Second Midterm and Answers

... 1. Print your last name, first name, and middle initial in the spaces marked "Last Name," "First Name," and "MI." Fill in the corresponding bubbles below. 2. Print your student ID number in the space marked "Identification Number." Fill in the bubbles. 3. Write the number of the discussion section y ...

... 1. Print your last name, first name, and middle initial in the spaces marked "Last Name," "First Name," and "MI." Fill in the corresponding bubbles below. 2. Print your student ID number in the space marked "Identification Number." Fill in the bubbles. 3. Write the number of the discussion section y ...

MASSIMO GIULIODORI - Universiteit van Amsterdam

... “Essays on the Monetary Economics of Low Income Countries” by Harold P.E. Ngalawa, University of Cape Town, May 2010 (supervisor: Prof. Nicola Viegi) ...

... “Essays on the Monetary Economics of Low Income Countries” by Harold P.E. Ngalawa, University of Cape Town, May 2010 (supervisor: Prof. Nicola Viegi) ...

CHAPTER 12

... decreases, the purchasing power of currency and checking account balances increases; therefore, households feel less need to save and are likely to buy a greater quantity of goods and services. Second, a lower price level decreases interest rates, which results in additional spending on investment g ...

... decreases, the purchasing power of currency and checking account balances increases; therefore, households feel less need to save and are likely to buy a greater quantity of goods and services. Second, a lower price level decreases interest rates, which results in additional spending on investment g ...

Econ 122a. Fall 2013. Note on definition of potential output Potential

... technological efficiency. Potential GDP tends to grow steadily because inputs like labor and capital and the level of technology change quite slowly over time. By contrast, actual GDP is subject to large business-cycle swings if spending patterns change sharply. During business downturns, actual GDP ...

... technological efficiency. Potential GDP tends to grow steadily because inputs like labor and capital and the level of technology change quite slowly over time. By contrast, actual GDP is subject to large business-cycle swings if spending patterns change sharply. During business downturns, actual GDP ...

President’s Report Board Directors

... personal consumption expenditures, private inventory investment, exports, residential fixed investment, nonresidential fixed investment, and state and local government spending. Those effects were partly offset by a negative contribution from federal government spending. Imports, which are a subtrac ...

... personal consumption expenditures, private inventory investment, exports, residential fixed investment, nonresidential fixed investment, and state and local government spending. Those effects were partly offset by a negative contribution from federal government spending. Imports, which are a subtrac ...

unit # 3 > aggregate demand and supply plus

... how would you describe the condition of the economy ? Given this equilibrium level of output , at what point would the economy line on the PPC ? Explain your ...

... how would you describe the condition of the economy ? Given this equilibrium level of output , at what point would the economy line on the PPC ? Explain your ...

chapter # 6 - how the markets work - supply

... how would you describe the condition of the economy ? Given this equilibrium level of output , at what point would the economy line on the PPC ? Explain your ...

... how would you describe the condition of the economy ? Given this equilibrium level of output , at what point would the economy line on the PPC ? Explain your ...

Government stability size and macroeconomic

... the destabilizing effects of taxes? Much of the observed effect results from the increase in the labor supply elasticity brought about by a higher tax rate, through its negative impact on steady state employment. lo The higher labor supply elasticity enhances the response of employment to a given te ...

... the destabilizing effects of taxes? Much of the observed effect results from the increase in the labor supply elasticity brought about by a higher tax rate, through its negative impact on steady state employment. lo The higher labor supply elasticity enhances the response of employment to a given te ...

Circular Flow: Drawing Further Inspiration from William Harvey

... The saving of the saving classes represents the capital of the global system; the nutrients passing to the saving class but not required by them for consumption purposes.13 The most direct way for the saving class to allocate this capital is via their companies as equity capital, through purchases o ...

... The saving of the saving classes represents the capital of the global system; the nutrients passing to the saving class but not required by them for consumption purposes.13 The most direct way for the saving class to allocate this capital is via their companies as equity capital, through purchases o ...

Money and Economic Stability in the ISLM World

... – There are two alternative LM curves: LMsteep and LMflat with two IS curves representing shifts in autonomous investment – Shift of the IS curve will result in much greater variations in economic activity with a flat LM curve – This is a result of greater variations in the rate of interest with the ...

... – There are two alternative LM curves: LMsteep and LMflat with two IS curves representing shifts in autonomous investment – Shift of the IS curve will result in much greater variations in economic activity with a flat LM curve – This is a result of greater variations in the rate of interest with the ...

Non-Keynesian Fiscal Policy effects

... Policy were developed by David Ricardo and John Maynard Keynes. On the one hand, David Ricardo's Theory, known as Ricardian Equivalence, debates Fiscal Policy will never affect the economy along with private consumption since Government expenditures are considered to be constant over time. So, any i ...

... Policy were developed by David Ricardo and John Maynard Keynes. On the one hand, David Ricardo's Theory, known as Ricardian Equivalence, debates Fiscal Policy will never affect the economy along with private consumption since Government expenditures are considered to be constant over time. So, any i ...

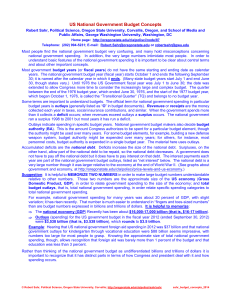

Budget Concepts - College of Liberal Arts

... budget years is outlays (generally listed as “O” in budget documents). Revenues or receipts are the money collected each year in taxes, social insurance contributions, and similar. When the government spends more than it collects a deficit occurs; when revenues exceed outlays a surplus occurs. The n ...

... budget years is outlays (generally listed as “O” in budget documents). Revenues or receipts are the money collected each year in taxes, social insurance contributions, and similar. When the government spends more than it collects a deficit occurs; when revenues exceed outlays a surplus occurs. The n ...

App 20

... Consumption is partly autonomous (the $1 trillion part, which people would spend no matter what their income, which depends on the current interest rate, real wealth, debt, and expectations), and partly induced, which means it depends on income, the portion that’s equal to 75 percent of income. ...

... Consumption is partly autonomous (the $1 trillion part, which people would spend no matter what their income, which depends on the current interest rate, real wealth, debt, and expectations), and partly induced, which means it depends on income, the portion that’s equal to 75 percent of income. ...

(a) Assume an economy is in internal balance but not external balan

... What has happened in the market for non-tradeables? As the relative price of non-tradeables has fallen, the consumption of non-tradeables has increased and the production of non-tradeables has fallen. This has led to excess demand in the market for nontradeables, and therefore inflation at point D. ...

... What has happened in the market for non-tradeables? As the relative price of non-tradeables has fallen, the consumption of non-tradeables has increased and the production of non-tradeables has fallen. This has led to excess demand in the market for nontradeables, and therefore inflation at point D. ...

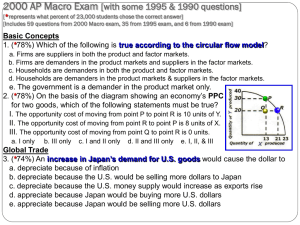

increase

... b. Income in the U.S. would be redistributed from the rich to the poor. c. The U.S. standard of living would increase. d. The United States economy would become less efficient. 6. (*58%) Mary Jane is a lawyer who can earn $150 per hour in her law practice. She is also an excellent carpenter who can ...

... b. Income in the U.S. would be redistributed from the rich to the poor. c. The U.S. standard of living would increase. d. The United States economy would become less efficient. 6. (*58%) Mary Jane is a lawyer who can earn $150 per hour in her law practice. She is also an excellent carpenter who can ...

Forecasting the 2008 Presidential Election

... Table 2 displays the fiscal model, combining either FISCAL or FPRIME with the four aforementioned controls, estimated over two different periods, 1880–2004 and 1916–2004. The longer period includes all 32 elections for which Fair provides data. The shorter interval is the one over which Fair estimat ...

... Table 2 displays the fiscal model, combining either FISCAL or FPRIME with the four aforementioned controls, estimated over two different periods, 1880–2004 and 1916–2004. The longer period includes all 32 elections for which Fair provides data. The shorter interval is the one over which Fair estimat ...

M. Finkler Macroeconomic Theory Answers to Problem Set #7 This

... Policy credibility means that the public believes the policy will be implemented, and, furthermore, acts on such beliefs even with occasional evidence to the contrary. Rules refer to formulas or equations. A monetary policy rule means an explicit equation that one might employ to predict the rate of ...

... Policy credibility means that the public believes the policy will be implemented, and, furthermore, acts on such beliefs even with occasional evidence to the contrary. Rules refer to formulas or equations. A monetary policy rule means an explicit equation that one might employ to predict the rate of ...

Government Spending Government Purchases versus Transfer

... Graphing the C + I + G + Xn Line To keep the graph as simple as possible, we are assuming the government spends a constant amount of money regardless of the level of disposable income ...

... Graphing the C + I + G + Xn Line To keep the graph as simple as possible, we are assuming the government spends a constant amount of money regardless of the level of disposable income ...

Inflation & Growth

... Inflation is a tax on money holders. A change in the rate of inflation can therefore change wealthholders’ preference between holding their wealth in the form of money or in the form of real assets and thus affect the growth rate. However, given the small proportion of total wealth which is held i ...

... Inflation is a tax on money holders. A change in the rate of inflation can therefore change wealthholders’ preference between holding their wealth in the form of money or in the form of real assets and thus affect the growth rate. However, given the small proportion of total wealth which is held i ...

The Effect of Government Purchases on Economic Growth in Japan

... We start by defining Y as Japan’s real GDP, G as the real value of central and local government purchases, Gc as the real value of government consumption, and Gi as the real value of government investment (where G ≠ Gc + Gi precisely, due to discrepancies). The first differences in these variables a ...

... We start by defining Y as Japan’s real GDP, G as the real value of central and local government purchases, Gc as the real value of government consumption, and Gi as the real value of government investment (where G ≠ Gc + Gi precisely, due to discrepancies). The first differences in these variables a ...

03/RT/2015 The macroeconomic effects of the Euro Area`s fiscal

... of annual Euro Area GDP from 2011 and 2013. The switch to fiscal austerity has been associated with a return of the EA economy to recession by the end of 2011, from which it emerged by the middle of 2013, thereby repeatedly undershooting predictions by the European Commission, the IMF and the OECD. ...

... of annual Euro Area GDP from 2011 and 2013. The switch to fiscal austerity has been associated with a return of the EA economy to recession by the end of 2011, from which it emerged by the middle of 2013, thereby repeatedly undershooting predictions by the European Commission, the IMF and the OECD. ...

Government Spending1

... Graphing the C + I + G + Xn Line To keep the graph as simple as possible, we are assuming the government spends a constant amount of money regardless of the level of disposable income ...

... Graphing the C + I + G + Xn Line To keep the graph as simple as possible, we are assuming the government spends a constant amount of money regardless of the level of disposable income ...

PAPER SERIES CURRENT MID ANTICIPATED DEFICITS, INTEREST RATES AND ECONOMIC ACTIVITY

... This section focuses on the effects of debt and deficits on the equilibrium sequence of interest rates in a full employment economy. This is needed to understand their effects in an economy which may not be at full employment; it is also of more than academic interest as some of the larger anticipat ...

... This section focuses on the effects of debt and deficits on the equilibrium sequence of interest rates in a full employment economy. This is needed to understand their effects in an economy which may not be at full employment; it is also of more than academic interest as some of the larger anticipat ...