to the unemployment rate over those three years? Before that, from 2006 to 2010, actual GDP grew slower than potential GDP, even contracting for s ...

... Most economists believe that from 2010 to 2013, actual GDP in the United States grew slightly faster than potential GDP. What, then, should have happened to the unemployment rate over those three years? Before that, from 2006 to 2010, actual GDP grew slower than potential GDP, even contracting for s ...

ECONOMICS FOR EVERYONE: ON-LINE GLOSSARY OF TERMS

... Balanced Budget Laws: Laws (usually passed by rightwing governments) which require governments to run balanced budgets regardless of the state of the overall economy. These laws have the perverse effect of worsening economic downturns – since governments either must reduce spending or increase taxes ...

... Balanced Budget Laws: Laws (usually passed by rightwing governments) which require governments to run balanced budgets regardless of the state of the overall economy. These laws have the perverse effect of worsening economic downturns – since governments either must reduce spending or increase taxes ...

EC 11 Practice Exam No 2 Instructions. Use a number #2 pencil

... by 10 percent. After these changes, per capita real output will be (a) $200. (b) $5000. (c) $2,000. (d) $500. 6. In the previous question, suppose growth continues at the same rate of 10 percent in both real GDP and population. How long will it take for GDP per capita to double? (a) 70/10 = 7 years. ...

... by 10 percent. After these changes, per capita real output will be (a) $200. (b) $5000. (c) $2,000. (d) $500. 6. In the previous question, suppose growth continues at the same rate of 10 percent in both real GDP and population. How long will it take for GDP per capita to double? (a) 70/10 = 7 years. ...