Investment Fund Overview

... Seeks to track the performance of a benchmark index that measures the investment return of stocks of companies located in developed and emerging markets around the world. The fund employs a “passive management” – or indexing-investment approach designed to track the performance of the FTSE All-World ...

... Seeks to track the performance of a benchmark index that measures the investment return of stocks of companies located in developed and emerging markets around the world. The fund employs a “passive management” – or indexing-investment approach designed to track the performance of the FTSE All-World ...

CF Canlife Portfolio Funds

... and generate superior returns. Its parent company, Great-West Lifeco, is one of Canada’s largest financial companies with over £750bn in consolidated assets under administration1. By being part of a much larger group, it is able to draw on a pool of expertise and resources that enable it to better s ...

... and generate superior returns. Its parent company, Great-West Lifeco, is one of Canada’s largest financial companies with over £750bn in consolidated assets under administration1. By being part of a much larger group, it is able to draw on a pool of expertise and resources that enable it to better s ...

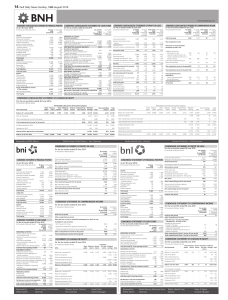

14 Gulf Daily News Sunday, 14th August 2016

... Available-for-sale securities: - Net change in fair value - Impairment transferred to profit or loss - Transfer to statement of profit or loss on disposal of securities Share of other comprehensive income of ...

... Available-for-sale securities: - Net change in fair value - Impairment transferred to profit or loss - Transfer to statement of profit or loss on disposal of securities Share of other comprehensive income of ...

Lectures 15 to 17

... 1980s been a net debtor with W = A − L < 0. Negative external wealth would lead to a deficit on net factor income from abroad with r*W= r* (A − L) < 0. Yet as we saw in the last chapter, U.S. net factor income from abroad has been positive throughout this period. How can this be? The only way a net ...

... 1980s been a net debtor with W = A − L < 0. Negative external wealth would lead to a deficit on net factor income from abroad with r*W= r* (A − L) < 0. Yet as we saw in the last chapter, U.S. net factor income from abroad has been positive throughout this period. How can this be? The only way a net ...

THE THEORY OF OPTIMAL TAXATION: WHAT IS THE POLICY RELEVANCE?

... taxes should be uniform and ’neutral’ or whether - even in the absence of externalities - they should systematically discriminate between different economic activities? In the latter case, does optimal tax theory offer any useful advice on the proper differentiation of tax rates, not just in qualitativ ...

... taxes should be uniform and ’neutral’ or whether - even in the absence of externalities - they should systematically discriminate between different economic activities? In the latter case, does optimal tax theory offer any useful advice on the proper differentiation of tax rates, not just in qualitativ ...

Earnings Release Q3 FY 2016: Strong execution drives growth and

... Centrally managed portfolio activities (CMPA): a negative result related to a major asset retirement obligation due primarily to lower interest rates; ongoing equity investment loss from Siemens’ stake in Primetals Technologies Ltd. which is operating in a difficult market environment Results of ...

... Centrally managed portfolio activities (CMPA): a negative result related to a major asset retirement obligation due primarily to lower interest rates; ongoing equity investment loss from Siemens’ stake in Primetals Technologies Ltd. which is operating in a difficult market environment Results of ...

Manulife Investments GIC

... The Manufacturers Life Insurance Company is the issuer of the Manulife Investments Guaranteed Interest Contract (GIC). Manulife, Manulife Investments, the Manulife Investments For Your Future logo, the Four Cubes Design, the Block Design and Strong Reliable Trustworthy Forward-thinking are trademark ...

... The Manufacturers Life Insurance Company is the issuer of the Manulife Investments Guaranteed Interest Contract (GIC). Manulife, Manulife Investments, the Manulife Investments For Your Future logo, the Four Cubes Design, the Block Design and Strong Reliable Trustworthy Forward-thinking are trademark ...

PPF - An Investment and Tax Saving Instrument

... PPF is a savings and tax-saving instrument. It also serves as a retirement planning tool for those who are not covered by any structured pension plan. The popularity of PPF as an investment avenue has been because of various reasons seldom found in other savings instruments - high rate of returns, c ...

... PPF is a savings and tax-saving instrument. It also serves as a retirement planning tool for those who are not covered by any structured pension plan. The popularity of PPF as an investment avenue has been because of various reasons seldom found in other savings instruments - high rate of returns, c ...

Taxation 220 - LSS | Cans DB

... Surrogatum Principle ..................................................................................................................................................................................................................................................................... 17 Inducement Pay ...

... Surrogatum Principle ..................................................................................................................................................................................................................................................................... 17 Inducement Pay ...

Pro-Forma Financials and Business Cycles: Wal

... make a profit. For this reason, comparison of net earnings will provide critical information in the stability of these 2 huge retail stores. Wal-Mart earned net profit of $14.4 billion in 2010, a net profit margin of 3.5%. In contrast, Target earned just $2.9 billion in net profit in the same year; ...

... make a profit. For this reason, comparison of net earnings will provide critical information in the stability of these 2 huge retail stores. Wal-Mart earned net profit of $14.4 billion in 2010, a net profit margin of 3.5%. In contrast, Target earned just $2.9 billion in net profit in the same year; ...

Why are Housing Prices so Volatile? Income Shocks in a Stochastic

... Given that all households have a strong preference for living in a dwelling of their own, the poorest households have a strong demand for the cheapest type of dwellings, starter homes. Through the down-payment constraint, this consumption demand yields a direct relationship between the income of poo ...

... Given that all households have a strong preference for living in a dwelling of their own, the poorest households have a strong demand for the cheapest type of dwellings, starter homes. Through the down-payment constraint, this consumption demand yields a direct relationship between the income of poo ...

Taxation and Economic Efficiency

... policies, focussing on measures that target investment and saving, and rank them according to their impact on domestic welfare1. The results indicate that taxes on saving and investment impose higher efficiency costs than taxes on wages and consumption. In particular, the results suggest that invest ...

... policies, focussing on measures that target investment and saving, and rank them according to their impact on domestic welfare1. The results indicate that taxes on saving and investment impose higher efficiency costs than taxes on wages and consumption. In particular, the results suggest that invest ...