2014 DCIIA: Dedicated to Enhancing Retirement Security

... © 2014 DCIIA: Dedicated to Enhancing Retirement Security ...

... © 2014 DCIIA: Dedicated to Enhancing Retirement Security ...

Collateral-Motivated Financial Innovation

... To understand these issues, first consider a benchmark case without collateral frictions. In this case, if an investor defaults on his promise (e.g., debt or a short position in an Arrow security), his counterparty can seize the collateral the investor has posted for the trade and the defaulting inve ...

... To understand these issues, first consider a benchmark case without collateral frictions. In this case, if an investor defaults on his promise (e.g., debt or a short position in an Arrow security), his counterparty can seize the collateral the investor has posted for the trade and the defaulting inve ...

Payments on Long-Term Debt As Voidable Preferences

... bankruptcy petition. In the case of a corporate debtor, an insider is defined to include a director, officer, or person in control of the debtor, IIU.S.C. § 101(28)(B)o-(ii) (Supp. III 1985), and in the case of an individual debtor, an insider is defined to include a relative of the debtor. Id. § 10 ...

... bankruptcy petition. In the case of a corporate debtor, an insider is defined to include a director, officer, or person in control of the debtor, IIU.S.C. § 101(28)(B)o-(ii) (Supp. III 1985), and in the case of an individual debtor, an insider is defined to include a relative of the debtor. Id. § 10 ...

Repo Regret? - The University of Chicago Booth School of Business

... with large IMC originators. This is consistent with the relaxation of funding constraints due to a positive funding supply shock as smaller firms in general tend to be more constrained than larger firms (Whited and Wu (2006)). Although comparing small and large IMC originators relieves the concern ...

... with large IMC originators. This is consistent with the relaxation of funding constraints due to a positive funding supply shock as smaller firms in general tend to be more constrained than larger firms (Whited and Wu (2006)). Although comparing small and large IMC originators relieves the concern ...

This PDF is a selection from an out-of-print volume from... of Economic Research

... suraljie. While they are easier to calculate than more appropriate ratios, and probably are more familiar, their use should be avoided if the other ratios are available. The ratio of financial intermediaries' net claims against business ' These ratios disregard the fact that the assets of linanclid ...

... suraljie. While they are easier to calculate than more appropriate ratios, and probably are more familiar, their use should be avoided if the other ratios are available. The ratio of financial intermediaries' net claims against business ' These ratios disregard the fact that the assets of linanclid ...

Mortgage Choices and Housing Speculation

... similarly to Kiyotaki and Moore (1997). This hypothesis is distinct but not mutually exclusive of the forces we study. ...

... similarly to Kiyotaki and Moore (1997). This hypothesis is distinct but not mutually exclusive of the forces we study. ...

GUARANTEED SENIOR SECURED NOTES PROGRAMME issued

... Goldman Sachs Bank (Europe) Plc (“GSBE”) and Goldman Sachs International (“GSI”, and together with GSBE, the “Issuers”, and each an “Issuer”), subject to compliance with all relevant laws, regulations and directives, may each from time to time issue debt securities (the “Notes”) under the programme ...

... Goldman Sachs Bank (Europe) Plc (“GSBE”) and Goldman Sachs International (“GSI”, and together with GSBE, the “Issuers”, and each an “Issuer”), subject to compliance with all relevant laws, regulations and directives, may each from time to time issue debt securities (the “Notes”) under the programme ...

The Impact of Consumer Credit Counseling on Distressed Mortgage

... Most competitors in the “distressed servicing” space of the mortgage industry either sub‐ service distressed loans serviced by other lenders or service loans owned by investors that have acquired portfolios of distressed loans, e.g., equity funds, hedge funds, etc. Typically, such co ...

... Most competitors in the “distressed servicing” space of the mortgage industry either sub‐ service distressed loans serviced by other lenders or service loans owned by investors that have acquired portfolios of distressed loans, e.g., equity funds, hedge funds, etc. Typically, such co ...

Real Estate - The Law Society of British Columbia

... Each year, lawyers in British Columbia help buyers and sellers with many thousands of transfers of real property, commonly known as conveyances. Lawyers who have a conveyancing practice often rely on non-lawyers to assist with some stages or parts of a transaction. ...

... Each year, lawyers in British Columbia help buyers and sellers with many thousands of transfers of real property, commonly known as conveyances. Lawyers who have a conveyancing practice often rely on non-lawyers to assist with some stages or parts of a transaction. ...

The Security Economy

... array of potential hazards, from terrorism and computer viruses to fraud and organised crime, the world is perceived by many to be an increasingly dangerous place. As a result, the focus on security issues has sharpened and the demand for security-related goods and services has steadily grown, givin ...

... array of potential hazards, from terrorism and computer viruses to fraud and organised crime, the world is perceived by many to be an increasingly dangerous place. As a result, the focus on security issues has sharpened and the demand for security-related goods and services has steadily grown, givin ...

SWD(2014) 61 final - European Commission

... record numbers of bankruptcies in most Member States, improving the efficiency of insolvency laws in the EU has become an important factor in supporting the economic recovery. In recent years, an average of 200,000 firms went bankrupt each year in the EU, resulting in direct job losses totalling 5.1 ...

... record numbers of bankruptcies in most Member States, improving the efficiency of insolvency laws in the EU has become an important factor in supporting the economic recovery. In recent years, an average of 200,000 firms went bankrupt each year in the EU, resulting in direct job losses totalling 5.1 ...

Chapter 25 - North Carolina General Assembly

... "Organization" means a person other than an individual. "Party," as distinguished from "third party," means a person that has engaged in a transaction or made an agreement subject to this Chapter. "Person" means an individual, corporation, business trust, estate, trust, partnership, limited liabilit ...

... "Organization" means a person other than an individual. "Party," as distinguished from "third party," means a person that has engaged in a transaction or made an agreement subject to this Chapter. "Person" means an individual, corporation, business trust, estate, trust, partnership, limited liabilit ...

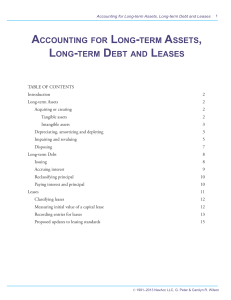

accounting for long-term assets, long

... resources are structurally the same. For example, to record depreciation expense, we increase the expense and increase accumulated depreciation. To record amortization expense, we increase the expense and increase accumulated amortization. These are the only depreciation and amortization entries for ...

... resources are structurally the same. For example, to record depreciation expense, we increase the expense and increase accumulated depreciation. To record amortization expense, we increase the expense and increase accumulated amortization. These are the only depreciation and amortization entries for ...

Social Security and Unsecured Debt

... discounting. Laibson, Repetto, and Tobacman (1998) show that one commitment device, 401 (k) plans, raises utility much more for hyperbolic than for exponential households in a partial-equilibrium model. Our findings for “tempted” households are completely consistent with the findings of Laibson et a ...

... discounting. Laibson, Repetto, and Tobacman (1998) show that one commitment device, 401 (k) plans, raises utility much more for hyperbolic than for exponential households in a partial-equilibrium model. Our findings for “tempted” households are completely consistent with the findings of Laibson et a ...

ALMADEN MINERALS LTD

... standards and amendments which the Company adopted and are effective for the Company's interim and annual consolidated financial statements commencing January 1, 2015. The following are the accounting standards issued but not yet effective, as of January 1, 2015. ...

... standards and amendments which the Company adopted and are effective for the Company's interim and annual consolidated financial statements commencing January 1, 2015. The following are the accounting standards issued but not yet effective, as of January 1, 2015. ...

Risk Disclosure Statement for Security Futures Contracts

... Under certain market conditions, it may be difficult or impossible to liquidate a position. Generally, you must enter into an offsetting transaction in order to liquidate a position in a security futures contract. If you cannot liquidate your position in a security futures contracts, you may not be ...

... Under certain market conditions, it may be difficult or impossible to liquidate a position. Generally, you must enter into an offsetting transaction in order to liquidate a position in a security futures contract. If you cannot liquidate your position in a security futures contracts, you may not be ...

What Does Accepted for Value Mean?

... UCC 1-201(44) generally says that a person gives value. He gives value to get rights. If one person is giving value, another person is asked to give rights in exchange. Both giving value and giving rights meet the element of consideration. The question has to be - What constitutes value? In today’s ...

... UCC 1-201(44) generally says that a person gives value. He gives value to get rights. If one person is giving value, another person is asked to give rights in exchange. Both giving value and giving rights meet the element of consideration. The question has to be - What constitutes value? In today’s ...

Portfolio Management: Course Introduction

... MVO: All risky assets (market) and one risk-free asset • We can generalize our previous results by considering all risky assets and one risk-free asset. The tangency (optimal risky) portfolio is the market portfolio. All investors will hold a combination of the risk-free asset and this market portf ...

... MVO: All risky assets (market) and one risk-free asset • We can generalize our previous results by considering all risky assets and one risk-free asset. The tangency (optimal risky) portfolio is the market portfolio. All investors will hold a combination of the risk-free asset and this market portf ...

The Myth of Home Ownership and Why Home Ownership is Not

... home ownership.' 8 Even before the recent mortgage crisis forced the government to increase its involvement in the housing market, the United States had an active role in the housing market and helped facilitate the transition from renting to home ownership. The Federal Housing Administration (FHA) ...

... home ownership.' 8 Even before the recent mortgage crisis forced the government to increase its involvement in the housing market, the United States had an active role in the housing market and helped facilitate the transition from renting to home ownership. The Federal Housing Administration (FHA) ...

Inflation and the Housing Market

... residence (totally exempt if reinvested in another residence and taxed at the capital gain rate otherwise), inflation should actually lower the real cost of home ownership. The Level of Inflation and the Ability of Households to Purchase Housing. Even though inflation does not increase the sum of di ...

... residence (totally exempt if reinvested in another residence and taxed at the capital gain rate otherwise), inflation should actually lower the real cost of home ownership. The Level of Inflation and the Ability of Households to Purchase Housing. Even though inflation does not increase the sum of di ...

Saving Your Home in Bankruptcy

... rental housing. If debtors default but do not file for bankruptcy, then mortgage lenders are assumed to foreclose and debtors relocate to rental housing. Assume that debtors’ relocation cost is L and that rental housing costs R per year. Lenders’ cost of foreclosure is denoted C f . Mortgages are a ...

... rental housing. If debtors default but do not file for bankruptcy, then mortgage lenders are assumed to foreclose and debtors relocate to rental housing. Assume that debtors’ relocation cost is L and that rental housing costs R per year. Lenders’ cost of foreclosure is denoted C f . Mortgages are a ...

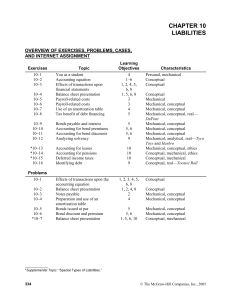

Internet Assignment

... short-term creditors. The fact that operating income amounts to only 75% of annual interest implies that Low-Cal may have great difficulty in remaining solvent in the long run. It does not imply, however, that the company is not currently solvent. Short-term creditors, because of their shorter inves ...

... short-term creditors. The fact that operating income amounts to only 75% of annual interest implies that Low-Cal may have great difficulty in remaining solvent in the long run. It does not imply, however, that the company is not currently solvent. Short-term creditors, because of their shorter inves ...

Pre-Sale Fitch - The Paragon Group of Companies

... favoured by BTL borrowers. Interest-only loans can be construed to be riskier than amortising loans because of the greater risk that the borrower may be unable to repay the debt in full at maturity (ie balloon payment risk). However, interest-only hits will ordinarily not apply to BTL products as th ...

... favoured by BTL borrowers. Interest-only loans can be construed to be riskier than amortising loans because of the greater risk that the borrower may be unable to repay the debt in full at maturity (ie balloon payment risk). However, interest-only hits will ordinarily not apply to BTL products as th ...

purchase price allocation in real estate

... particular property regardless of other considerations. Correct application of the sales comparison approach is an essential part of the valuation process, as it provides a probable range of market value for the subject property. In the sales comparison approach, the geographic limits of the apprais ...

... particular property regardless of other considerations. Correct application of the sales comparison approach is an essential part of the valuation process, as it provides a probable range of market value for the subject property. In the sales comparison approach, the geographic limits of the apprais ...

Annual and Semi-annual Reporting Instructions

... In corresponding and communicating with regulated institutions, the AMF must, at all times, ensure that it complies with the Charter of the French Language and government policy regarding the use and quality of the French language. Accordingly, the AMF provides its regulated institutions with regula ...

... In corresponding and communicating with regulated institutions, the AMF must, at all times, ensure that it complies with the Charter of the French Language and government policy regarding the use and quality of the French language. Accordingly, the AMF provides its regulated institutions with regula ...