Experimental Instructions

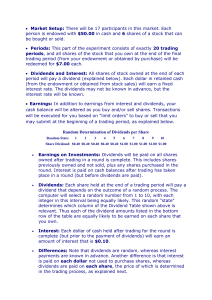

... pay the most will buy from those who are willing to sell for the least, but all trades will be at the same price. The mechanics of determining the clearing price will be explained next. Example: Suppose that the only bids submitted in a round are 60 cents for one share and 20 for another, and the ...

... pay the most will buy from those who are willing to sell for the least, but all trades will be at the same price. The mechanics of determining the clearing price will be explained next. Example: Suppose that the only bids submitted in a round are 60 cents for one share and 20 for another, and the ...

Longevity risk - Andrei Simonov

... * Smaller can mean either absolutely smaller than G1 (if fertility 2.0) or “smaller than would be the case if fertility had not ...

... * Smaller can mean either absolutely smaller than G1 (if fertility 2.0) or “smaller than would be the case if fertility had not ...

Risk-adjusted pricing: Risk-neutral, real

... Risk-adjusted pricing: Risk-neutral, real-world, or does it matter? By Seng Goh and David Wang ...

... Risk-adjusted pricing: Risk-neutral, real-world, or does it matter? By Seng Goh and David Wang ...

What is the Stock Market, anyway?

... If a company starts purchasing its own stock, what are the company leaders attempting to do? • (A) To raise company profits • (B) To increase company expenses • (C) To show that the company believes the price is too low • (D) To confuse the Securities and Exchange ...

... If a company starts purchasing its own stock, what are the company leaders attempting to do? • (A) To raise company profits • (B) To increase company expenses • (C) To show that the company believes the price is too low • (D) To confuse the Securities and Exchange ...

Chapter 8

... without owning the currency, the writer would now have to buy the currency at the spot and take the loss delivering at the strike price – The amount of such a loss is unlimited and increases as the underlying currency rises – Even if the writer already owns the currency, the writer will experience a ...

... without owning the currency, the writer would now have to buy the currency at the spot and take the loss delivering at the strike price – The amount of such a loss is unlimited and increases as the underlying currency rises – Even if the writer already owns the currency, the writer will experience a ...

What Types of Financial Market Structures Exist

... dealers themselves post bid and asked prices for this asset and then stand ready to buy or sell units of this asset with anyone who chooses to trade at these posted prices. The dealers provide customers more flexibility in trading than brokers, because dealers can offset imbalances in the demand and ...

... dealers themselves post bid and asked prices for this asset and then stand ready to buy or sell units of this asset with anyone who chooses to trade at these posted prices. The dealers provide customers more flexibility in trading than brokers, because dealers can offset imbalances in the demand and ...

DOC - Europa.eu

... more efficient market functioning. To close this gap, the Commission proposes action in several areas. Actions to accelerate market integration at EU level. As stressed by the Commission’s communication, timely implementation of the Financial Services Action Plan (FSAP) is the key. The FSAP includes ...

... more efficient market functioning. To close this gap, the Commission proposes action in several areas. Actions to accelerate market integration at EU level. As stressed by the Commission’s communication, timely implementation of the Financial Services Action Plan (FSAP) is the key. The FSAP includes ...

MFIN5600 Practice questions Chapter 1 1. Characterize each of the

... 1. Jane Farkas tells Susan DiMarco that she has seen exciting data on the performance of marketneutral, convertible arbitrage, and global macro hedge funds. Farkas states: ‘‘The Sharpe ratios of all of these hedge fund strategies are much higher than for traditional equities or bonds, which means th ...

... 1. Jane Farkas tells Susan DiMarco that she has seen exciting data on the performance of marketneutral, convertible arbitrage, and global macro hedge funds. Farkas states: ‘‘The Sharpe ratios of all of these hedge fund strategies are much higher than for traditional equities or bonds, which means th ...

Southeastern Asset Management

... can result in different things to different companies that we invest in or are considering investing in. Some of our companies are exporters, like United Technologies, and could benefit. Some that might be more dependent on world trade, like FedEx, might not, but there are certainly parts of FedEx, ...

... can result in different things to different companies that we invest in or are considering investing in. Some of our companies are exporters, like United Technologies, and could benefit. Some that might be more dependent on world trade, like FedEx, might not, but there are certainly parts of FedEx, ...

download

... • Typically larger in forward market • Costs increase as contracts move further into the future since spread widens • The employee cost • Trained staff necessary to monitor market for hedging instruments ...

... • Typically larger in forward market • Costs increase as contracts move further into the future since spread widens • The employee cost • Trained staff necessary to monitor market for hedging instruments ...

Capacity Markets Are Not the Optimal Means to Determine a

... means to support needed capacity. • A meaningful dialogue is needed to shift the paradigm away from capacity constructs. • APPA’s proposal can form the framework for such a dialogue. • Questions and comments are encouraged! ...

... means to support needed capacity. • A meaningful dialogue is needed to shift the paradigm away from capacity constructs. • APPA’s proposal can form the framework for such a dialogue. • Questions and comments are encouraged! ...

Longevity risk transfer markets: market structure, growth drivers and

... either structure. A deeper discussion of counterparty risks and the extent to which collateralisation can reduce them might be helpful in this section. Chapter 3 In Section 3.2 the CD states that “the degree to which pension plans are incentivised to pursue longevity de-risking are also impacted by ...

... either structure. A deeper discussion of counterparty risks and the extent to which collateralisation can reduce them might be helpful in this section. Chapter 3 In Section 3.2 the CD states that “the degree to which pension plans are incentivised to pursue longevity de-risking are also impacted by ...

entrada - Bolsa de Madrid

... In their report they state that in the present environment, where high frequency and algorithmic trading predominate, liquidity problems are an inherent difficultly that must be addressed. Indeed, even in the absence of extraordinary market events, limit order books can quickly empty and prices can ...

... In their report they state that in the present environment, where high frequency and algorithmic trading predominate, liquidity problems are an inherent difficultly that must be addressed. Indeed, even in the absence of extraordinary market events, limit order books can quickly empty and prices can ...

authorisation to purchase and hold own shares, in accordance with

... price for the three days the Stock Exchange is open prior to the transaction, and in any event not exceeding 6.80 euros (six euros, eighty cents); the quantity purchased in each transaction must not be less than 250 shares or more than 5,000 shares; 2. to authorise the Board of Directors, in accorda ...

... price for the three days the Stock Exchange is open prior to the transaction, and in any event not exceeding 6.80 euros (six euros, eighty cents); the quantity purchased in each transaction must not be less than 250 shares or more than 5,000 shares; 2. to authorise the Board of Directors, in accorda ...

Econ252 Midterm 1 Answers 1. WHAT IS BACKFILL BIAS? WHAT IS

... backfill bias: When a hedge fund is added to an index, the fund's past performance may be "backfilled" into the index. For example, if the fund has been in business for two years at the time it is added to the index, past index values are adjusted for those two years to reflect the fund's performanc ...

... backfill bias: When a hedge fund is added to an index, the fund's past performance may be "backfilled" into the index. For example, if the fund has been in business for two years at the time it is added to the index, past index values are adjusted for those two years to reflect the fund's performanc ...

The Black-Scoles Model The Binomial Model and Pricing American

... The Binomial Model and Pricing American Options Pricing European Options on dividend paying stocks Pricing European Options on Stock Indices Pricing European Options on FOREX Pricing European Options on Futures Pricing European Options on consumption commodities Pricing American Options on the above ...

... The Binomial Model and Pricing American Options Pricing European Options on dividend paying stocks Pricing European Options on Stock Indices Pricing European Options on FOREX Pricing European Options on Futures Pricing European Options on consumption commodities Pricing American Options on the above ...

1) Eurobonds versus Domestic Bonds

... Since I am selling euros and buying dollars, I should buy the put to hedge the risk of my profits. d. In the figure from parts (a) and (b), plot your “all in” profits using the option hedge (combined profits of crab contract, option contract, and option price) as a function of the exchange rate in o ...

... Since I am selling euros and buying dollars, I should buy the put to hedge the risk of my profits. d. In the figure from parts (a) and (b), plot your “all in” profits using the option hedge (combined profits of crab contract, option contract, and option price) as a function of the exchange rate in o ...