View/Open

... entrepreneurship [Sobolewski 2011]. Growth of financial capital boosts the production, brings additional tax flows and helps reduce an unemployment rate. Besides acquiring new experience and learning advanced technologies (“know-how”) by local companies leads to an increase of their competiveness an ...

... entrepreneurship [Sobolewski 2011]. Growth of financial capital boosts the production, brings additional tax flows and helps reduce an unemployment rate. Besides acquiring new experience and learning advanced technologies (“know-how”) by local companies leads to an increase of their competiveness an ...

Western Asset Corporate Bond Ladders 1-5 Years

... put provisions and the issuer can offer a lower coupon rate based on current market rates. If market rates are higher than the current yield of a bond, the YTW calculation will assume no prepayments are made, and YTW will equal the yield to maturity. The YTW will be the lowest of yield to maturity o ...

... put provisions and the issuer can offer a lower coupon rate based on current market rates. If market rates are higher than the current yield of a bond, the YTW calculation will assume no prepayments are made, and YTW will equal the yield to maturity. The YTW will be the lowest of yield to maturity o ...

Slide 1

... USE OF ILLIQUID ASSETS Commercial Mortgages: add diversification into an asset class challenging for clients to achieve on their own, by a team of experienced mortgage specialists. Private Placement Loans: provide corporate bond type returns with reduced risk and/or higher yields. Real Estate: adds ...

... USE OF ILLIQUID ASSETS Commercial Mortgages: add diversification into an asset class challenging for clients to achieve on their own, by a team of experienced mortgage specialists. Private Placement Loans: provide corporate bond type returns with reduced risk and/or higher yields. Real Estate: adds ...

Jeremy Jennings Presentation

... Based on a fundamental theory that value can be determined based a comparison to similar companies that have been sold or are publicly traded. For FLLC/FLPs, comparisons should be made based on factors such as type of assets, capital structure and cash distribution characteristics ...

... Based on a fundamental theory that value can be determined based a comparison to similar companies that have been sold or are publicly traded. For FLLC/FLPs, comparisons should be made based on factors such as type of assets, capital structure and cash distribution characteristics ...

Chapter 15

... the used of financial leverage Leverage allows the cash flows to be divided into two components: less risky and more risky Value can be created if debt holder and equity holder have different risk-return preferences ...

... the used of financial leverage Leverage allows the cash flows to be divided into two components: less risky and more risky Value can be created if debt holder and equity holder have different risk-return preferences ...

Justification for investments in land administration systems

... local tax. Without knowledge about taxable persons, taxable objects and land values (all data to be provided by the land administration system), the generated revenue cannot be high. Land taxation in many countries is based on land administration systems. The management of environmental resources is ...

... local tax. Without knowledge about taxable persons, taxable objects and land values (all data to be provided by the land administration system), the generated revenue cannot be high. Land taxation in many countries is based on land administration systems. The management of environmental resources is ...

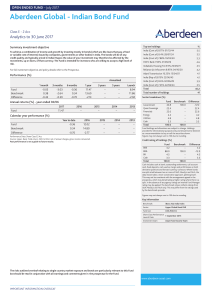

Aberdeen Global - Indian Bond Fund

... Variable (a “SICAV”). The information contained in this marketing document is intended to be of general interest only and should not be considered as an offer, or solicitation, to deal in the shares of any securities or financial instruments. Aberdeen Global has been authorized for public sale in ce ...

... Variable (a “SICAV”). The information contained in this marketing document is intended to be of general interest only and should not be considered as an offer, or solicitation, to deal in the shares of any securities or financial instruments. Aberdeen Global has been authorized for public sale in ce ...

Profit shifting

... Jonathan Pycroft, Maria Gesualdo, Dimitrios Pontikakis Disclaimer: The views expressed are purely those of the authors and may not in any circumstances be regarded as stating an official position of any affiliated institution. ...

... Jonathan Pycroft, Maria Gesualdo, Dimitrios Pontikakis Disclaimer: The views expressed are purely those of the authors and may not in any circumstances be regarded as stating an official position of any affiliated institution. ...

Introduction - Corporate and Professional Pensions Ltd

... * Unquoted shares will need special consideration and you should let us have details of any proposed purchase as we may not be able to enter into certain transactions. A valuable concession for SIPP’s is the ability to purchase a commercial property, which may then be leased back to the members’ bus ...

... * Unquoted shares will need special consideration and you should let us have details of any proposed purchase as we may not be able to enter into certain transactions. A valuable concession for SIPP’s is the ability to purchase a commercial property, which may then be leased back to the members’ bus ...

C Corporation

... • Loss limits apply to owners of partnerships, LLCs, and S corps – Passive losses are separately stated items that flow through to owners – Passive loss rules apply at the owner level ...

... • Loss limits apply to owners of partnerships, LLCs, and S corps – Passive losses are separately stated items that flow through to owners – Passive loss rules apply at the owner level ...

east bay apartments, llc

... LLC will invest in more than one residential property with the profit goal being to first return investor's original capital investment and then profits through ongoing property management and improvement, adding value, refinancing and sale or exchange of the LLC properties. There are no Managing Me ...

... LLC will invest in more than one residential property with the profit goal being to first return investor's original capital investment and then profits through ongoing property management and improvement, adding value, refinancing and sale or exchange of the LLC properties. There are no Managing Me ...

Investment Bond Option B

... This product summary insert is to be read in conjunction with Investment Bond from Aviva brochure and our Fund Guide, Your Investment Options. Investment Bond is a unit-linked product that allows you to invest a single contribution into a range of different funds. It is intended as a medium to long- ...

... This product summary insert is to be read in conjunction with Investment Bond from Aviva brochure and our Fund Guide, Your Investment Options. Investment Bond is a unit-linked product that allows you to invest a single contribution into a range of different funds. It is intended as a medium to long- ...

Economic Inequality in the United States

... This greater wealth inequality arises from two sources: 1. Life-cycle saving patterns 2. Transfers of wealth between generations The significant aspects of intergenerational wealth transfers that increase economic inequality is that marriage concentrates wealth. © 2012 Pearson Education ...

... This greater wealth inequality arises from two sources: 1. Life-cycle saving patterns 2. Transfers of wealth between generations The significant aspects of intergenerational wealth transfers that increase economic inequality is that marriage concentrates wealth. © 2012 Pearson Education ...

PricingNotes

... between revenues (sales), costs, and profits by completing an income statement. It is found at the end of this lesson. 2. Analyzing a Balance Sheet Analyzing a balance sheet is the second way to calculate the relationship between revenue (sales), expenses, and profit. A balance sheet is a summary of ...

... between revenues (sales), costs, and profits by completing an income statement. It is found at the end of this lesson. 2. Analyzing a Balance Sheet Analyzing a balance sheet is the second way to calculate the relationship between revenue (sales), expenses, and profit. A balance sheet is a summary of ...