Code for fair disclosure - Indraprastha Gas Limited

... The Company shall provide only public information to the analyst/research persons/large investors like institutional investor. Alternatively, the information given to the analyst should be simultaneously made public at the earliest. (ii) Handling of unanticipated questions – The Company should be ca ...

... The Company shall provide only public information to the analyst/research persons/large investors like institutional investor. Alternatively, the information given to the analyst should be simultaneously made public at the earliest. (ii) Handling of unanticipated questions – The Company should be ca ...

What Are Financial Intermediaries Paid For?

... sell a security. A forward contract is a purchase agreement for goods or securities that is signed now, while the actual delivery of the good or securities occurs at a predetermined time in the future. A future contract is a traded forward contract that is secured by marking its value to the market ...

... sell a security. A forward contract is a purchase agreement for goods or securities that is signed now, while the actual delivery of the good or securities occurs at a predetermined time in the future. A future contract is a traded forward contract that is secured by marking its value to the market ...

Investment Management

... He adopts a buy and hold policy. He does not usually expect any significant increase in the value of his investments in less than a year. ...

... He adopts a buy and hold policy. He does not usually expect any significant increase in the value of his investments in less than a year. ...

Equity and Time to Sale in the Real Estate Market

... Realtors 1993). Over that same time period, real prices rose by over 130 percent, and then declined by almost one-third. These changes are much more dramatic than the movements of economic fundamentals such as unemployment and gross state product over the same time period. Some have argued that this ...

... Realtors 1993). Over that same time period, real prices rose by over 130 percent, and then declined by almost one-third. These changes are much more dramatic than the movements of economic fundamentals such as unemployment and gross state product over the same time period. Some have argued that this ...

Asset Classes and Financial Instruments

... instruments, which sell in minimum denominations of $100,000, T-bills sell in minimum denominations of only $100, although $10,000 denominations are far more common. The income earned on T-bills is exempt from all state and local taxes, another characteristic distinguishing them from other money mar ...

... instruments, which sell in minimum denominations of $100,000, T-bills sell in minimum denominations of only $100, although $10,000 denominations are far more common. The income earned on T-bills is exempt from all state and local taxes, another characteristic distinguishing them from other money mar ...

KCEE ECONOMICS/FINANCIAL LITERACY LESSON Title: Stock

... 11. How does the PE ratio help the investor evaluate a company and what should the investor compare it to? In general, a high P/E suggests that investors are expecting higher earnings growth in the future compared to companies with a lower P/E. However, the P/E ratio doesn't tell us the whole story ...

... 11. How does the PE ratio help the investor evaluate a company and what should the investor compare it to? In general, a high P/E suggests that investors are expecting higher earnings growth in the future compared to companies with a lower P/E. However, the P/E ratio doesn't tell us the whole story ...

Stock Prices Day 1

... A system for buying and selling shares of companies. This was how corporations were able to raise funds very quickly. ...

... A system for buying and selling shares of companies. This was how corporations were able to raise funds very quickly. ...

PowerPoint (file size: 4.1 MB) - Houston Marine Insurance Seminar

... you avoid significant volatility. … The improved visibility is worth it from a budgeting and expense allocation standpoint. - Michael Alvarez First Wind Energy ...

... you avoid significant volatility. … The improved visibility is worth it from a budgeting and expense allocation standpoint. - Michael Alvarez First Wind Energy ...

Trade Scheduling in Equity Markets: Theory and Practice

... Large orders are relatively expensive to trade. Stocks with high volume tend to be cheaper to trade Stocks with higher bid-ask spreads tend to be more expensive to trade Volatile stocks tend to be more expensive to trade than stocks that stay in tight trading ranges Similar stocks in diffe ...

... Large orders are relatively expensive to trade. Stocks with high volume tend to be cheaper to trade Stocks with higher bid-ask spreads tend to be more expensive to trade Volatile stocks tend to be more expensive to trade than stocks that stay in tight trading ranges Similar stocks in diffe ...

Solvency and Risk Based Supervision

... regulatory capital requirements, economic capital. insurers have asset-liability management policy and describe relationship to product development, pricing , investment management. insurers have explicit investment policy and how policy complies ...

... regulatory capital requirements, economic capital. insurers have asset-liability management policy and describe relationship to product development, pricing , investment management. insurers have explicit investment policy and how policy complies ...

September 2014

... However, an inflation-only hedge with a deferred interest rate hedge offers the potential opportunity to achieve real rate coverage at a more attractive combined level. However, doing so changes the nature of the overall risk exposure, which may not result in risk reduction. Whilst it is true th ...

... However, an inflation-only hedge with a deferred interest rate hedge offers the potential opportunity to achieve real rate coverage at a more attractive combined level. However, doing so changes the nature of the overall risk exposure, which may not result in risk reduction. Whilst it is true th ...

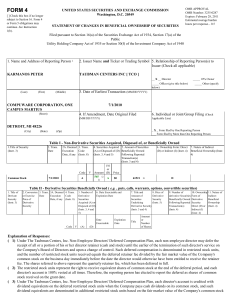

TAUBMAN CENTERS INC (Form: 4, Received: 07/01/2010 16:04:49)

... receipt of all or a portion of his or her director retainer (cash and stock) until the earlier of the termination of such director's service on the Company's Board of Directors and upon a change of control. Such deferred compensation is denominated in restricted stock units, and the number of restri ...

... receipt of all or a portion of his or her director retainer (cash and stock) until the earlier of the termination of such director's service on the Company's Board of Directors and upon a change of control. Such deferred compensation is denominated in restricted stock units, and the number of restri ...

press release text the wall street journal category kings

... futures, involve risks different, and in certain cases, greater than the risks presented by more traditional investments. Short selling of securities may result in the Fund's investment performance suffering if it is requires to close out a short position earlier than it had intended. Growth stocks ...

... futures, involve risks different, and in certain cases, greater than the risks presented by more traditional investments. Short selling of securities may result in the Fund's investment performance suffering if it is requires to close out a short position earlier than it had intended. Growth stocks ...

derivatives - Borsa İstanbul

... 1,000,000 capital, deposit interest rate is 10.27% and you expect USD/TRY rate not to be below 2.6000 by the end of June. In this case, you can sell the put option worth TRY 1,000,000 with the exercise price 2.6000. When the spot rate is 2.6300 and contract size is USD 1,000, this amount equals to 3 ...

... 1,000,000 capital, deposit interest rate is 10.27% and you expect USD/TRY rate not to be below 2.6000 by the end of June. In this case, you can sell the put option worth TRY 1,000,000 with the exercise price 2.6000. When the spot rate is 2.6300 and contract size is USD 1,000, this amount equals to 3 ...

7 Principles of Investing in a Volatile Market. - 401k.com

... Companies, Inc., and has been licensed for use by Fidelity Distributors Corporation and its affiliates. It is an unmanaged index of the common stock prices of 500 widely held U.S. stocks that includes the reinvestment of dividends. Bonds are represented by the U.S. Intermediate Government Bond Index ...

... Companies, Inc., and has been licensed for use by Fidelity Distributors Corporation and its affiliates. It is an unmanaged index of the common stock prices of 500 widely held U.S. stocks that includes the reinvestment of dividends. Bonds are represented by the U.S. Intermediate Government Bond Index ...