Base Prospectus of TIMBERLAND SECURITIES INVESTMENT PLC

... In accordance with the Liechtenstein law relating to securities prospectuses dated 23 May 2007 as amended (Wertpapierprospektgesetz) (the Liechtenstein Securities Prospectus Act), this Base Prospectus was approved by the Liechtenstein Financial Market Authority (the FMA) as the competent authority i ...

... In accordance with the Liechtenstein law relating to securities prospectuses dated 23 May 2007 as amended (Wertpapierprospektgesetz) (the Liechtenstein Securities Prospectus Act), this Base Prospectus was approved by the Liechtenstein Financial Market Authority (the FMA) as the competent authority i ...

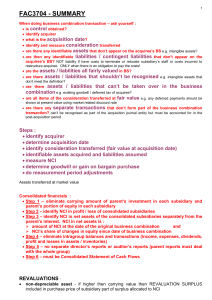

Assignment 1 is compulsory and due

... Subsidiary would depreciate at 20% so would have R 9 000 depreciation per year If eliminate unrealised profit of R 5 000 then subsidiary must value asset at R 40 000 and depreciation @ 20% would be R 8 000 per year So excess depreciation of R 1 000 (R 9 000 – R 8 000) must be written back every year ...

... Subsidiary would depreciate at 20% so would have R 9 000 depreciation per year If eliminate unrealised profit of R 5 000 then subsidiary must value asset at R 40 000 and depreciation @ 20% would be R 8 000 per year So excess depreciation of R 1 000 (R 9 000 – R 8 000) must be written back every year ...

Equipment Leasing - Slaughter and May

... make a capital investment needed finance. Banks were the obvious source for this but if a company which was in a tax loss position and expected to be so for some years simply borrowed the money to buy the asset, the benefit of the first-year allowance would be wasted. The easy solution, as the banks ...

... make a capital investment needed finance. Banks were the obvious source for this but if a company which was in a tax loss position and expected to be so for some years simply borrowed the money to buy the asset, the benefit of the first-year allowance would be wasted. The easy solution, as the banks ...

Addressing the Tax Challenges of the Digital Economy, Action 1

... today. The integration of national economies and markets has increased substantially in recent years, putting a strain on the international tax rules, which were designed more than a century ago. Weaknesses in the current rules create opportunities for base erosion and profit shifting (BEPS), requir ...

... today. The integration of national economies and markets has increased substantially in recent years, putting a strain on the international tax rules, which were designed more than a century ago. Weaknesses in the current rules create opportunities for base erosion and profit shifting (BEPS), requir ...

Issues Paper - Tax Review 2001

... New Zealand cannot set tax policy in ignorance of other countries’ tax systems or the effects of a rapidly changing global economy. We live in a small country with a high reliance on foreign capital and an increasing reliance on skilled labour. It is therefore critical that we understand both how ta ...

... New Zealand cannot set tax policy in ignorance of other countries’ tax systems or the effects of a rapidly changing global economy. We live in a small country with a high reliance on foreign capital and an increasing reliance on skilled labour. It is therefore critical that we understand both how ta ...

1/20/04 All rights reserved IS EQUITY

... employees in the interim, and thus one must consider how that investment is made and how it is taxed in order to complete the equity compensation taxation equation.5 The primary aim of this article is to begin to complete this picture. We will focus on the two issues raised in the prior paragraph. F ...

... employees in the interim, and thus one must consider how that investment is made and how it is taxed in order to complete the equity compensation taxation equation.5 The primary aim of this article is to begin to complete this picture. We will focus on the two issues raised in the prior paragraph. F ...

Problems Involving Permanent Establishments: Overview of

... capacity to a higher international degree in order to include foreign taxpayers, they are also further enhancing the risk that one of those subjects may become susceptible to overlapping taxation by more than one tax jurisdiction. As a response, some legal instruments, assuming the form of internati ...

... capacity to a higher international degree in order to include foreign taxpayers, they are also further enhancing the risk that one of those subjects may become susceptible to overlapping taxation by more than one tax jurisdiction. As a response, some legal instruments, assuming the form of internati ...

The Separation of Ownership and Control and Corporate Tax

... market pressure place greater weight on financial than taxable income when divesting operating units, relative to public firms subject to less capital market pressure.10 That is, public firms subject to greater capital market pressure are willing to trade-off higher tax costs for the benefit of high ...

... market pressure place greater weight on financial than taxable income when divesting operating units, relative to public firms subject to less capital market pressure.10 That is, public firms subject to greater capital market pressure are willing to trade-off higher tax costs for the benefit of high ...

Capital Gains Taxation and Cross-border M&As

... for which a large part of total investor returns comes in the form of capital gains. Thus, capital gains taxation potentially depresses share prices, and raises the cost of equity finance to firms. The measurement of the impact of capital gains taxation on the cost of capital, however, has proven di ...

... for which a large part of total investor returns comes in the form of capital gains. Thus, capital gains taxation potentially depresses share prices, and raises the cost of equity finance to firms. The measurement of the impact of capital gains taxation on the cost of capital, however, has proven di ...

Constructive Sales

... In general, most constructive sales are also considered straddles. But not every straddle is a constructive sale. We will discuss several major differences here. First, the language in section (1092) for straddles uses the term “offsetting” to determine when a second position induces a straddle. Con ...

... In general, most constructive sales are also considered straddles. But not every straddle is a constructive sale. We will discuss several major differences here. First, the language in section (1092) for straddles uses the term “offsetting” to determine when a second position induces a straddle. Con ...

Tax and Liquidity Effects in Pricing Government Bonds

... wishes to thank Nasdaq for financial assistance. ...

... wishes to thank Nasdaq for financial assistance. ...

Taxation Around the World in Profile

... No single tax structure can possibly meet the requirements of every country in the world. The best system for each country must be determined on the basis of its economic structure, its capacity to administer taxes, its public service needs, and many other factors discussed later in this report. Non ...

... No single tax structure can possibly meet the requirements of every country in the world. The best system for each country must be determined on the basis of its economic structure, its capacity to administer taxes, its public service needs, and many other factors discussed later in this report. Non ...

Taxation of Intermediate Goods

... for taxes on commodities are distinguished. The purpose of fiscal taxes is to collect money for government expenditure. The purpose of Pigovian taxes is to correct for externalities in consumption or production. In some cases a tax fulfils both these purposes at the same time; in which case the so-c ...

... for taxes on commodities are distinguished. The purpose of fiscal taxes is to collect money for government expenditure. The purpose of Pigovian taxes is to correct for externalities in consumption or production. In some cases a tax fulfils both these purposes at the same time; in which case the so-c ...

Implications of a Switch to a Territorial Tax System in the United States

... We compare the behavior of U.S. MNCs under the current system with their likely behavior under a stylized territorial tax system (characterized in more detail below). This point of comparison is an essential element of our analysis. We assess the expected benefits and costs from a switch to a territ ...

... We compare the behavior of U.S. MNCs under the current system with their likely behavior under a stylized territorial tax system (characterized in more detail below). This point of comparison is an essential element of our analysis. We assess the expected benefits and costs from a switch to a territ ...

A European Financial Transaction Tax

... that neither labour market impacts from higher overall taxation nor the effect of recirculating tax revenue is included in the GDP estimates. With rates for securities of 0.1 per cent and 0.01 per cent, and using earlier studies, the negative GDP effects for Germany might be in the range in between ...

... that neither labour market impacts from higher overall taxation nor the effect of recirculating tax revenue is included in the GDP estimates. With rates for securities of 0.1 per cent and 0.01 per cent, and using earlier studies, the negative GDP effects for Germany might be in the range in between ...

Dr. (CS) Sanjiv Agarwal

... having comprehensive and continuous chain of set-of benefits from the producer’s/ service provider’s point up to the retailer’s level where only the final consumer should bear the tax.” ...

... having comprehensive and continuous chain of set-of benefits from the producer’s/ service provider’s point up to the retailer’s level where only the final consumer should bear the tax.” ...

elective taxation on inbound real estate investment

... and domestic investors by ensuring collection of tax on inbound investments.11 Despite the equal treatment aim, however, the United States has created an inbound investment environment where the rules are both easily avoided, and becoming less stringent.12 The effect is that foreign investors have a ...

... and domestic investors by ensuring collection of tax on inbound investments.11 Despite the equal treatment aim, however, the United States has created an inbound investment environment where the rules are both easily avoided, and becoming less stringent.12 The effect is that foreign investors have a ...

B — Investment and entity taxation B1. C ........................................................149

... income tax rate from 35 per cent to 30 per cent would lead to an increase in the investment to capital ratio of around 1.9 per cent. The study found that the effect of company income taxes is strongest on industries that are older and more profitable (and so have larger tax bases). Younger and small ...

... income tax rate from 35 per cent to 30 per cent would lead to an increase in the investment to capital ratio of around 1.9 per cent. The study found that the effect of company income taxes is strongest on industries that are older and more profitable (and so have larger tax bases). Younger and small ...

Research Centre for International Economics Working Paper: 2013046

... reliance on collateral in financially more developed economies. First, better developed credit registries and higher branch penetration might reduce average borrowing costs and thus make the potential increase in financing costs due to tax evasion more affordable to firms. 9 Another possible counter ...

... reliance on collateral in financially more developed economies. First, better developed credit registries and higher branch penetration might reduce average borrowing costs and thus make the potential increase in financing costs due to tax evasion more affordable to firms. 9 Another possible counter ...

The Information Content of Tax Expense: A Firm- and Market

... enters into firm and market returns is important to researchers and policy makers for assessing the potential capital market implications of a change in its measurement due to changes in tax or financial reporting policy. Further, the study of aggregate tax expense and market returns contributes to ...

... enters into firm and market returns is important to researchers and policy makers for assessing the potential capital market implications of a change in its measurement due to changes in tax or financial reporting policy. Further, the study of aggregate tax expense and market returns contributes to ...

Optimal Tax Timing with Asymmetric Long-Term/Short

... We also show that adopting the optimal trading strategy can be economically important. For example, consider the alternative strategy of immediately realizing all losses and long-term gains but deferring all short-term gains, as most of the existing literature recommends. We find that the certainty ...

... We also show that adopting the optimal trading strategy can be economically important. For example, consider the alternative strategy of immediately realizing all losses and long-term gains but deferring all short-term gains, as most of the existing literature recommends. We find that the certainty ...

NBER WORKING PAPER SERIES INTERNATIONAL TAXATION Roger H. Gordon James R. Hines Jr.

... national economy was closed. In this literature the implications for tax policy of international trade and international factor movements typically consisted of a short discussion at the conclusion of a long analysis. In studies of closed economies, real and financial activity cannot cross internati ...

... national economy was closed. In this literature the implications for tax policy of international trade and international factor movements typically consisted of a short discussion at the conclusion of a long analysis. In studies of closed economies, real and financial activity cannot cross internati ...

An effective property tax regime for Rwanda

... land tax, sales tax, and rental income tax. If any of these are too high, it would suggest taking a lower buildings tax rate, and vice versa if they are too low. The rental income tax is in line with rates in other countries and a good, progressive regime, 1 so is not discussed in this paper. We als ...

... land tax, sales tax, and rental income tax. If any of these are too high, it would suggest taking a lower buildings tax rate, and vice versa if they are too low. The rental income tax is in line with rates in other countries and a good, progressive regime, 1 so is not discussed in this paper. We als ...

Goods and Services Tax (GST)

... is offset against the amount collected and the net figure is then paid regularly to the Australian Taxation Office (ATO) by the business. Because we collect on behalf of someone else (the ATO) and the money is not ours, we record it in a liability account. It is a debt we must repay. There are many ...

... is offset against the amount collected and the net figure is then paid regularly to the Australian Taxation Office (ATO) by the business. Because we collect on behalf of someone else (the ATO) and the money is not ours, we record it in a liability account. It is a debt we must repay. There are many ...

Luxembourg Leaks

Luxembourg Leaks (sometimes shortened to Lux Leaks or LuxLeaks) is the name of a financial scandal revealed in November 2014 by a journalistic investigation conducted by the International Consortium of Investigative Journalists. It is based on confidential information about Luxembourg’s tax rulings set up by PricewaterhouseCoopers from 2002 to 2010 to the benefits of its clients. This investigation resulted in making available to the public tax rulings for over three hundred multinational companies in Luxembourg.The LuxLeaks' disclosures attracted international attention and comment about tax avoidance schemes in Luxembourg and elsewhere. This scandal contributed to the implementation of measures aiming at reducing tax dumping and regulating tax avoidance schemes beneficial to multinational companies.The judicial aspects of this case concerns the persons charged by Luxembourg justice for participating in the revelations.